Dixon Technologies: PAT growth of 113% & Revenue growth of 119% in 9M-25 at a PE of 108

Revenue growth of 225% in FY25 with growth of 140%. FY25 margins expected to be stable. Strong margin expansion expected after FY26.

1. Largest Indian Original Design Manufacturing (OEM & ODM) Company

dixoninfo.com | NSE: DIXON

India’s largest ODM player in lighting solutions

Largest Semi- Automatic Washing Machine (SAWM) manufacturer from the past 2 years

Fastest growing EMS Company by Revenue and Market Gap.

Largest manufacturer in the Indian security surveillance space

2. FY20-24: PAT CAGR of 33% & Revenue CAGR of 42%

3. FY24: PAT up 47% & Revenue up 45% YoY

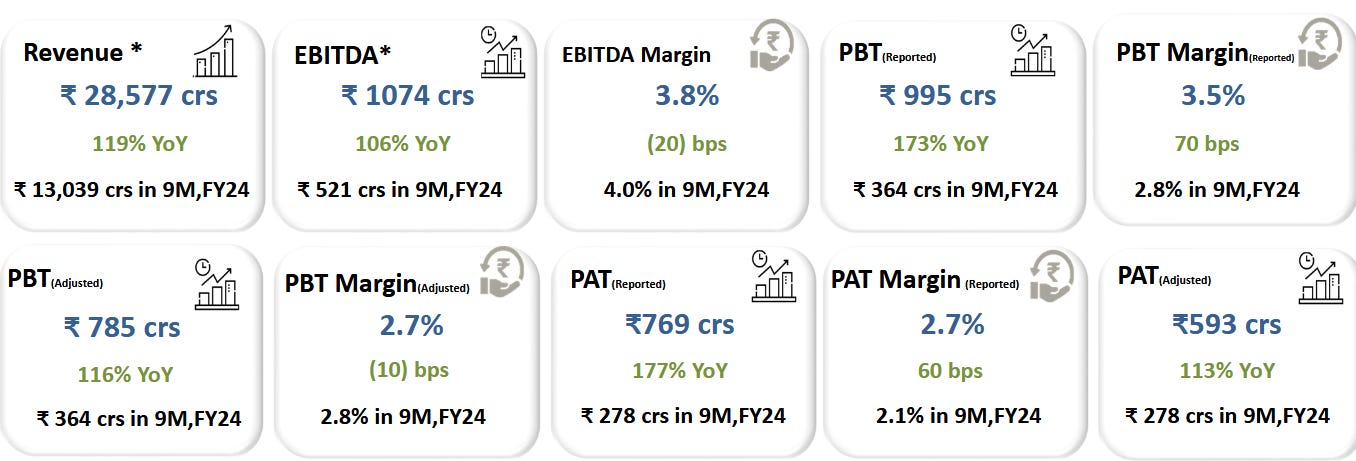

4. Q3-25: PAT up 124% & Revenue 117% YoY

5. 9M-25: PAT up 113% & Revenue up 119% YoY

6. Business metrics: Strong return ratios

7. Outlook: Strong growth drivers

Growth drivers:

Mobile phones: Dixon is strengthening partnerships with leading global smartphone brands, adding new facilities, and expanding export volumes. They anticipate exporting 0.5 to 6 million units in February and March of this fiscal year, with a healthy order book for Motorola, Xiaomi and OPPO. They have also entered a joint venture with Vivo, with Dixon holding a 51% share.

Telecom and networking products: This segment is expected to be a key driver, with a new facility commencing production in November 2024 and plans to double capacity for 5G FWA. They are also localizing certain components to drive cost efficiency.

Laptops, tablets, and IT hardware: Mass production has started for Lenovo, Acer, and another unit. Dixon is in final discussions for a JV to expand its product portfolio in this segment.

Consumer electronics: While the LED TV market has seen slower growth, Dixon has onboarded new multinational brands. The refrigerator business has captured around 8% of the Indian market and is expanding capacity.

Home appliances: Washing machine production is growing, and the company is exploring new product categories like robotic vacuum cleaners and water purifiers.

Lighting: The company has received orders for outdoor lighting and is working on backward integration to improve margins.

Strategic Investments:

Backward Integration: Dixon is focused on increasing value addition and improving margins through backward integration.

They are foraying into components, including precision components, mechanicals, camera modules, and battery packs.

They have finalized the location for manufacturing display modules in partnership with HKC and expect to begin manufacturing by the end of Q1 or beginning of Q2 of the next fiscal year.

They are also in active discussions with a global technology partner to set up a world-class display fab. This project is awaiting the roll out of policy guidelines under ISM2. The estimated capex for this display fab is around $3 billion.

They are pursuing camera modules as part of a component strategy.

Capacity Expansion: The company is investing in capacity expansions across various segments, including mobile phones, refrigerators, and telecom.

Joint Ventures (JVs): Dixon is pursuing joint ventures to expand its product portfolio in IT and mobile segments.

A JV with Vivo for manufacturing smartphones, with Dixon holding 51% of the shareholding.

A JV with a large global ODM for IT products.

Financial Outlook:

A display fab project is considered to be margin accretive, with a fast payback period.

Dixon expects to see margin expansion in the mobile segment in the next 24 to 36 months due to backward integration projects.

Guidance on Volumes:

Mobile Phones: Dixon expects to reach a volume of 30 million smartphones by the end of the current fiscal year. They also expect volumes from OPPO to be around 7-8 million in the next fiscal year.

Refrigerators: They aim to expand their capacity from 1.2 million to 1.5 million per annum, with plans to further increase it to 2.2 million.

Laptops: They expect to see significant growth in the laptop segment with a potential JV and anticipate revenues of 2.5 to 3 thousand crores in the next financial year.

Telecom: The company expects a revenue of approximately 3,000 crores in the current fiscal year, with the possibility of doubling this figure in the next fiscal year.

Challenges and Risks:

Government Approvals: The Vivo JV and the display fab project are subject to government approvals.

PLI incentives: While the company is receiving PLI incentives, there are some delays in the process. The company has booked approximately 200 crores of PLI related income with receivables of approximately 1000 crores. The mobile PLI is set to expire in FY26 and post that the company expects to see margin expansion.

i. FY25: Revenue growth of 225%

ii. FY25: PAT growth of about 140%

FY24 cr PAT growing from Rs 375 cr to about Rs 900 cr implies a PAT growth of about 140% which looks reasonable given the 113% growth in PAT for 9M-25.

iii. FY25: EBITDA Margins to be stable

iiv. Strong margin expansion to drive PAT growth

9M-25 margin of 3.5% increasing to 4.5% levels after FY26 will drive strong profitability growth.

Dixon anticipates margin expansion in the mobile segment by 100 bps in the next 24-36 months due to backward integration and the display project and also expects that margins in this business can expand by 120 bps

8. PAT growth of 113% & Revenue growth of 119% in 9M-25 at a PE of 108

9. Hold?

If I hold the stock then one may continue holding on to DIXON

Strong confidence by the DIXON management in their business prospects as it has increased revenue guidance from Rs 30,000-32,000 cr to Rs 40,000 cr. DIXON looks on track to deliver a strong FY25

PAT growth from Rs 375 cr in FY4 to Rs 900 cr in FY25 is a strong reason to continue with DIXON

The outlook for margin expansion beyond FY26 is a reason to continue in the DIXON from a longer term perspective.

One can continue to hold DIXON as long as the business momentum sustains and margins are going in the right direction.

10. Buy?

If I am looking to enter DIXON then

DIXON has delivered PAT growth of 113% and Revenue growth of 119% in 9M-25 at a PE of 108 which makes the valuations fully valued in the short term.

DIXON is guiding for PAT growth of about 140% and Revenue growth of 225% in FY25 at a PE of 108 which makes the valuations acceptable from FY25.

Bases on historical execution of FY20-24 PAT CAGR of 33% & Revenue CAGR of 42% at a PE of 108 makes the valuations quite expensive from a historical performance perspective.

The margin of safety at a PE of 100+ is limited irrespective of strong business performance in 9M-25. At a PE of 100+, DIXON will stock not be able to sustain even a single quarter of average performance.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Thanks for the review.much needed!