Gujarat Themis Biosyn - Get growth at an attractive price

Successfully changed business model. Looking at at R&D Lab, increase fermentation capacity and API block for future growth

Company Overview

Gujarat Themis Biosyn Limited (GTBL) manufactures Rifamycin S and Rifamycin O both of which are intermediates for the antibiotics Rifampicin and Rifaximin respectively.

GTBL is among the few companies in India with fermentation capabilities for intermediates. Setting up fermentation capabilities is capital intensive and is an entry barriers for new players.

In FY19 GTBL moved away from contract manufacturing to a manufacturing and sales model. GTBL has fungible capacities of up to 16,000 kg/month at its manufacturing manufacturing plant in Vapi, Gujarat with about 200 employees.

Share Details

BOM: 506879 ( gtbl.in)

Quality: Returns on capital employed in cash

The business model undertaken during FY19 changed the company profile in terms of the business profiles, hence the financials are analysed from FY20. A PAT margin of 35% looks quite attractive and the challenge will be to sustain it.

Growth

Top-line growth of 21% along with a bottom-line growth of 35% is quite good but the margins may not be sustainable

Outlook

The outlook as based on various comments during the earnings calls in the last few years shows that the business model transition impact has played out.

In FY24, We are looking at 25-30% growth

So I think it’s something that we’ve really not come out and given those numbers, but what we are looking at is 25% to 30% growth in terms of where we are this year in the next financial year. So this particular API block should help us attain that kind of growth level.

Based on the bullish demand outlook, we plan to continue with our ongoing levels of production for both the products. As mentioned in the last quarter, this year we have not undertaken a plan shutdown as we had in the last two years, so that we can continue to build inventory for the anticipated demand

So our capex plans are divided into three. One is the R&D. The second is our API block and the third is our fermentation block.

In FY25, we are looking forward to new R&D and API’s coming in and growing the top-line and bottom-line

We don't really feel the need to increase capacity for our current products, but we definitely see a lot of opportunity in terms of introducing new products.

One can expect the API block to start giving us both top line and bottom line in the next financial year or perhaps in the, a little bit towards the end of this financial year.

In FY26, based on fermentation capacity there is a potential for the company to more than double in size given the plan for fermentation capacity expansion which is expected to be completed by end of calendar year 2024 which means that the full impact of the fermentation capacity will be seen in FY26 which is some years away.

Increase our fermentation capacity that we have currently from 450 cubic meters by another 550 cubic meters

The last leg of our capex will be the new fermentation facility, which are expected to be ready by the end of the next calendar year.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. The intention is to retain it for as long as one can see the impact of the capex planned till FY26 playing out as planned and adding to the top-line and bottom line of the company.

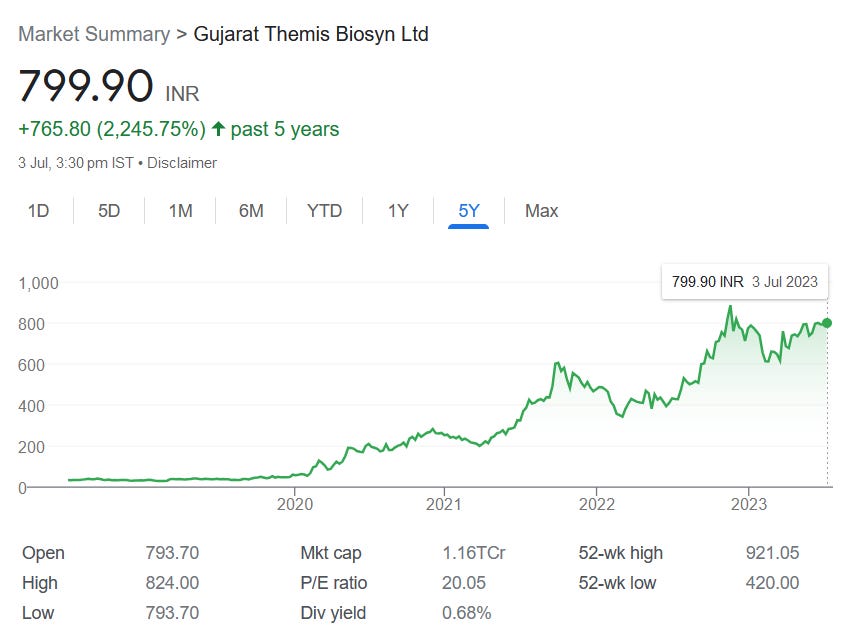

If I don't currently own the stock, I might consider entering it given that its available at a PE of 20 when the growth expectation for FY24 is in the 25-30% range. If the planned capex around the increase in fermentation capacity happens as per plan then there is a company to more than double in size by FY26.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades