Foods & Inns: 60%+ PAT growth in FY24, PLI impact of 3.3X FY23 PAT coming between FY23-27 at 21 PE

Valuations don't factor the impact of PLI. Rs 145 cr of PLI i.e. 3.3X FY23 PAT coming in the next 4 years. Beyond the PLI benefit, FOODSIN is a supplier to Coke & Pepsi trying to build its own brands

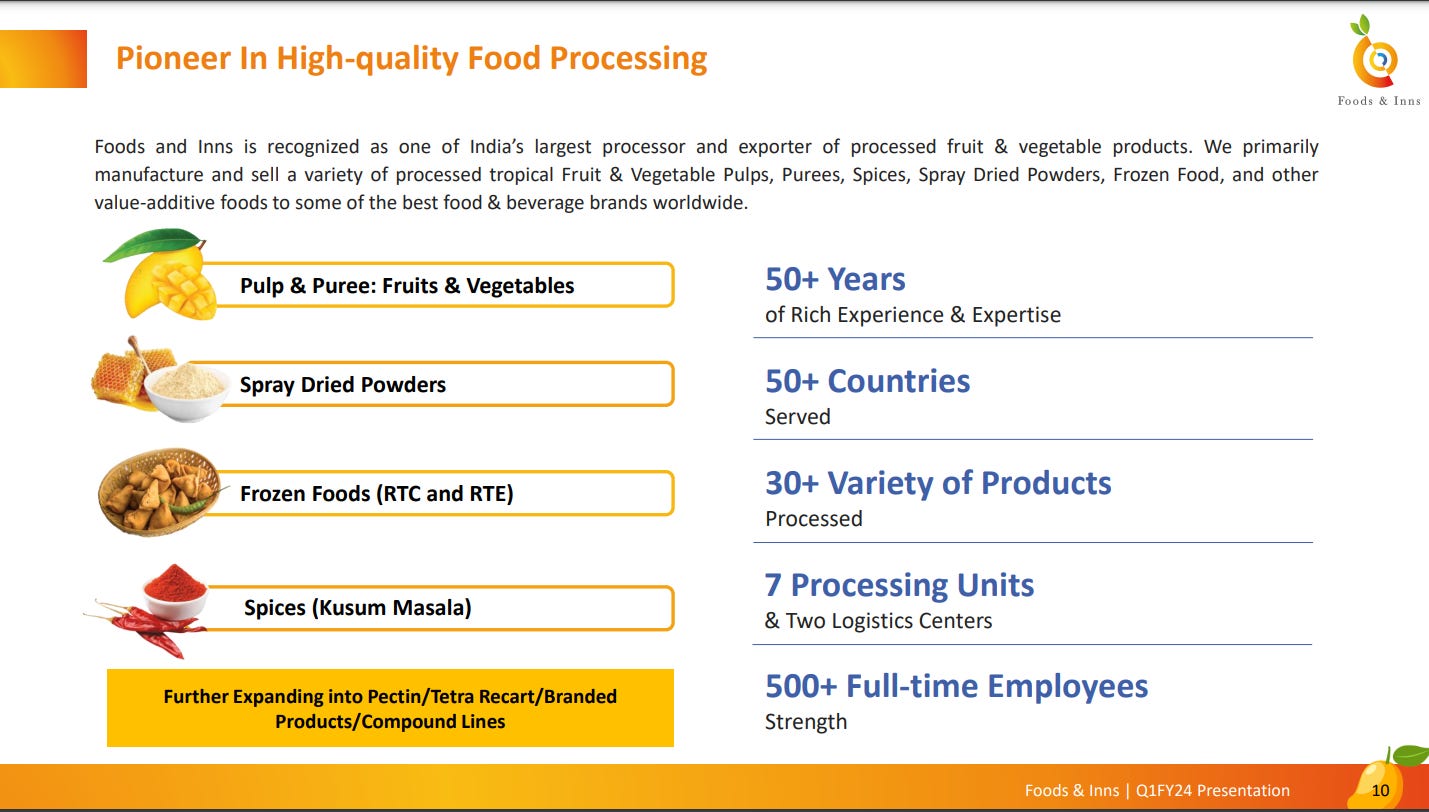

1. Processor & exporter of processed fruit & vegetable products

foodsandinns.com | NSE : FOODSIN

Foods & Inns Ltd is a manufacturer and exporter of a range of processed tropical fruits pulps, purees, and vegetables. Its principal divisions are

Pulp & Puree

Spray drying

Frozen foods, ready to to cook and ready to eat

Spices.

Primarily a mango pulp company

Pulping: This business contributed to 91% of total sales for Foods and Inns. Mango pulping took the dominant share with 82% contribution to the total sales. The Company’s tomato pulping business is also showing a lot of promise and contributed to 5.5% of the total sales.

So Coca-Cola has a brand called as Maaza for which we almost supply, say somewhere between 40% to 50% of their requirement

For Pepsi, we service around 20% of their requirement

In FY24, Coke had a share of around 40% to 42% of our total revenues and Pepsi had around a share of around 8% to 10% approximately.

There are global brands like Boiron, Symrise and a few others, Dohler, all these guys contribute to this. So the top 10 contribute to around 60% to 65% of our total revenues.

2. FY21-23: 247% PAT & 62% Revenue CAGR

3. FY23: PAT up 210% and Revenue up 57% YoY

4. Q1-24: PAT up 200% and Revenue up 31% YoY

5. Cash generation is a negative and a red flag

Business running on overdrafts. Seems like FOODSIN is funding the working capital of Coke & Pepsi

6. Outlook: Big Benefits of PLI

i. ~Rs 20 cr or 40% of FY23 PAT to come as PLI in FY24

3X FY23 PAT expected as PLI incentive

PLI, we received our sanction letter on the 7th of July 2023 and it is going to be accounted in Q2 of our results as such.

Roughly around Rs. 20 odd crores and we expect that to come by end of March 2024.

The total PLI incentives expected including the 9.71crs already received, is ~Rs 145 Cr.

The Production Linked Incentive (PLI) scheme provided a subsidy of 4% to 6% on the value of the additional production firms generate. The value of the production includes inputs purchased from the outside. For instance, if a Rs 10,000 mobile phone assembled in India contains Rs 9,000 worth of purchased components, the production unit only adds Rs 1,000 in value, with a potential profit of Rs 200. However, under the PLI scheme, the company would receive a subsidy of 5% of Rs 10,000, which is Rs 500. This would increase the profit on additional production to Rs 700, raising the profit margin from 20% to 70%.

Additional information on PLI

ii. 15-20% volume growth in FY24

PAT FY23

Q1-23 = Rs 7 cr

FY23 = Rs 48 cr

Q2-23 to Q4-23 PAT = 48 =7 = Rs 41 cr

If we assume zero PAT growth in the remaining three quarters of FY24

FY24 PAT = 14 (Q1-24) + 41 (same as last 3 quarters of FY23 i.e. no further growth in FY24) +PLI incentive of 20 cr = 75 cr

A Rs 75 cr PAT in FY-24 with no growth in remaining part of FY24 vs Rs 48 cr PAT in FY23 implies a minimum PAT growth of 56% in FY24. Assuming marginal PAT growth in FY24, one can easily expect a 60%+ PAT growth in FY24

The realization and the sales growth that we are expecting. Realization, as I told you, for on the mango side, some mango variety realization will be higher, some mango variety, realization will be lower, but volume we are expecting to go around 15% to 20% in annualized basis.

iii. From a supplier to Coke & Pepsi to building new businesses

B2C Brands

Tetra Recart Packaging

Pectin Project

7. 60%+ PAT growth for FY24 at a PE of 21

8. So Wait and Watch

If I hold the stock then one may continue holding on to FOODSIN. The current valuations do not seem to discount the impact of PLI scheme. FOODSIN expects to receive PLI of Rs 145 cr FY26-27 which is about Rs 35 cr over a 4 year period which is 3X FY23 PAT. Rs 145 cr is 14% of the current market cap of Rs 1058 cr.

The red flag in this is the cash generation by FOODSIN. However, with Rs 20 cr coming in FY24, and an average of Rs 35 cr coming in over a 4 year period should improve the cash situation of FOODSIN. Cash generation is a red flag and needs to watched closely.

Foods & Inns got selected under the Production Linked Incentive (PLI) Scheme of the Govt. of India under Fruits & Vegetables processing category. The selection was under both Component 1 as well as Component 3 of the scheme and the company stands to receive incentives between the period FY’22-23 to FY’26-27 based on future growth in sales and investment as per committed capex.

9. Or, join the ride

If I am looking to enter the stock then

60%+ PAT growth in FY24 at a PE of 21 looks reasonable.

Rs 145 cr of PLI i.e. 14% of current market cap of Rs 1058 cr makes the case for PE PE re-rating

FOODSIN market cap of Rs 884 is less than 0.9 time FY23 sales of ~Rs 1,000 cr.

An underlying assumption behind the assessment is that for the next four years its business as usual based on the trajectory seen FY21-23 and Q1-24.

Cash flow generation by FOODSIN is a big red flag and the risk needs to be taken while entering the stock.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades