Glenmark Life Sciences: Solid business, reasonable price, outlook for growth

2X increase in API capacity; doubling contribution of high margin CDMO business

Company Overview

Glenmark Life Sciences (GLS), a subsidiary of Glenmark Pharmaceuticals is a leading developer of generic API’s. The API business generates close to 90% of its toal revenue. It is a manufacturer of select high value, non-commoditized Active Pharmaceutical Ingredients (APIs) in chronic therapies which contribute to close two-thirds of its API business. It also manufactures and sells APIs for acute therapies in the area of gastrointestinal, anti-infective and other therapeutic areas.

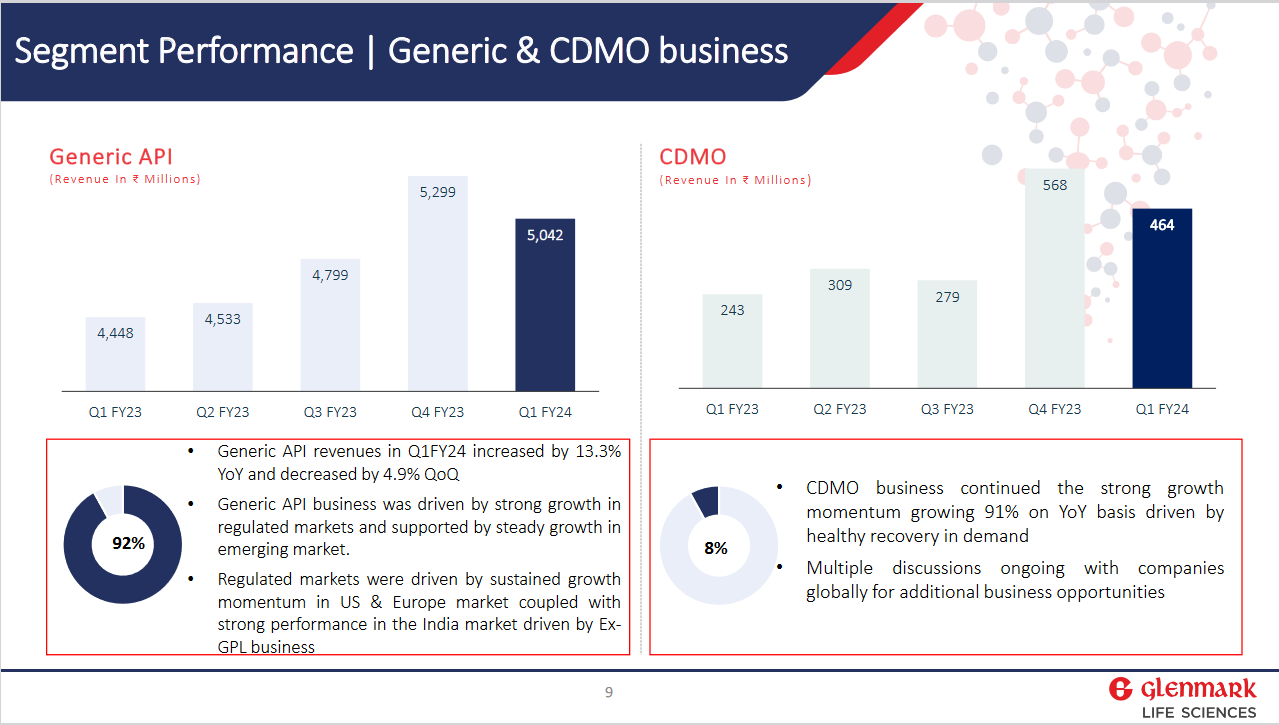

GLS also provides CDMO (contract development and manufacturing) services. The company currently derives ~8% of its revenue from CDMO services.

Parent Glenmark Pharmaceuticals is the company’s largest client for APIs accounting for about 31% of the revenue of GLS in FY23.

Share Details

NSE:GLS( glenmarklifesciences.com)

Quality: Returns on capital employed in cash

The return ratios are solid and cash conversion is good.

Growth

Growth parameters are quite average, though GLS is generating free cash flow.

Q1-24 Update

Revenue up 18.1% YoY

PAT up 24.3% YoY

PAT margin 23.4%

Cash conversion ratio: 0.72 (cash flow for quarter the Rs 98 cr)

Cash and cash equivalents of Rs 308 cr as Q1-23 end

Strategy of calibrated capex of around INR150 crores to INR200 crores for the year.

Assuming a capex of Rs 175cr (mid point of 150 to 200 cr). Free cash flow estimate for the year = 4*98 - 175 = Rs 217 cr which on market cap of Rs 7,731 cr translates into a free cash flow yield of 2.8% which makes it valuations attractive.

Q1-24 is pointing towards a better FY24 as compared to FY-23.

Outlook

2X+ opportunity by FY26 based on planned capacity expansion translating to 26%+ capacity growth CAGR.

Outlook for FY24 could mean a top-line growth of 15% and EBITDA margin of 31%

We continue to guide to the mid-teens with stable margins for FY '24.

we are saying that we will maintain at around 31%-ish

Outlook for CDMO indicates a 40%+ CAGR for the next 5 years. For FY24 CDMO to contribute 8% to 9% of revenue

We're at about INR150-ish crores right? In 5 years, we expect to go to about INR600 crores

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. The doubling of the API capacity and doubling of CDMO contribution to the overall business will keep me in the stock.

If I don't currently own the stock, I may want to enter it.

Efficiently run company, return ratios and cash generation is solid

Q1-24 results are positive, pointing to a FY24 being stronger than Fy23.

Potential arising out of the 2X increase in API capacity by FY26

Improvement in bottom-line margins on account of doubling of contributuion of the higher margin CDMO business.

GLS is available at a reasonable price of PE less than 16 and free cash flow yield of around 2.85%

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades