Elecon Engineering Q4 FY25 Results: Record Revenue, Robust FY26 Growth Outlook, Attractive Valuations

Strong cash flows, global OEM traction, margin stability, and a debt-free balance sheet position Elecon as a resilient industrial growth story for FY26 and beyond.

Table of Content

Elecon Q4 FY25 & FY25: Financial and Operational Highlights

Elecon FY26 Strategy, Guidance & Growth Outlook

Elecon Stock Valuation: FY25 Metrics & FY26 Outlook

Implications for Elecon Investors: What to Watch

1. Financial & Operational Performance Snapshot

Elecon delivered its best-ever quarterly and annual performance, driven by a domestic rebound, strong export traction, MHE margin expansion, and record order book. The balance sheet remains strong, supporting growth into FY26.

1.1 Q4 FY25: Highest-Ever Revenue, PAT, and Order Book

1.2 FY25: Full-Year Performance vs Guidance

Management achieved full-year guidance, led by domestic market recovery and international order strength, while maintaining margin stability despite cost pressures.

1.3 Segmental Trends: Gear vs MHE — Diverging Growth Engines

Gear Division faced slight margin compression due to product mix shifts and freight costs.

MHE Division became a high-growth, high-margin vertical post repositioning toward productized business.

1.4 Geography-wise Split: Domestic Rebound, Global Expansion on Track

Domestic: Recovery driven by steel, power, cement sectors.

Overseas: Strong OEM traction; building towards FY30 target of 50% export revenue.

1.5 Key Ratios: ROCE, Asset Turns, Margins, and Capital Allocation

Debt levels remain negligible. Company remains net cash positive.

Small working capital stretch due to strong demand and inventory buildup.

Cash conversion cycle remains healthy despite aggressive revenue growth.

2. Management Strategy & Outlook

Management expects continued double-digit growth in FY26 with stable margins, supported by strong sectoral tailwinds, global expansion initiatives, and an evolving high-margin MHE business.

2.1 FY26 Guidance: Revenue, Margins, Segmental Focus

Management Target:

Achieve ~19% growth in FY26, keeping margins stable, despite global macro volatility.

2.2 Strategic Priorities: MHE Growth, Global OEM Alliances, R&D, ESG

2.3 FY30 Vision: 50% International Revenue, Leadership in Core Segments

Strategic Levers:

Deeper global distribution.

Strategic tie-ups with global OEMs.

Innovation-driven product upgrades.

2.4 Commentary from CMD: Demand Drivers, Capabilities, and Positioning

"Our focus remains on sustaining profitable growth while expanding our global footprint and driving innovation-led market leadership. FY26 will be a year of consolidation and acceleration."

3. Valuation Analysis

3.1 Valuation Snapshot: Metrics and Multiples

Insight: At 30× earnings with strong FCF and a debt-free structure, Elecon is priced as a high-quality compounder, not a cyclical.

3.2 How Valuations Stack Up vs History and Peers

Despite being net cash and high ROCE, Elecon still trades at a discount to MNC peers like Timken or SKF — with similar or better financials.

Elecon trades at reasonable valuations for a 25% ROCE, debt-free, high-FCF business — with additional upside from margin expansion and international scale-up.

3.3 What’s Built Into the Price Today

Market assumes steady compounding, not hypergrowth — giving comfort on downside protection.

3.4 What’s Not Fully Priced In Yet (Optional Upside)

There’s long-duration upside if Elecon executes on exports, aftermarket, and margin levers.

4. Implications for Investors: What to Watch

4.1 Bull, Base & Bear Case Scenarios (FY26-FY27 Forward View)

CMP of ₹560 prices in the base case, leaving valuation upside in bull case, and moderate downside risk in the bear case.

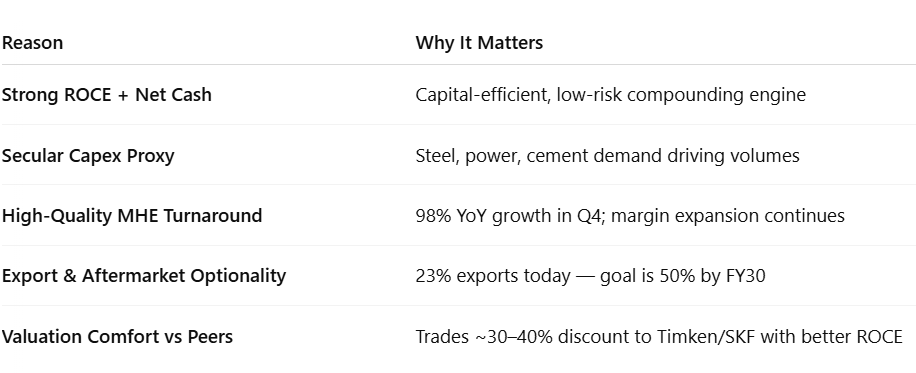

4.2 Reasons to Stay Invested or Add on Dips

Elecon is an execution-backed compounder, not a hope-based story.

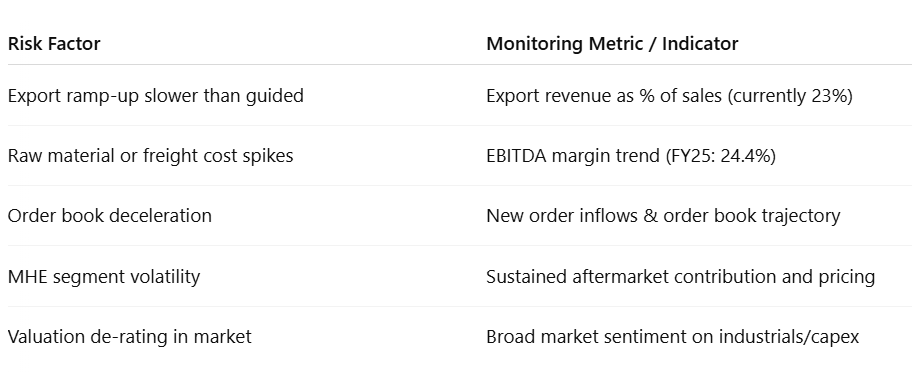

4.3 Key Risks & What to Monitor

Track order flow momentum, export contribution, and segment-level margin stability.

Specific Macro Risk: Trump Tariffs on Industrial Goods

US is a key OEM-driven market for Elecon’s gears.

Tariffs could indirectly impact margins, order wins, and longer-term global expansion narrative.

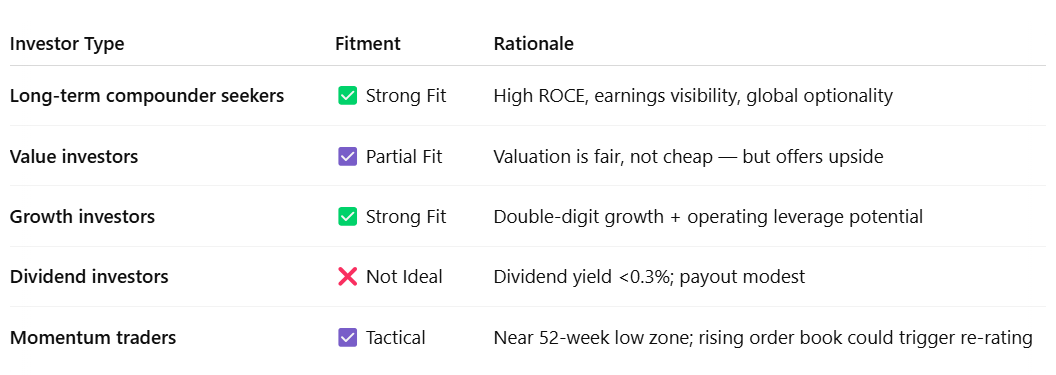

4.4 Investor Segmentation Outlook: Who Should Own This Stock?

Elecon suits long-term, quality-focused investors looking for industrial compounding + margin expansion optionality.

Final Investor Takeaway:

Elecon is transitioning from a mid-cap industrial to a globally competitive, high-margin engineering play. With MHE profitability back, exports growing, and valuations still reasonable, it offers durable upside with downside protection.

Disclaimer

Content Accuracy and Reliability: This summary of the earnings call is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities. Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions. No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary. Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional