Company Overview

GMM Pfaudler is a global leader in corrosion-resistant technologies, systems, and services for the chemical, pharmaceutical, food and energy industry.

Corporate History

GMM Pfaudler was established in 1962 as Gujarat Machinery Manufacturers.

In 1987 Pfaudler Inc., USA subscribed to a 40% equity to form a joint venture.

Pfaudler Inc. further increased their stake to 51% in 1999 and the name of the company was changed to GMM Pfaudler Limited.

In 2021 GMM Pfaudler completed the acquisition of the majority stake in the global business of the Pfaudler Group.

The interest in GMM Pfaudler Ltd. is on account of the global business of the Pfaudler Group. FY20-21 includes two months of the global business. Hence, the company will be analyzed from FY21-22.

Share Details

NSE:GMMPFAUDLR

Closing Price = 1459 (5-Jun-23)

52 Week High = 2110 (31% above closing price)

52 Week Low = 1256.67 (16% below closing price)

P/E = 39

Market Cap = 6,561 cr ( <$ 800 million)

Quality: Returns on capital employed in cash

The analysis has become difficult as the time period of the analysis starts from FY21-22. It is very difficult to be satisfied that the results are not a one off but are something which can be sutained over the long term.

Last two years ROE and ROCE is what generated the initial interest in the company. Additionally the company has guided for a ROCE of 25% in FY25. We are looking at a company which gives importance to capital allocation and is promising to run the company more efficiently

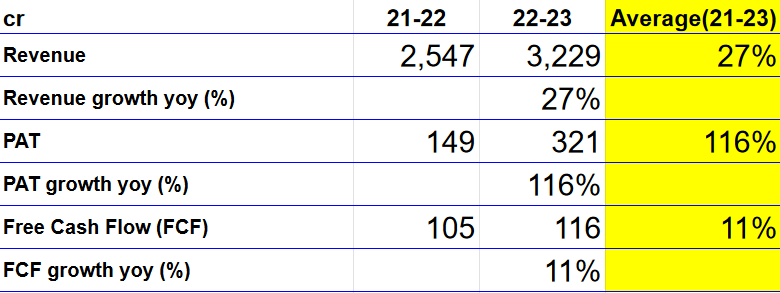

Growth

The growth data is good for the period 21-23. However, two years data to come to a conclusion on the growth performance of the company is very difficult.

We are looking at the company as it has given a bold guidance

FY25 Revenue = 3700 crore (End of FY24 we should see if the company can beat the guidance. If not, the interest in the stock may change)

FY22-25 Revenue CAGR = 14% (If there is an expectation that revenue guidance will be beaten then the CAGR guidance will automatically be beaten)

FY22-25 EBIDTA CAGR = 24%

So What????

If I own the stock, I will definitely hold on to it given its performance in FY21-22 and FY22-23 and the management guidance till 2025.

If I don’t own the stock, I would like to buy it given that its available at PE of 39 and the future prospects look interesting.

Keep in mind this is not a buy it and forget it stock. You have to be on your toes if you buy it. Read up on the controvery related to the OFS at the time of the acquisition of the international business in 2021. Look into the history of management compensation. These are some red flags. Typical of the red flags one sees investing in a small cap.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades