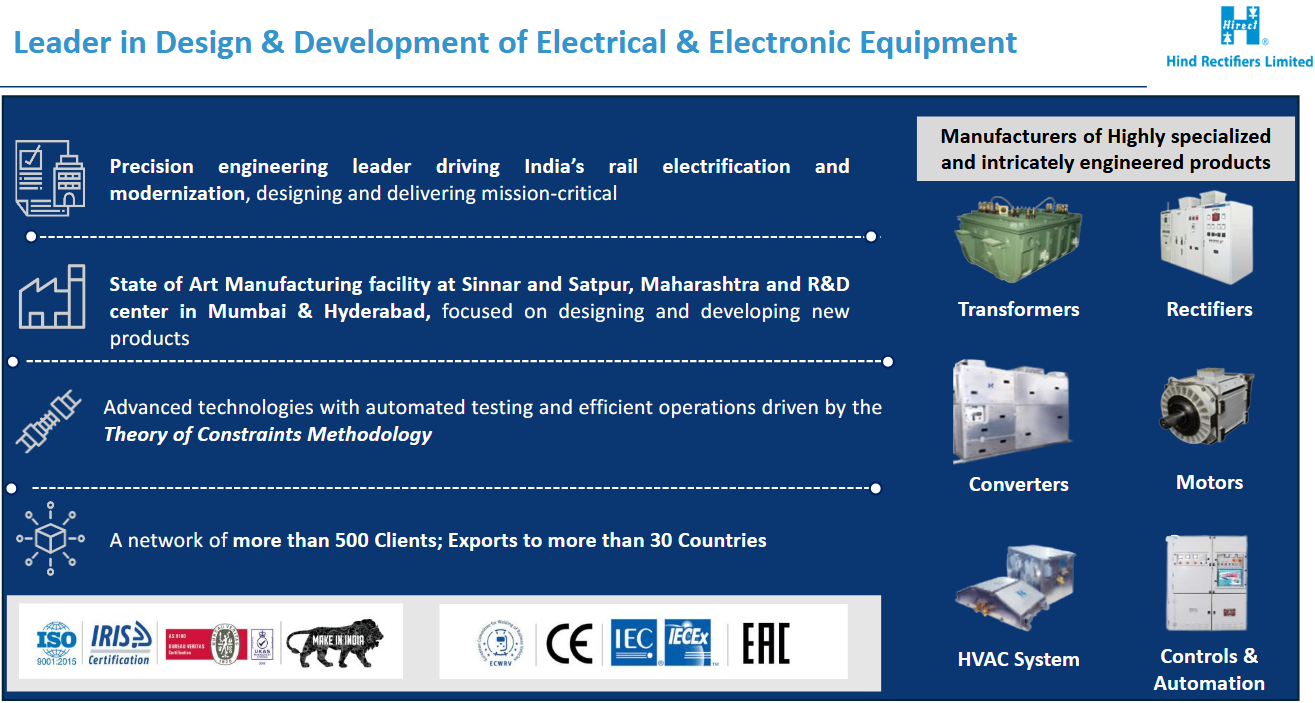

Hind Rectifiers Q2 FY26 Results: PAT Up 44%, FY26 Guidance On-track

Guidance of 30%+ revenue CAGR for FY25-29 by Hind Rectifiers. Even after a strong a Q2 FY26 the valuations are at a premium and price in the growth till FY27

1. Power Electronics Equipment Manufacturing

hirect.com | NSE: HIRECT

Our core customer is Indian Railways, contributing 90% of our revenues

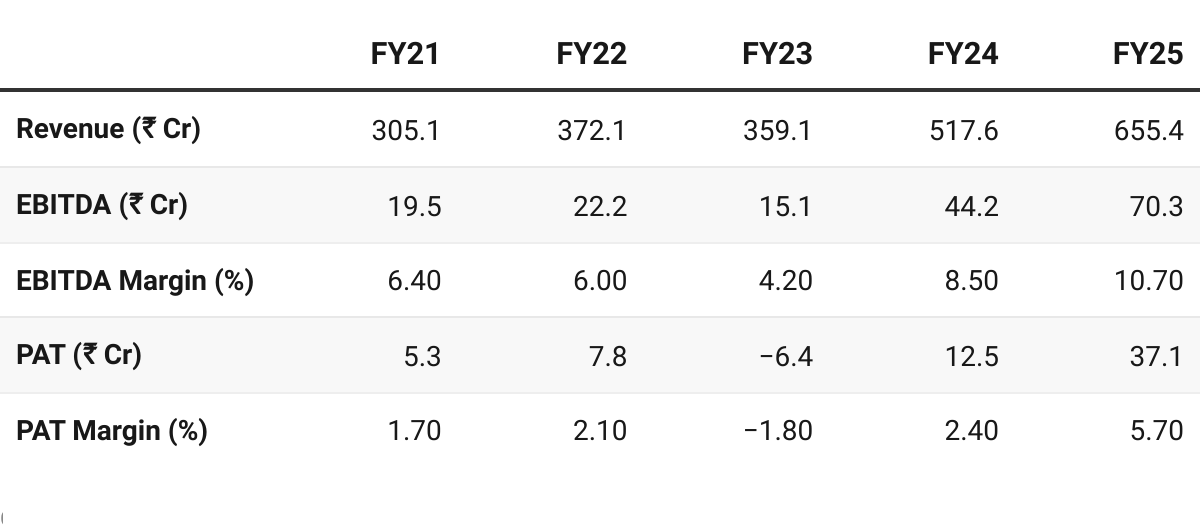

2. FY21–25: PAT CAGR of 63% & Revenue CAGR of 21%

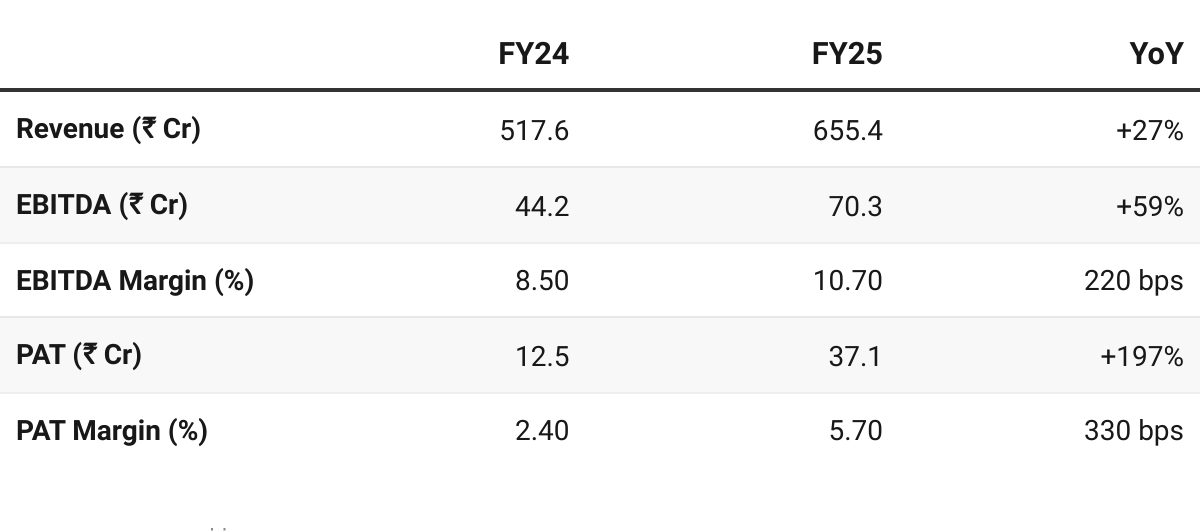

3. FY25: PAT up 197% & Revenue up 27%

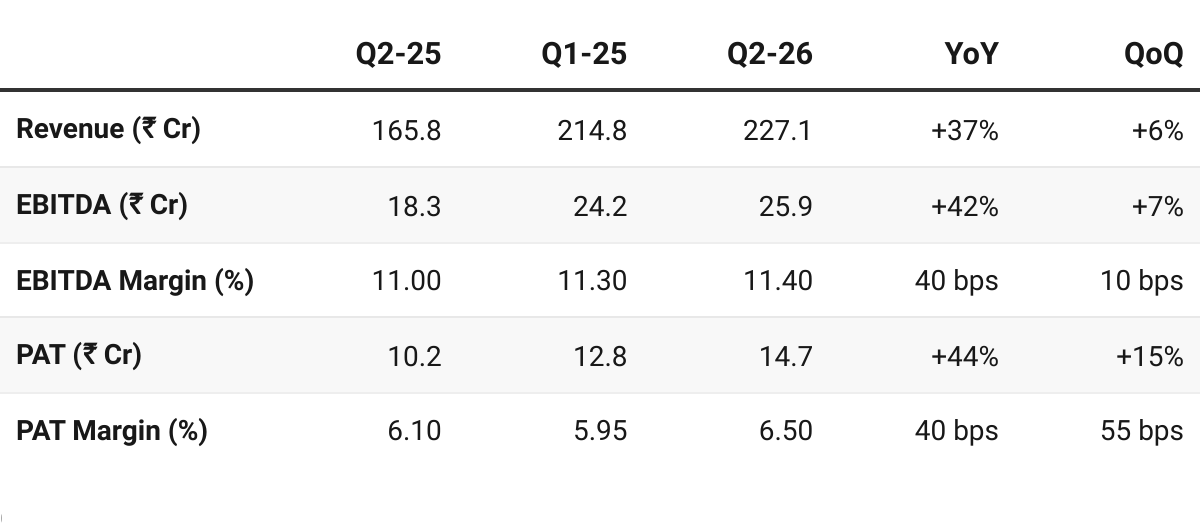

4. Q2-26: PAT up 44% & Revenue up 37% YoY

PAT up 15% & Revenue up 6% QoQ

Appointment of a new CEO

Acquisition of BeLink Solutions, France – European manufacturing base

Commissioning of Copper Conductors facility at Sinnar

Backward integration, supporting traction transformer requirements

Gross margins contracted (H1 to H1 comparison).

Due to supply chain and logistics problems

Shortage of copper conductors which necessitated expensive imports

Weaker product mix was also a contributing factor.

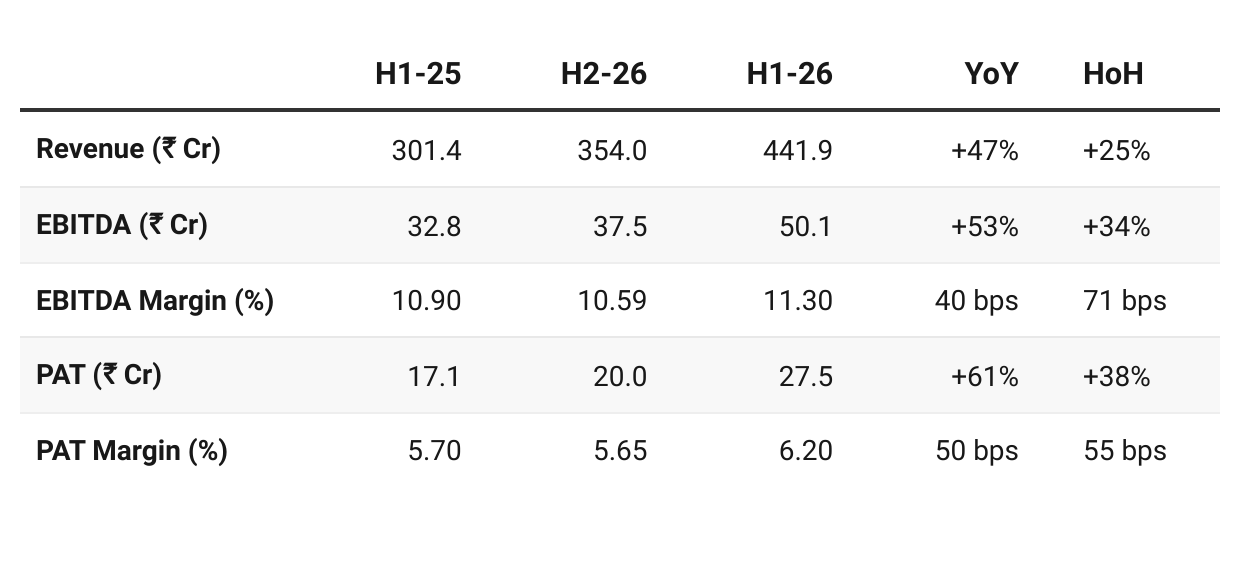

5. H1-26: PAT up 61% & Revenue up 47% YoY

PAT up 38% & Revenue up 25% HoH

Despite gross margin challenges Hind Rectifiers delivered improvement in EBIDTA and PAT margins in H1-26 compared to FY25

Margin improvement is a key deliverable of the new CEO of Hind Rectifiers

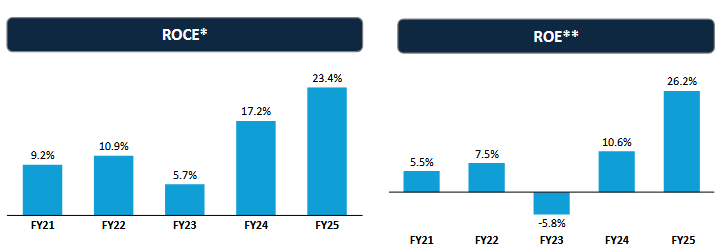

6. Return Metrics: Improving & Strong Return Ratios

7. Outlook: 30% Revenue CAGR for FY25-29

7.1 Management Guidance

Revenue Growth

You can expect higher growth but my official commitment is 30%.

We will be crossing that 30% on the year to year basis at least for next three years

EBIDTA Margin: Can we reach mid double digit in next one or two years – regarding the margins that’s actually the first goal of our CEO

Order-book: execution is 12 to 18 month window by which we have by which time we have to complete all the orders that we have on hand, particularly for the railway side.

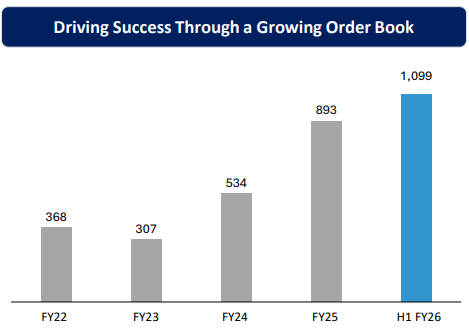

Order book – at an all time high

7.2 H1 FY26 Performance vs FY26 Guidance

HIRECT H1 FY26 Performance Ahead of FY26 Guidance

Revenue: H1 revenue ahead of the official 30% revenue growth guidance.

Even the management is indicating growth to be higher than the promised 30%

Margins: Improvement from FY25

Order-Book: Order book at all time high and supporting revenue visibility to FY27

7. Valuation Analysis — Hind Rectifiers

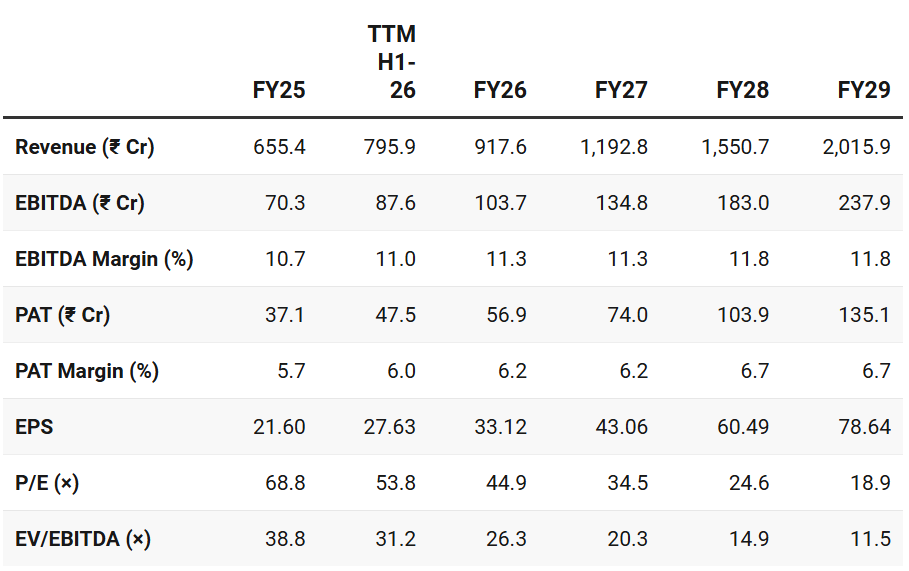

7.1 Valuation Snapshot

Current Market Price: 1485.6; Market Cap: ₹2,552.8 Cr

Assumptions: 40% growth in FY26, 30% growth going forward

Valuations reflects its high growth and improving margins

Even after the recent correction — multiples already discounts the guidance till FY27.

Suggests limited room for further multiple expansion in the near term

Limited opportunity for entry barring corrections

Existing holders can ride the momentum till it lasts

7.2 Opportunity at Current Valuation

Conservative Guidance

FY26 growth ahead of 30% growth guidance

Management indicating that growth for FY27 to FY29 will also be higher than the 30% guidance

Margin Expansion

With margin expansion a key deliverable for the new CEO bottom-line expected to grow faster than the top-line

Optionality from exports, HVAC, and defense could unlock further upside.

7.3 Risk at Current Valuation

High Execution Bar: Delivering 30%+ revenue CAGR for FY25-29 will need strong execution even though supportive demand tailwinds are in place

Valuations are demanding: Valuations for FY26 and FY27 don’t allow for any margin of safety. Impact of even a single weak quarter will be seen in the stock price

Supply Chain Risks: H1 FY26 has already seen lowered gross margins on account of supply chain issues

Concentration Risk: Railways accounting for ~90% of revenue of Hindustan Rectifiers

Propulsion system still in field trial phase – contribution to revenue is contingent on trial success and tender wins.

Previous Coverage of HIRECT

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer