ICICI Bank Q4 FY25 Result: Profit Up 18%, Clean Book, Rich Valuations

Strong loan growth, cleaner asset quality, digital expansion drive robust profits & return ratios for ICICI Bank. Consistent execution drive premium valuations

Table of Content

ICICI Bank Q4 & FY25 Financial Performance: A Deep Dive

Management Commentary & Strategic Outlook

ICICI Bank Valuation Analysis: Premium, But Justified?

What Should Investors Do? ICICI Bank Investment Outlook

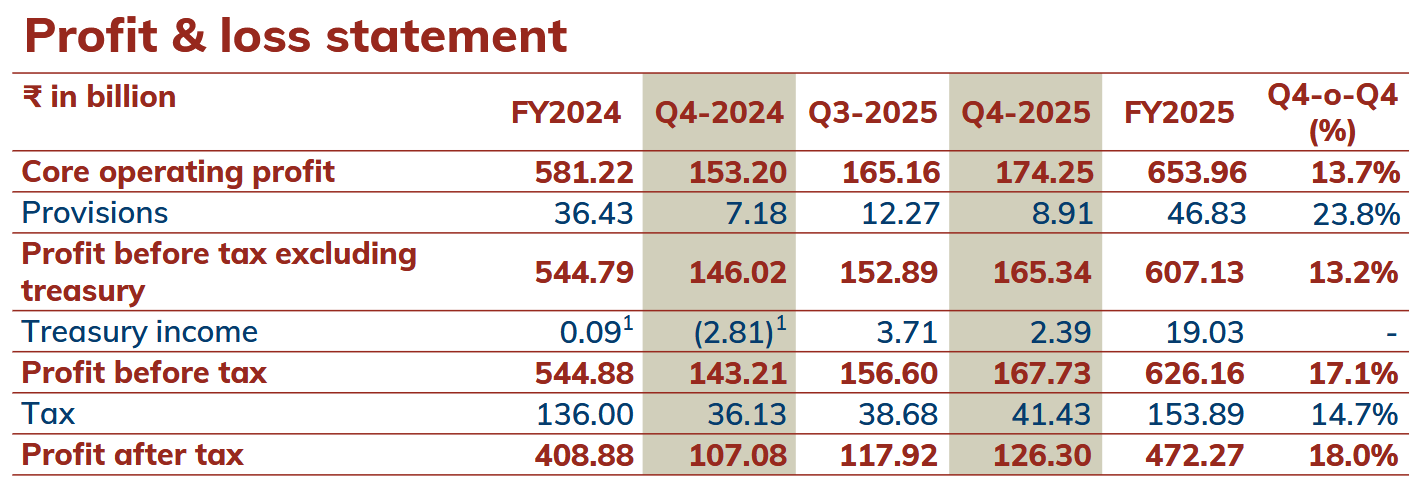

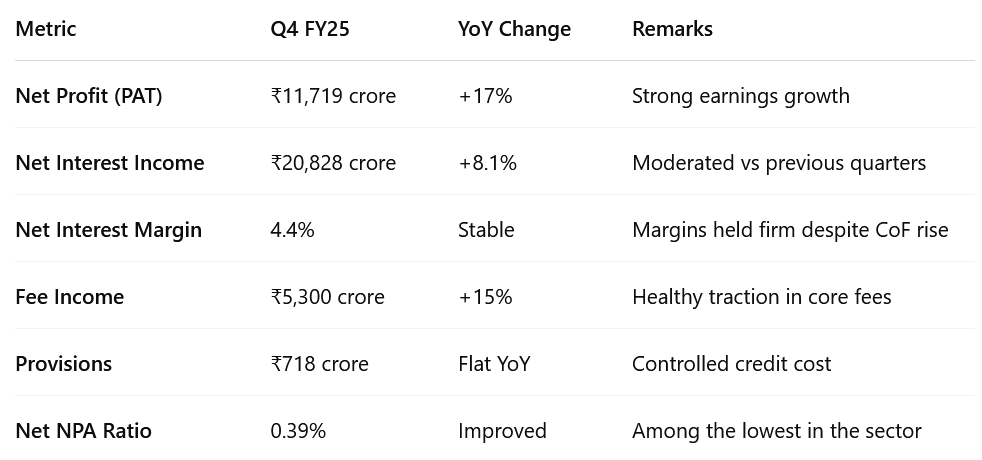

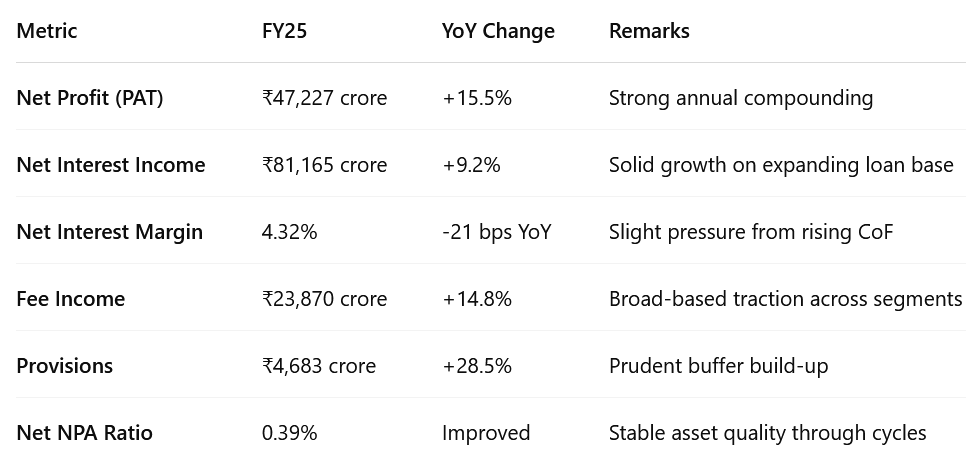

1. ICICI Bank Q4 & FY25 Financial Performance: A Deep Dive

ICICI Bank delivered strong financials in Q4 FY25 and for the full fiscal year, showcasing solid loan growth, margin expansion, and superior asset quality—hallmarks of its well-executed strategy. Here's a comprehensive look at the numbers:

1.1 Quarterly Highlights (Q4 FY25):

1.2 Full-Year FY25 Highlights:

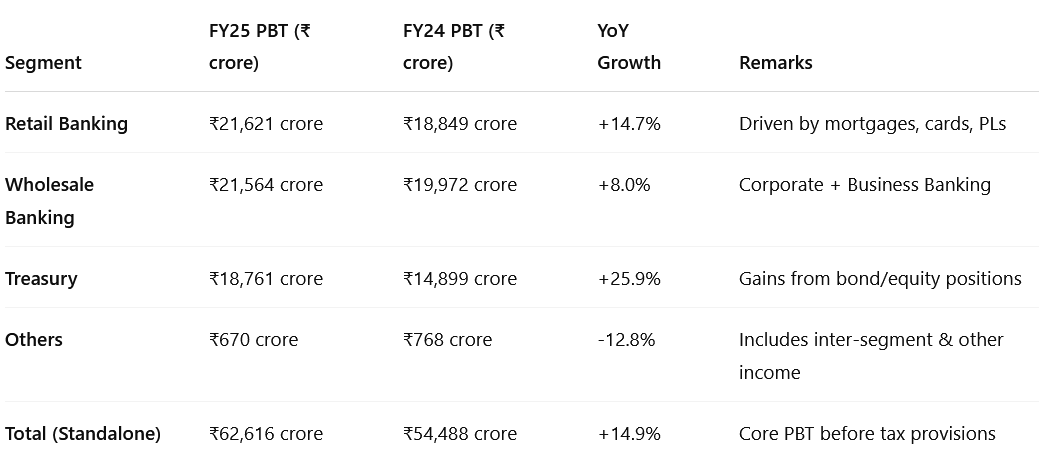

1.3 ICICI Bank FY25 Segmental Breakdown

2. Management Commentary & Strategic Outlook

The bank's leadership emphasized continued focus on high-quality growth across retail and SME segments. Key takeaways:

Digital Ecosystem Strength: Growth in iMobile Pay, API banking, and platforms like InstaBIZ has led to deeper customer engagement and cross-sell.

Credit Trends: No signs of stress. Collection efficiency remains robust. Portfolio quality improving across unsecured retail too.

Corporate Book: Healthy credit demand from manufacturing, infrastructure, and government-linked projects.

Capital Position: Strong CET-1 allows room for growth without immediate equity dilution.

Dividend: Final dividend of ₹10/share declared, indicating healthy capital buffers.

The management remains cautiously optimistic about credit offtake in FY26 amid global macro uncertainties.

2.1 Key Themes

“We remain focused on delivering consistent and predictable returns to shareholders. Our 360° customer strategy, deepening franchise, and technology-led transformation will help us grow market share profitably.”

A. Core Strategy: 360° Customer-Centric Growth

Emphasis on capturing value across ecosystems and micromarkets (e.g., farmers, small businesses, retail borrowers)

Focused on both depth and breadth of customer relationships—not just asset-side growth

B. Capital Allocation & Risk Discipline

Continued prioritization of “risk-calibrated profitable growth”

CET-1 ratio of 15.94%, well above regulatory requirement

Provisions of ₹13,100 crore contingency buffer (1% of advances) retained for macro prudence

C. Operational Focus

Goal to build a seamless delivery architecture, reduce friction, and scale internal efficiency

Targeted investments in technology, people, and distribution

Branch expansion: 241 added in Q4, taking total to 6,983 branches and 16,285 ATMs

D. Digital & Tech Transformation

Continued investments in digital platforms such as iLens (mortgages), InstaBIZ (SME), Amazon Pay cards

Focus on process simplification and system resilience

Tech expenses accounted for 10.7% of total OPEX in FY25, signaling strategic prioritization

E. Loan Book Focus:

Mortgage growth led by salaried segment, with an average loan-to-value of ~60%

Auto loans: 87% of disbursements for new vehicles; digital disbursal for pre-approved customers

Credit card spends up, with digital onboarding (esp. Amazon Pay) driving higher activation

F. Retail Quality:

Retail NPA additions down sharply: ₹4,339 crore in Q4 vs ₹5,304 crore in Q3

Recovery and upgrade trends improved across portfolios

G. Corporate Risk:

Exposure to BB and below-rated performing corporates remains <0.7% of book

Builder finance portfolio (~₹61,600 crore) stable, with just 1.7% classified as BB or below/internal NPA

2.2 Management Outlook

Loan growth outlook: Confident on sustaining high-teens growth across retail, SME, and corporate segments

NIM outlook: Cautious optimism as rate hikes stabilize, but cost of deposits trending up

Asset quality: Expect stable-to-improving metrics with tight underwriting discipline

Subsidiary strength: Will continue leveraging ICICI AMC, Lombard, and Life as performance engines

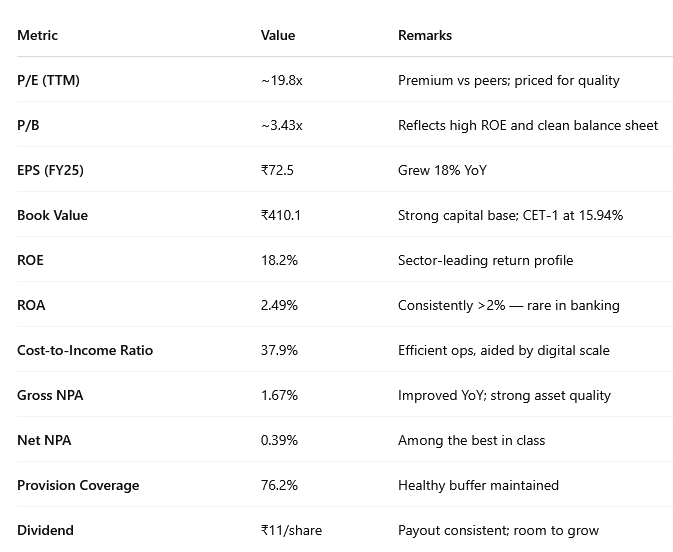

3. ICICI Bank Valuation Analysis: Premium, But Justified?

3.1 What’s Built Into the Price Today?

At a P/E of ~19.8x and P/B of ~3.43x, ICICI Bank is trading at a premium to sector averages. That premium implies the market is pricing in:

A. Sustained High Profitability

The market is baking in:

ROE near 18–20% consistently (vs. long-term average of ~15%)

ROA above 2.4% — among the highest in Indian banking

NIMs around 4.3–4.5% despite rising deposit costs

Implied EPS growth expectation: ~14–16% CAGR over the next 3–5 years

B. Loan Growth Above System Average

Current valuations assume:

Loan book CAGR of ~13–15% driven by:

Retail & SME compounding

Market share gains from PSUs

Strong performance from subsidiaries (AMC, Insurance)

C. Continued Clean Asset Quality

To justify this valuation, ICICI must:

Keep gross NPA <2%

Maintain net NPA <0.5%

Keep credit cost <70–80 bps annually

Avoid large negative surprises from builder/NBFC/corporate exposure

D. Tech-Led Operating Leverage

A cost-to-income ratio of <40% is implicitly priced in — meaning:

Operating costs grow slower than revenues

Digital platforms (InstaBIZ, iLens, Amazon Pay) drive cross-sell & scale

E. Capital Efficiency & Capital Return

With a CET-1 of 15.94%, the bank is well-capitalized — but the market is expecting:

Higher dividend payouts over time

Continued low dilution via capital raises

Strategic use of excess capital (e.g., inorganic growth or buybacks eventually)

3.2 Valuation Summary

Compared to peers like HDFC Bank, ICICI Bank trades at a modest premium—justified by higher RoA, cleaner asset profile, and digital leadership. ICICI offers higher return ratios than Axis or Kotak, with comparable asset quality and a stronger retail + SME engine than HDFC.

3.3 Risk Flags to Watch

If any of the following happens, the current valuation could look stretched:

NIM compression below 4.1%

Credit costs rising to >1%

Retail loan stress post interest rate normalization

Weak performance from subsidiaries (e.g., Life, AMC, Securities)

❌ Limited Margin of Safety: At current levels, the stock prices in strong execution. Any macroeconomic shocks, NIM compression, or asset quality hiccups could impact near-term returns.

4. What Should Investors Do? ICICI Bank Investment Outlook

With FY25 behind it, ICICI Bank has delivered yet another year of steady compounding — with profitability, growth, and risk metrics all pointing in the right direction. But does that mean it’s a buy today?

4.1 Reasons to Stay Invested / Accumulate on Dips:

Consistent Compounding Engine

5-year PAT CAGR >15%

Return ratios (ROE 18.2%, ROA 2.49%) among the best in Indian banking

Margins stable despite rising deposit costs

Top-Quality Loan Book

Net NPA at 0.39% with robust 76.2% provision coverage

Strong retail (52.4% of book) and SME/Biz banking growth (+33.7% YoY)

Very low exposure to stressed corporate assets (<0.7% BB and below)

Subsidiary Strength

ICICI Prudential Life, AMC, and Lombard continue to deliver growth

Synergies expanding as ICICI Securities becomes a 100% subsidiary

Digital and Operational Leverage

Tech-heavy, process-light approach aiding cost efficiencies (C/I at 37.9%)

Aggressive investments in digital distribution, lending platforms, and embedded finance

4.2 Risks to Watch:

Valuation Risks: Trading at ~19.8x P/E and ~3.4x P/B — priced for perfection.

Cost of Deposits: Rising faster (5.00% in Q4) and may pressure NIMs if rate cycle turns

Macro Uncertainty: Global liquidity, inflation shocks, or geopolitical risks may affect flows and credit growth

Competition from PSU banks: As balance sheets of SBI, BoB improve, margin pressure may emerge in pricing-sensitive segments

4.3 Investment Verdict:

ICICI Bank remains a structural compounding story, though near-term upside may be capped due to valuations.

ICICI Bank is a structural story, not a tactical trade.

For investors who prefer quality, predictability, and compounding over 2–5 years, this is a core banking stock worth holding — and buying more of during market dips.

Disclaimer

Content Accuracy and Reliability: This summary of the earnings call is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities. Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions. No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary. Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional