Dixon Technologies Q1 FY26 Results: PAT Up 100%, Targets 40-45% Growth for FY26

Pivot to high-margin components driving long-term earnings visibility that supports premium valuation and is key to sustaining profitability after PLI benefits fades

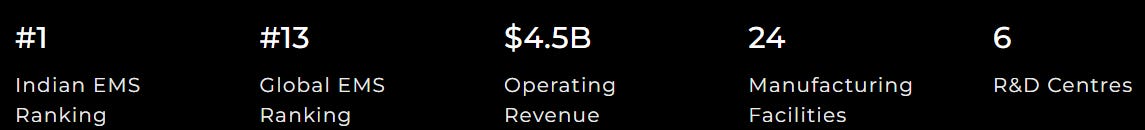

1. Electronics Manufacturing Services Provider

dixoninfo.com | NSE: DIXON

India’s largest EMS provider, offering end-to-end design and manufacturing solutions for both global and domestic brands

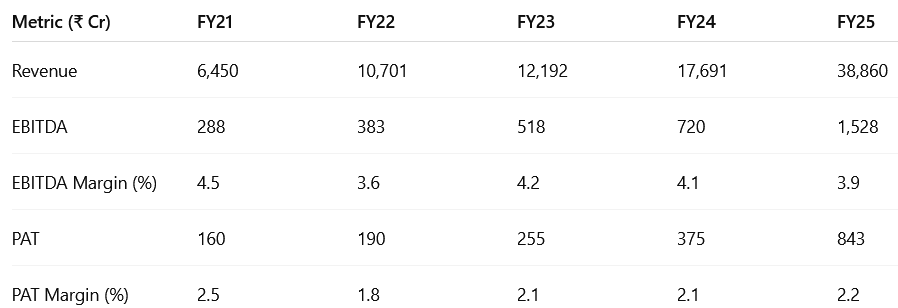

2. FY21-25: PAT CAGR of 52% & Revenue CAGR of 57%

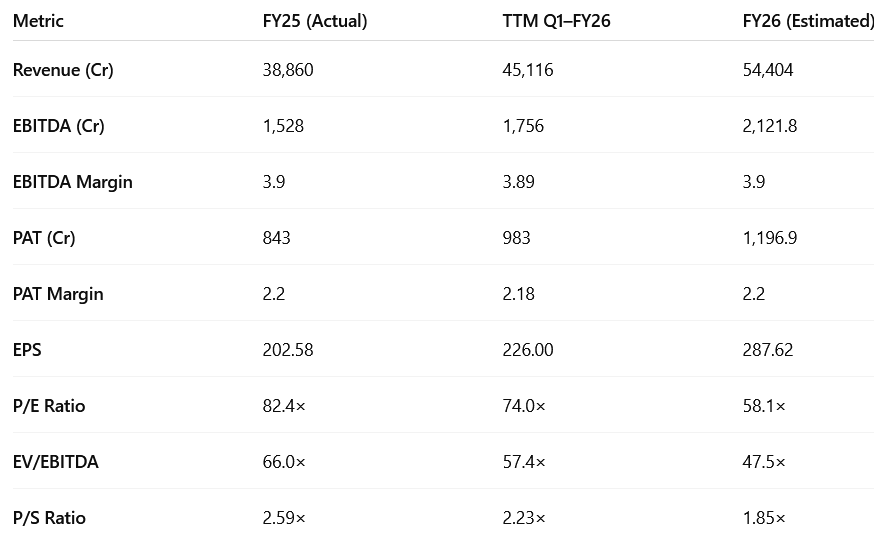

For FY25, the reported PAT of ₹1,233 Cr includes a one-time fair value gain of ₹460 Cr from Dixon’s stake in Aditya Infotech Ltd. The adjusted PAT of ₹843 Cr, shown in the table, excludes this gain to provide a normalized view of operating performance.

Revenue Growth: Outstanding — 58% CAGR driven by EMS scale-up and strategic acquisitions

Margin Profile: Thin and volatile — typical for EMS players; modest expansion via operating leverage

Risks: Client concentration, low margins, dependence on policy (PLI), forex shocks

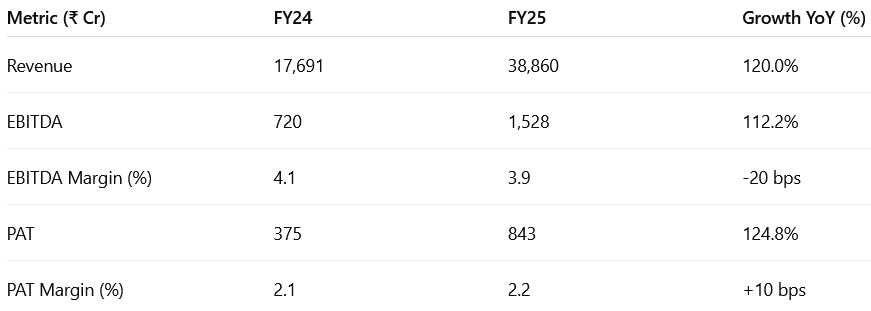

3. FY25: PAT up 47% & Revenue up 45% YoY

Growth was broad-based across segments, but Mobile & EMS led the charge, benefitting from PLI-linked execution, Ismartu acquisition, and new client additions.

Ismartu Acquisition (50.1%): ~₹4,045 Cr revenue contribution; part of Dixon's mobile ramp-up.

JV Exit (AIL Dixon): Stake sold in exchange for Aditya Infotech equity. Fair value gain of ₹460 Cr booked.

New Subsidiaries: Dixon IT Devices, Electroconnect, and Teletech — supporting product diversification.

ROCE and ROE improved sharply — a quality sign, reflecting asset-light expansion and higher capacity utilization.

Net cash position sustained even after large capex.

Working capital cycle held steady despite scale-up, thanks to tight receivables and efficient supplier credit terms.

Free cash flow improved, a positive sign in a high-growth phase.

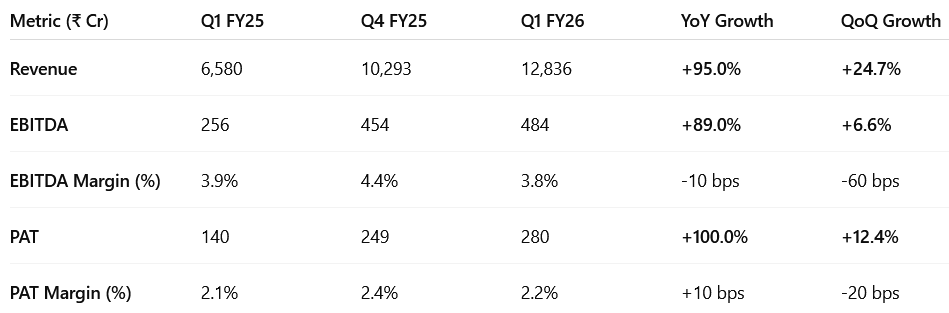

4. Q1-26: PAT up 100% & Revenue up 95% YoY

PAT up 12% & Revenue up 25% QoQ

Strong topline growth: 25% QoQ and 95% YoY, driven by Mobile & EMS and Other EMS ramp-up.

EBITDA growth of 6.6% QoQ was solid but margins contracted sequentially due to increased raw material costs (material cost as % of revenue rose 110 bps YoY).

PAT rose 12.4% QoQ, reflecting operating leverage and improved execution across divisions.

Net working capital days improved to (4) days, maintaining Dixon’s best-in-class working capital cycle.

Free cash flow of ₹57 Cr in Q1, reversing the outflow in Q1 FY25.

SEGEMENTAL PERFORMANCE

Mobile & Other EMS

Largest contributor to overall growth.

Benefited from IT hardware, wearables, telecom, and the Ismartu acquisition.

ROCE expansion shows excellent capital efficiency.

Consumer Electronics (LED TV & Refrigerator)

Revenue under pressure due to base effect and subdued appliance demand.

Margin improvement sustained from FY25 exit, likely due to favorable mix and ODM share.

Home Appliances (Washing Machines)

Steady performer with the highest margins in the portfolio.

Slight margin normalization from Q4 peak.Lighting Products

Lighting Products

Revenue and profit declined both QoQ and YoY.

Margin compression suggests pressure from pricing or inventory absorption.

5. Business metrics: Strong return ratios

6. Outlook: 40-45% Revenue Growth in FY26

6.1 Dixon Technologies: FY26 Guidance and Long-Term Growth Outlook

FY26 Revenue Guidance

Dixon targets 40–45% revenue growth in FY26, driven mainly by the mobile and telecom segments. A strong order book supports management’s confidence.

Long-Term Growth Outlook (Beyond FY26)

Mobile Phones: Expected to remain the largest contributor, with production rising from 28 million (FY25) to 41–43 million units (FY26).

Telecom: Revenue projected to touch ₹5,000 Cr, forming 9–10% of total sales.

Refrigerators: Growth driven by capacity expansion and new product additions. anticipated to make a meaningful contribution in the next couple of years.

Lighting: The Signify JV is expected to boost revenue via new categories and exports.

Components: A key part of Dixon's long-term strategy. Full ramp-up in FY27 (e.g., camera modules via Q-Tech) will enhance margins as PLI incentives phase out.

IT Hardware: Laptops and personal devices expected to scale from FY27.

Exports: To rise from ₹1,600 Cr (FY25) to ₹7,000–9,000 Cr (FY26) and ₹11,000 Cr (FY27).

Dixon is well-positioned for robust growth in FY26, with a long-term strategy focused on high-value manufacturing, exports, and segment diversification.

6.2 Margin Outlook for FY26 and Beyond

FY26 Guidance:

Stable Margins will be supported by the ongoing PLI benefits, helping maintain a healthy blended profile.

FY27 & Beyond (Post-PLI):

Despite the expiry of PLI incentives, Dixon expects to expand margins by 100–150 bps by FY27–28 through a strategic shift in business mix.

Key Drivers of Margin Expansion

Backward Integration into Components:

Core to the strategy. Enables value chain control and higher margins.Camera Modules (Q-Tech):

Expected EBITDA margin of 8.5–9%.Display Modules (JV with HKC):

Aims to deepen vertical integration.Precision Mechanics (JV with Chongjing UI):

High-margin supply of laptop components.Operational Leverage:

Targeting 65–66 million mobile units, which will improve cost efficiency.Premium Product Shift:

Increased focus on higher-value products across segments.Lighting (JV with Signify):

Moving into premium/professional lighting to improve margin mix.IT Hardware (Inventec JV):

Laptop and server manufacturing to enhance blended margins.New Verticals:

Growth in higher-margin businesses to further lift profitability.

Dixon is actively replacing PLI benefits with structural levers—component manufacturing, scale, and premiumization—to build a resilient, margin-accretive model for FY27 and beyond.

7. Valuation Analysis

7.1 Valuation Snapshot — Dixon Technologies

Assumptions / Notes

Revenue: Conservative 40% YoY growth. Guided for 40-45% in FY26

EBITDA: Margins to remain stable at ~3.9% supported by PLI and scale

PAT: Stable margins despite rising scale

The valuation of Dixon Technologies is clearly predicated on its high-growth profile.

Premium for Growth: The market has assigned premium multiples (P/E, EV/EBITDA) to Dixon, which is a vote of confidence in its ability to execute its expansion plans and capitalize on the "Make in India" theme in the electronics sector.

Justification Through Performance: The valuation is highly dependent on the company achieving its estimated growth of ~40% in revenue and earnings for FY26. If these targets are met, the valuation multiples will naturally compress, making the stock seem more attractively priced.

Investment Thesis: An investment in Dixon at the current price is a bet on continued, aggressive growth. The analysis suggests that while the stock is expensive on a historical basis, its strong forward earnings trajectory provides a path to justify this premium. The primary risk lies in the company's ability to meet these high expectations; any shortfall could lead to a significant re-rating of its valuation multiples.

7.2 Opportunity at Current Valuation

Growth Visibility

Robust Revenue CAGR of ~40% (FY25-26E) driven by:

Ramp-up in mobile manufacturing, targeting 65-66 million units annually.

Significant scale-up in Telecom and IT Hardware verticals.

New large-scale JVs and partnerships with global leaders like Vivo, Longcheer, HKC, and Inventec.

Export share rising dramatically, with a target of ~₹7,000-9,000 Cr in FY26 from ₹1,600 Cr in FY25.

ROE/ROCE >30% maintained through efficient capital allocation and high asset turnover.

Strategic Execution

Significant Capex of ~₹1,100-1,200 Cr strategically deployed for backward integration and new capacity creation.

Strong balance sheet with negative working capital days showcases superior operational efficiency and cash flow management.

Focused execution on building a resilient component ecosystem to de-risk supply chains and capture higher value.

Global Optionality

Exports are a key growth engine, expected to become a substantial part of the revenue mix.

JVs with global ODMs like Longcheer and Inventec open up significant opportunities to serve international markets.

Proven ability to meet stringent quality and delivery standards for global anchor customers.

Margin Expansion

Operating Margin expansion of 100-150 bps targeted by FY27, successfully offsetting the PLI benefit phase-out.

Backward integration into high-margin display modules, camera modules, and precision mechanics is a primary driver.

Operating leverage from scaling up production volumes will improve cost structures.

PAT Margin to remain stable at 2.2% in FY26 before expanding as high-margin component businesses achieve scale.

Backward Integration & Component Ecosystem Flywheel

Large-scale end-product manufacturing creates guaranteed demand for in-house components.

In-house components improve margins, de-risk the supply chain, and reduce costs.

Enhanced competitiveness from vertical integration leads to more client wins and greater scale.

Faster turnaround and design collaboration with JVs ensure client stickiness and a deeper moat.

Valuation Comfort

Trades at a forward P/E of 58.1x FY26E EPS, a significant compression from the 82.4x historical multiple.

Forward EV/EBITDA of 47.5x (FY26E), showing the market's confidence in strong operational profit growth.

The premium valuation is justified by the company's powerful execution and a clear path to "grow into" its valuation on the back of ~42% projected EPS growth.

7.3 Risks at Current Valuation

Valuation Leaves Limited Room for Misses

FY26E Multiples: The stock trades at a premium P/E of 58.1x and an EV/EBITDA of 47.5x on FY26 estimated earnings.

While reflecting strong growth, this valuation assumes seamless execution across multiple fronts: mobile volume ramp-up, timely commissioning of component JVs, and a successful scale-up of exports.

Any delay in project timelines, JV approvals, or client order conversion could significantly limit near-term upside and risk a valuation de-rating.

Execution Bottlenecks

Complex Multi-Project Execution: The company is simultaneously managing several large-scale, capital-intensive projects, including new JVs and backward integration for displays, cameras, and mechanics. The meaningful benefits from these are largely back-ended, expected post-FY26.

Joint Venture & Regulatory Hurdles: New JVs with foreign partners (especially those requiring PN3 approval) are in early stages. Delays in regulatory clearances or cultural integration could impact project timelines.

Export Ramp-Up: The targeted multi-fold increase in exports is a complex undertaking, requiring significant development of international logistics, supply chains, and customer relationships.

Margin Profile Risk

Post-PLI Transition: The core mobile business is volume-sensitive, and margins are currently supported by the PLI scheme, which ends in FY26. The company's ability to offset this through the component business is critical. A slower-than-expected ramp-up in high-margin components could lead to margin compression in FY27.

Component Price Volatility: Fluctuations in the price of key components like semiconductors and display panels could impact profitability if not managed through efficient sourcing or passed on to clients.

Increased Competition: The success of the "Make in India" initiative is attracting more players into the EMS space, which could lead to increased competitive intensity and pressure on pricing over the long term.

Dependence on Anchor Customers

Client Concentration: A significant portion of the high-volume mobile and consumer electronics business hinges on timely order flow from a few large anchor clients.

Changes in sourcing strategies by these key brands or delays in their product launch cycles could significantly hurt near-term volume run-rates.

Working Capital Discipline Required

Maintaining Efficiency at Scale: Dixon has demonstrated exceptional working capital management, operating with negative working capital days. Maintaining this discipline while scaling a more complex business with multiple JVs and a deeper supply chain will be challenging.

New business verticals or a different customer mix could alter the working capital cycle, requiring constant monitoring.

Regulatory & Policy Sensitivity

Dependence on Government Schemes: The company's growth has been significantly aided by favorable government policies like the PLI schemes. Any adverse changes to existing or future schemes could impact the financial viability of new projects.

The smooth and timely approval process for new JVs and manufacturing setups is crucial for adhering to project timelines.

In summary, while Dixon Technologies offers strong earnings momentum and clear margin expansion levers, its premium valuation assumes near-perfect, linear execution across new projects, JVs, and geographies. Any slip in capital discipline, project timelines, or demand momentum could cap the potential for further re-rating in the near term.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer