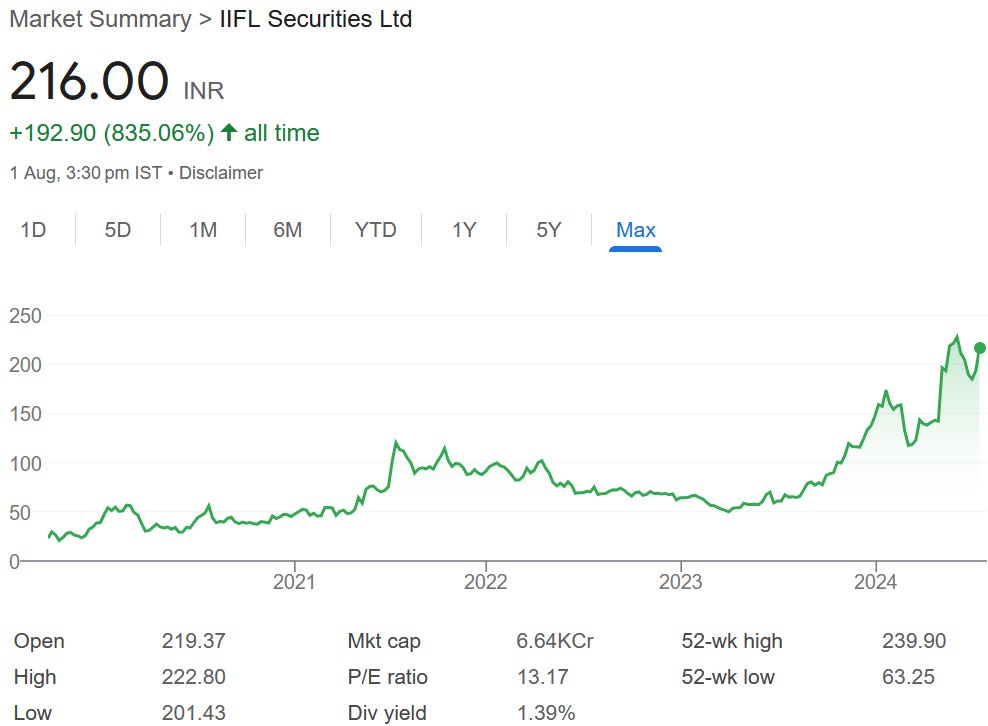

IIFL Securities: PAT growth of 144% & Revenue growth of 56% in Q1-25 at a PE of 11

IIFLSEC at attractive valuations based on business performance. Real estate assets and cash on books add cushion to valuation. Strong industry tailwinds providing for an attractive outlook

1. Broking, financial product distribution & investment banking

iiflsecurities.com | indiainfoline.com | NSE : IIFLSEC

IIFL Securities along with its subsidiaries offers advisory and broking services, financial products distribution, institutional research and investment banking services.

Business offerings comprise equity, commodities and currency broking, Demat services, portfolio advisory and distribution of investment products

2. FY20-24: PAT CAGR of 22% & Revenue CAGR of 31%

3. Weak FY23: PAT down 19% and Revenue up 10% YoY

4. Strong FY24: PAT up 105% & Revenue up 60% YoY

5. Strong Q1-25: PAT up 144% & Revenue up 56% YoY

PAT up 1% & Revenue down 7% QoQ

6. Business metrics: Strong return ratios

7. Outlook: Strong outlook for FY25

i. Management pointing towards a strong outlook but unwilling to provide any guidance

Outlook for Indian Capital Markets related businesses is good over the medium to long term. And this is irrespective of any short-term hiccups that we may see. And outlook is strong primarily because of low penetration of financial products, increased financialization of savings, technology development and evolved regulatory regime.

8. PAT growth of 144% & Revenue growth of 56% in Q1-25 at a PE of 10

9. So Wait and Watch

If I hold the stock then one may continue holding on to IIFLSEC.

Coverage of IIFLSEC was initiated after Q2-24 results. The investment thesis has not changed after IIFLSEC delivered the highest PAT in FY24, beating previous high in FY22. IIFLSEC has followed it with a strong Q1-25

IIFLSEC has increased its PAT QoQ for the last 5 quarters, starting Q1-24. One can ride the business momentum as long as it runs.

There is a strong tailwind and business momentum is in favor of IIFLSEC

Q1FY25 has been has been a prolific period for the investment banking business

Pipeline remains strong- Likely to be executed over the next 4-6 quarters

10. Or, join the ride

If I am looking to enter IIFLSEC then

IIFLSEC has delivered PAT growth of 144% & Revenue growth of 56% in Q1-25 at a PE of 11 which makes valuations quite attractive.

One can hope that IIFLSEC will continue with its track records of growing its net-worth and EPS at a CAGR of around 20% which at a PE of 11 makes the valuations quite attractive

IIFLSEC has Rs 650 cr worth of real estate asset is on the balance sheet on a market cap of Rs 6,644 cr. This provides a cushion to the valuations of IIFLSEC.

Potential for a 11 PE re-rating to mid-teens PE is possible if IIFLSEC is able to match historic EPS growth of 20%+. Potential of a PE re-rating provide opportunity in IIFLSEC.

Previous coverage of IIFLSEC

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer