ICICI Lombard Q1 FY26 Results: PAT up 29%, Muted Start to FY26

Strong profits on stable investments; retail health shines, but growth lags and CoR >100% signal underwriting pressure. Premium valuation with no margin of safety

Confused about analyzing insurance stocks? Most investors get confused about GDPI, Combined Ratio etc. Here’s how to actually do it right.

1. General Insurance Company

icicilombard.com | NSE: ICICIGI

Products & Services

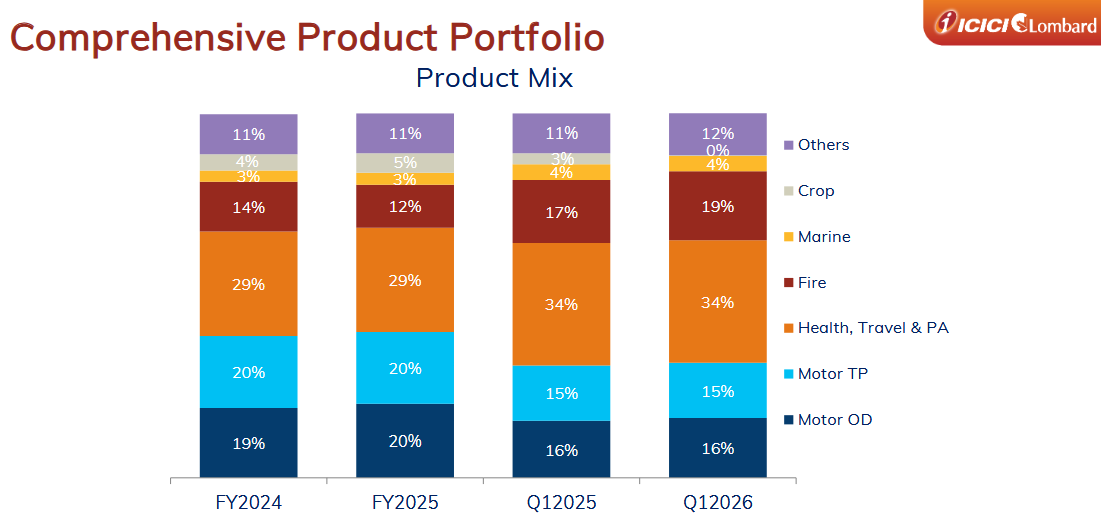

Diversified product mix– motor, health, travel & personal accident, fire, marine, crop and other insurance

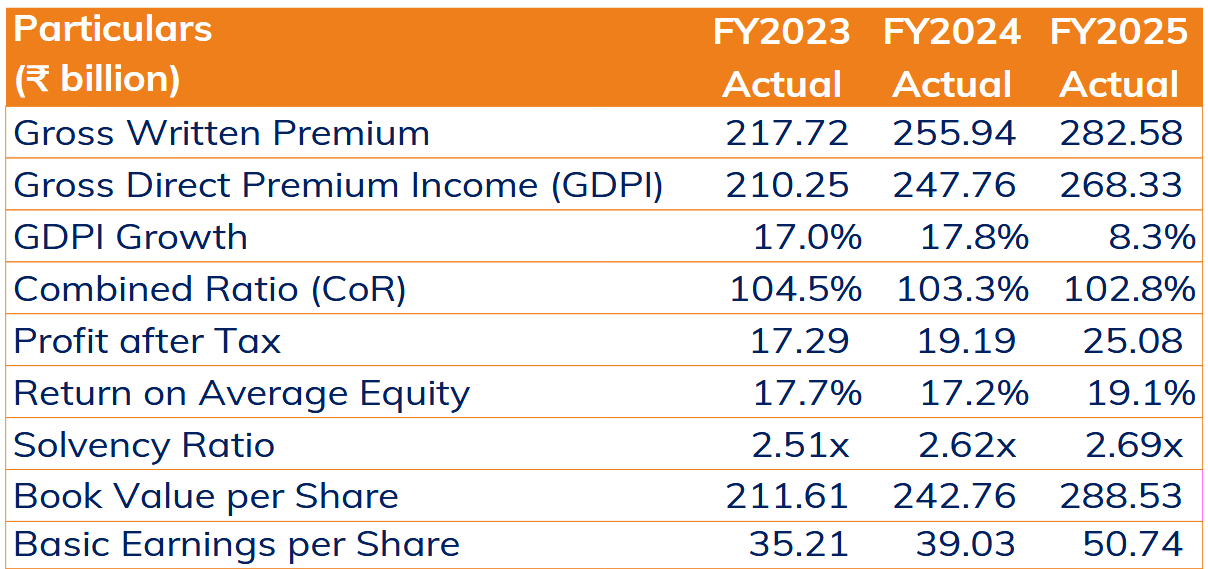

2. FY23-25: PAT CAGR of 20% & GDPI CAGR of 13%

** W.e.f. October 1, 2024 Long-term Products are accounted on 1/n basis, as mandated by IRDAI, hence FY2025 numbers are not comparable.

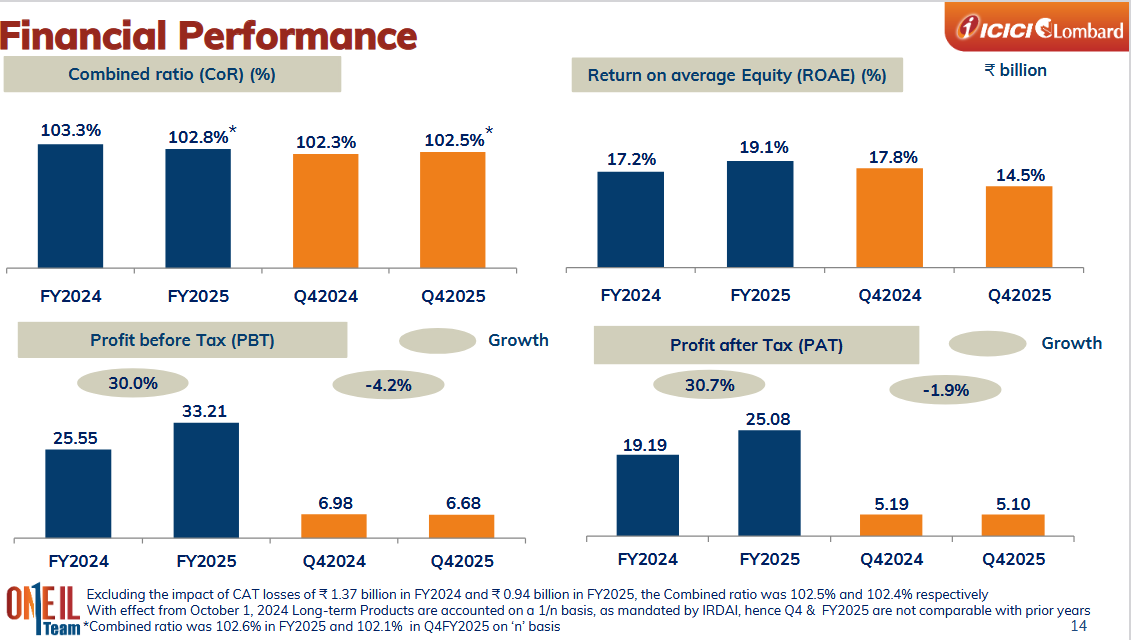

3. FY25: PAT up 31% & GDPI up 8%

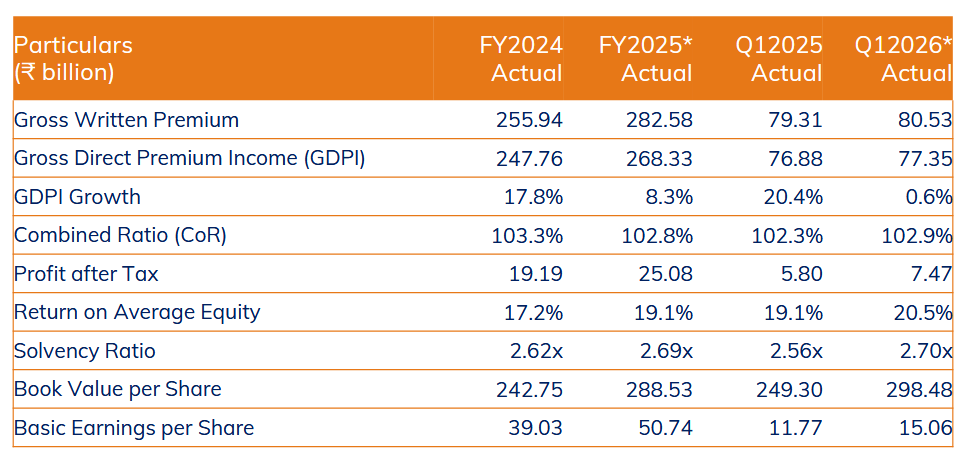

4. Q1-26: PAT up 29% & GDPI up 0.6% YoY

4.1 Headline Financials

Growth Slows, Profitability Holds

ICICI Lombard continues to prioritize underwriting quality over volume, especially in segments like motor and commercial.

Growth in PAT driven by both higher investment income and capital gains, while underwriting remained under pressure.

Investment book continues to contribute significantly to earnings.

Returns remain stable, with a conservative portfolio (G-Secs + AAA bonds + <15% equity).

4.2 Segmental Performance

Health Segment: Mixed Signals

Overall health GDPI up 1.9% YoY (vs industry 8.1%).

Retail health: Stellar growth of 32.2% (vs industry 9.4%) — driven by new product innovation and distribution.

Market share improved from 2.9% → 3.5%.

Retail loss ratio rose slightly to 74.3% (from 72.5%), but management expects it to settle within the 65–70% comfort band by FY-end.

Group health: Declined 2.5%, impacted by muted credit disbursement and 1/N accounting norm.

Motor Segment: Playing Defense

Grew only 3.2% YoY (vs industry 8.7%) amid heavy competitive intensity.

TP pricing pressure continues — no hike yet, and combined ratios across the industry remain elevated.

ICICI Lombard remains selective and cautious, focusing on profitable customer cohorts.

Commercial Lines: Holding Ground

Grew 6.8% (vs industry 13%) — company is calibrating for profit, not share gains.

Management noted improvement in pricing, especially in property & engineering, but intensity remains high in some sub-lines.

4.3 Risks from the Q1 FY26 Earnings Call

Retail health loss ratio uptick is being monitored; severity/frequency of claims rose slightly.

Commercial pricing remains sub-optimal in some areas despite improvement; risk of delayed profitability.

Motor TP rate hike still pending — a key catalyst for margin improvement.

Competitive pressure continues from private and PSU peers; management is cautious but confident in long-term strategy.

Crop insurance unlikely to grow significantly this year — most tenders shift to FY27.

Confident in long-term health of commercial and retail health segments.

Digital transformation and cost initiatives are bearing fruit.

Will stay patient in face of irrational competition, especially in motor and group health.

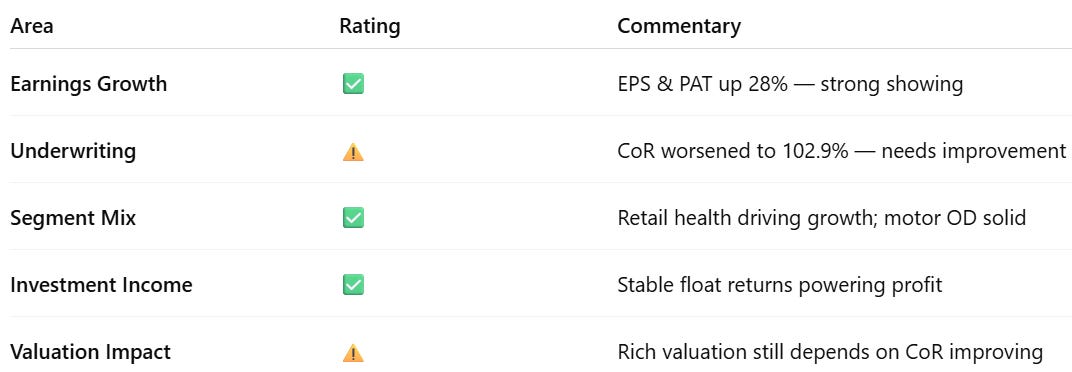

4.4 Bottom Line

Strong profit growth backed by stable investment income and capital discipline

Solvency is well above regulatory norms, with no near-term capital pressure.

Retail health is the standout segment with margin and scale potential

Underwriting still not profitable overall (CoR >100%)

Growth lags industry in most segments due to strategic conservatism. Recovery in motor and commercial lines contingent on pricing improvement, TP rate hike

5. FY26 Guidance & Outlook — ICICI Lombard

Growth Outlook

Overall Premium Growth:

Guided for industry outperformance even under the continuing 1/n accounting drag.

Growth expected to pick up in H2 FY26 as base effects normalize and prior-year policies unwind.

Motor Segment:

Targeting mid- to high-single digit growth.

New vehicle sales expected to support growth; private cars remain stable, CV segment could benefit from higher government capex.

Focus remains on prudent underwriting over aggressive growth, especially given PSU pricing pressure.

Retail Health:

Double-digit growth expected.

Likely to maintain leadership; premium mix contribution could rise above 40% (from 38.1% in FY25).

Management confident in continued new-to-insurance growth and medical inflation tailwinds.

Commercial Lines:

Targeting a return to double-digit growth after a muted FY25.

Fire, Engineering, and Marine expected to improve with renewed pricing discipline and infra spending.

Underwriting & Combined Ratio

No explicit combined ratio target given, but:

Management aims to maintain the gap versus worsening industry average (which rose to 113.2% in 9M FY25).

Expect modest improvement only if market discipline returns — especially in Motor TP.

Focus Areas:

Portfolio optimization

Digital-driven efficiency

Risk-based pricing

Claims cost control (e.g., PPN and cloud-calling adoption)

Investment Book and Returns

Yield improvement likely to sustain:

Capital Gains Uncertain:

No reliance on timing-based capital gains in FY26.

Market conditions to dictate opportunity.

Reinsurance and Risk Management

Better reinsurance terms secured for FY26:

ICICI Lombard secured above-industry commissions and capacity from quality reinsurers.

Strong renewal cycle in Commercial Lines expected to aid profitability.

Reserve Redundancy:

Continued actuarial conservatism.

FY25 saw further reserve releases, affirming quality of provisioning.

Profitability and Return Guidance

ROE Target:

Long-term ambition: 18–20%

FY25 ROE: 19.1% | FY26 expected to be in the same zone if underwriting improves and rate cycle supports investment yield.

🚨 Key Risks Highlighted

Delay in Motor TP rate hikes (none announced as of Q1 FY26).

Continued irrational pricing by PSUs or peers (esp. in Motor).

Medical inflation outpacing health premium pricing.

IFRS transition and accounting volatility not expected to materially change economic view.

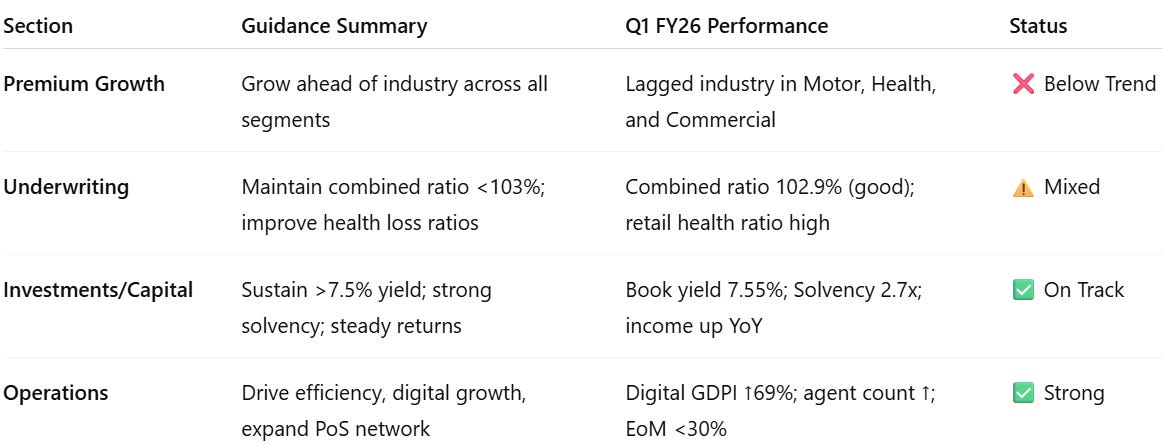

6. Guidance vs. Performance: Q1 FY26 Check-In

Misses: GDPI growth across core segments (Motor, Health, Commercial) has underwhelmed vs. guidance.

Hits: Underwriting margins, solvency, digital initiatives, and investment income are tracking guidance well.

Caution: Health and Motor remain under pressure from competition and inflation; company needs H2 rebound to meet FY26 goals.

7. Valuation Analysis

7.1 Snapshot — ICICI Lombard General Insurance

Book Value/Share: ₹298.48

ROAE (Q1 FY26 annualised): 20.5%

Combined Ratio: 102.9%

P/E (TTM): 36.5×

P/E (Forward, based on 20.5% ROE): 32.3×

P/B: 6.61×

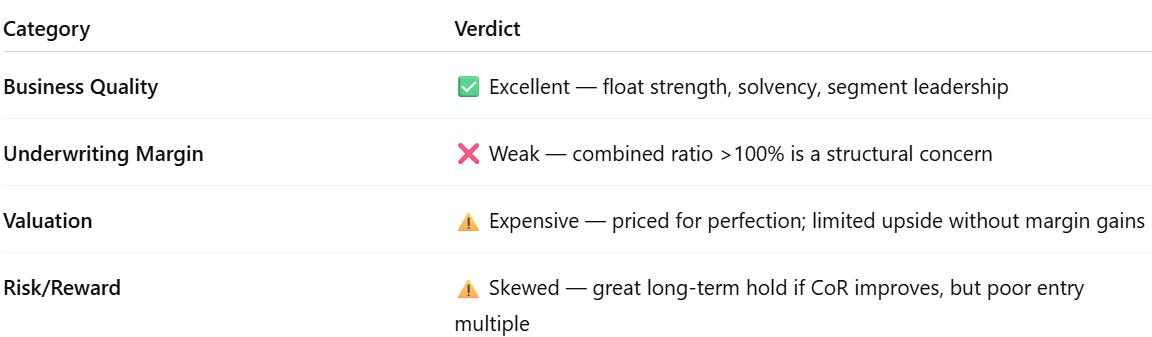

Business Quality Is High

ROE of ~20% is elite for any Indian financial services company.

Solvency ratio of 2.7x gives strong buffer — capital is not a constraint.

Investment book is large, well-rated, and generates consistent yield (realised return: 2.32%).

But…

The Core Engine Is Not Working Well

Combined ratio >100% means the company loses money on its main business (underwriting).

Current profits are entirely dependent on investment income. That’s not sustainable in volatile or falling markets.

Investors are paying a growth multiple without underwriting margin of safety.

🔎 Would you pay 32–36× for a business that loses money on its core operations?

Valuation Is Rich vs Peers and History

You’re paying 3x the book that most general insurers trade at — and getting similar or only slightly better returns.

If ROE drops to 17–18% (e.g. if float returns soften), this valuation will look stretched.

No Margin of Safety

High P/B + high P/E + weak underwriting = limited downside protection.

If investment income takes a hit or CAT losses spike, there is no room for error in the stock price.

Markets are currently pricing in perfect execution — sustained ROE + investment tailwinds + eventual underwriting improvement.

ICICI Lombard is a great business. It’s not a great price.

If you believe underwriting discipline will return, it could justify the premium. Otherwise, wait for: Improved CoR (<100%)

7.2 Opportunity at Current Valuation

P/B at ~6.6x & P/E at 38.5x TTM EPS

→ Premium valuation, but justified by strong ROE (20.5%) and consistent solvency (>2.7x).High-quality Retail Health Franchise

→ 32.2% YoY growth in retail health; market share up from 2.9% to 3.5%.Focus on Profitability over Volume

→ Combined Ratio at 102.9% vs industry >112%; company prioritizing disciplined underwriting.Robust Investment Book

→ ₹554 bn in assets; 3.74x leverage; stable and growing investment income.Digital and Distribution Strength

→ 69% YoY growth in digital fresh business; app downloads crossed 16.6 million.Cycle-Turn Potential

→ Motor TP rate hike expected; if approved, could significantly boost segment margins.Industry-Leading Operational Efficiency

→ 78% jump in call center productivity; 38% digital service adoption.Safe Capital Position

→ Solvency ratio at 2.7x vs regulatory minimum of 1.5x — strong buffer for shocks.

7.3 Risk at Current Valuation

Risk at Current Valuation — ICICI Lombard (Q1 FY26)

Valuation Still Rich

→ P/B at ~6.6x and P/E at ~38.5x — leaves little margin for error.Underwriting Still Unprofitable

→ Combined ratio above 100% (102.9%) — reliant on investment income to sustain profits.Slow Growth vs Industry

→ Overall GDPI growth just 0.61% YoY vs industry 8.8%; losing share in motor and group health.Motor Segment Weakness

→ Motor OD flat, TP pricing unrevised; aggressive competition pressuring margins.Retail Health Loss Ratio Rising

→ Loss ratio up to 74.3% (vs 72.5% YoY); risk if claim frequency persists.Group Health and Crop Underperform

→ Group health degrew by 2.5%; crop exposure uncertain and volatile.No Visibility on TP Price Hike

→ If delayed further, motor profitability may not recover soon.Competitive Intensity Remains High

→ Aggressive peers still pricing irrationally; hard to win share without compromising margins.1/N Accounting Norm Still a Drag

→ Makes premium and revenue recognition lumpy; clouds near-term growth visibility.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Hello,

We are keen on checkinn if ICICI Lombard touches 1600 mark. With zero borrowing book? The counter looks interestingly poised at 1948 but their 1639.7 on 4th march 2025 was when we were looking if it could touch down 1600.

This one is still on the watchlist for 1600 mark though….