Chamanlal Setia Exports: 16% PAT growth & revenue down 6% in 9M-24 at a PE of 10

Bottom-line focused company operating an asset light model, delivering robust financial performance, with sustained cash surplus in the process of building a brand

1. Leading private label exporter of basmati rice

clsel.in | maharanirice.in | NSE : CLSEL

Flagship brand “Maharani”

Chaman Lal Setia Exports Limited is one of the India’s leading basmati rice exporters. It has processing facilities in Karnal (Haryana) and Kandla (Gujarat). The company exports to more than 90 countries and 440+ distributors spread across the world.

2. FY19-23: PAT CAGR of 36% and Revenue CAGR of 16%

3. Strong FY23: PAT up by 82% and Revenue up by 49%

4. H1-24: PAT up by 26% & Revenue down by 15% YoY

During H1 FY24, revenue growth was impacted owing to cyclone led disruptions at Gujarat port in June

Despite this, EBITDA grew by 26% YoY & margins expanded by 426 bps in H1FY24, supported by moderation in freight expenses, improved realizations and our efforts towards operational efficiency

Cash flow from operations grew to Rs. 253 crores, compared to Rs. 71 crores in H1 FY23, with growth in profitability and prudent working capital management

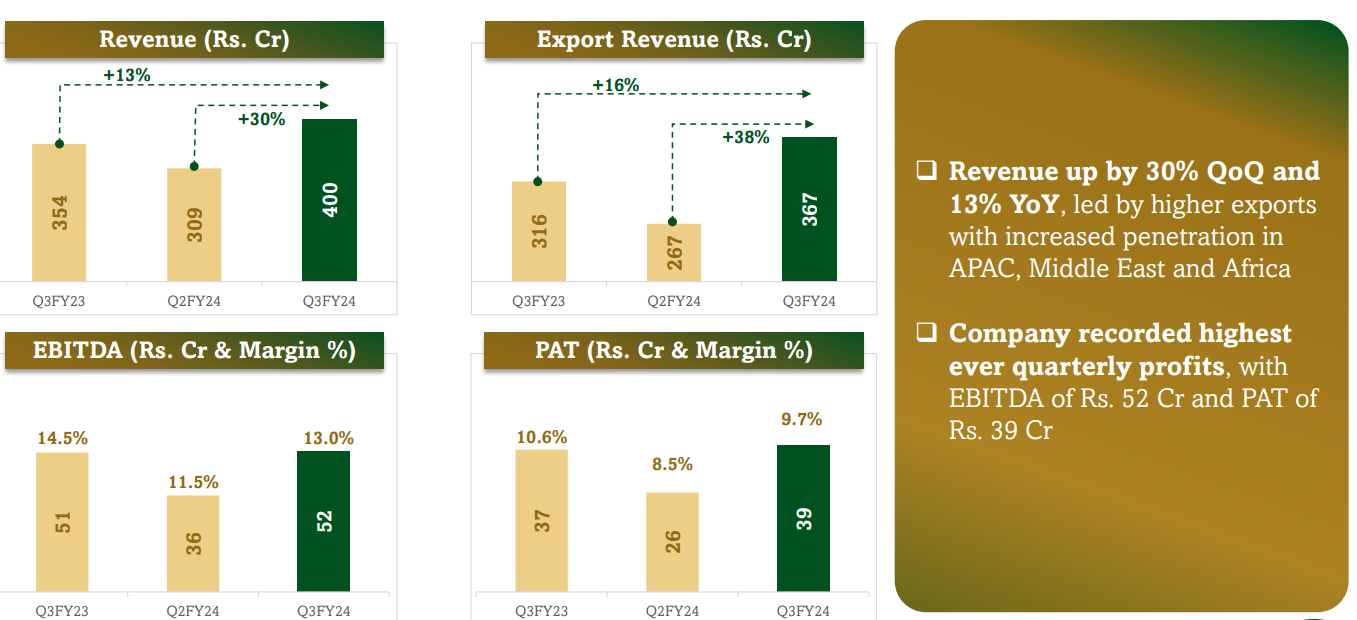

5. Q3-24: PAT up by 3% & Revenue up by 13% YoY

Q3-24: PAT up by 48% & Revenue up by 30% QoQ

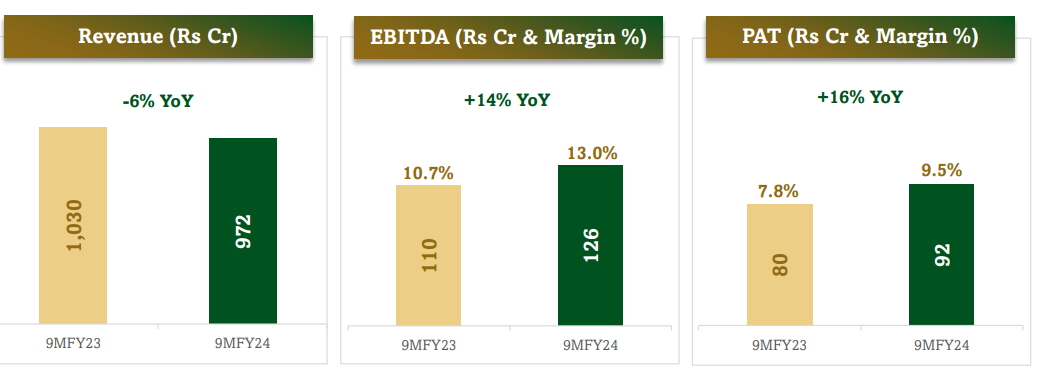

6. 9M-24: PAT growth of 16% & Revenue down by 6% YoY

Cyclone-led disruptions at Gujarat port in June and Government restrictions on Basmati rice exports below USD 1,200 per ton during September impacted revenue growth during 9M FY2024

Despite this, EBITDA and PAT were up by 14% and 16% YoY respectively. EBITDA margins expanded by 228 bps YoY, while PAT margins expanded by 175 bps, supported by our efforts towards operational efficiency

7. Business metrics: Strong return ratios

Majority of the production is through procurement of semi-finished rice and conversion to finished rice (mostly requiring Sortex), keeping the overall processing cycle short, and the company remaining relatively asset light

Inventory holding vis-à-vis peers remains moderate as the company does not engage into ageing and thus, possess lower inventory risk

6. Outlook: Strong PAT growth in FY24

i. Rs 1400 cr top-line in FY24 similar to FY23

last year our revenue was 1400 crore about so we have to achieve that target which we feel it will come.

ii. EBITDA margins of 11-14%

Our EBITDA margins continue to stand in our guided range of 11%-14%. During the nine months, our EBITDA margins expanded by 228 bps to 13.0%, while our PAT margins expanded by 175 bps to 9.5%

7. 16% PAT growth & revenue down 6% in 9M-24 at a PE of 10

8. So Wait and Watch

If I hold the stock then one may continue holding on to CSEL.

Coverage of CSEL was initiated after Q2-24 results. The investment thesis has not changed after a strong 9M-24. The only changes are the delivery of a strong Q3-24 and the increased confidence in the management after beating FY24 guidance

The reason to stay in the stock is the transformation of CSEL from a private label exporter to a brand as it could lead to re-rating of its single digit PE

Brand revenues (Maharani, Mithas and Begum) comprised 12% of overall revenues and grew by a healthy 82% YoY during 9M FY24

Value-added segment (Rice suitable for Diabetes & Brown Rice) grew by 167% YoY during 9M FY24

My target is within a few years to increase the percentage level to at least 55% to 60% of our entire revenue. I think this is what my competitors also have achieved. This is the maximum you can do and I think in a few years we would manage that.

In the interim while the transformation is taking place its performance is reasonable in line with a single digit PE.

CSEL has delivered a good 9M-24 and in line with historic performance.

It looks on track to deliver a good FY24 with a top-line of Rs 1,400 cr with improving profitability in Q3-24.

9. Or, join the ride

If I am looking to enter the stock then

The company is not suited for every one as CLSEL does not focus on the top-line

I follow the bottom line. I never follow the top line. I am more concerned that I don't pay any bank interest. I buy my raw material at the lowest level. I get the best quality. I manage my bottom line. Top line will manage itself, like you can see in the past. I don't want to give you any false hopes. I don't want to say I'll become a 2000 or 3000 crore company. It will follow. My intention is to buy raw material at the lowest price, best quality and I want to manage the best bottom line for my company. Top line is not the issue.

CLSEL has delivered a PAT growth of 16% with revenue down by 6% in 9M-24 at a PE of 10 which makes valuations quite reasonable .

CLSEL generated Rs 248 cr of free cash flow in H1-24 at a current market cap of Rs 1,260 cr. It is available at free cash flow yield of 19.6% (not annualized) which makes the valuations quite attractive.

CLSEL at a market cap of about Rs 1,242 cr against an expected revenue of Rs 1,400 cr in FY24 means that it is available at a market cap to sales of less than 1

A net-worth of Rs 656 cr as of H1-24 on a market cap of about Rs 1,242 cr, implies that CLSEL is available at a price to book of 1.9 which makes the valuations quite attractive.

Rs 250 cr of cash on balance sheet as Q3-24 on a market cap of about Rs 1,242 cr, implies 20% of the market cap is in cash adding to the margin of safety on the stock.

The potential for a single digit PE moving to a a mid teen PE as the Maharani brand develops could provide multi-bagger upside in the stock over the long term.

Previous coverage of CLSEL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer