Genus Power Q1 FY26 Results: PAT up 194%, Can Beat FY26 Guidance

Guiding 60%+ growth with stable margins in FY26 with potential upgrades. Order-book 7x FY26 guidance provides long-term visibility. Attractive forward valuation

1. Smart Metering Company

genuspower.com | NSE: GENUSPOWER

Core Business: Smart Metering Solutions

End-to-end AMI (Advanced Metering Infrastructure) solutions

Not just a meter manufacturer — evolved into a AMISP (Advanced Metering Infrastructure Service Provider).

Offerings include:

Smart Meters – Electricity meters with communication modules.

Head-End Systems (HES) – Collects meter data.

Meter Data Management System (MDMS) – Stores, validates, and analyzes consumption data.

Installation & System Integration – Complete rollout of smart meters across utility networks.

Operations & Maintenance (O&M) – 8–10 year contracts for ongoing support, generating annuity revenues.

Genus designs, manufactures, integrates, and maintains the entire stack — hardware + software + services — creating high entry barriers.

Market Share: Maintains ~25–30% of India’s smart metering rollout

Diversification Beyond Electricity

Water Meters: Strong future demand (e.g., Jal Jeevan Yojana in India; traction in ANZ & Western markets).

Gas Meters & Data Loggers: Early-stage opportunity; currently small but growing.

Exports: Focus on ANZ, Middle East, SE Asia, Africa — meaningful revenues expected post-FY27.

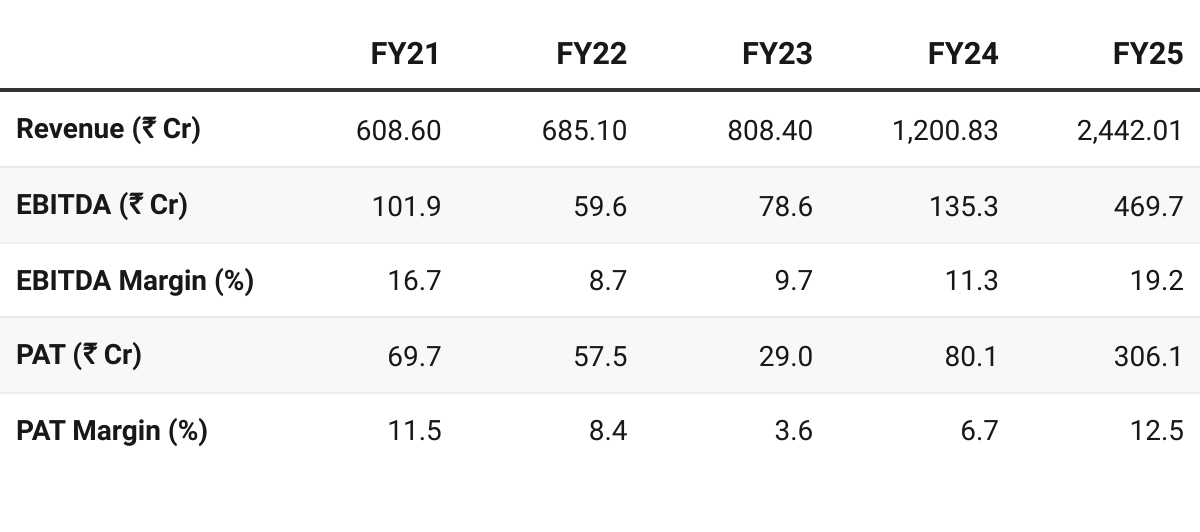

2. FY21–25: PAT CAGR of 45% & Revenue CAGR of 42%

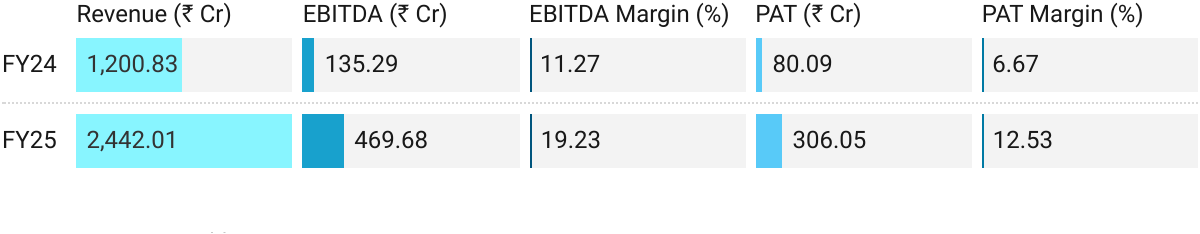

3. FY25: PAT up 282% & Revenue up 103% YoY

Sharp ramp-up in smart meter execution under RDSS and higher offtake from utilities.

FY25 marked a margin expansion cycle — operating leverage and integration of head-end system (HES) and meter data management (MDM) drove profitability.

Order-book: Composition: majority from AMISP platform/SPVs, providing both front-loaded supply/installation revenue and annuity-like O&M income.

Working Capital: Elongation during the ramp-up phase, as multiple projects started simultaneously.

Demerger: NCLT sanctioned the demerger of the Strategic Investment Business into Genus Prime Infra Ltd., sharpening focus on core AMISP business and improving capital allocation.

Capacity: Enhanced to 15 million meters per annum, supporting growth over FY26–27.

Exports & Diversification: Laid groundwork in water/gas meters and overseas markets, though material revenues are 2–3 years away.

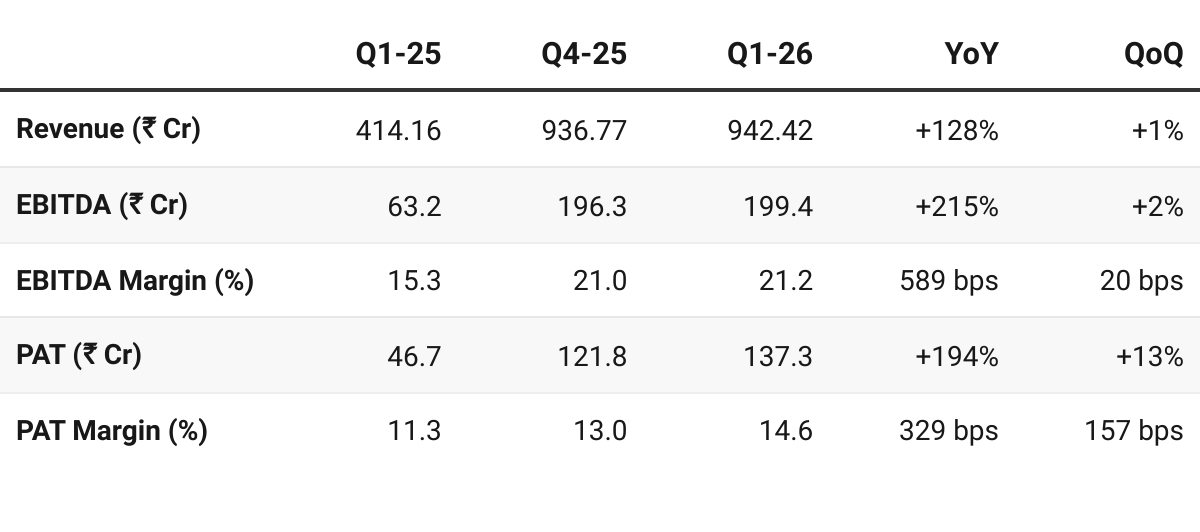

4. Q1 FY26: PAT up 194%, Revenue up 128% YoY

PAT up 13% & Revenue up 1% QoQ

Accelerated project execution, ramp-up in installations, and strong demand from state utilities and private AMISPs.

Working Capital Cycle Improving:

Cash Flow Outlook: Management expects to turn cash flow positive in FY26, supported by projects achieving operational go-live (OGL), which unlocks recurring O&M revenues and faster cash collections.

Diversification:

Exports: Momentum in ANZ, Middle East, SE Asia, Africa — meaningful contribution expected FY27 onwards.

Water Meters: Strong potential in India (Jal Jeevan Yojana) and international markets; revenues 2–3 years away.

Gas Meters: Smaller, slower opportunity; focus on data loggers.

5. Outlook: 100% Revenue CAGR till FY27

5.1 Guidance

We remain confident in delivering our FY '26 guidance of over Rs. 4,000 crores in revenue and 18% EBITDA margin. This reflects both the scaling up of current projects and the operational maturity of those entering the O&M phase.

We are just waiting for one more quarter to happen because second quarter, normally because of rain and some things, sometimes is not very

good. So, we are very hopeful that we will be doing better in the coming quarters. And surely after once the six months are finished, we will be revising our guidance for the revenue also and for the profits also

18% is definitely sustainable, and we should do better than that.

Volumes:

FY26: Our target is to install around 80 lakh to 90 lakh smart meters.

FY27: In the next financial year, we will do around 1.1 crores to 1.2 crores smart meters.

Order book: Total order book as of June 30, 2025, stands at about Rs. 29,321 crores net of taxes across all SPVs and the GIC Platform. These concessions span 8 years to 10 years and provide long-term revenue visibility. Importantly, approximately 80% of AMISP revenue from this order book will accrue directly to Genus Power over the life cycle of these projects. This mix offers both near-term execution scale-up and annuity-like O&M income streams.

Order Book Analysis

Total Order Book (₹29,000 Cr)

₹2,000 Cr is Genus’ direct supply business (traditional meter sales, non-AMI orders).

₹27,000 Cr, is the AMISP platform/SPVs (large-scale smart metering projects under RDSS).

Genus’ Share from ₹27,000 Cr, Platform Order-Book (~80–85%)

Genus doesn’t get 100% of platform revenue — SPVs are jointly owned with partners (like GIC).

Still, about 80–85% of ₹27,000 Cr (~₹22,000–23,000 Cr) will accrue to Genus over the life of these projects.

Timing of Revenue

Phase 1: Supply + Installation (Front-loaded, 3 years)

~55–58% of platform revenues come here.

That’s roughly ₹16,000 Cr for Genus (₹12,500 Cr supply of smart meters + ₹4,000 Cr installation/system integration).

This phase is revenue-heavy, driven by aggressive rollout.

Phase 2: O&M (Annuitized, 6–7 years)

The remaining ~20–22%, i.e. ~₹7,000 Cr, comes from Operations & Maintenance fees.

This is recurring, predictable income over 8–10 years (post go-live).

Implications for Revenue Projections

Near term (FY26–28): Genus sees a big surge in revenues from supply & installation (~₹16,000 Cr over 3 years).

Medium/long term: After rollout stabilizes, steady annuity revenues (~₹7,000 Cr over 6–7 years) kick in from O&M.

5.2 Q1 FY26 vs FY26 Guidance — Genus Power

Performance is ahead of run-rate on both growth and margins

Strong Start: Q1 at ₹942 Cr is already ~24% of FY26 target. Even if Q2 slows due to monsoon, trajectory suggests potential upside to ₹4,000 Cr guidance.

Profitability Ahead of Guidance: Reported EBITDA margin of 21.2% vs 18% guided. Management is deliberately conservative; exit margins are tracking higher.

Installations: 16 lakh in Q1 implies annualized pace of 64 lakh, but H2 (seasonally stronger) is expected to lift totals to 80–90 lakh.

Working Capital: Early improvements reinforce guidance of sustainable cash flows from FY26 onwards.

Q1 FY26 performance is already ahead of run-rate on both growth and margins. While management maintains a conservative stance (₹4,000 Cr revenue, 18% EBITDA margin), the execution momentum, order book strength, and improved working capital cycle suggest scope for guidance upgrades post H1 FY26.

6. Valuation Analysis

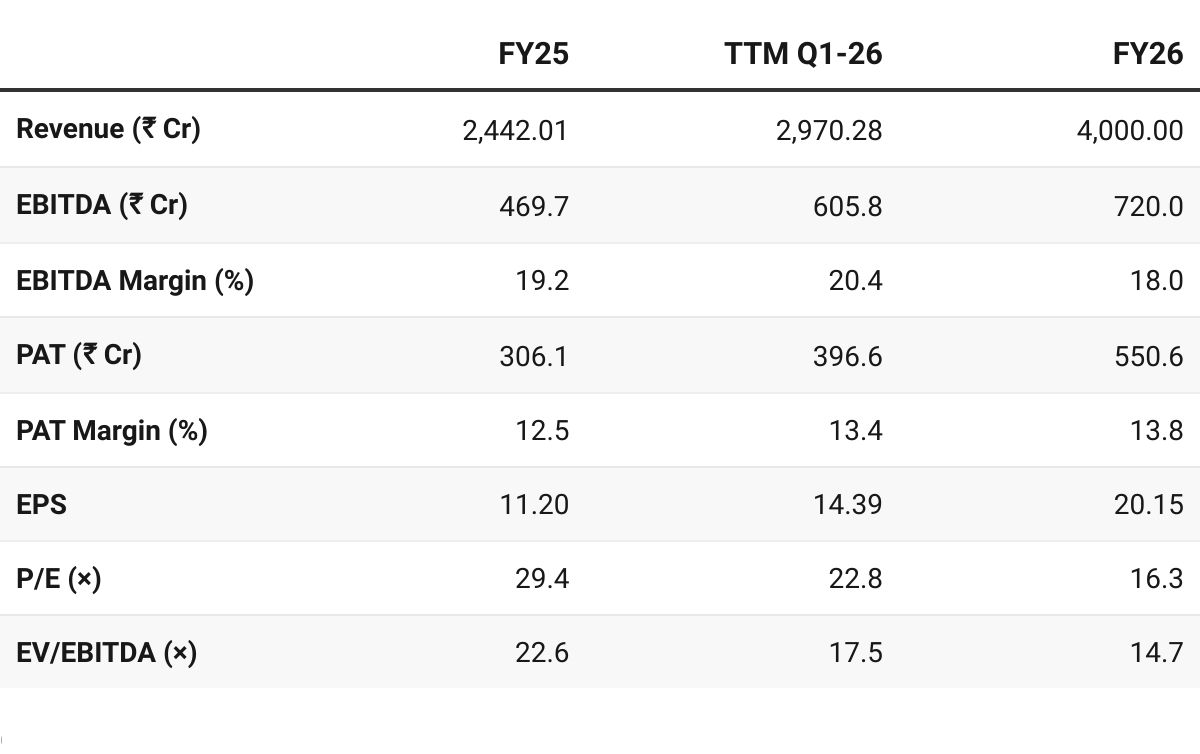

6.1 Valuation Snapshot — Genus Power

CMP ₹328.7; Mcap ₹9,996.15 Cr;

Attractive Forward Valuation:

Genus Power trades at reasonable forward valuations (P/E ~16×, EV/EBITDA ~15× FY26E), supported by a robust growth pipeline, improving profitability, and multi-year order visibility.

If execution remains on track and margins sustain above guidance, there is potential for earnings upgrades and a re-rating from FY27 onwards.

6.2 Opportunity at Current Valuation

Revenue & Earnings Upside: There is scope for upward revision of FY26 revenue and PAT.

Order Book Visibility: A robust ₹29,000+ Cr order book (~7× FY26 revenue) provides long-term certainty.

Industry Tailwinds:

India’s target of 30–31 Cr smart meters by FY32 (vs only ~3 Cr installed to date) represents a massive structural demand opportunity. Genus’ 25–30% market share positions it as a leading beneficiary.Margin Expansion Potential:

Backward integration in software (HES, MDM) and scale benefits have already lifted EBITDA margins above 20%. Sustained execution can keep margins above the conservative 18% guidance.Cash Flow Improvement: FY26 is expected to be cash-flow positive, easing investor concerns around working capital intensity.

Optionalities Beyond Power Meters:

Exports, water metering (Jal Jeevan Yojana), and data loggers for gas utilities represent new revenue streams that could contribute meaningfully from FY27 onwards, enhancing growth visibility.

6.3 Risks at Current Valuation

Working Capital Intensity:

Despite improvements, receivables and inventory remain elevated. Sustained growth may keep working capital locked up, potentially requiring more debt.Execution Challenges: Any disruption can slow down quarterly execution and cash conversion.

Utility Dependence:

Revenue realization depends on timely payments from state electricity boards. Initial hiccups in OGL receipts highlight potential cash flow risks if utilities delay.Concentration on Smart Metering:

While Genus is diversifying, >90% of current revenues come from smart metering. Any slowdown in RDSS execution or government funding could impact growth.

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer