Hind Rectifiers Q1 FY26 Results: Profit Up 86%, FY26 Guidance on Track

Guidance of 30% growth. At premium multiples, for a company dependent on one customer, with tender-based pricing, & early-stage execution in propulsion & exports

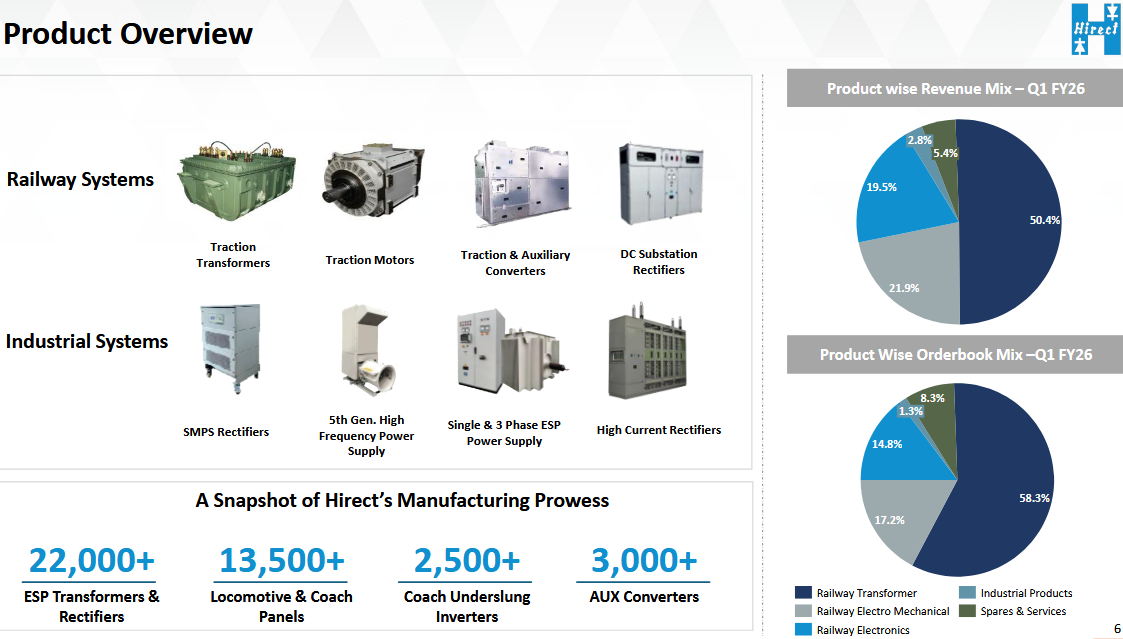

1. Power Electronics Equipment Manufacturing

hirect.com | NSE: HIRECT

Our core customer is Indian Railways, contributing 90% of our revenues

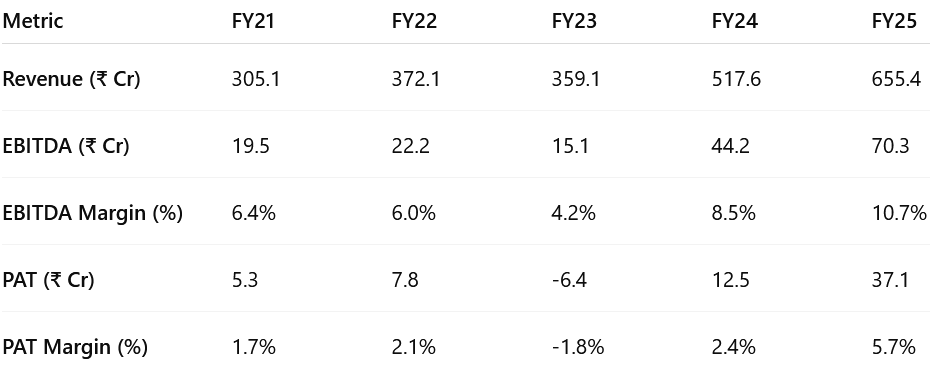

2. FY21–25: PAT CAGR of 63% & Revenue CAGR of 21%

Set up new manufacturing plant at Sinnar (2023)

Deep backward integration in transformers and converter subassemblies

Established in-house propulsion system (commissioned by FY25-end)

Created AI, IT & Web3 subsidiaries for future diversification

Expansion into export markets (Europe, MENA) initiated

Transitioned from a component vendor to a full railway systems provider

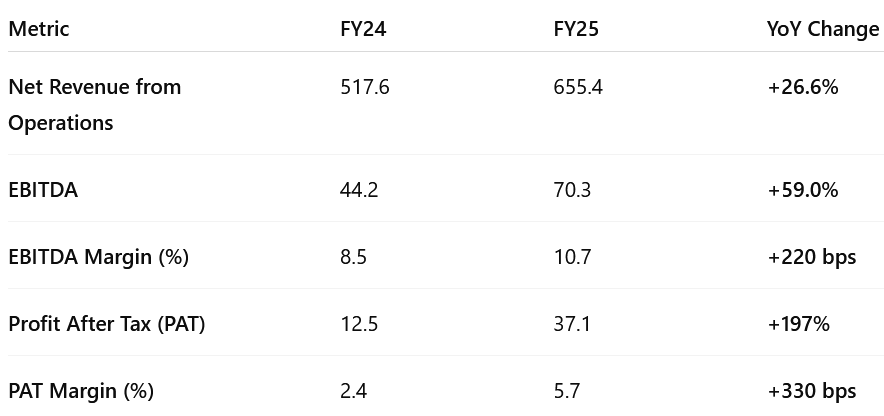

3. FY25: PAT up 197% & Revenue up 27%

Railway Business (90% of revenue)

Propulsion System: Commissioned & field-tested

Successful propulsion system commissioning positions company for 20% tender share once 50,000 km field trials complete (expected in FY26 Q2)

Traction Transformers: Market leader with ~45% share

Aux Converters for Alstom: >2,000 units supplied

HVAC for LHB coaches: Commissioned

EBITDA margin expanded by 220 bps, signaling healthier product mix

₹893 Cr order book provides strong visibility for FY26

Backward Integration:

Transformer tank welding (30–35% BOM cost) now in-house via robotic welding

Two new backward integration product lines to be operational by FY26 Q2–Q3

R&D: Focus: Braking systems, new converters, battery chargers

Goal: Increase margin, indigenize supply chain

New Subsidiaries:

Coincade Studios (AI, IT, Web3)

Hirect FZ-LLC (Middle East expansion)

Export Market: First products exported to Germany and USA

Targeting 30% growth in FY26 with improving ROE/ROCE and no major capex need

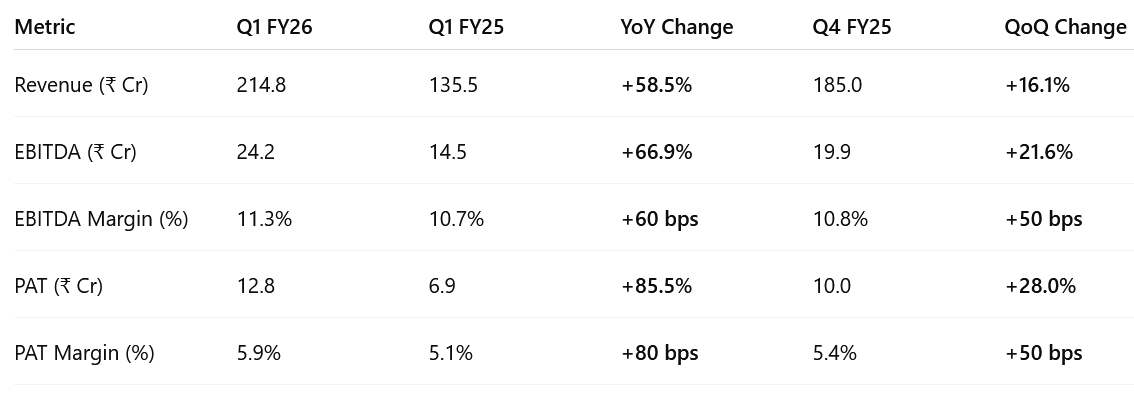

4. Q1-26: PAT up 86% & Revenue up 59% YoY

PAT up 28% & Revenue up 16% QoQ

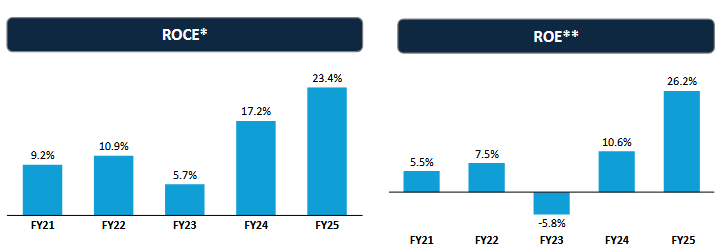

5. Return Metrics: Improving & Strong Return Ratios

6. Outlook: 30% Revenue Growth for FY26

6.1 Management Guidance

Revenue Growth: ~30% YoY growth in FY26

EBITDA Margins:

Targeting “mid to late teens” over 2–3 years;

Near-term stable/improving margins expected

Propulsion System: Field trials underway; revenue contribution expected from FY26 onwards

Order Book:

Targeting strong visibility with order book at ₹1,025 Cr as of 30th June 2025

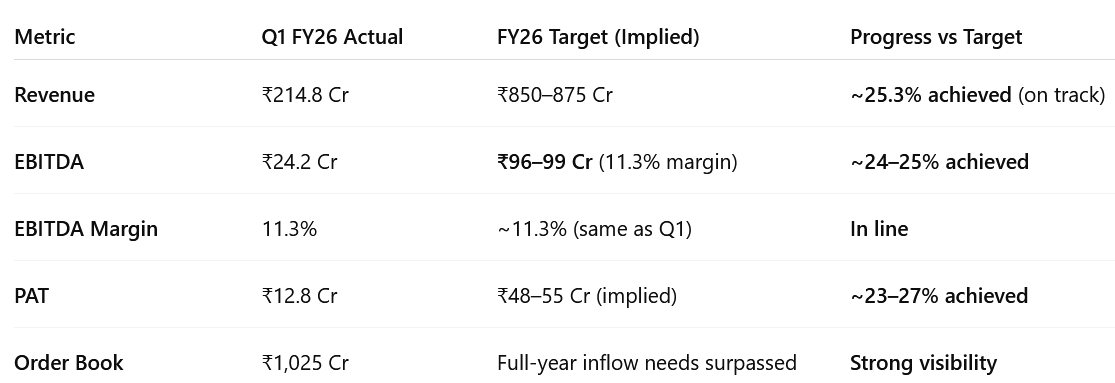

6.2 Q1 FY26 Performance vs FY26 Guidance

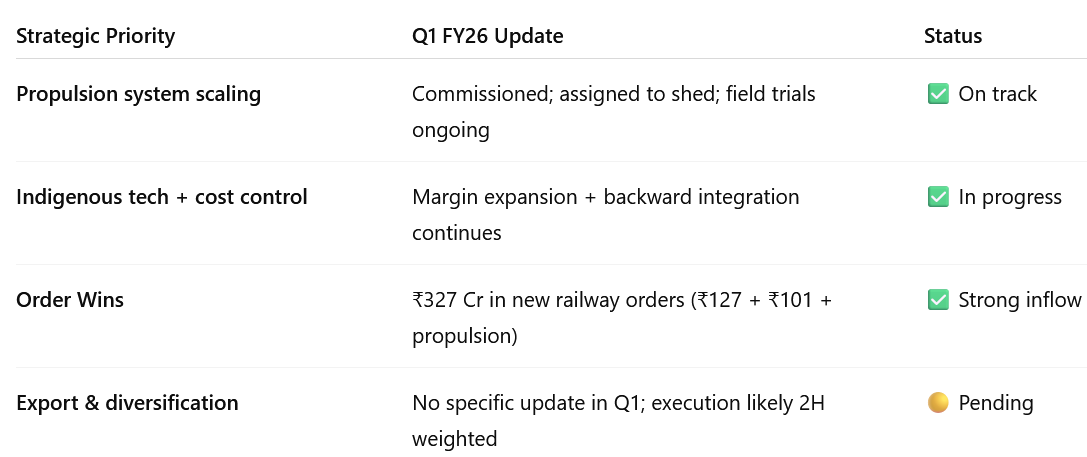

Key Qualitative Metrics vs Strategic Direction

7. Valuation Analysis — Hind Rectifiers

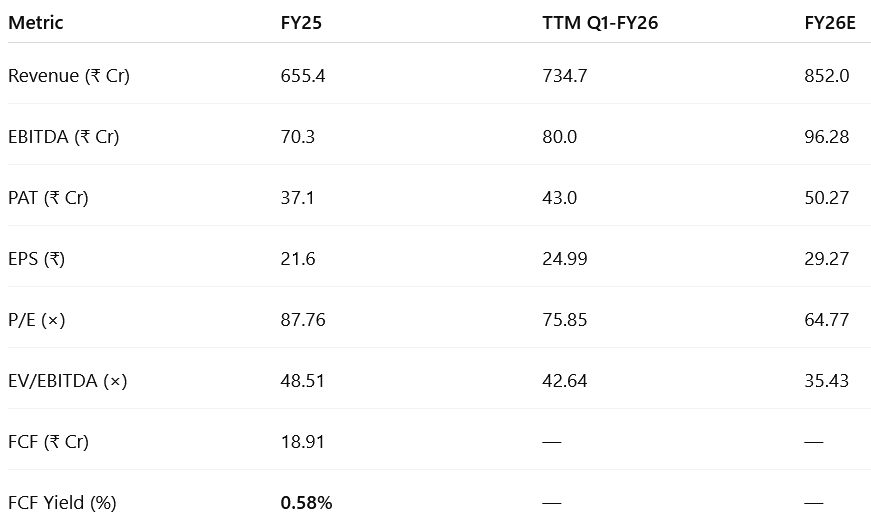

7.1 Valuation Snapshot

Market Cap: ₹3,253.36 Cr | EV: ₹3,411.26 Cr

These are premium multiples, especially for a company still dependent on a single customer (Indian Railways), with tender-based pricing, and early-stage execution in propulsion and exports.

P/E Ratio

FY25 P/E of 87.76× looks optically expensive. FY26E P/E drops to 64.77×, reflecting strong expected earnings growth (~35% PAT growth on account of margin expansion).

This still implies a premium valuation for a mid-cap industrial stock.

EV/EBITDA

FY25: 48.5×, FY26E: 35.4×

These are rich multiples, even for high-growth capital goods businesses.

A typical fair range for industrials: 12–18× EV/EBITDA.

Free Cash Flow Yield

Only 0.58% in FY25, suggesting that HIRECT is reinvesting heavily (capex + working capital).

Low FCF yield implies valuation is growth-justified, not yield-driven.

Valuation Perspective

Absolute valuation: Appears expensive on P/E and EV/EBITDA. Valuation embeds high growth expectations

Growth-adjusted: PAT CAGR of ~35%,if sustained from FY25 to FY28 still leaves it at premium valuations

Peer Comparison Higher valuation than peers like TRIL, HBL Power due to product mix & margin profile

Risk Premium High dependency on Indian Railways & tender-based business implies some execution risk

Re-rating Catalysts

Successful propulsion system scale-up: Field trials ongoing (Q1 FY26)

Export traction (Germany/USA orders): Early-stage

Operating leverage from ₹1,000 Cr order book: Visible in FY26

Margin expansion to 13–15% EBITDA: Gradual by FY27

7.2 Opportunity at Current Valuation

Strong execution visibility with ₹1,025 Cr order book; core segments scaling well.

Propulsion system field trials underway; eligibility for 20% of new railway tenders could be a game-changer.

EBITDA margin expansion from 8.5% (FY24) to 10.7% (FY25), and 11.3% in Q1 FY26.

PAT expected to grow ~35% in FY26; ROE already at a robust 26.2%.

Leaner working capital cycle and backward integration support sustained margin improvement.

Valuation has moderated – P/E at ~65×, EV/EBITDA at ~35× on FY26E, reflecting growth.

Optionality from exports, HVAC, and defense could unlock further upside.

7.3 Risk at Current Valuation

High customer concentration – 90%+ revenue linked to Indian Railways; any slowdown or policy shift can materially impact growth.

Valuation risk – P/E (~65×) and EV/EBITDA (~35×) leave little room for execution slippage or delays.

Propulsion system still in field trial phase – contribution to revenue is contingent on trial success and tender wins.

Low free cash flow yield (0.58%) – cash conversion remains weak due to high working capital and reinvestment needs.

Execution-heavy business model – ₹1,000+ Cr order book demands timely delivery and quality compliance across complex systems.

Tender-driven pricing – limits pricing power and exposes margins to competitive pressure.

Risk Rating: HIGH

Current valuations assume smooth execution and margin expansion. Any delay in propulsion scale-up, railway order deferrals, or margin pressures could lead to meaningful downside from elevated levels.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer