Dreamfolks Services: 60%+ revenue growth in FY24 despite a weak Q1-24 at PE of 37

Focus on growth while maintain leadership position in India while spreading globally and adding more services. On the other hand business models and cost structures undergoing change

1. India's largest Airport Service Aggregator platform

dreamfolks.in | NSE : DREAMFOLKS

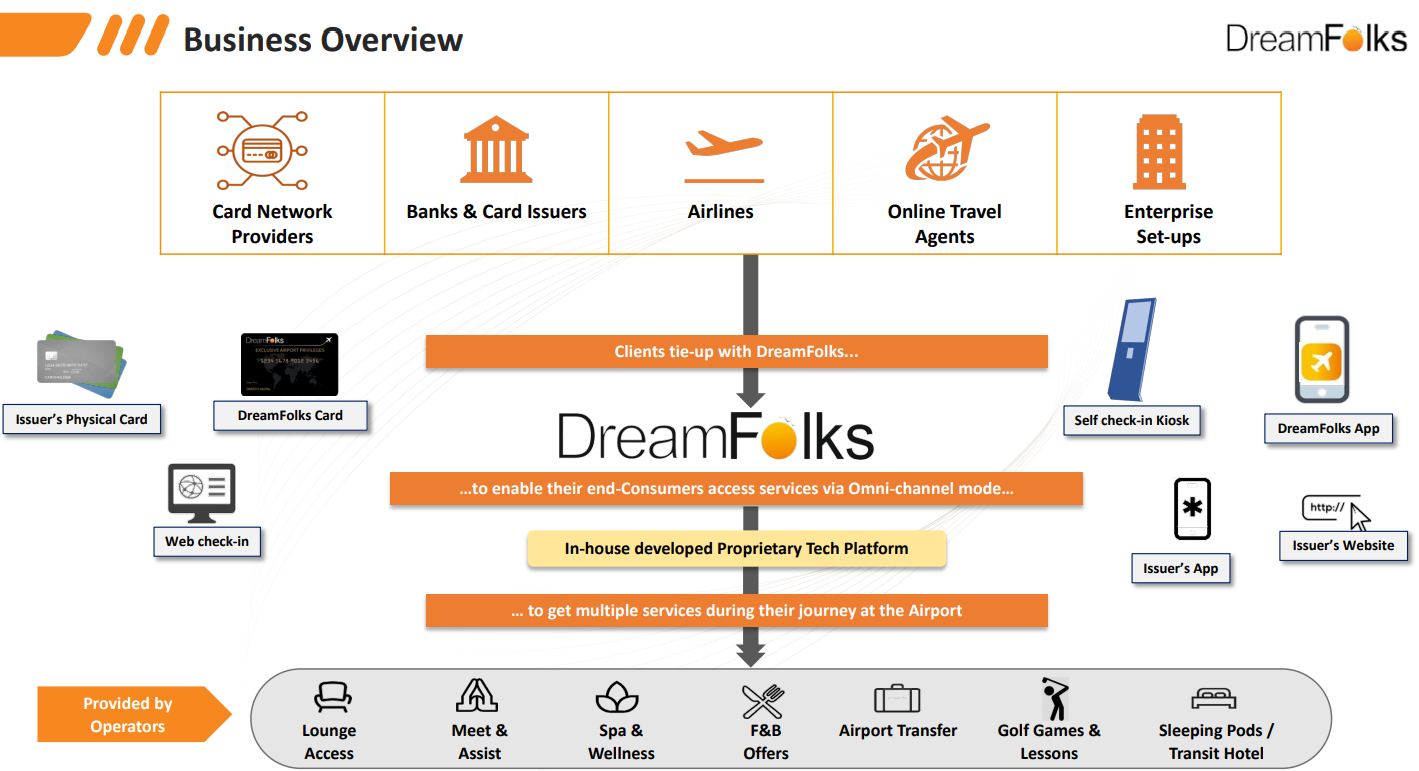

Dreamfolks Services Ltd is a market leader in the airport lounge aggregation industry in India with diversified service portfolio across travel assistance value spectrum

95% market share in card-based lounge access in India

Our first mover advantage in the lounge access aggregator industry in India has enabled us to become a dominant player in the industry. We enable seamless connections between airport service operators and card issuers or card networks with many to one connection and even in the event of operators changing over the years, establishing uninterrupted services to the end consumers.

We started the current financial year on an extremely strong note, with record high air traffic numbers clocked each month and a growing propensity of passengers to access lounges. We continue to maintain our 100% coverage of airports and railway lounges in the country and have been instrumental in driving majority of the traffic to these lounges. In addition to lounge access, we now offer a bouquet of premium service offerings like Meet & Assists, Airport transfers, Golf sessions, and much more

2. FY20-23: Surpassed pre-COVID levels, reaching new highs in revenue, PAT & PAT margins in FY23

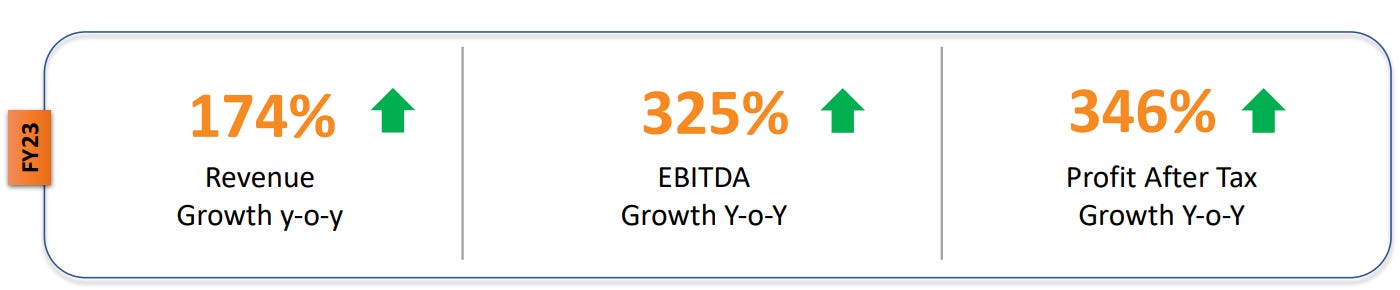

3. FY23: PAT up 346% on revenue growth of 174%

Revenue growth of 174% with the highest ever revenues of INR 773.25 crores for the full year as against INR 282.50 crores in the previous year.

The PAT for the year was INR 72.53 crores, which has significantly increased by 346% compared to the last year.

During FY '23, our PAT margin was 9.38% compared to 5.75% in the previous year.

4. Q1-24: Weak quarter, PAT down 3% on a revenue growth of 66% YoY

Strong growth of 66% YOY and the revenue stood at Rs. 2,663 Mn as compared to Rs. 1,603 Mn in Q1FY23.

Reasons that have contributed to the drop in margins

Timing mismatch escalation in cost with vendors versus increase in price points with clients that occurs annually

An unexpected cost escalation. Our operator cost to us increased by 10% to 15% instead of the usual 5% to 8%.

Increase in employment benefit expenses, ESOP charges, added around 15% to our employee costs

5. High quality earnings : Return ratios managed well

Coming to the return ratios clocked by the company, our strong profitability stemming from efficient operations at scale and an asset-light business model has helped us deliver tremendous value to our stakeholders. Our ROE stands at 46.3% for FY '23 and ROCE stands at 62.6%.

6. Outlook: 60-65% growth & reduced EBIDTA margin

i. FY24: Revenue growth of 60-65%

The forecast for this year is around 60% to 65%. So, that is the growth what we are expecting for this financial year.

ii. FY24: EBITDA margin guidance reduced from 14-15% to 11-13%

We are changing our gross margin guidance from the 14% to 15% that we have been reporting over the last couple of years to a more conservative 11% to 13% for this financial year.

7. 60-65%+ growth in FY24 at a PE(TTM) of 37

8. So Wait and Watch

If I hold the stock then one can hold on to DREAMFOLKS provided one is ready to see some bad days in the near future. The weak performance in Q1-24 has raised question marks on the valuations of the stock. The reduction in margin guidance has raised even bigger question marks on the bottom-line growth potential for the stock. Q2-24 needs to be watched very carefully for the impact of margin reduction on the overall FY24 bottom-line.

9. Or, join the ride

If I am looking to enter the stock then

DREAMFOLKS is guiding for a revenue CAGR of 60%+ for FY24 which makes the PE of 37 look attractive.

Positive industry dynamics along with company’s differentiated products and right investments in people & technology will augment strong revenue growth in the medium term

In the medium terms top-line prospects of the company look solid but there is an uncertainty given the impact of reduction in gross profit margin guidance .

One needs to enter DREAMFOLKS in small steps on bad days over a period of time till the uncertainty around the impact of margins on FY24 performance is resolved. An entry price closer to its listing price would be better.

If the uncertainty due to the margins is navigated wisely, the momentum in the top-line growth will open up opportunities for multi-bagger returns in the stock.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades