Genus Power Q2 FY26 Results: PAT up 194%, Upward Revision of FY26 Guidance

Guiding 50%+ revenue CAGR with improving margins. Order-book in-place to support growth. GENUSPOWER after a strong H1 FY26 is available at attractive valuations

1. Smart Metering Company

genuspower.com | NSE: GENUSPOWER

Core Business: Smart Metering Solutions

End-to-end AMI (Advanced Metering Infrastructure) solutions

Not just a meter manufacturer — evolved into a AMISP (Advanced Metering Infrastructure Service Provider).

Offerings include:

Smart Meters – Electricity meters with communication modules.

Head-End Systems (HES) – Collects meter data.

Meter Data Management System (MDMS) – Stores, validates, and analyzes consumption data.

Installation & System Integration – Complete rollout of smart meters across utility networks.

Operations & Maintenance (O&M) – 8–10 year contracts for ongoing support, generating annuity revenues.

Genus designs, manufactures, integrates, and maintains the entire stack — hardware + software + services — creating high entry barriers.

Market Share: Maintains ~25–30% of India’s smart metering rollout

Diversification Beyond Electricity

Water Meters: Strong future demand (e.g., Jal Jeevan Yojana in India; traction in ANZ & Western markets).

Gas Meters & Data Loggers: Early-stage opportunity; currently small but growing.

Exports: Focus on ANZ, Middle East, SE Asia, Africa — meaningful revenues expected post-FY27.

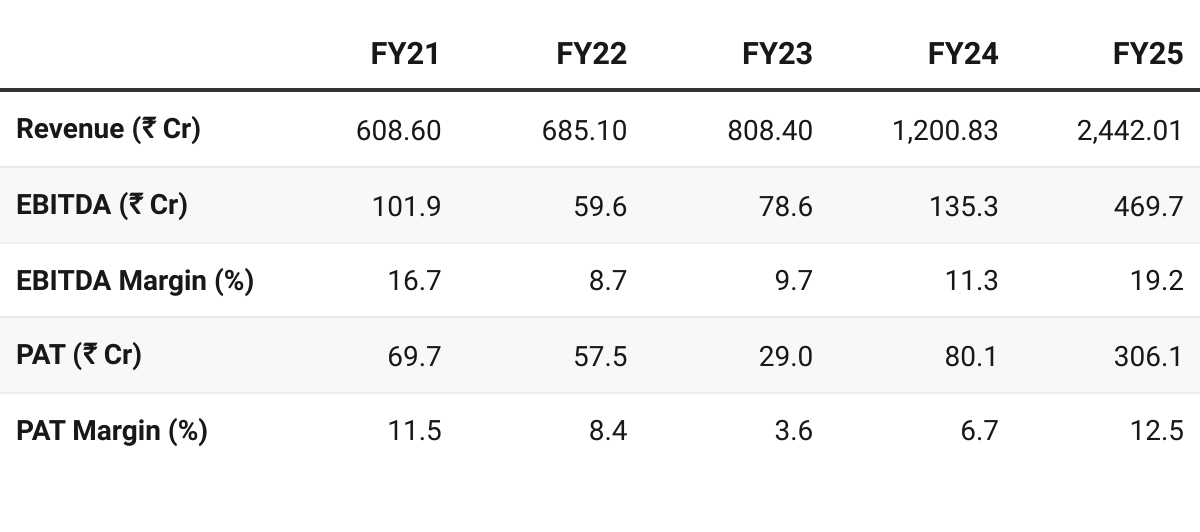

2. FY21–25: PAT CAGR of 45% & Revenue CAGR of 42%

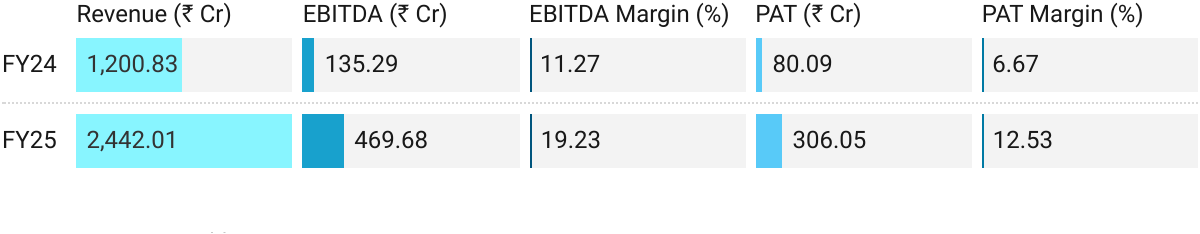

3. FY25: PAT up 282% & Revenue up 103% YoY

Sharp ramp-up in smart meter execution under RDSS and higher offtake from utilities.

FY25 marked a margin expansion cycle — operating leverage and integration of head-end system (HES) and meter data management (MDM) drove profitability.

Order-book: Composition: majority from AMISP platform/SPVs, providing both front-loaded supply/installation revenue and annuity-like O&M income.

Working Capital: Elongation during the ramp-up phase, as multiple projects started simultaneously.

Demerger: NCLT sanctioned the demerger of the Strategic Investment Business into Genus Prime Infra Ltd., sharpening focus on core AMISP business and improving capital allocation.

Capacity: Enhanced to 15 million meters per annum, supporting growth over FY26–27.

Exports & Diversification: Laid groundwork in water/gas meters and overseas markets, though material revenues are 2–3 years away.

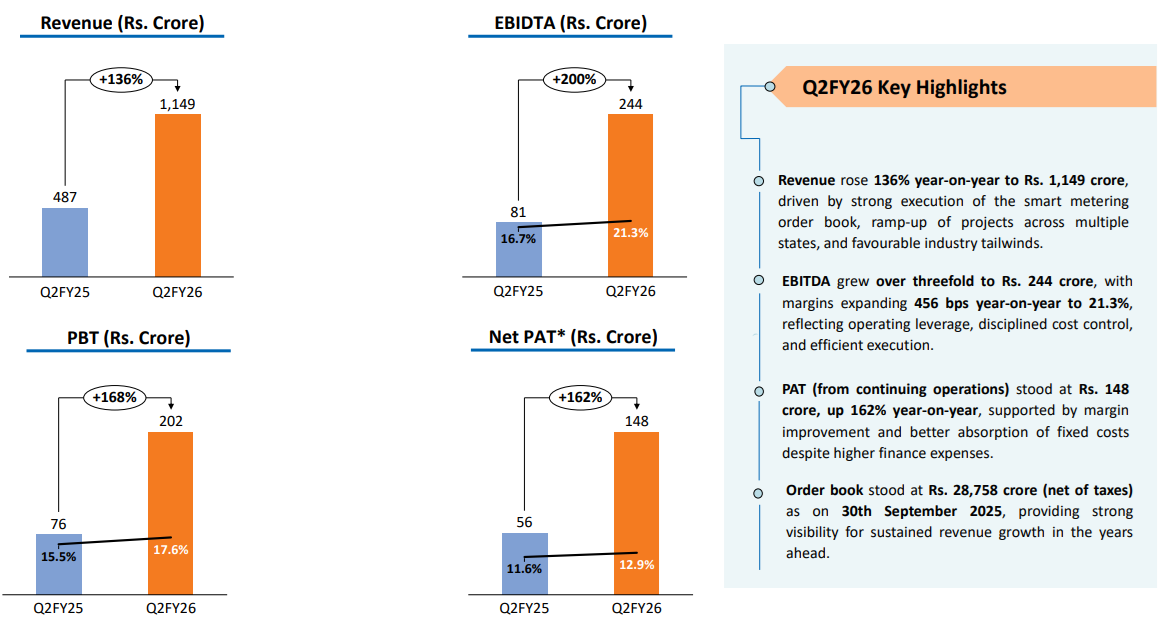

4. Q2 FY26: PAT up 162%, Revenue up 136% YoY

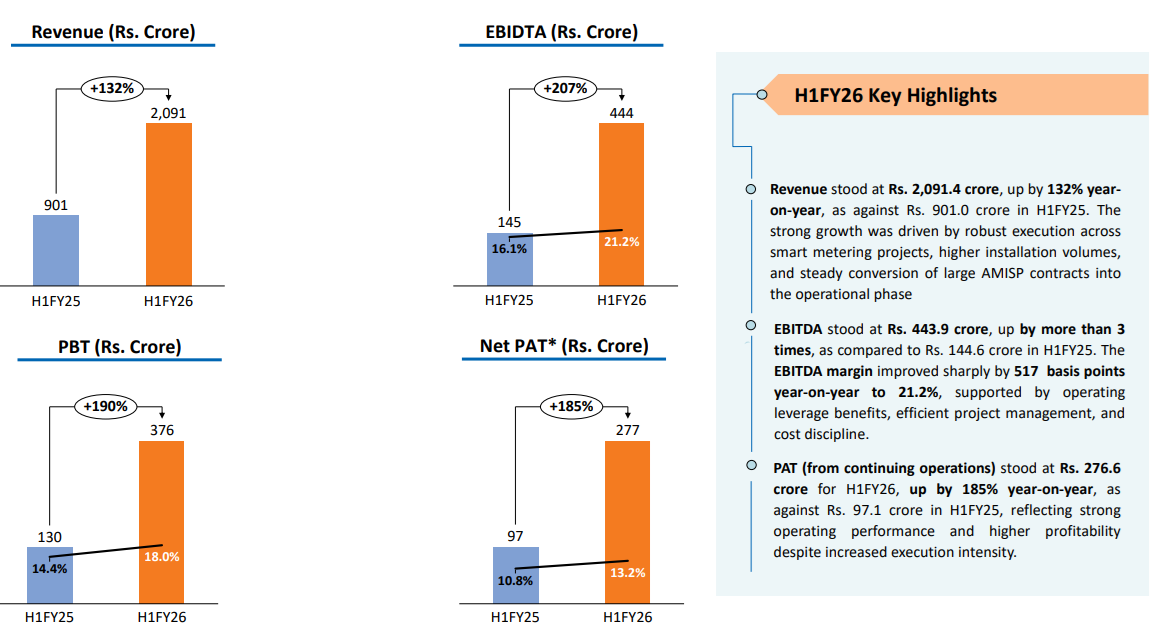

5. H1 FY26: PAT up 185%, Revenue up 132% YoY

6. Outlook: 50% Revenue CAGR till FY27

6.1 Guidance

Earlier, we have given a guidance of INR 4,000 crores and 18% EBITDA. Now, we are giving a guidance of INR 4,500 crores for FY26 with EBITDA of 20% and for FY27 around INR 5,500-6,000 crores with EBITDA of 20%.

Order book:

As on 30th September 2025, the company had a total order book of INR 28,758 crores (net of taxes) for about 3.6 crore meters for supply to utilities, other AMISPs and to the joint venture Platform.

These concessions span 8 years to 10 years and provide long-term revenue visibility. Importantly, approximately 80% of AMISP revenue from this order book will accrue directly to Genus Power over the life cycle of these projects. This mix offers both near-term execution scale-up and annuity-like O&M income streams.

Order Book Analysis

Total Order Book (₹29,000 Cr)

₹2,000 Cr is Genus’ direct supply business (traditional meter sales, non-AMI orders).

₹27,000 Cr, is the AMISP platform/SPVs (large-scale smart metering projects under RDSS).

Genus’ Share from ₹27,000 Cr, Platform Order-Book (~80–85%)

Genus doesn’t get 100% of platform revenue — SPVs are jointly owned with partners (like GIC).

Still, about 80–85% of ₹27,000 Cr (~₹22,000–23,000 Cr) will accrue to Genus over the life of these projects.

Timing of Revenue

Phase 1: Supply + Installation (Front-loaded, 3 years)

~55–58% of platform revenues come here.

That’s roughly ₹16,000 Cr for Genus (₹12,500 Cr supply of smart meters + ₹4,000 Cr installation/system integration).

This phase is revenue-heavy, driven by aggressive rollout.

Phase 2: O&M (Annuitized, 6–7 years)

The remaining ~20–22%, i.e. ~₹7,000 Cr, comes from Operations & Maintenance fees.

This is recurring, predictable income over 8–10 years (post go-live).

Implications for Revenue Projections

Near term (FY26–28): Genus sees a big surge in revenues from supply & installation (~₹16,000 Cr over 3 years).

Medium/long term: After rollout stabilizes, steady annuity revenues (~₹7,000 Cr over 6–7 years) kick in from O&M.

6.2 H1 FY26 vs FY26 Guidance — Genus Power

Revenue and margin guidance revised upwards

Revenue:

H2 is historically the most productive for meter installations.

H2 FY26 is expected to be stronger than the first half,

GENUSPOWER expected to meet its full-year revenue guidance.

Margins

Performance in H1 indicates GENUSPOWER is on track to meet 20% EBIDTA margin target.

Order-book:

Order-book in place to meet required run-rate for H2

Guidance upgrade delivered

GENUSPOWER had indicated to a guidance revision after Q2 results — it delivered on its promise

Turning cash-flow positive — Lagging

GENUSPOWER had indicated turning cash-flow positive in FY26 — its not pushed to FY27

we are very hopeful that in FY27, for sure, we will be cash flow positive company

7. Valuation Analysis

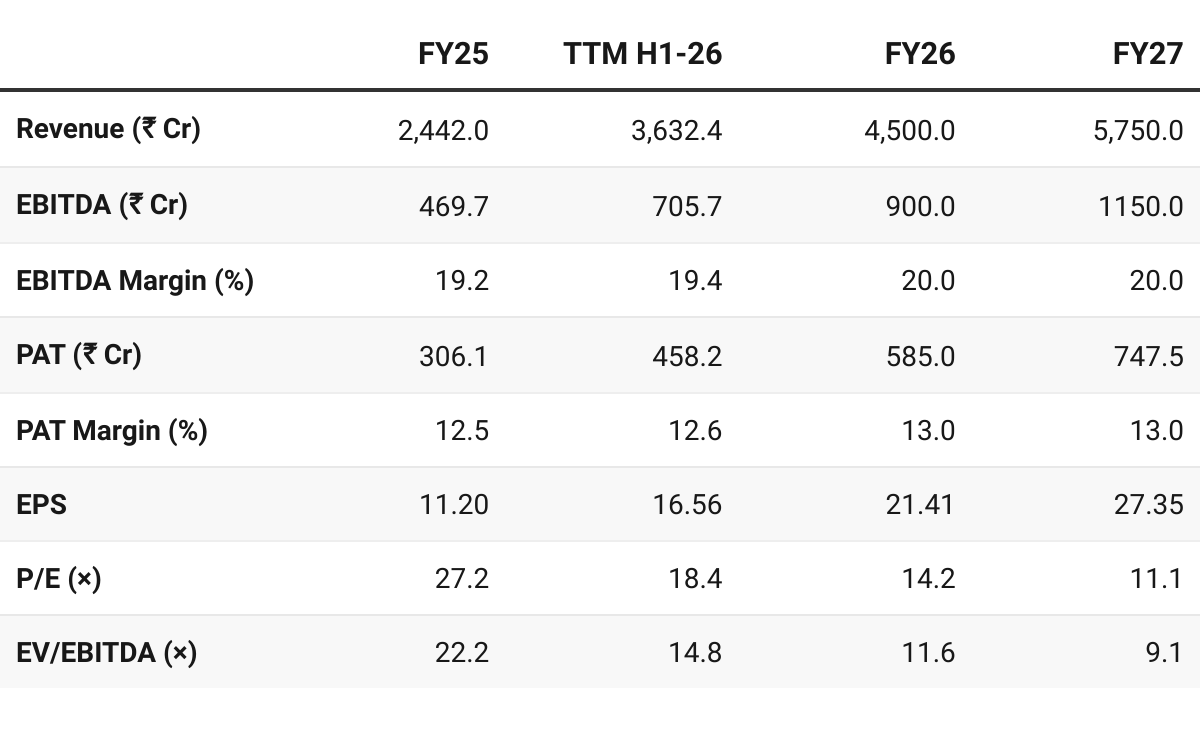

7.1 Valuation Snapshot — Genus Power

CMP ₹304.8; Mcap ₹9,269.3 Cr;

Attractive Forward Valuation:

Genus Power trades at attractive forward valuations (P/E ~14×, EV/EBITDA ~12× FY26E), supported by a upward revenue guidance, robust growth pipeline, improving profitability, and multi-year order visibility.

If execution remains on track and margins sustain above guidance, there is potential for earnings upgrades and a re-rating from FY27 onwards.

7.2 Opportunity at Current Valuation

For the short-to-medium term (FY26-FY27): Growth will lead to a re-rating of the stock as its valuation multiples contract.

Order Book Visibility: A robust ~₹29,000 Cr order book (~7× FY26 revenue) provides long-term certainty.

Industry Tailwinds: India’s target of 30–31 Cr smart meters by FY32 (vs only ~3 Cr installed to date) represents a massive structural demand opportunity. Genus’ 25–30% market share positions it as a leading beneficiary.

Optionalities Beyond Power Meters:

Exports, water metering (Jal Jeevan Yojana), and data loggers for gas utilities represent new revenue streams that could contribute meaningfully from FY27 onwards, enhancing growth visibility.

7.3 Risks at Current Valuation

Execution and Operational Risks: Most significant and immediate risk. The entire investment case hinges on the company’s ability to deliver on its massive order book.

Financial and Working Capital Risks: Growth is capital-intensive, and the quality of growth will be tested.

Pushing back the deadline of turning cash-flow positive is an example of this risk

Policy Risk: Smart meter order book is driven by the government’s RDSS scheme. Any change in government policy, a shift in priorities, or a slowdown in the scheme’s funding could halt the pipeline of future orders.

Customer Concentration Risk: The clients are primarily SEBs.

A slowdown in decision-making or financial distress in a few large states could disproportionately impact Genus Power’s revenue and cash collections.

A temporary slowdown in Maharashtra due to municipal elections as an example of such external dependencies.

Previous Coverage of GENUSPOWER

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer