Deep Industries Q3-26 Result: PAT up 54%, On-track FY26 guidance

Guidance of 30-35% revenue CAGR for FY25-28 with stable margins. Order-book provides visibility till FY27. At attractive valuations. Opportunity for re-rating

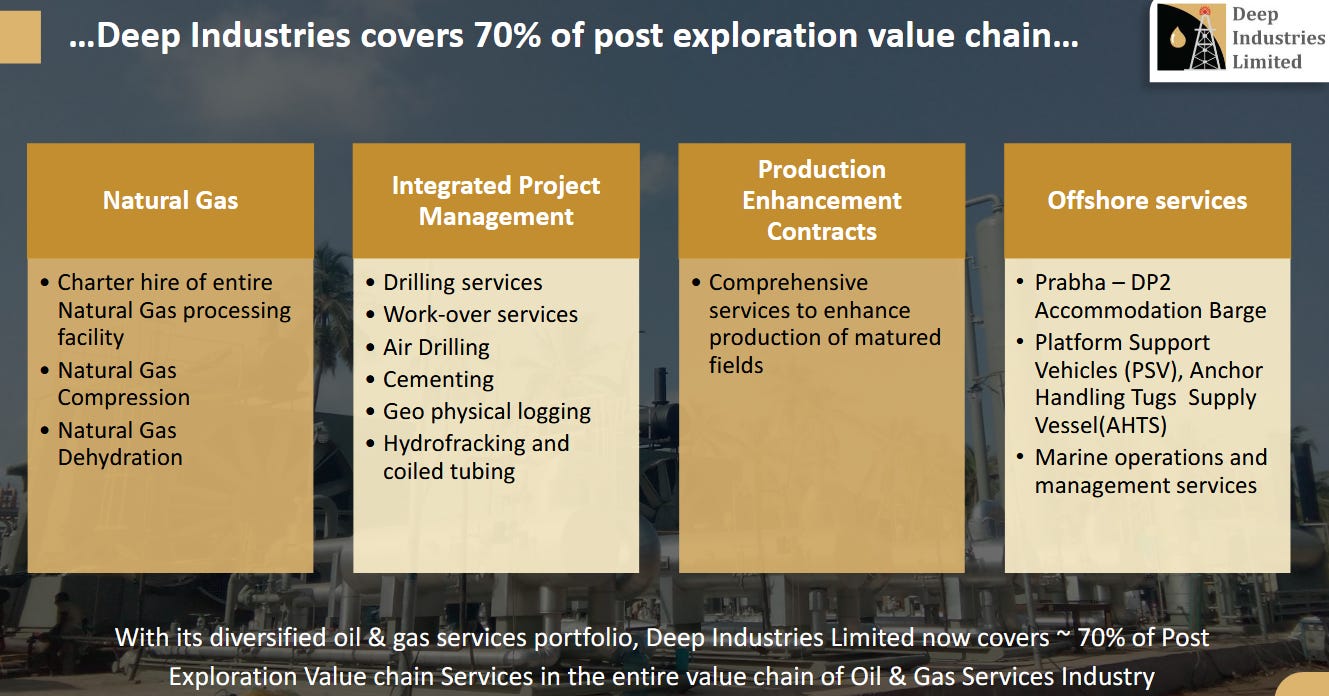

1. Oil & Gas Support Services

deepindustries.com | NSE: DEEPINDS

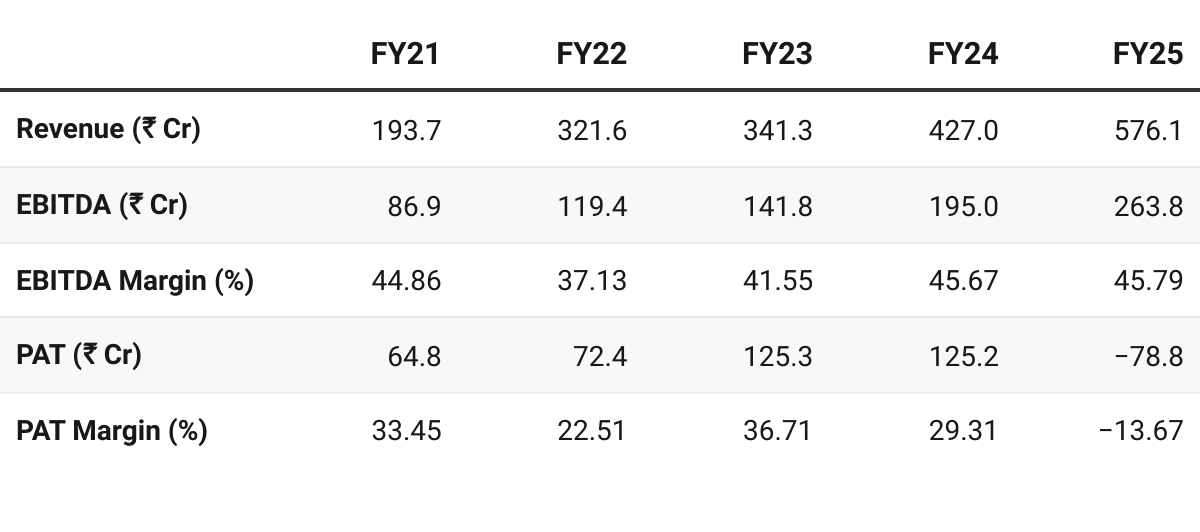

2. FY21-25: EBITDA CAGR of 32% & Revenue CAGR of 30%

3. FY25: In Losses & Revenue up 35% YoY

Acquisitions in FY25

Dolphin Offshore: Marine capability — signed export contracts for Mexico, Gulf

Kandla Energy: backward integration in PEC/IPM chemicals

Exceptional item loss of ₹251 crore in Q4 FY25

Consisting of writing-off inventory and receivables which are not recoverable. Clean-up followed the acquisitions of:

Kandla Energy & Chemicals (acquired from liquidation)

Dolphin Offshore Shipping Ltd. (acquired via CIRP)

A strategic, non-cash clean-up related to acquired entities’ legacy issues.

No deterioration in Deep’s core operations or profitability as seen from the revenue growth and EBITDA margins

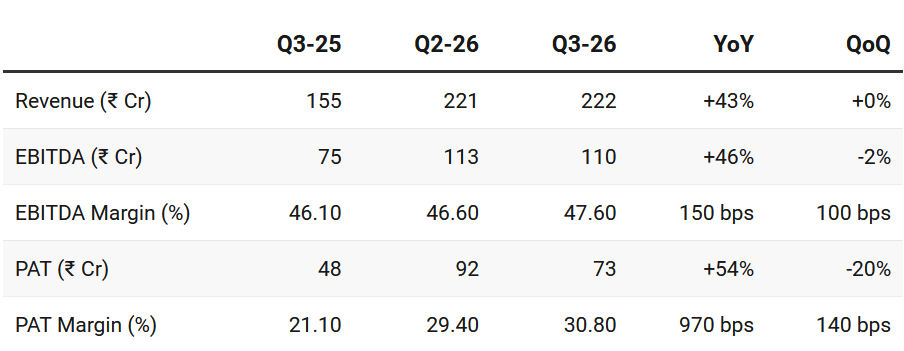

4. Q3-26: Profit up 54% & Revenue up 43% YoY

Profit down 20% & Revenue flat QoQ

During the current quarter, the Company acquired M/s Deep Natural Resources Limited.

Consequently, M/s Deep Natural Resources limited has become a subsidiary and has been consolidated with effect from the current quarter.

The financial results for the current quarter are not comparable with those of the previous periods to that extent.

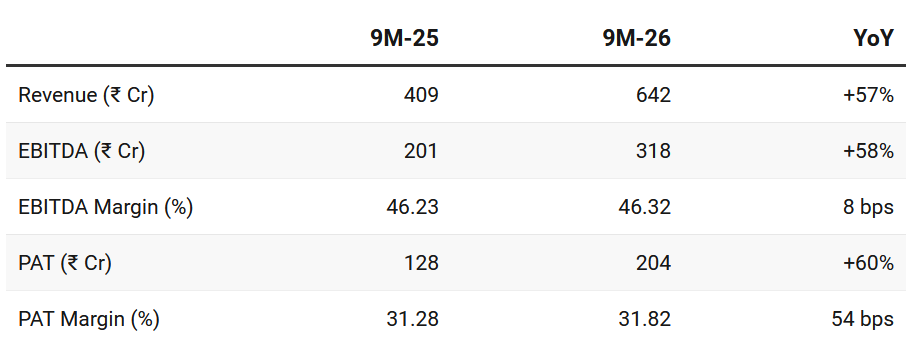

5. 9M-26: Profit up 60% & Revenue up 57% YoY

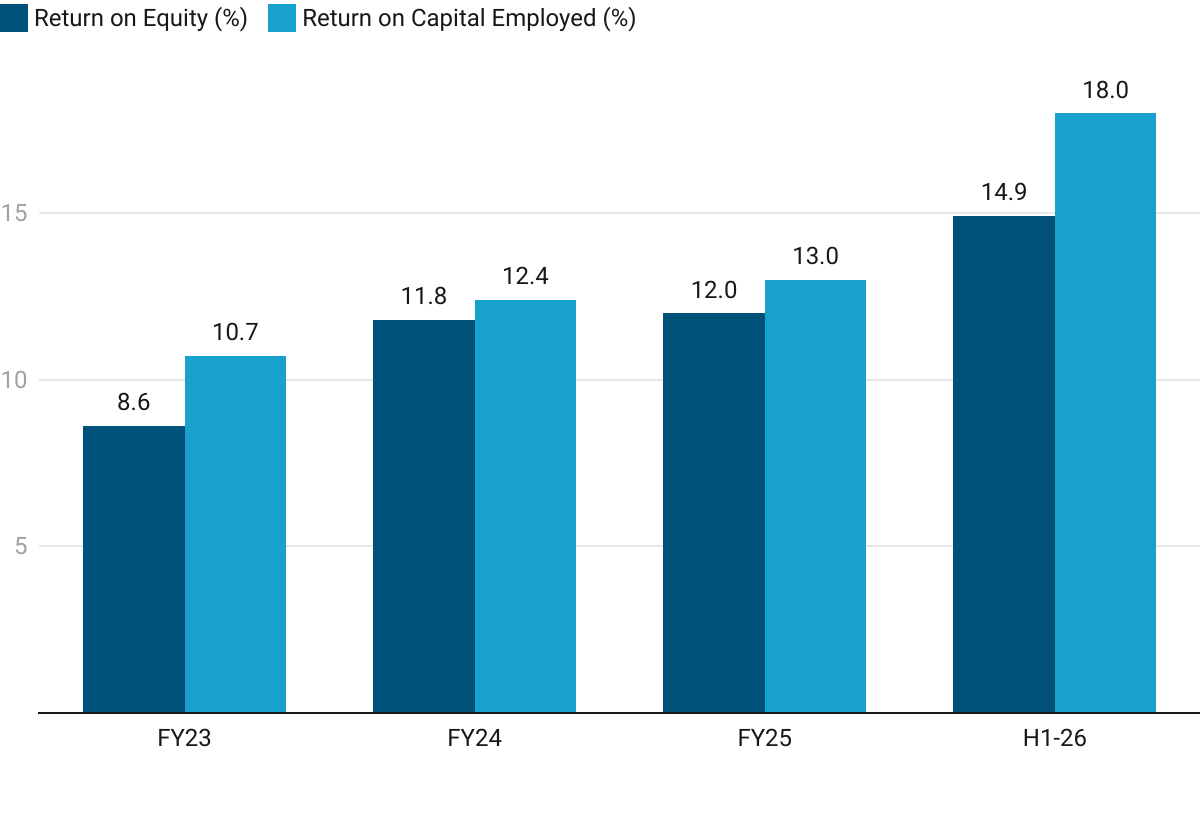

6. Business Metrics: Improving Return Ratios

FY25 - excluding the ₹251 crore exceptional loss

7. Outlook: Revenue CAGR of 35%+ FY25-27

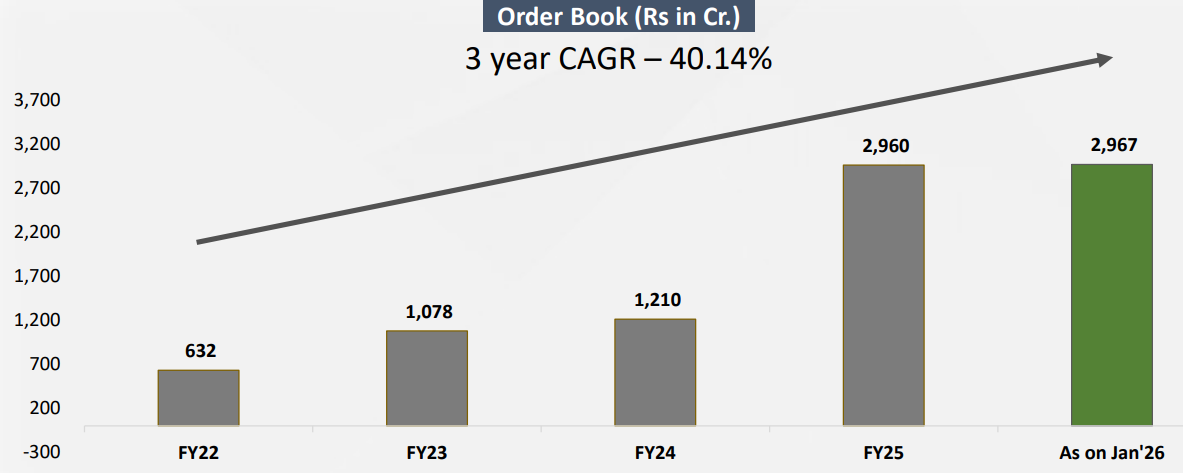

Strong growth visibility supported by order book

7.1 Management Guidance – FY26

Revenue Growth:

30-35% revenue growth for FY27 based on the existing order book.

Similar 30-35% growth for FY28.

Margins: EBITDA margins =46-48%, ensuring strong operating cash generation.

QIP Status: QIP has been paused — comfortable with its current debt levels and cash generation to fund operations and Capex,.

Future Opportunities:

Management sees strong demand in the onshore drilling market.

Evaluating opportunities in new verticals such as Carbon Capture, Utilization, and Storage (CCUS) and Compressed Biogas, though these are in early evaluation stages.

Looking to expand its client base beyond major PSUs (like ONGC and OIL) to include private clients, although PSUs currently hold the largest market share.

7.2 9M FY26 Performance vs Full-Year FY26 Guidance

Revenue:

Ahead of 30-35% revenue growth in FY26

Indicating for FY26 revenue of ₹850 Cr +~55 Cr other income

EBITDA Margin(%): Within guided range of 46-48%

Order Book: Provided visibility and supports FY27 growth

With a robust order book, strong project execution, supportive policy direction on domestic exploration and energy independence, and steadily rising energy demand, we remain well positioned to scale operations strategically, strengthen cash flows, and deliver sustainable long-term value for all stakeholders.

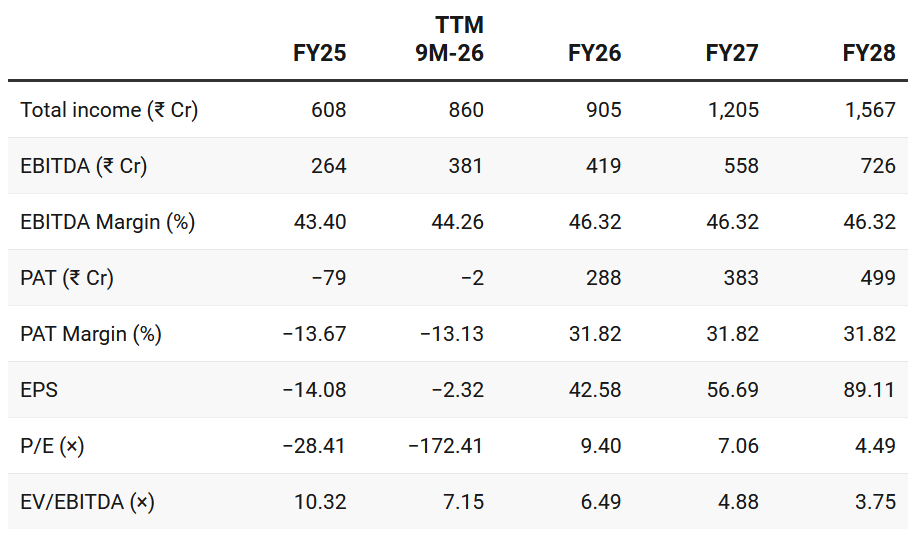

8. Valuation Analysis — Deep Industries Ltd

8.1 Valuation Snapshot

CMP: ₹400 | Market Cap: ₹2,560 Cr

Assumptions — 30-35% revenue growth with stable margins (as per guidance) till FY28

Attractive Forward Valuations

FY26 and FY27 valuations are not demanding — provide flexibility to sustain a quarter or two where performance is not as per guidance

Attractively valued on FY26E and FY27E, provided execution sustains with the guided range with stable margins. Multiples leave room for re-rating if FY26 is delivered.

8.2 Opportunity at Current Valuation

Conservative Guidance: 30-35% growth till FY28 is not discounted in the valuations

Revenue Visibility: FY26 and FY27 revenue projections supported by an order book of ~₹3,000 Cr order book

Possibility of re-rating: PAT turns positive in FY26

8.3 Risk at Current Valuation

Execution Risks: Delivering 30-35% growth for till FY28 requires execution excellence

Client Concentration (PSU Dependence): Relies heavily on ONGC and Oil India, which hold the largest market share in India.

Trying to diversify into private clients (like Vedanta, GSPC),

Though impossible to avoid the PSU’s given their dominance

Kandla + Dolphin Receivables: No recovery since the last quarter.

Have not yet taken any provision on these receivables

While management expects no write-offs.

A repeat of Q4-25 possible where one-off items made PAT negative for FY25

Impact of Crude Oil Prices:

DEEPINDS provides support services which are essential for production regardless of the oil price.

Fluctuations in crude oil prices have little impact on their business.

While they claim insulation from daily price volatility, — business is still driven by the broader industry investment climate.

Previous coverage of DEEPINDS

If you want to share any suggestions about the Money Muscle, or if there are any specific stocks you’d like us to cover, just send an email to hi@moneymuscle.in

Don’t miss reading our Disclaimer