DMart Valuation Analysis: Growth vs. Quick Commerce Squeeze (9M FY26 Update)

Is the "King of Retail" still a buy after a 22% correction? We dive into the 9M FY26 financials, the management's warning on Quick Commerce, and the CEO transition.

dmartindia.com | NSE: DMART

1. Valuation Inputs (Current Data Points)

Current Stock Price: ₹3,832.20

Market Capitalization: ₹2.49 Lakh Crore (₹2,49,000 Cr)

Reported P/E Ratio: 91.50

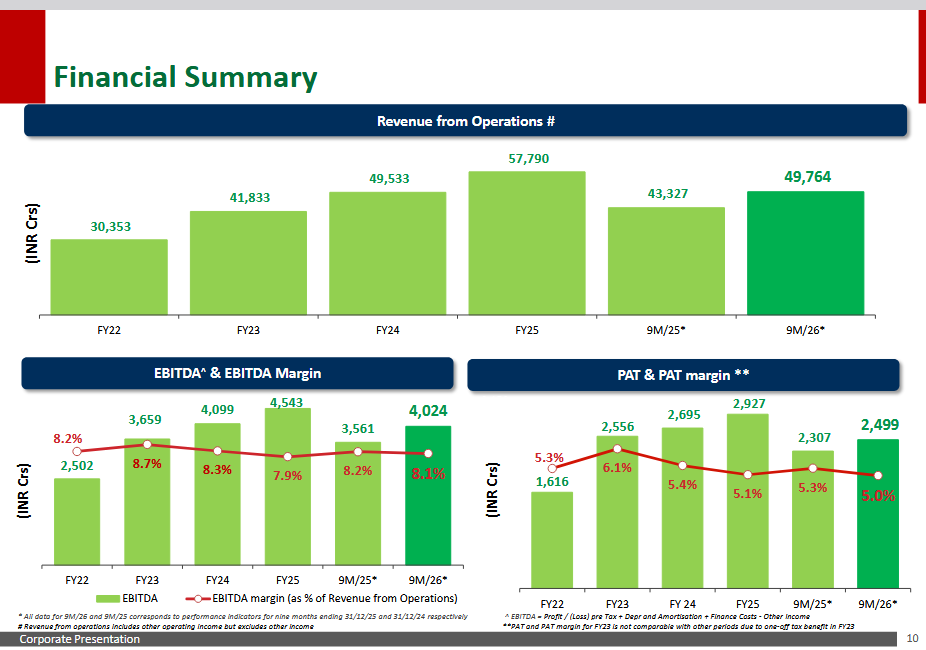

9M FY26 Standalone PAT: ₹2,499 Cr

9M FY26 Standalone Revenue: ₹49,764 Cr

9M FY26 EBITDA: ₹4,024 Cr

2. Multiples Analysis of DMART

A. Price-to-Earnings (P/E) Analysis

P/E = 91.50 — Trailing Twelve Months (TTM) earnings.

Estimated FY2026 PAT: Based on a 9-month PAT of ₹2,499 Cr, the full-year run rate is approximately ₹3,332 Cr.

Forward P/E: ₹2,49,000 Cr (Mkt Cap) / ₹3,332 Cr (Proj. PAT) = ~74.7x.

Interpretation: This is still a significant premium compared to the Nifty 50 (~22-25x) and most retail peers.

B. EV/EBITDA Analysis

Projected FY2026 EBITDA: ₹4,024 Cr (9M) extrapolated to 12 months = ₹5,365 Cr.

Enterprise Value (EV): EV is roughly equal to Market Cap (~₹2.50 Lakh Cr).

EV/EBITDA Ratio: ₹2,50,000 Cr / ₹5,365 Cr = 46.6x.

Interpretation: DMart typically trades at 40x-50x EBITDA. At 46.6x, it is trading in its historical fair-value zone, neither extremely cheap nor at a bubble peak (which has historically touched 60x+).

C. Price-to-Sales (P/S) Ratio

Projected FY2026 Revenue: ₹49,764 Cr (9M) extrapolated = ₹66,352 Cr.

P/S Ratio: ₹2,49,000 Cr / ₹66,352 Cr = 3.75x.

Interpretation: For a grocery retailer, a P/S of 3.75x is very high (Walmart trades at ~0.8x), reflecting the market’s high confidence in DMart’s ownership model and future store expansion.

3. Growth-Adjusted Valuation (PEG Ratio)

Earnings Growth: 9M FY26 PAT grew ~8.3% year-over-year.

PEG Ratio (P/E / Growth): 91.5 / 8.3 = 11.02.

Interpretation: A PEG ratio above 1.0 is considered expensive; a PEG of 11.0 is exceptionally high. This suggests that the DMART is rising much faster than the actual earnings growth rate, or the market is pricing in a massive earnings explosion in the next 2-3 years.

4. Valuation Risks (Why DMART is down from its 52-week high)

DMART stock peaked at ₹4,949.50 and is currently down ~22% from those highs.

LFL Slowdown: Like-for-Like (same store) growth has slowed from 8.4% (FY25) to 5.6% (Q3 FY26). Valuation multiples usually contract when same-store growth slows.

Quick Commerce Headwinds: Management admitted a 1% to 1.5% impact on sales from Quick Commerce players. Investors are worried this impact might grow.

The “Zepto Factor”: Quick Commerce is Leaving a Mark

The most discussed topic in the latest Analyst Meet was the impact of Quick Commerce (QC) players like Blinkit, Zepto, and Swiggy Instamart.

Management has historically been dismissive of online threats, but the tone has shifted. CEO Neville Noronha recently admitted to a 1% to 1.5% sales impact on same-store sales due to the rise of 10-minute deliveries.

The Warning Signal:

The Like-for-Like (LFL) growth—which measures sales growth at stores open for more than 24 months—has seen a steady decline:

FY2025: 8.4%

Q3 FY2026: 5.6%

When same-store growth slows to mid-single digits, it becomes very difficult for a stock to justify a P/E ratio above 90x.

Leadership Transition: The market is in a “wait and watch” mode as long-time CEO Neville Noronha exits and Anshul Asawa takes over.

5. Final Conclusion

Valuation Verdict: Expensive but Consolidating.

DMart is currently in a “Time Correction” phase. While the P/E of 91.5x looks high, the stock has corrected 22% from its highs while the earnings (PAT) continue to grow at ~8%.

Bull Case: If the new CEO successfully accelerates store openings (Management target: 50+ per year) and LFL growth stabilizes above 7%, the stock could justify its premium.

Bear Case: If LFL growth continues to slide toward 3-4% due to Quick Commerce, the P/E multiple is likely to de-rate further toward 50x-60x, implying more downside for the stock price despite revenue growth.

Current Stance: Neutral/Hold. The valuation is still demanding, and until the market sees the Q4 results under new leadership, the upside may be capped.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer