E2E Networks Q4 FY25 Results: 117% PAT Growth, GenAI Tailwind, Rich Valuation

E2E's revenue grew 74% on GPU monetization and GenAI platform gains. Growth hinges on monetizing undeployed capex. Rich valuations price in AI cloud potential.

Table of Content

Q4 & FY25 Financial Performance: Strong Growth Across Metrics

E2E Management Commentary & Strategic Outlook: Building India’s Sovereign AI Cloud

E2E Valuation Analysis: Priced for Perfection or Platform Execution?

Implications for E2E Investors: High-Conviction Story or Hold-Off Zone?

1. E2E Q4 & FY25 Financial Performance: Strong Growth Across Metrics

E2E Networks delivered a solid financial performance for both Q4 and the full FY25, underpinned by its aggressive expansion into GPU-backed AI infrastructure and a strategic push into sovereign cloud offerings.

Exceptional full-year growth: Both PAT and EBITDA doubled YoY, with margins improving substantially.

Temporary softness in Q4 revenue, but offset by very high non-operating income and tight cost controls.

Strong balance sheet with ₹464 Cr cash, and over ₹630 Cr in capex pending monetization—a clear visibility into FY26 tailwinds.

ARPU strength shows deep enterprise traction, though quarterly volatility remains.

1.1 E2E Q4 FY25 Snapshot

Top-line slowdown in Q4 is notable (QoQ dip of 19.5%), likely due to seasonality, temporary onboarding delays, or customer budget resets.

Margins held firm, with PAT margins hitting 40.7%—a sign of strong operating leverage and growing high-yield workloads.

EPS grew despite lower revenue, driven by sharp increases in other income (₹254 Mn vs ₹2 Mn YoY), likely from treasury operations on undeployed funds.

1.2 E2E Full-Year FY25 Performance

Top-line scale + margin expansion = rare combination; driven by monetization of earlier GPU investments and a more enterprise-focused customer mix.

EBITDA margins at 59% are extremely high for a tech infra company, pointing to strong control on opex and minimal cost creep despite capacity additions.

PAT more than doubled despite heavy depreciation and finance costs from new GPU purchases—demonstrating that investments are already generating returns.

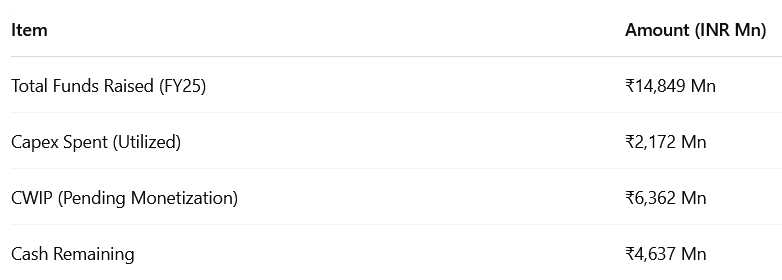

1.3 E2E Capex & Fundraising Activity

E2E raised over ₹1,484 Cr in equity, of which only ~15% has been monetized via capex deployment so far. A large ₹636 Cr worth of high-end GPU infrastructure remains under construction or pre-revenue and will be key growth levers for FY26

1.4 E2E ARPU & Customer Metrics

ARPU for Top 500 customers rose from ₹5.1 Lakh (Q4 FY24) to ₹7.5 Lakh (Q1 FY25), peaking at ₹8.6 Lakh in Q2 FY25, and ended the year at ₹5.8 Lakh in Q4.

Reflects strong enterprise monetization but also some normalization or churn toward the end of the year.

Despite this, monthly revenue run-rate improved steadily, touching ₹165 Mn in Sep 2024 before a slight decline.

2. E2E Management Commentary & Strategic Outlook: Building India’s Sovereign AI Cloud

Rather than competing on generic cloud compute like AWS or Azure, E2E is crafting a verticalized moat focused on high-performance GenAI workloads, data sovereignty, and cost-performance leadership in AI compute.

Clear platform positioning: Not a generic IaaS player but a niche sovereign AI infra firm with full-stack capabilities.

Deep vertical focus: BFSI, Government, Healthcare, and Education—sectors that demand both compliance and compute.

Execution aligned with policy: Strategic alignment with India’s AI ambitions gives a non-linear upside if national projects are awarded.

Smart capital deployment: CWIP-led GPU capacity means costs are front-loaded, but monetization is just beginning.

2.1 Platform Vision: Full-Stack AI Cloud, Not Just Infrastructure

E2E’s stack spans:

Physical Infrastructure: Multi-region data centers in Delhi NCR & Chennai

Compute: Over 3,700 high-end cloud GPUs (H100, H200, L40S, etc.)

Software Platform: Proprietary TIR AI/ML platform with integrated model tuning, inference, and version control

End Services: GenAI capabilities offered as PaaS to AI-first startups and institutional customers

“We are not just selling infrastructure—we’re enabling innovation. TIR is where India's GenAI transformation will be built.”

— Tarun Dua, MD, E2E Networks

This approach gives them control over the entire AI stack, enabling better unit economics and deeper integration with clients’ ML pipelines.

2.2 Strategic Growth Pillars Outlined by Management

TIR – Generative AI/ML Platform

Central to E2E’s monetization flywheel

Supports rapid interactive development via Jupyter, vLLM, LORA/BnB quantization, and seamless checkpointing

Helps developers fine-tune large models with lower latency and high throughput

Sovereign Cloud Platform

Enables BFSI, Govt, Healthcare, and EduTech sectors to deploy compliant, India-hosted private clouds

“Build your own Sovereign Cloud in 15 days” offering combines IaaS + TIR on-prem or hybrid

Reduces dependency on US hyperscalers while improving regulatory alignment

AILaaS (AI Lab-as-a-Service)

White-labeled solutions for educational institutions and research labs

Taps into India’s academic R&D base and STEM talent pool

Partnership with Larsen & Toubro (L&T)

Extends E2E’s reach into large enterprises via co-branded Go-to-Market motion

Enhances credibility with Government and regulated sectors

Strengthens capability to bid for India AI Mission, a ₹10,000 Cr public sector AI infrastructure initiative

2.3 Addressable Market & Tailwinds (As Framed by Management)

E2E sees itself as a critical AI infra enabler as India becomes a hub for:

Model training & fine-tuning

Domain-specific GenAI applications

Regulated-sector innovation using Indian data

3. E2E Valuation Analysis: Priced for Perfection or Platform Execution?

At first glance, E2E Networks appears expensive on traditional metrics. But the valuation narrative goes deeper—it's not just about trailing numbers, but also about what the market is pricing in for FY26 and beyond.

E2E is a net cash company with minimal debt and ~₹636 Cr in GPU capex (CWIP) not yet monetized—an important buffer for future growth.

At CMP ₹1,903, the market is already pricing in 60x on FY26E EPS as the “Base Case.” Unless E2E delivers a strong beat, upside is capped in the short term.

E2E trades at a premium to every peer—even globally—based on the GenAI hype and India's AI policy tailwinds. While justified for a tech-platform inflection, any execution miss or delay in TIR platform monetization could trigger multiple compression.

3.1 What’s Built Into the Price Today?

Flawless FY26 Execution

CMP already prices in a 60x forward P/E, meaning investors expect a near-doubling of earnings.Sticky Growth from TIR and Sovereign Cloud

Investors believe E2E can achieve “platform economics” via proprietary services—not just rent out GPUs.India AI Mission Tailwinds

Strategic narrative gives optionality if E2E wins major Govt or PSU AI infra deals.

3.2 Valuation Summary

3.3 Risk Flags to Watch

Slow GPU monetization from CWIP could hurt margins and ROCE

Customer churn or ARPU decline from top 500 clients

Platform execution delays on TIR or Sovereign Cloud offerings

Valuation compression if GenAI demand moderates or competition intensifies (AWS/GCP price cuts)

4. Implications for E2E Investors: High-Conviction Story or Hold-Off Zone?

E2E Networks presents a compelling—but complex—investment case. While the fundamentals show strong execution and the business is strategically aligned with India’s AI ambitions, the stock is no longer under the radar. It's now priced like a category-defining platform, not a speculative growth story.

Here’s what this means for different types of investors:

4.1 Investor Playbook by Risk Appetite

4.1.1 For Long-Term Thematic Investors (3–5 year view)

Thesis: India’s GenAI ecosystem is in its infancy. As the only listed, India-born sovereign cloud platform with ~3,700 cloud GPUs and a proprietary GenAI stack (TIR), E2E is a picks-and-shovels play on AI infrastructure.

What to do:

Use market dips or earnings-related corrections to accumulate gradually

Focus on FY27–FY28 earnings potential, not short-term multiples

Track execution milestones: TIR platform traction, customer onboarding, sovereign cloud deals

4.1.2 For Tactical Investors (6–12 month horizon)

Thesis: Near-term upside appears priced in. The stock trades at 60x+ forward P/E, meaning Q1/Q2 FY26 results must deliver re-acceleration or face derating pressure.

What to do:

Wait for a 15–20% correction or a clear inflection in revenue growth (especially from CWIP utilization)

Monitor for declines in ARPU or margin compression as signs of revenue bottlenecks

Stay nimble; earnings surprises (positive or negative) could drive quick price swings

Avoid full positions; consider staggered entries post Q1 FY26

4.1.3 For Value Investors / Margin of Safety Purists

Thesis: Current valuation leaves zero room for error. Even in the bear case, the stock is ~30% overvalued relative to fair value.

What to do:

Stay on the sidelines until the stock pulls back below ₹1,500–₹1,600

Re-enter only if:

Revenue visibility improves

Margin expansion continues

Competition (e.g., hyperscalers) doesn’t undercut pricing

4.2 Signals to Track Going Forward

4.3 Final Call

E2E Networks is not cheap—but great stories rarely are.

If you believe in the India AI infrastructure thesis, this is one of the few pure-play ways to express that view. But timing matters—and with valuations stretched, investors would be wise to let earnings confirm the optimism before going all in.

Disclaimer

Content Accuracy and Reliability: This summary of the earnings call is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities. Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions. No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary. Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional