Garware Hi Tech Films: PAT growth of 64% & revenue growth of 46% in H1-25 at a PE of 37

Revenue CAGR of 22% guidance for FY24-26. Possibility of GRWRHITECH beating guidance. Margins to be stable at 25% (+/- 3%). Reasonable valuations from the perspective of free cash yield.

1. Polyester + specialty film manufacturer

garwarehitechfilms.com | NSE: GRWRHITECH

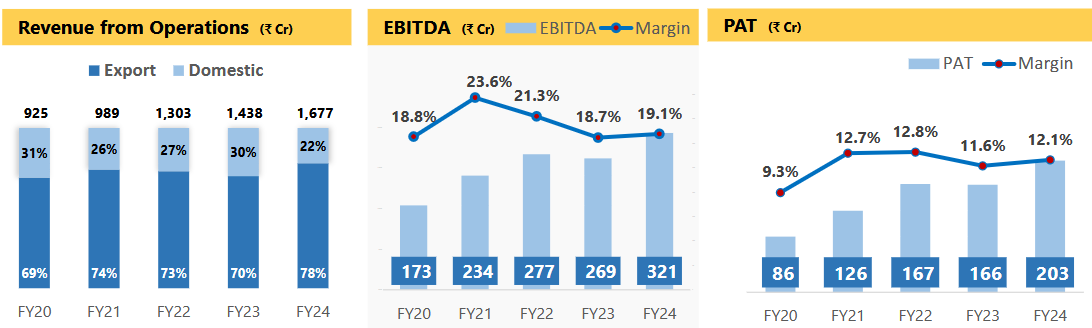

2. FY20-24: PAT CAGR of 34% & Revenue CAGR of 21%

3. FY24: PAT up 22% & Revenue up 17% YoY

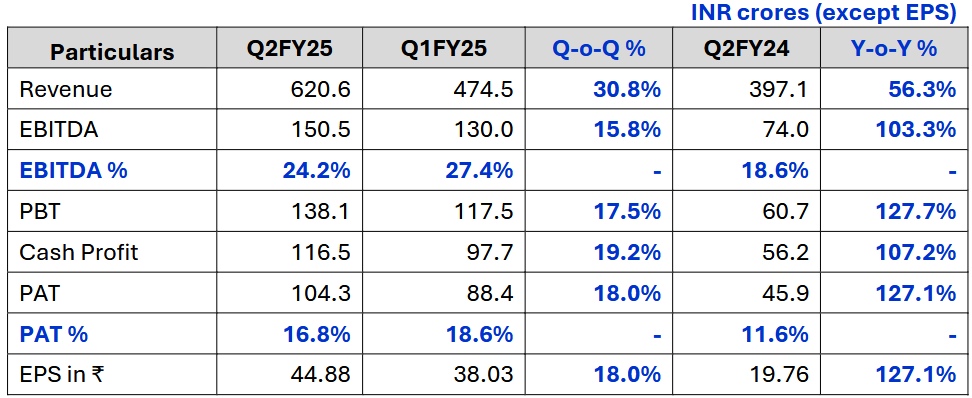

4. Q2-25: PAT up 127% & Revenue up 56% YoY

PAT up 18% & Revenue up 31% QoQ

5. H1-25: PAT up 115% & Revenue up 41% YoY

6. Business metrics: Improving return ratios

7. Outlook: 22% Revenue CAGR for FY24-26

Financial Performance and Targets:

Revenue: Management expressed confidence that the company could surpass the expected INR 2,000 crore revenue for the year. They also anticipate reaching around INR 2,500 crore in revenue the following year, with the new production line.

EBITDA Margin: The company aims to maintain an EBITDA margin of 25% (+/- 3%). This guidance accounts for the seasonality of the business and changes in product mix. Q3 is typically a lower season, while Q4 is expected to be stronger.

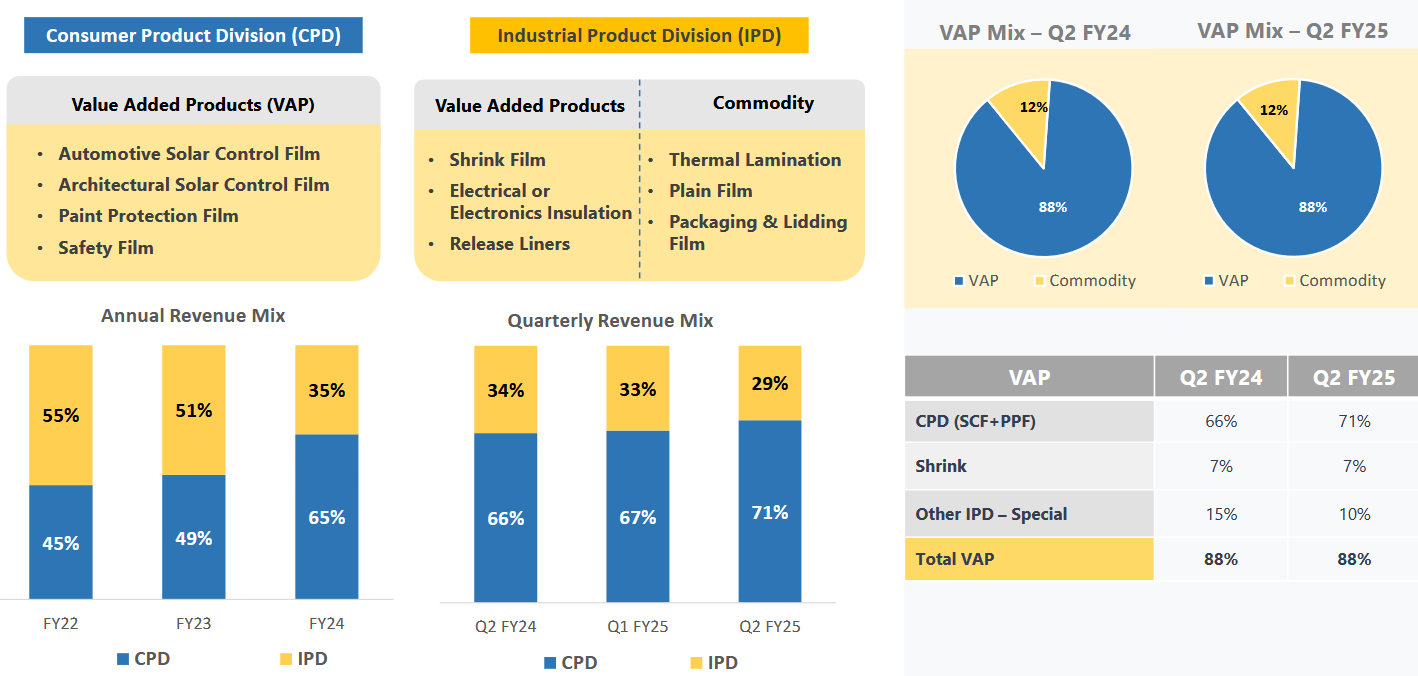

Product Divisions:

Solar Control Films (SCF): SCF sales continue to perform well, with increased revenues compared to Q1. Growth is attributed to product innovations like Spectra Pro and DecoVista series.

Paint Protection Films (PPF): The PPF segment has seen strong demand, with the company launching a new series of Colored PPF. A new PPF production line with an annual capacity of 300 lakh square feet is progressing as planned, with commercial production expected by Q2 FY'26. Management sees a potential fivefold increase in PPF sales in India. PPF sales are not as affected by seasonality compared to SCF.

Industrial Products Division (IPD): The IPD showed steady recovery, with a focus on specialty films with high margins. The company is focusing on high-margin products like Shrink Films, Floatable Shrink Films, PCR Films, and Lidding Films.

Architectural Films: The company is experiencing 100% growth in the architectural segment. The company has launched products like the Spectrally Selective Film and DecoVista Series, and is seeing success with these in Europe, America and India.

Market Strategies:

Geographic Expansion: Expanding its presence in new markets, with a focus on digital engagement. The company's exports comprised approximately 81.3% of Q2 revenue. North America accounts for about 55% of sales.

Garware Application Studios: The company plans to continue growing its Garware Application Studios beyond the initial target of 200, due to demand from channel partners in Tier-2 and Tier-3 cities.

Branding: The company is putting more effort into global brand sales and is seeing growth in this segment, as well as in white box sales.

Additional Points:

Management does not anticipate a significant negative impact from potential changes in US trade policies, noting that their main competitor is China.

The company is aware of the seasonality of the sun control film market and adjusts its production and sales strategies accordingly.

The company is working on products for the used car market.

The company is exploring new geographies for sales and has added key sales force in five new countries.

The company is running its PPF lines beyond capacity, around 135-140%.

8. PAT growth of 64% & Revenue growth of 46% in H1-25 at a PE of 37

9. Hold?

If I hold the stock then one may continue holding on to GRWRHITECH.

Based on H1-25 performance one can look forward to a strong FY25 providing a reason to continue with GRWRHITECH. However one should keep a lookout for the impact of seasonality in H2-25

Q3 definitely is a low season because Sun Control there is hardly any sun in our primary market. So, then we see a little drop in our sales in Q3, which is very standard phenomena, but PPF is not directly affected by that. So, I can say it will be more or less stable in Q3, but Q4 with the CPD division coming back, so we expect a strong Q4 for us. For us, it's a seasonality mainly hits Q3, not Q4.

GRWRHITECH management is indicating of a possibility of beating revenue guidance

We are confident that we can beat that, but there are certain geopolitical things which we are always aware in our consideration. So, that is moderate, but we would like to stick to that.

GRWRHITECH is in the middle of a strong run and has delivered 7 consecutive quarters of PAT growth starting Q4-23. Q3 is the slowest quarter and hence we have an understanding of what to expect in Q3-25. Barring seasonality, one can hold on as long as the underlying business momentum is strong.

10. Buy?

If I am looking to enter GRWRHITECH then

GRWRHITECH has delivered PAT growth of 115% & Revenue growth of 41% in H1-25 at a PE of 37 which makes valuations reasonable in the short term.

GRWRHITECH has a given a guidance for 22% revenue CAGR for FY24-26 at a PE of 37 makes valuations look reasonable from a longer term perpspective.

GRWRHITECH delivered Rs 191.96 cr of free cash flow against a market cap of Rs 11,363 cr. As of H1-25 end it is available on a free cash flow yield of 1.7% (not annualized) which makes the valuations reasonable.

At a PE of 37, the margin of safety is limited and the stock may react if performance is not in line with the management guidance of Rs 2,500 cr revenue by FY26.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Well it reacted. Now time to figure out why. Keep it coming