India Shelter Finance Corporation: PAT growth of 59% & Total Income growth of 38% in 9M-25 at a PE of 26

Guidance of 30% PAT & AUM FY25-30 CAGR. Growth outlook based on steady loan growth, controlled credit costs, stable funding rates. Government's emphasis on affordable housing is a tailwind

1. Home Loans and Loan Against Property

indiashelter.in | NSE: INDIASHLTR

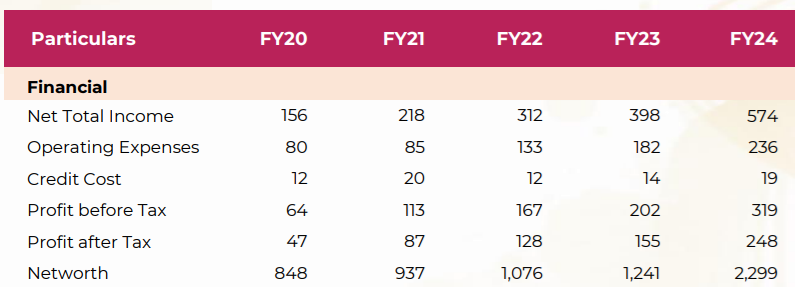

2. FY20-24: PAT CAGR of 52% & Total Income CAGR of 38%

3. FY24: PAT up 49% & Total Income up 42% YoY

4. Q3-25: PAT up 54% & Total Income up 38% YoY

5. 9M-25: PAT up 59% & Total Income up 38% YoY

6. Business metrics: Improving return ratios

The ROA for the quarter is stable at 5.5%. ROE for the quarter is 15.1% at a leverage of 2.8 times. It is up by 40 basis points QoQ.

7. Outlook: AUM CAGR of 30-35% over next few years

Growth and Expansion Plans

Plans to add 40-45 new branches per year for the next few years to strengthen its presence in Tier-2 and Tier-3 cities.

Focus on self-employed and first-time mortgage borrowers, particularly in underserved markets.

Operational and Financial Guidance

Profitability & Margins:

Aiming to maintain ROA at 4%.

ROE guidance remains in the 14-17% range, depending on leverage utilization.

Spread guidance of ~6% is expected to remain stable.

Credit Quality:

Credit cost guidance remains at 40-50 bps.

Loan-to-Value (LTV) ratio on the book stands at 52%, indicating a conservative approach to risk management.

Gross Stage 3 (GNPA) remains stable at 1.2%, and Net Stage 3 at 0.9%.

Cost Efficiency:

Operating expense to AUM ratio is expected to improve by 20 bps over the next few years.

The company aims to enhance digital adoption and improve operational efficiencies to keep cost-to-income ratios under control.

Borrowing and Funding Strategy

Diversified Borrowing Mix:

The borrowing profile includes Term Loans (54%), Direct Assignments (21%), Refinancing (13%), and NCDs (1%).

Average borrowing tenure is 7 years, providing financial stability.

Cost of Funds Management:

Despite rising market interest rates, the cost of funds remains stable at 8.8%.

The company has an undrawn sanction of ₹450 crore from the National Housing Bank (NHB) to ensure liquidity.

Improving Credit Ratings:

India Shelter aims for a further credit rating upgrade post-IPO, currently rated AA- (Stable).

Key Industry Trends

Mortgage Penetration in India remains low (around 12% of GDP, compared to 21% in South Africa and 64% in the UK), providing long-term growth potential.

Government initiatives like PMAY-II (Pradhan Mantri Awas Yojana) are expected to drive demand in the affordable housing segment.

Challenges and Risk Management

Slight uptick in 30+ DPD (delinquent loans past due), but they expect stabilization in coming quarters.

Actively monitoring customer behavior to prevent overleveraging and maintain portfolio quality.

Branch-level risk controls and enhanced collection mechanisms are being implemented to manage asset quality.

i. FY24-30: AUM CAGR of 30%

Target to reach AUM of Rs 30,000 cr implies a CAGR of 30% from the FY24 AUM of Rs 6084 cr

We guided for an AUM growth of 30% to 35% for the next few years and continue to grow as per the plan.

AUM growth of 36% YoY to Rs. 7,619 crores supported by disbursement growth of 29%, this quarter, we clocked Rs. 879 crores of disbursement.

ii. FY24-30: PAT CAGR of 30%

ROA of 4% on an AUM of Rs 30,000 cr implies a FY25 PAT of Rs 1,200 cr. This a CAGR of 30% from the FY24 PAT of Rs 248 cr

8. PAT growth of 59% & Total Income up 38% in 9M-25 at a PE of 26

9. Hold?

If I hold the stock then one may continue holding on to INDIASHLTR.

Based on 9M-25 performance one can look forward to a strong FY25 in line with the guidance of 36% AUM growth seen in 9M-25.

INDIASHLTR is executing strong as per its previous guidance and is a reason to continue as the Vision 2030 gets executed.

10. Buy?

If I am looking to enter INDIASHLTR then

INDIASHLTR has delivered PAT growth of 59% & Total Income up 38% in 9M-25 at a PE of 26 which makes valuations reasonable in the short term.

INDIASHLTR is guiding for 30% AUM & PAT CAGR for FY25-30 which at a PE of 26 which makes valuations attractive over the longer term.

The investment thesis is built on consistent execution till FY30. Hence one needs to keep a close watch for steady loan growth, controlled credit costs, stable funding rates with moderate competition from banks & NBFCs.

AUM grows at 30% CAGR, with branch expansion & organic growth.

ROA stabilizes at 4.0%, in line with historical trends.

Cost of borrowing remains stable at ~8.5-8.8%, with a steady credit rating.

Delinquency rates remain controlled, with credit costs at 40-50 bps.

Competition remains moderate, allowing INDIASHLTR to maintain 6%+ spreads

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Isn’t P/B is a better metric to valuate ?