Gravita: 35%+ PAT & 25%+ revenue CAGR till FY27 at a PE of 32

Redefining of Battery Waste Management Rules (BWMR) , Extended producers responsibility (EPR) & stricter implementation of GST driving GRAVITA towards achieving its Vision 2027

1. Among the largest recyclers of non-ferrous in India

gravitaindia.com | NSE: GRAVITA

One of the largest lead producer in India

2. FY19-23: PAT CAGR of 35% & Revenue CAGR of 22%

YoY increase in PAT margin since FY19

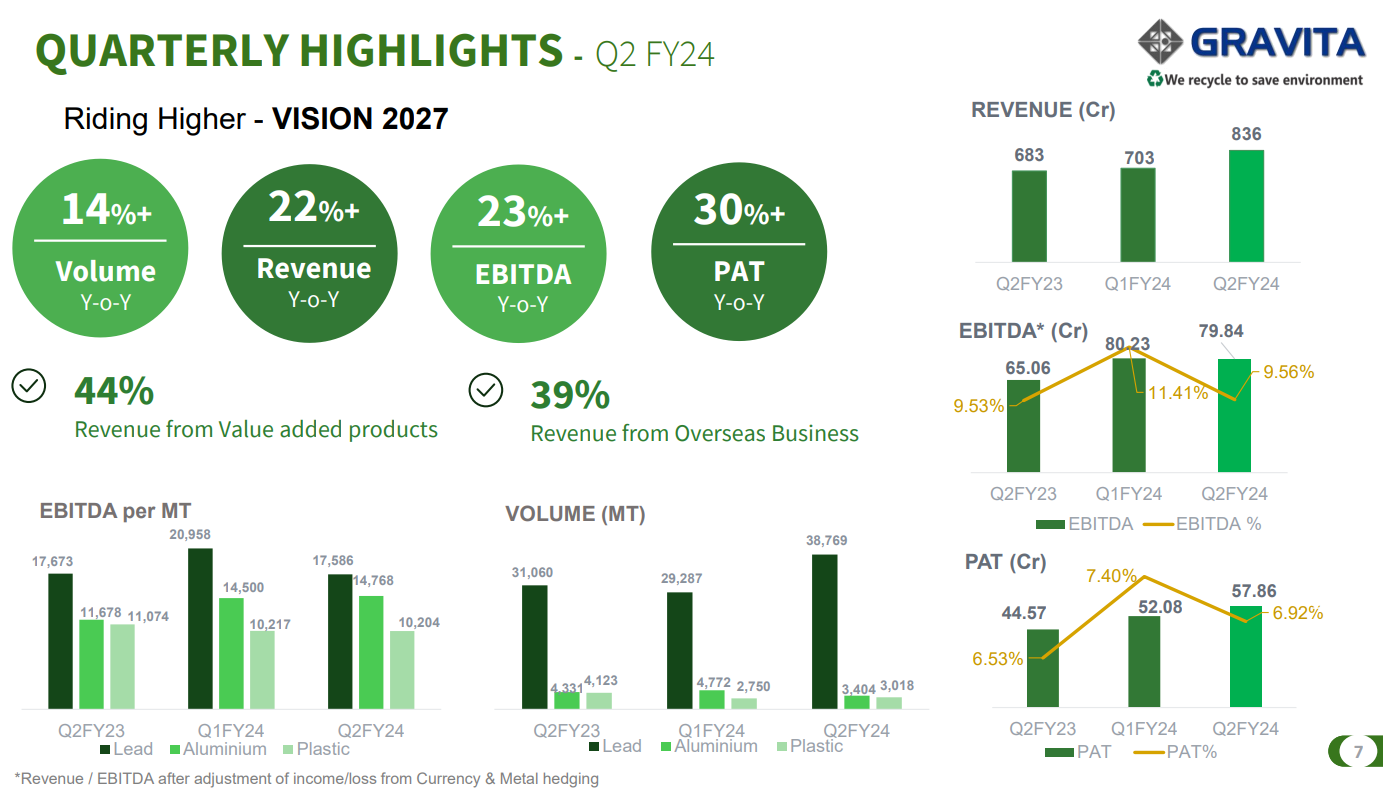

3. Q1-24: PAT up 22% on revenue growth of 21% YoY

4. Q2-24: PAT up 132% on revenue growth of 88% YoY

Volumes, Revenue, EBITDA and PAT for the quarter have increased by 14%, 22%, 23% and 30% resp.

5. H1-24: PAT up 24% & Revenue up 22% YoY

Drop in H1-24 PAT margin vs FY23 margin needs to be watched.

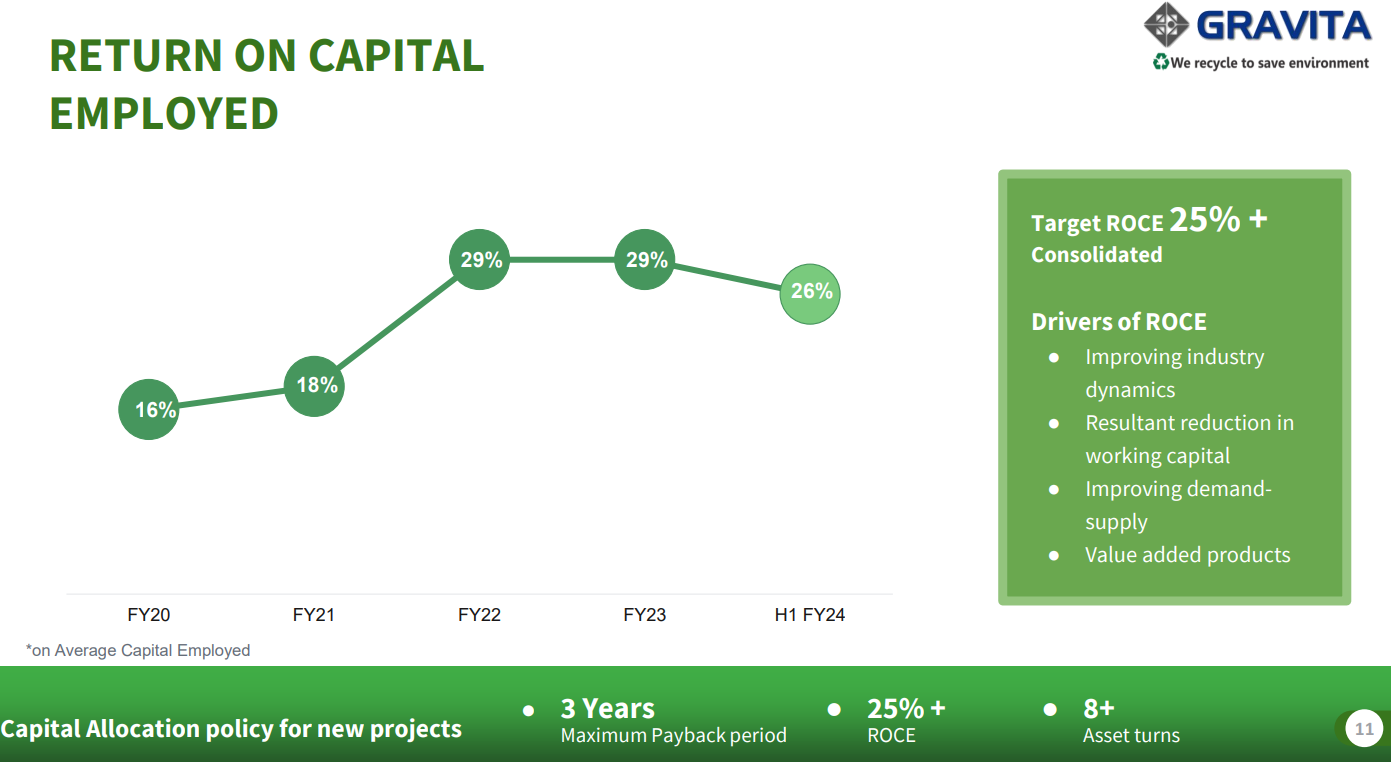

6. Strong Return Ratios: 25%+ ROCE

7. Outlook: 35%+ PAT CAGR & 25%+ Revenue CAGR till FY27

i. Executing as per Vision 2027

Confident that we will continue to deliver our best and achieve our Vision 2027.

ii. Capacity to grow at CAGR of 18% for FY23-26 to support the volume growth

We are confident that we will reach 4.25 lakh metric tonne per annum capacity by financial year '26, which will include both existing as well as new verticals.

iii. Margin expansion to be supported by increasing contribution of Value Added Products

Looks on track to meet target of 50% revenue from value added products by FY26

Proportion of Value-added products increased to 48% in H1FY24 which is very close to our Vision 2027.

iii. Industry tailwinds : Formal market will grow from 35% of total market to 75% of total market by FY26

8. 35% PAT & 25%+ revenue CAGR till FY27 at a PE of 32

9. So Wait and Watch

If I hold the stock then one may continue holding on to GRAVITA

Coverage of GRAVITA was initiated after Q4-23 results. The investment thesis has not changed after a reasonable H1-24.

H1-24 looks on track to deliver on 25% revenue growth and 35% PAT growth in FY24

Margin contraction needs to be watched for very closely. It can derail GRAVITA from delivering on its profitability growth targets. In this context Q3-24 becomes very important. A miss in Q3-24 will make the asking rate quite high to achieve the FY24 targets.

The outlook till FY27 is strong given that the management is confident of achieving Vison 2027 targets.

10. Or, join the ride

If I am looking to enter the stock then

GRAVITA is guiding for a PAT CAGR of 35%+ and Revenue CAGR for 25%+ till FY27 which makes the PE of 32 look fairly valued.

While the stock looks fairly valued, there is still a lot of headroom for the stock to grow as it works it way towards achieving Vision 2027

There could be some volatility in case 35% profitability growth in FY24 is missed given the margins delivered in H1-24

Previous coverage of GRAVITA

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades