Happiest Minds Technologies Ltd - Expensive stock

A good company, confident about its prospects in FY24.

Company Overview

Happiest Minds enables Digital Transformation for enterprises and technology providers by delivering seamless customer experience, business efficiency and actionable insights through an integrated set of disruptive technologies such as: artificial intelligence, blockchain, cloud, digital process automation, internet of things, robotics/drones, security, virtual/augmented reality, etc.

Its capabilities span digital solutions, infrastructure, product engineering and security. It delivers these services across industry sectors such as automotive, BFSI, consumer packaged goods, e-commerce, edutech, engineering R&D, hi-tech, manufacturing, retail and travel/transportation/hospitality.

Happiest Minds is headquartered in Bangalore, India with operations in the U.S., UK, Canada, Australia and Middle East.

Share Details

NSE:HAPPSTMNDS

Closing Price = 1014 (21-Jun-23)

52 Week High = 1136. Trading at 11% below 52 wk high.

52 Week Low = 763.25. Trading at 33% above 52 wk low.

P/E = 25

Market Cap = 14,394 cr ( ~$ 1.8 billion)

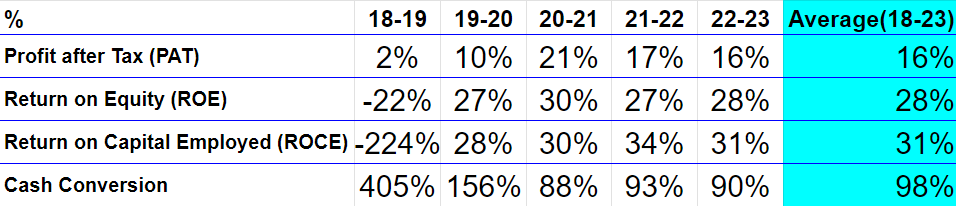

Quality: Returns on capital employed in cash

The return ratios are excellent and consistent since FY18 and is indicative of a high quality management running the company quite efficiently

We've been able to sustain #1 or #2 position in comparison with all our peers on EBITDA percentage, growth percentage, or on an index of EBITDA plus revenue growth on year-over-year basis.

Management comment during Q4-23 earnings call

Growth

25% top line growth over the last five years is impressive. A 101% bottom line growth over is even better. But these growth numbers don’t look impressive when comparing it against a PE of 62.

Outlook

Looking at remarks made by the management during the Q4-23 earnings call, the company is continuing with is guidance of 25% dollar revenue growth in constant currency terms. The management is confident of meeting its guidance and has a strong pipeline in place to deliver on its guidance

Happiest Minds has delivered outstanding results for FY23, with 23.7% revenue growth in constant currency and 26.2% EBITDA margin. We have missed our revenue growth target by 1.3%

Looking ahead for FY24, as mentioned by Ashok, we are guiding on a revenue growth of 25% and EBITDA continues to be in the range of 22% to 24%.

Many of the larger companies with whom we benchmark ourselves have reported sharply lower guidance for FY24 and reported ramp downs in accounts. We have been able to sustain our growth guidance because of a very strong pipeline

So What????

If I own the stock, I may keep it based on my historic returns, future return expectations, and availability of alternative stock ideas. Its a good company and if I am sitting on historical returns then I may want to stay with it.

If I don’t own the stock, I may not want to enter it given that its very expensive at a PE of 62. For a quick comparison TCS, which is 83 times bigger in market cap is available at a PE of 28. Even if I look at NSE:HAPPSTMNDS in isolation, its very hard to justify a PE of 62 for a guidance of 25% top line growth in constant currency terms.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades