D B Corp: PAT growth of 137% & revenue growth of 13% for 9M-24 at a PE of 15

DBCORP on the back of 4 quarters of consecutive PAT growth at very reasonable valuations. DBCORP has a track record of generating free cash. Available at free cash flow yield of 6.6% (not annualized)

1. The Largest Print Media Company In India

motilaloswalgroup.com | NSE: DBCORP

# 1 News Publisher App in India with a wide gap

2. FY19-23: De-growth in PAT & Revenue CAGR

Recovery since FY22. Yet to touch the peak of FY19

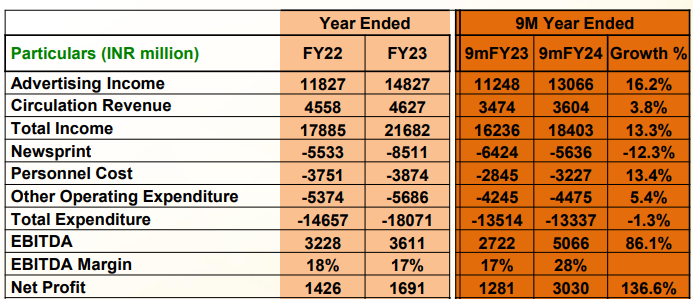

3. FY23: PAT up 19% & Revenue up 21%

4. Strong H1-24: PAT up 124% & Revenue up 15% YoY

5. Strong Q3-24: PAT up 157% & Revenue up 16% YoY

PAT up 39% & Revenue up 2% QoQ

6. Strong 9M-24: PAT up 137% & Revenue up 13% YoY

7. Business metrics: Return ratios improving in FY24

8. Strong outlook: Indications for a strong Q4-24 & Q1-25

Yes. I think India as a country is in a very positive state and a positive mood looking forward to the Lok Sabha elections also coming in the month of April, May. So on the back of it, I'm very confident and very buoyant.

We are very bullish on print sectors as besides traditional categories new digital and App based players are embracing print for their media campaigns

The sustained growth in both top line and bottom line across all our business segments reaffirms our confidence that happy days are indeed back for the print business.

9. PAT growth of 159% & Revenue growth of 32% in 9M-24 at a PE of 15

10. So Wait and Watch

If I hold the stock then one may continue holding on to DBCORP

Based on 9M-24 performance, DBCORP looks on track to deliver the strongest PAT in FY24 (higher than the PAT in FY19)

DBCORP is in the middle of a strong run and has delivered sequential QoQ growth in PAT in the last four consecutive quarters starting from Q4-23

11. Join the ride

If I am looking to enter DBCORP then

DBCORP has delivered PAT growth of 137% and revenue growth of 13% in 9M-24 at a PE of 15 which makes the valuations quite attractive.

DBCORP has a track record of generating free cash flow. In 9M-24 it has generated Rs 337 cr of free cash flow against the current market cap of Rs 5118. It is available at 9M-24 end free cash flow yield of 6.6% (not annualized) which makes the valuations quite attractive.

our company has generated free cash flow of Rs 337 crores in last 9 months.

Rs 870 cr of cumulative free cash flow for FY20-23 against a market cap of Rs 5,118 cr

DBCORP has Rs 825 cr on its balance against a market cap of Rs 5,118 cr. 16% of the market cap in cap adds a cushion of safety to the valuations

Our balance sheet is in a very healthy position with our cash and bank balance at INR 825 crores with zero debt

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer