IIFL Securities Ltd: PAT growth of 104% & Revenue growth of 55% in 9M-24 at a PE of 13

A strong performance in 9M-24 supported by reasonable valuations however consistency in delivering strong performance needs to be seen.

1. Broking, financial product distribution & investment banking

iiflsecurities.com | indiainfoline.com | NSE : IIFLSEC

Investment banking: Ranked #1 for IPOs in FY23 and 1H FY24

We have three segments which are targeting.

One is institutional broking where our team continues to do well. We are known for our research.

Investment banking again in the mid-market space we're trying to build capacities and

Last, but not the least is I would say instead of derivatives broking or chasing market share in broking we were more focused on the financial planning on the affluent segment.

Business offerings comprise equity, commodities and currency broking, Demat services, portfolio advisory and distribution of investment products

2. FY18-23: Bottom line up & down, no clear growth trajectory

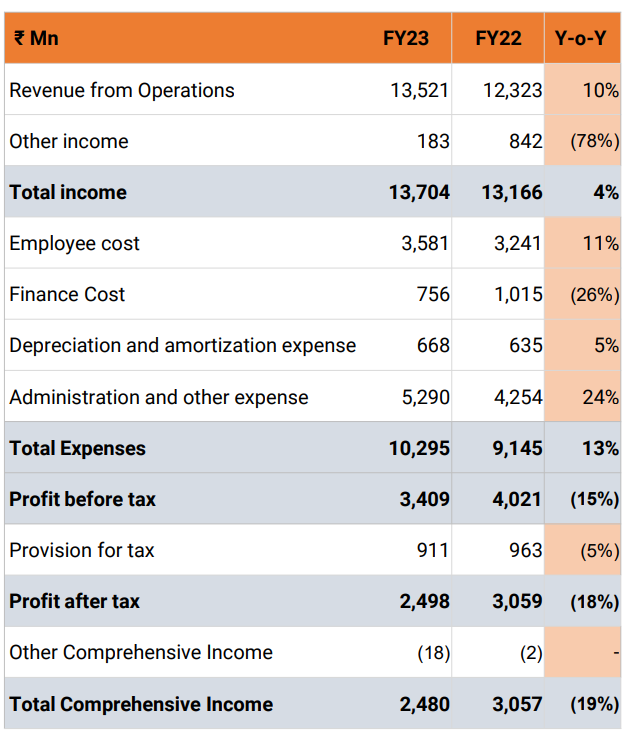

3. Weak FY23: PAT down 19% and Revenue up 10% YoY

4. Strong H1-24: PAT up 84% & Revenue up 51% YoY

5. Strong Q3-24: PAT up 133% & Revenue up 63% YoY

PAT up 40% & Revenue up 9% QoQ

6. Strong 9M-24: PAT up 104% & Revenue up 55% YoY

7. Business metrics: Strong return ratios

8. Outlook: Strong PAT growth in FY24

i. Management unwilling to provide any outlook for the future

9. PAT growth of 104% & Revenue growth of 55% in 9M-24 at a PE of 13

10. So Wait and Watch

If I hold the stock then one may continue holding on to IIFLSEC.

Coverage of IIFLSEC was initiated after Q2-24 results. The investment thesis has not changed after a strong Q3-24. The management is on track to deliver the biggest PAT, beating the previous high made in FY22.

The past record during FY18-23 has seen bottom line going up & down, with no clear growth trajectory. Hence one needs to watch and decide on IIFLSEC at a quarter to quarter level. One doesn’t want to get stuck with a stock where the business is not showing a clear growth trajectory.

11. Or, join the ride

If I am looking to enter the stock then

IIFLSEC has delivered PAT growth of 104% & Revenue growth of 55% in 9M-24 at a PE of 13 which makes valuations quite attractive.

Given that FY24 looks like being the biggest year in the last five years. Hence it is a good entry point for the stock. However, a track record of delivering growth makes it a risky bet

The management unwilling to provide any outlook for the future makes IIFLSEC a difficult call to take.

The potential for a 13 PE moving to a a mid teen PE is easily possible if IIFLSEC is able to deliver growth consistently across quarters. The potential of a PE re-rating could provide multi-bagger upside in the stock over the medium term.

Previous coverage of IIFLSEC

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action.