ICICI Lombard Q4 FY25 Results: Strong Profits, Health Losses Rise

Solid profit growth, strong motor performance & digital gains. Health & crop loss ratios rise; stock at a premium. Steady outlook for FY26 with cautious expansion

ICICI Lombard General Insurance Company Ltd: Table of Contents

Financial Performance Review

Business Segment Performance

Management Commentary

What to Watch for in FY26?

Valuation Analysis

Investor Takeaways & Action Plan

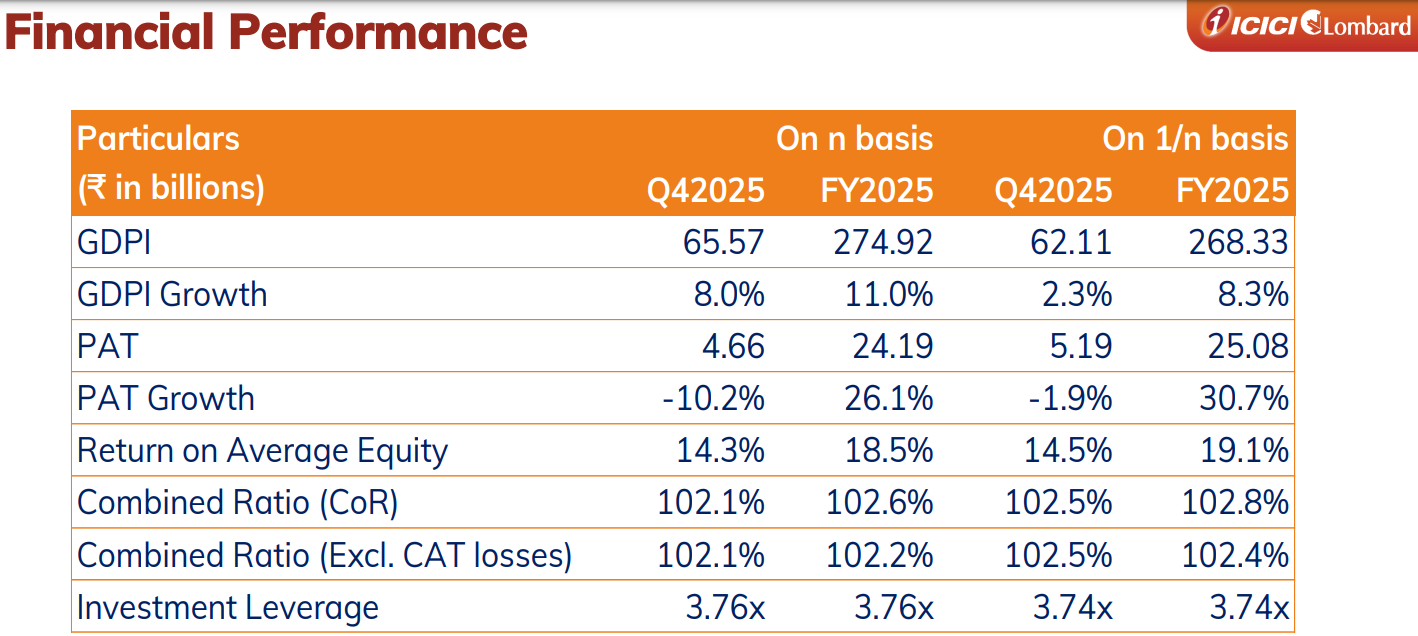

1. ICICI Lombard’s Quarterly & Annual Financial Performance Review

ICICI Lombard's financial results for FY25 reinforce its status as a capital-efficient, profitable insurance leader - but Q4 signals the need to monitor health and crop claims trends heading into FY26.

1.1 ICICI Lombard FY25 Financial Performance

ICICI Lombard’s FY25 results stand out in the Indian insurance sector for combining steady GDPI growth with exceptional bottom-line leverage.

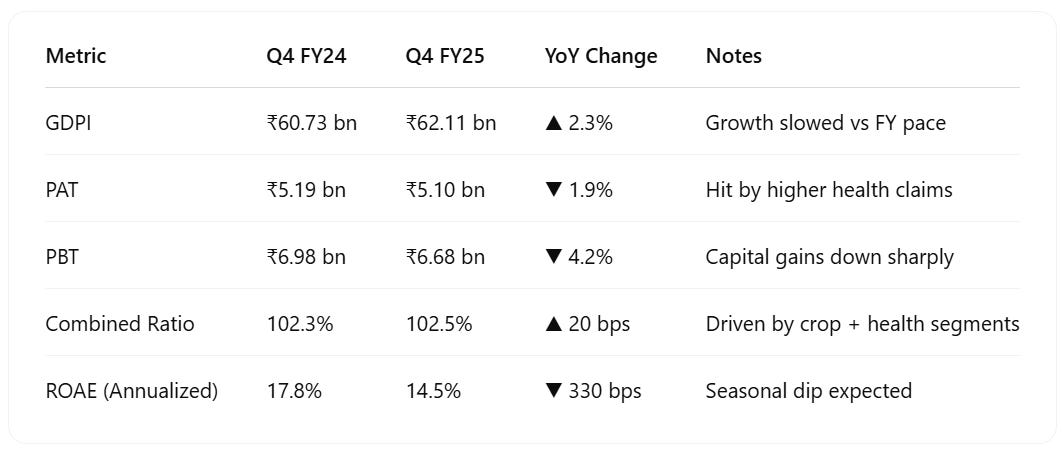

1.2 Q4 FY25 Results: Stable Revenue, Margin Headwinds

Q4 FY25 showed signs of stress in health and crop portfolios, partially offset by strong motor and fire underwriting.

1.3 Segmental Trends Worth Noting (FY25)

ICICI Lombard's portfolio is well-diversified, but group health and crop remain the weak links. Retail and motor lines continue to drive margin stability.

1.4 Investment Income & Capital Gains

Investment Book: ₹535.08 bn (vs ₹489.07 bn in FY24)

Realized Return: 8.42% (vs 7.98% in FY24)

Capital Gains FY25: ₹8.02 bn (up from ₹5.51 bn)

Capital Gains Q4 FY25: ₹0.06 bn (vs ₹1.56 bn in Q4 FY24)

FY25 gains were strong, but Q4 performance was muted — highlighting volatility in quarterly profit due to market-linked returns.

2. ICICI Lombard Business Segment Performance: Motor, Health, Crop & P&C

2.1 Segment Summary for FY25

ICICI Lombard’s FY25 segment performance underscores its shift toward retail and risk-adjusted growth. The management’s approach to limit exposure in volatile areas while pushing retail health and digital-led motor business shows strong strategic clarity. However, investors must watch loss ratio trends in health and crop portfolios closely in FY26.

2.2 Motor Insurance: Steady Growth, Controlled Claims

Motor remains the most stable contributor to ICICI Lombard’s underwriting margin.

Private Car mix increased to 53.4%, supporting premium per policy.

Despite no hike in Motor TP rates, ICICI Lombard grew its motor portfolio through AI-based risk segmentation and retention via D2C tools.

Loss ratios improved, signaling better pricing and claims control.

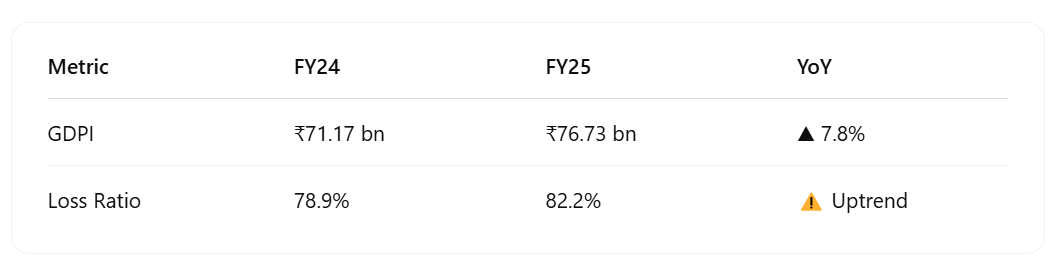

2.3 Health, Travel & PA Insurance: Retail Grows, Group Drags Margins

Health will be the key swing factor for margin recovery in FY26.

Retail health agency vertical grew 29.5%, reflecting ICICI Lombard’s focus on margin-friendly segments.

Group health claims surged, contributing to the elevated loss ratio of 82.2%.

Initiatives like IL Sahayak and ILTakeCare app are driving better onboarding and engagement, especially in Tier 3/4 cities.

2.4 Crop Insurance: High Growth, High Risk

Crop business adds scale, but not profitability. Further rationalization likely in FY26.

Cluster wins in Andhra Pradesh, Assam, and Jharkhand drove revenue growth.

Weather volatility continues to impact claims — leading to one of the highest loss ratios in the portfolio.

Management emphasized a conservative reserving philosophy, but this segment remains earnings-dilutive.

2.5 Property & Casualty: Fire and Engineering Deliver Margin Upside

P&C is the silent performer — smaller in size but meaningful to margin stability.

The P&C book remains a margin anchor with relatively lower loss ratios and strong pricing.

Fire and engineering are seeing selective expansion in SME and mid-market sectors.

Marine remains volatile, but ICICI Lombard has limited exposure.

3. ICICI Lombard Management Commentary: Strategy, Risks & FY26 Outlook

ICICI Lombard’s management has made it clear: the path to growth lies in underwriting excellence, digital leadership, and retail segment dominance — not chasing top-line at the cost of margins. FY26 will test their ability to turn this disciplined approach into consistent earnings delivery.

3.1 Key Themes from Management Commentary

i. Focus on Underwriting Quality, Not Just Volume

Management reiterated that they’ve deliberately pulled back from low-margin group health and volatile crop clusters. The emphasis now is on:

Improving claim ratios

Better risk pricing

Selective business acceptance

“We walked away from business that didn’t meet our profitability filters.”

ii. Retail Health and Motor Will Drive Growth

Retail health agency vertical grew 29.5% in FY25.

Motor insurance market share rose to 10.8%, even without a hike in Motor TP base rates.

Management plans to scale Tier 3/4 distribution and invest in digital onboarding.

“Retail is where we’re seeing consistent margins and long-term value creation.”

3.2 Digital Execution is Core to ICICI Lombard's Strategy

Management highlighted that digital transformation is not an afterthought — it's a core moat. Highlights include:

73.2% of group health claims processed using AI in March 2025 (vs 61.8% YoY)

99.9% digital policy issuance

14.9 million ILTakeCare app downloads (up 60% YoY)

The company is also planning deeper Direct-to-Customer (D2C) expansion via:

WhatsApp renewals

AI-led targeting

Cross-selling through ILTakeCare

“Technology will drive margins, efficiency, and customer retention in the coming years.”

3.3 Strong Solvency and Conservative Investment Policy

Solvency ratio improved to 2.69x, well above the 1.5x regulatory requirement.

Investment portfolio remains conservative:

86.1% in sovereign or AAA-rated debt

Zero credit defaults since inception

Management emphasized zero tolerance for credit risk, reaffirming long-term capital stability.

3.4 Risk Acknowledgements: Health & Crop Are Pressure Points

While upbeat on long-term prospects, management clearly acknowledged two areas of concern:

Health loss ratio at 82.2% in FY25, driven by inflation and claim frequency in group policies

Crop loss ratio at 89.2%, worsened by climate volatility

“We’re closely monitoring these portfolios. Pricing interventions and risk-based underwriting will continue.”

3.5 Outlook for FY26: Steady, Cautious Expansion

Management avoided giving formal guidance but conveyed a measured outlook:

Prioritizing margin protection over premium expansion

Expecting retail health and SME fire/marine to contribute more

Staying clear of underpriced or high-risk segments

No immediate M&A — focus remains on organic tech-led growth

4. What to Watch for in FY26

ICICI Lombard’s Q4 FY25 call revealed a disciplined, risk-aware strategy that isn’t chasing growth blindly. Management is doubling down on tech, pulling back on loss-heavy segments, and preparing for D2C scale-up. These silent signals may define the stock’s rerating potential over the next 4 quarters.

4.1 Profitability Over Premiums: Strategic Pullback in Group Health

Management confirmed deliberate exits from unprofitable group health contracts.

Despite rising GDPI in health, the company emphasized that quality of earnings matters more than scale.

FY25 health loss ratio spiked to 82.2%, pushing ICICI Lombard to reprice or walk away from poorly priced group policies.

This signals a structural shift in strategy — one that prioritizes underwriting discipline over market share.

4.2 Health and Crop Insurance Loss Ratios are Under Watch

Investors should track how ICICI Lombard manages product mix shifts in FY26 - especially in its high-loss portfolios.

Crop insurance loss ratio stood at 89.2% due to weather-related claims across AP, Assam, and Jharkhand.

Both health and crop are expected to remain margin-sensitive in FY26.

The company hinted at rationalizing exposure in these segments unless loss trends improve.

4.3 Retailization of Business Model Accelerating

Retail lines offer better claim predictability and renewability — both critical for lifetime customer value.

The company is clearly scaling up retail-focused segments: individual health, SME fire, private car insurance.

Retail health agency vertical grew by 29.5%, while private car share in motor climbed to 53.4%.

IL Sahayak support, local hospital partnerships, and digital onboarding tools are driving deep Tier 3/4 penetration.

4.4 Capital Gains Volatility Affects Quarterly Earnings

Q4 FY25 capital gains dropped sharply to ₹0.06 bn (from ₹1.56 bn in Q4 FY24).

Management acknowledged that investment returns can vary, but focus remains on long-term asset quality.

Unrealized gains stood at ₹18.14 bn, offering valuation buffer for FY26.

Capital gains remain a swing factor for quarterly EPS - not to be overemphasized for long-term investors.

4.5 D2C Business is Small but Strategically Important

Management noted that Direct-to-Customer (D2C) remains a small revenue contributor.

However, ICICI Lombard is investing in app-based renewals, WhatsApp flows, and cross-selling via ILTakeCare.

D2C is seen as a margin-improving lever over the medium term.

This slow-burn growth area could significantly reduce acquisition costs if scaled successfully.

4.6 CAT Risk and Climate Volatility Are Being Reassessed

While not explicitly a headline theme, the call revealed increasing sensitivity to climate-linked CAT losses.

ICICI Lombard is investing in predictive catastrophe models and spreading risk across a wider reinsurance panel.

Climate volatility is becoming a core underwriting concern, especially in crop and property lines.

5. ICICI Lombard Valuation Analysis: Is the Stock Fully Priced In?

ICICI Lombard General Insurance continues to trade at premium valuation multiples, supported by its leadership position, consistent profitability, and robust solvency metrics. But with rising loss ratios and a muted Q4 FY25 performance, investors must ask: Does the current stock price still offer upside?

ICICI Lombard trades at a premium to industry averages - reflecting its quality moat, but also limiting near-term re-rating potential.

ICICI Lombard remains the most expensive general insurer in India - justified by returns, but with limited upside unless earnings surprise.

The recent correction discounts the price reflects:

Q4 earnings miss

Health and crop claim pressures

Weak capital gains in Q4

Broader caution in financials ahead of FY26

The market has already priced in high-quality earnings - any margin slippage or EPS stagnation may cap upside.

At current prices, the stock offers limited risk-reward unless margins improve.

ICICI Lombard is a best-in-class insurance stock - but valuations leave little room for error. Long-term holders can stay invested. New entrants may wait for FY26 margin signals or a more attractive price.

6. Investor Takeaways & Action Plan: ICICI Lombard FY25

6.1 Why Long-Term Investors May Continue to Hold

19.1% ROAE in FY25 and consistent profit CAGR make ICICI Lombard a reliable long-term compounder.

Solvency ratio at 2.69x offers downside protection and dividend headroom.

Continued investments in digital, AI, and retail distribution show the company is building for scalability.

If I already hold the stock, there’s no compelling reason to exit - unless margin trends significantly deteriorate in FY26.

6.2 Why New Investors May Want to Wait

At 35.4x P/E and 6.2x P/B, ICICI Lombard trades at one of the highest valuations among Indian financials.

Health and crop loss ratios are elevated, and Q4 FY25 saw a 1.9% PAT decline.

Without a strong margin rebound or earnings beat in FY26, upside may be limited in the short term.

Ideal entry trigger: after confirmation of margin improvement in Q1/Q2 FY26.

6.3 When to Exit or Reduce Exposure

Watch loss ratios and management’s pricing actions in high-risk segments closely in the next two quarters

6.4 Final Word: How to Position for FY26

Long-term holders: Stay invested, track health & crop loss ratios, and watch FY26 EPS momentum.

New investors: Wait for either a valuation dip or signs of operating margin improvement.

All investors: Use Q1 FY26 results as a pivot point to reassess exposure.

Disclaimer

Content Accuracy and Reliability: This summary of the earnings call is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities. Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions. No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary. Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional