Himadri Speciality Q1-26 Results: Profit Up 35%, FY27 PAT Guidance on Track

Evolving into a high-margin specialty materials company. PAT to grow 20%+ CAGR by FY27 with capital efficiency. Execution priced in — but delivery unlocks compounding

1. Speciality Chemicals Company

himadri.com | NSE: HSCL

India’s leading coal tar pitch (CTP) manufacturer with ~50% market share

Integrated operations spanning coal tar distillation, carbon black, and specialty chemicals.

Among the top five domestic carbon black producers, with flexibility in feedstock and plans to expand specialty carbon black capacity from 60,000 MT to 130,000 MT by Q3 FY26

Produces naphthalene for SNF applications

Acquisitions to strengthen position in high-performance batteries, particularly in electric vehicles and renewable energy storage

Investment in Sicona Battery Technologies

Investment in International Battery Company (IBC)

Investment in Invati Creations

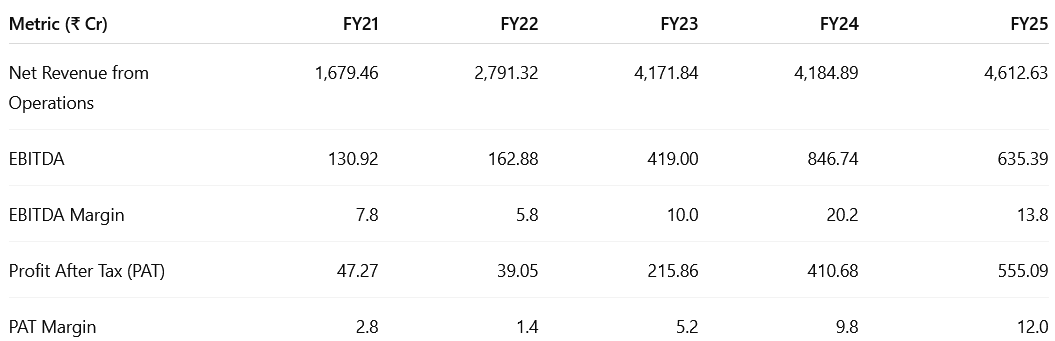

2. FY21–25: PAT CAGR of 85% & Revenue CAGR of 29%

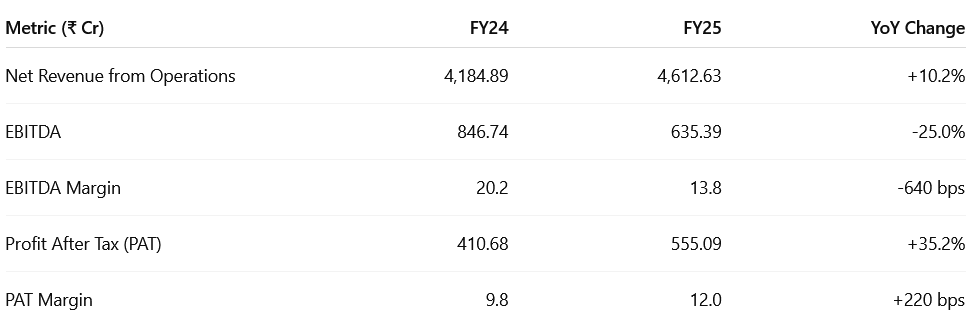

3. FY25: PAT up 36% & Revenue up 10%

FY25 witnessed robust 35% PAT growth, even as EBITDA declined YoY due to lower raw material cost pass-throughs and margin normalization. PAT margin expanded by 220 bps to 12%.

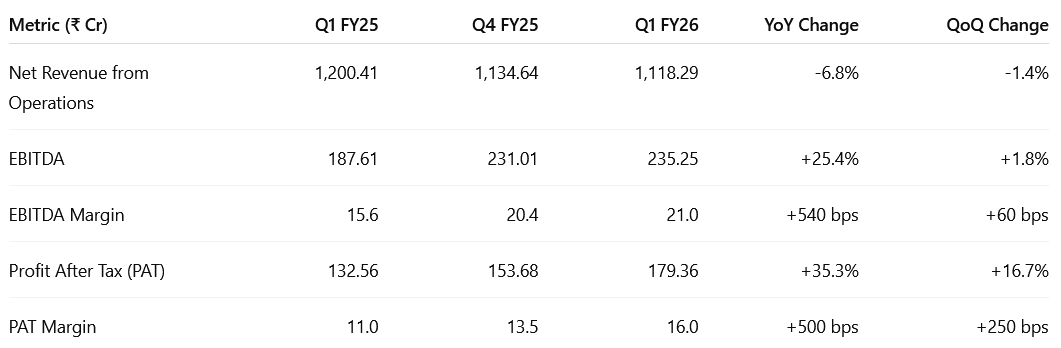

4. Q1-26: PAT up 35% & Revenue down 7% YoY

PAT up 8% & Revenue down 1% QoQ

Margin-led Profit Growth

EBITDA Margin expanded 540 bps YoY, despite a revenue decline — driven by:

Increased share of high-value products (e.g. refined naphthalene, specialty carbon black).

Waste heat recovery systems and better yield management.

Stable input costs with stronger pricing in export markets.

Controlled employee and other expenses despite scale-up of tyre and carbon black initiatives.

Jump in other income to ₹26.7 Cr (vs ₹12.6 Cr YoY), aided by treasury gains and FX movement.

Segmental Growth Drivers

Battery Materials & Clean Tech

LFP cathode material pilot line results successful with IBC.

Commercial-scale LFP plant (40,000 MTPA) on track for Q3 FY27.

Anode material samples undergoing validation; capex announcement expected post-engineering completion.

Specialty Carbon Black

Operating at ~99% utilization; new 70,000 MTPA brownfield capacity on track for Q3 FY26 commissioning.

Europe exports rising (15–18% of carbon black sales); benefiting from competitor shutdowns (e.g., Orion in Europe).

Birla Tyres (Consumer Brand Relaunch)

₹18 Cr revenue in Q1 (₹5 Cr from tyres, rest from marketing/trading arm).

Distributed across 11 states; strong response for brands like BT112, Ultra Mileage.

PCR (EV & SUV) and OTR product lines to scale from H2 FY26.

Refined Chemicals (Aromatics)

First-of-its-kind anthraquinone + carbazole extraction plant under construction.

Commissioning expected in Q2 FY27; will substitute imports and boost margins.

Consumer Product – Durofresh

Launch of retail mothball (naphthalene balls) brand.

Backed by 99.5% purity and existing global supply leadership.

Capex pipeline: ₹2,500–3,000 Cr over FY25–27 across LFP, carbon black, tyres, and aromatics.

Key Takeaways

Strong PAT growth despite revenue dip — driven by mix and efficiency

Specialty Carbon Black and Refined Naphthalene scaling steadily

Tyre business operational and earning — early signs of strong brand recall

Battery materials ramping well: IBC partnership de-risked LFP rollout

FY26–FY27 to be pivotal in monetizing years of R&D and vertical integration

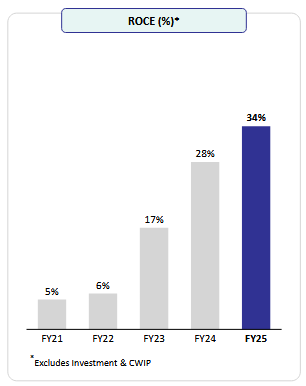

5. Return Metrics: Improving & Remain Strong

Capital Efficiency, Operating Leverage, and Growth Without Dilution

6. Outlook: 20% PAT CAGR for FY25-27

6.1 FY27 Financial Outlook

20% PAT CAGR for FY25-27

So total, if you look at our numbers, last year, we did a PAT of INR411 crores. This year, we did a PAT of on a stand-alone basis INR558 crores. So, by FY '27, we expect a PAT of INR800-plus crores

The PAT growth trajectory from ₹411 Cr (FY24) to ₹800+ Cr (FY27) is supported by operating leverage, product mix shift, and new verticals maturing.

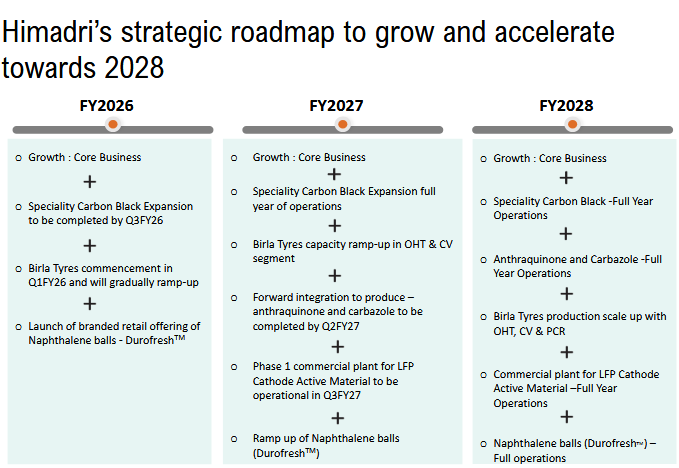

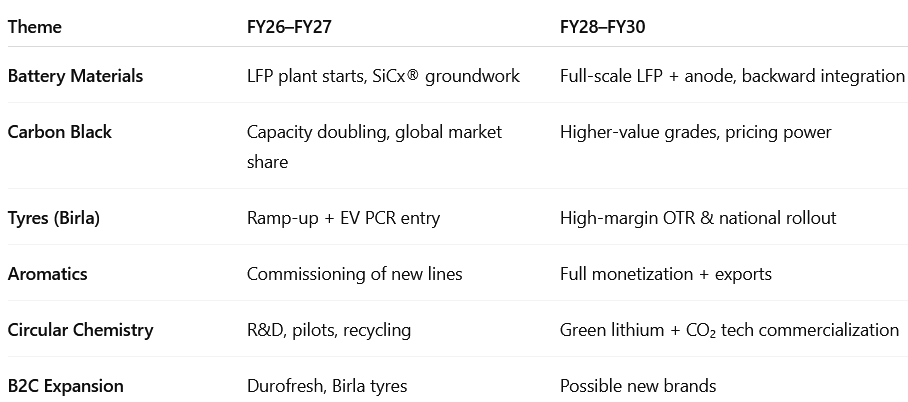

6.2 Himadri’s Strategic Evolution: FY26 to FY30

1. Battery Materials — Core Driver of Next-Gen Growth

LFP Cathode Active Material (CAM)

40,000 MTPA commercial plant to be commissioned by Q3 FY27.

Part of long-term goal to supply 100+ GWh of lithium-ion battery capacity.

Expected revenue from Phase 1: ₹2,500–2,700 Cr/year.

Strategic customers: IBC (India/U.S.), EV and energy storage firms.

Anode Materials (Natural, Synthetic, Si-Carbon)

Exclusive India license for Sicona’s SiCx® (silicon-carbon) tech.

Strong global tailwinds: U.S. and EU tariffs on Chinese anodes open up export opportunities.

Himadri has not announced capex yet but:

Customer sample testing is ongoing

Engineering work is underway

Will cater to hybrid and high-performance battery chemistries

🎯 Himadri is positioning to become India’s only integrated supplier of cathode + anode battery materials.

2. Birla Tyres – Flagship B2C Transformation

Rebranded and relaunched in Q1 FY26; sold ₹18 Cr in first month.

Focus areas:

Off-highway tyres (OTR)

Commercial and agri tyres

Passenger Car Radials (PCRs) for EVs and SUVs

Capex of ₹250–300 Cr to modernize and restart bias, OTR, and PCR lines.

Birla is a strategic B2C entry platform, with strong brand recall and dealer expansion in 11+ states.

3. Speciality Carbon Black – Scaling to Global Top 5

Brownfield expansion to 130,000 MTPA by Q3 FY26.

Applications: batteries, electronics, plastics, inks, FDA-compliant products.

Export markets: Europe, East Asia; well-positioned due to shutdowns by peers like Orion.

Contribution to PAT expected to rise sharply from FY27 onward.

4. Aromatics: Anthraquinone + Carbazole – New Profit Pillar

Plant under setup to extract high-value intermediates from coal tar streams.

Commissioning in Q2 FY27.

Import substitution for OLEDs, dyes, agrochemicals, pharma.

Product pricing ~7x raw oil value with low incremental costs.

5. Clean-Tech & Circular Chemistry

Green lithium: R&D on CO₂-based lithium carbonate extraction – potential breakthrough.

Battery recycling and waste-to-energy tech under incubation.

Early-stage entry into mining for backward integration.

Himadri aims to be a clean-tech ecosystem player, not just a materials company.

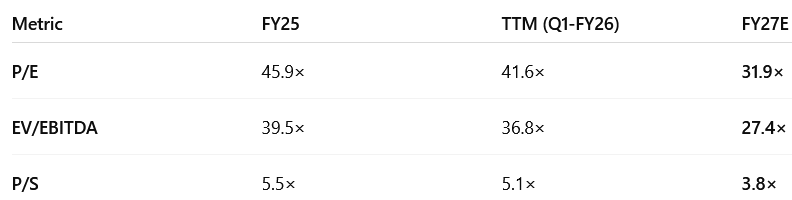

7. Valuation Analysis — Elecon Engineering

7.1 Valuation Snapshot

Derived from FY27 management guidance of ₹800 Cr PAT, with EBITDA margins similar to TTM Q1-26.

1. Price-to-Earnings (P/E)

High trailing P/E (~46× on FY25) reflects strong investor optimism around Himadri’s transformation from a chemical company to a clean-tech and new materials player.

However, the FY27E P/E of 31.9× is more moderate, implying earnings growth is expected to catch up with the valuation.

⚠️ The stock is not cheap on absolute earnings today, but investors seem to be pricing in aggressive growth from:

LFP cathode commercialization

Specialty carbon black capacity ramp-up

High-margin aromatic chemicals

New B2C segments like tyres and mothballs

2. EV/EBITDA

39.5× on FY25 EBITDA is very high — even for premium specialty chemical names.

But falls to 27.4× on FY27E EBITDA, suggesting:

Operating leverage will kick in from capacity utilization

High fixed-cost absorption will improve

New business verticals (tyres, battery materials) will start contributing meaningfully

3. Price-to-Sales (P/S)

P/S drops from 5.5× (FY25) to 3.8× (FY27E) — reasonable for a company with high margins (PAT margin 12–16%) and growing exports.

Indicates the valuation expansion is mostly earnings/margin-driven, not revenue bloat.

4. Strategic Overlay

Multiple growth engines are in motion:

Battery material scale-up (LFP + anode)

Aromatics value-unlock (anthraquinone, carbazole)

Specialty carbon black expansion (130,000 MTPA by Q3 FY26)

Consumer-facing brand revival (Birla Tyres, Durofresh)

Overall

Valuation Today: Expensive by traditional metrics — FY25 and TTM multiples are elevated

Valuation on FY27: More justifiable — implies strong 2-year earnings compounding (~20–25% CAGR)

Investor Sentiment: Pricing in a "platform company" story — diversified clean-tech, not just chemicals

Risk: Execution risk across many verticals + dependence on demand ramp-up (e.g. LFP adoption)

If management delivers, Himadri’s FY27 multiples may look cheap in hindsight. Otherwise, current valuation leaves little room for disappointment.

7.2 Opportunity at Current Valuation

Growth Visibility

PAT expected to grow ~21% CAGR over FY25–27 (₹555 Cr → ₹800+ Cr), driven by:

High-margin ramp-up in specialty carbon black, battery materials, and consumer brands.

Incremental revenue from Birla Tyres, aromatic downstreams, and IBC JV.

ROE >18% and ROCE ~19% in FY25; expected to expand with better margin mix.

Asset-Light Execution

₹400+ Cr of capex is fully funded without equity dilution or debt risk.

Net cash balance of ₹229 Cr enables optionality across growth bets.

Underpenetrated Global Optionality

Exports already contribute 34% of revenue (Q1 FY26); share expected to rise further with:

LFP commercial scale-up in FY28 targeting global cell makers (IBC, MGL JV, etc.).

Carbon black expansion focused on premium European market (20% export share today).

Margin Expansion from Product Mix

High-margin share increasing:

Refined Naphthalene, advanced carbon black grades, and specialty coal-tar derivatives.

Waste heat recovery and operational yield optimization support margin durability.

Q1 FY26 PAT margin hit 16%, vs. 12% in FY25.

Optionality: Tyres + Battery Materials

Birla Tyres ramp-up to generate ₹1,000+ Cr revenue potential by FY28.

LFP cathode + anode materials entering early OEM qualification; commercial scale-up by FY27–28.

Himadri is the first non-China player with a commercial 40,000 TPA LFP plant in execution.

If PAT compounds at >20% CAGR through FY27–30, the current valuation (P/E of 31.9x FY27E) may prove reasonable on risk-adjusted basis — particularly if earnings quality remains high.

7.3 Risk at Current Valuation

Rich Valuation Leaves Little Room for Error

FY27E multiples:

P/E: 31.9×, EV/EBITDA: 27.4×, P/S: 3.8×

Execution must be flawless to justify current valuations. Even mild delays or misses could result in de-rating.

Execution Bottlenecks

New verticals (e.g. tyres, battery chemicals, aromatics) carry execution, ramp-up, and demand risk.

LFP cathode success hinges on OEM approval and IBC ramp-up timeline.

Tyres require B2C brand trust + multi-tier dealer expansion — a different DNA from chemicals.

Margin Compression Risk

Q1 FY26 EBITDA margin fell to 21% (vs. 25% in Q1 FY25); offset by product mix, but...

Raw material volatility, price competition, or delayed operating leverage could hurt profitability.

Dependence on Capex Monetization

₹400 Cr+ of expansion is underway (carbon black, LFP, tyres, chemicals).

If utilization delays extend beyond FY27, ROCE drag is likely.

Demand Fragility

Demand linked to EV adoption (LFP), commodity cycles (coal-tar), and macro conditions in export markets.

Revenue concentration still moderately high in coal tar and carbon black (legacy verticals).

TTM Earnings Elevated by One-Offs

FY25 and Q1 FY26 PAT benefited from:

FX gains (₹9.8 Cr Q1 FY26)

Inventory gains amid soft input prices

Normalized earnings could be 10–15% lower in stress cases — raising true valuation multiples.

Himadri is building a platform of integrated, high-margin chemical and cleantech businesses. While the FY27 valuation is optically fair if execution holds, any delays in LFP ramp-up, tyre scale-up, or export-driven revenue growth could lead to swift multiple contraction.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer