Freshara Agro H1 FY26 Results: PAT up 31%, On-track FY26 Guidance

Guidance of 30% FY25-27 revenue CAGR. Capacity in-place for growth till FY27. After solid H1 FY26 results, Freshara Agro is available at attractive valuations

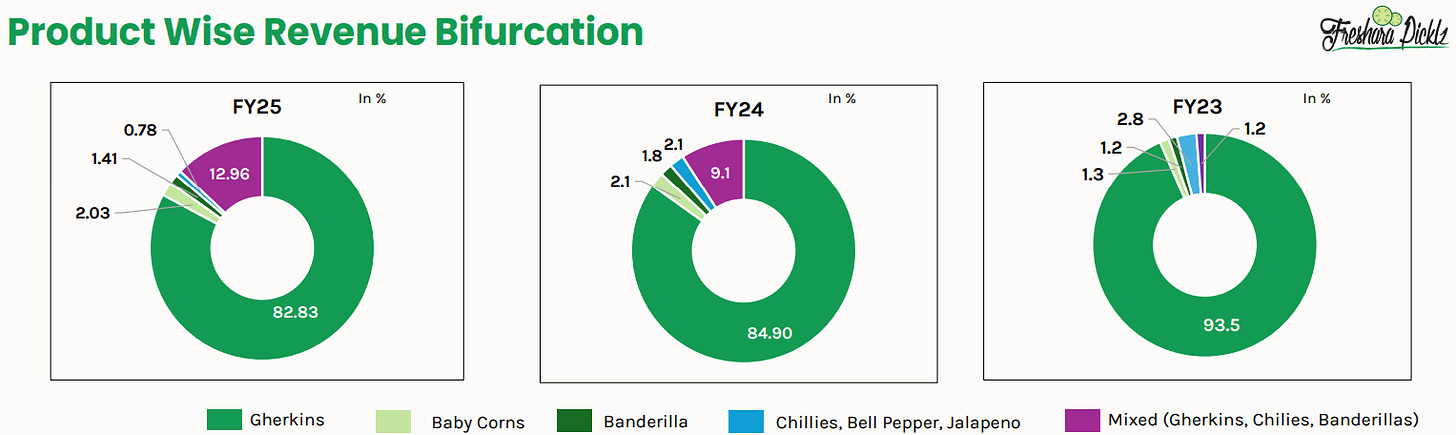

1. Exporting Preserved Gherkins & Pickled Vegetables

fresharaagroexports.com | NSE - SME: FRESHARA

3rd Largest Gherkin Exporter

Specializes in procurement, processing, and exporting preserved gherkins and pickled vegetables.

2 facilities in Tirupattur, Tamil Nadu

Exports to 40+ countries, including Europe, USA & Russia.

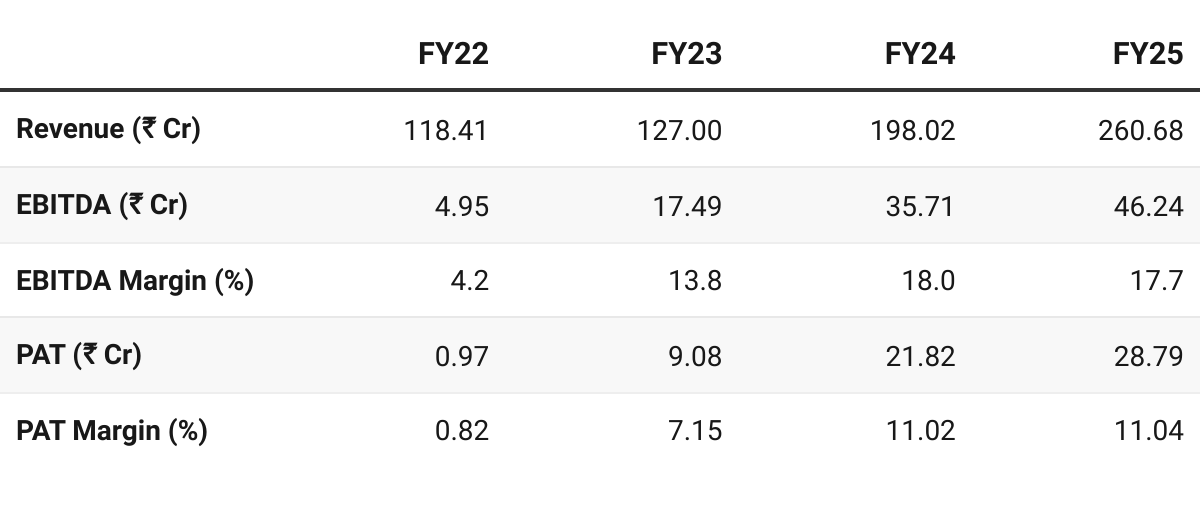

2. FY22–25: PAT CAGR of 209% & Revenue CAGR of 30%

Top-line growth supported by consistent margin expansion

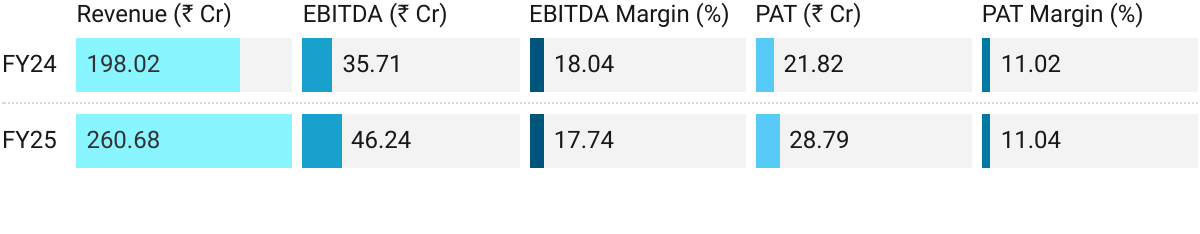

3. FY25: PAT up 32% & Revenue up 32% YoY

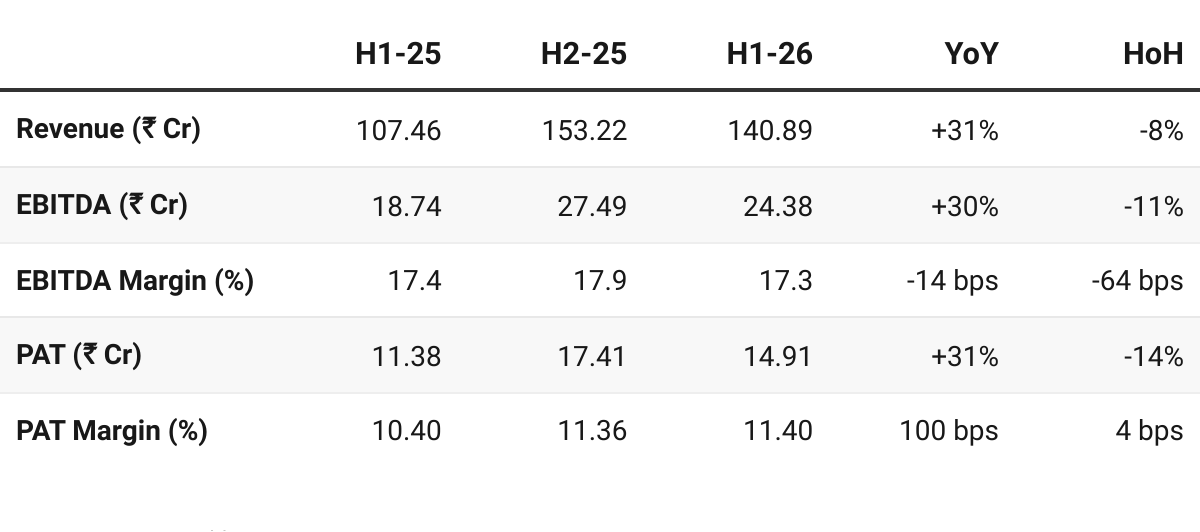

4. H1 FY26: PAT up 119% & Revenue up 84% YoY

PAT up 6% & Revenue up 9% HoH

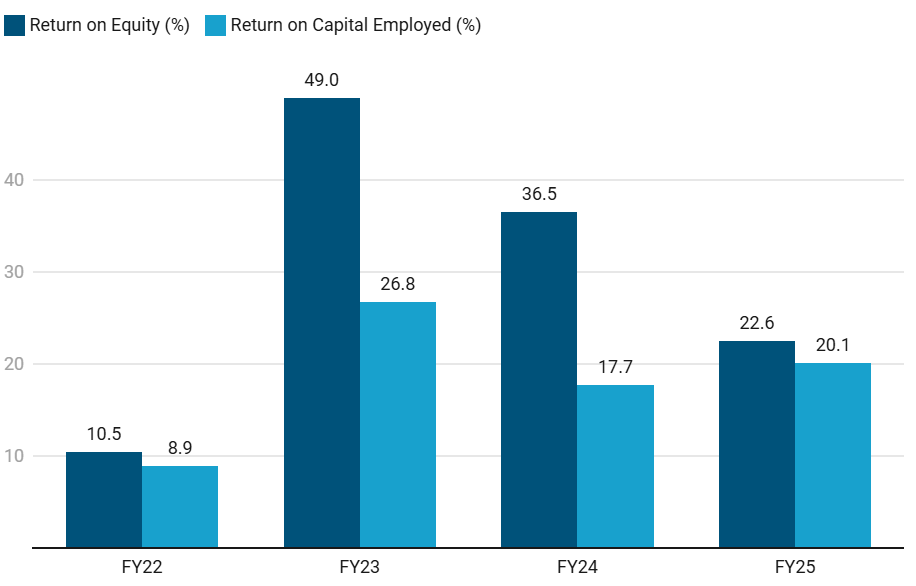

5. Business Metrics: Strong Return Ratios

6. Outlook: Revenue CAGR of 30% for FY25-27

6.1 Management Guidance — Freshara Agro Exports

Growth: The plant capacity helps us to grow 30%. And we have a historical growth pattern, which is, we’ve grown about 30%. We understand the industry in such a fashion that 30% growth is easily achievable.

PAT Margin: We will be able to achieve the sustainable margins and maybe improve a bit, but may not be beyond 14%-15%. But yes, our entire effort is to become better.

Growth:

30% growth in the coming years.

Growth is considered easily achievable based on historical patterns.

Peak Sales Capacity:

Maximum sales achievable with the two combined facilities is around ₹450 Cr.

Sufficient capacity for 30% growth available till FY27

New production line planned in Unit II to support growth for FY28

Capacity:

Capacity of Unit I (50 metric tons per day)

New Unit II (75 to 100 metric tons per day)

Operational since January 2025

FY26: Expected to function at 50% of its expected capacity

H2 FY26: Utilization to reach 60% to 70%

FY27: 100% productivity from the new plant by the end of FY26.

90%-95% of the capex for the new facility is concluded.

Future Expansion:

Unit II has scope for expandability.

After FY26, the company plans to install another production line in the same plant, which would help them grow another 30% from that unit.

Strategic Priorities and Market Focus

Product Portfolio Expansion:

While gherkins remains the core product, contributing the major revenue.

Expanded its product portfolio to include high-potential items:

green peppercorns, corn kernels, olives, and white onions.

Focus on Retail/White Labeling:

Actively increasing the contribution of retail packaging (white labeling)

Currently less than 20% of the business.

This segment has long-term contracts and offers stable margins.

Sourcing Diversification:

To fix supply of raw material and hedge against erratic climate conditions

Expanded contract farming base beyond Tamil Nadu to Karnataka and Andhra.

This diversification allows for raw material arrivals for approximately 200 to 250 days a year.

Geographic Sales Expansion:

USA Market:

Growing the US market share is a focus.

New Territories:

Secured a new contract with Hungary

In discussions to enter a few other new territories this year.

Iran:

If current geopolitical tensions resolve — presents a large opportunity.

Domestic Market Exploration:

Exploring to expand domestically in India

Groundwork is ongoing to choose products with good margins.

6.2 H1 FY26 Performance vs FY26 Guidance

On-track FY26 guidance

Strong H1 vs FY26 Guidance:

H1 delivered 30% growth as per guidance

The run-rate for H2 FY26 remains at 30% to deliver on its overall guidance of 30% growth

Confirmation of FY26 guidance post H1-26 earnings: position APS to achieve its targeted 75% CAGR in revenue growth during FY25–26

Strong Margins:

Freshara referred to pricing headwinds during its FY25 earnings call

Yet, trend of PAT margin expansion continues into H1 FY26 even though EBITDA margins weakened

Capacity Expansion on-track — will support growth till FY27

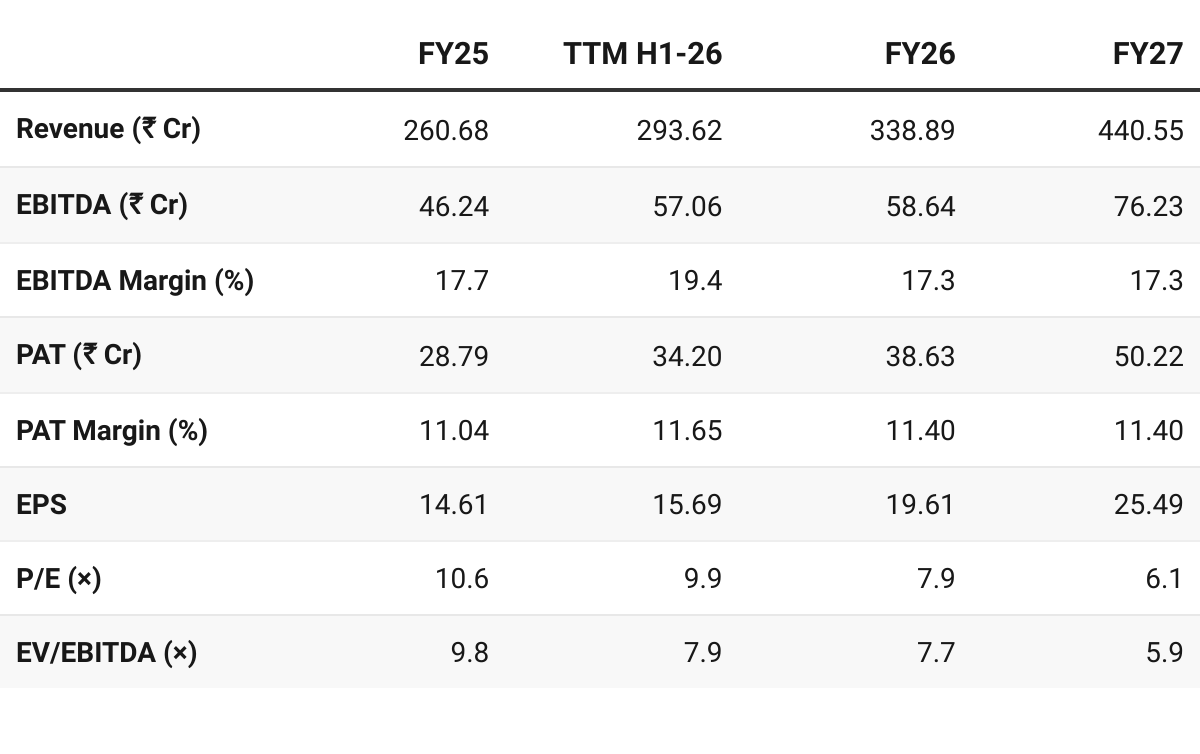

7. Valuation Analysis

7.1 Valuation Snapshot — Freshara Agro Exports

CMP ₹155.3; Mcap ₹364.94 Cr;

Assumptions:

30% growth till Unit II capacity sustains till FY27

While management has indicated 14-15% PAT margins — valuation exercise carried out H1 FY26 levels

Attractive Valuations:

Freshara looks attractive on TTM numbers, and multiples compress as earnings scale.

Scope for valuation re-rating if FY26 guidance is delivered

Valuations are undemanding — provide flexibility to sustain periods where performance is not as per guidance

Freshara, is trading at a discount, reflecting its smaller scale and limited track record as listed company.

Looking undervalued on current, FY26E FY27E basis provided execution stays on track. Multiples leave room for re-rating.

7.2 Opportunities at Current Valuation

Attractive Valuations: Trading at a discount for a company guiding to grow at 30% till FY27 with 11% PAT margin.

Scope for significant re-rating if growth sustains.

What if it re-rates to a very reasonable PE 15-20×

Based on capacity availability growth path till FY27 is clear

Established supplier from an established sourcing location

India accounts for ~15% of global gherkin production.

Freshara as the 3rd largest gherkin exporter from India should have relatively lesser challenges in establishing itself as supplier to large global packed food manufacturers

7.3 Risks at Current Valuation

Microcap Risk: May not grow into a small-cap; Illiquid, SME-listed; entry/exit difficult.

Limited track-record of the Freshara management as a listed entity

Freshara did not conduct earnings call after H1 FY26 results

Little is know about the company

While valuations look cheap, discount may persist until Freshara delivers on FY26 and FY27 guidance

Quality of earnings is not strong:

Freshara based on H1 FY26 and FY25 performance has not shown a strong ability to convert profits to cash

One needs to keep a close watch for quality of earnings thru is cashflow performance

We need to see improvement — even though current performance is not strong

Growth in FY28 and beyond

Unit I and Unit II will deliver full revenue potential in by FY27

For growth in FY28, new capacity is needed. Even if Freshara starts building additional capacity in FY27 it may come on-line in FY29.

Pricing pressure

We need to watch the margins given the headwinds on pricing

Price increase is not really happening. As you know, global headwinds are very high.

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer