Caplin Point Labs: PAT growth of 16% & revenue growth of 16% in 9M-25 at a PE of 29

Outlook of PAT CAGR of 18-20% & revenue CAGR of 15-18% for the next 3-5 years. Strong track record of consistent compounding of top-line, bottom-line & cash generation.

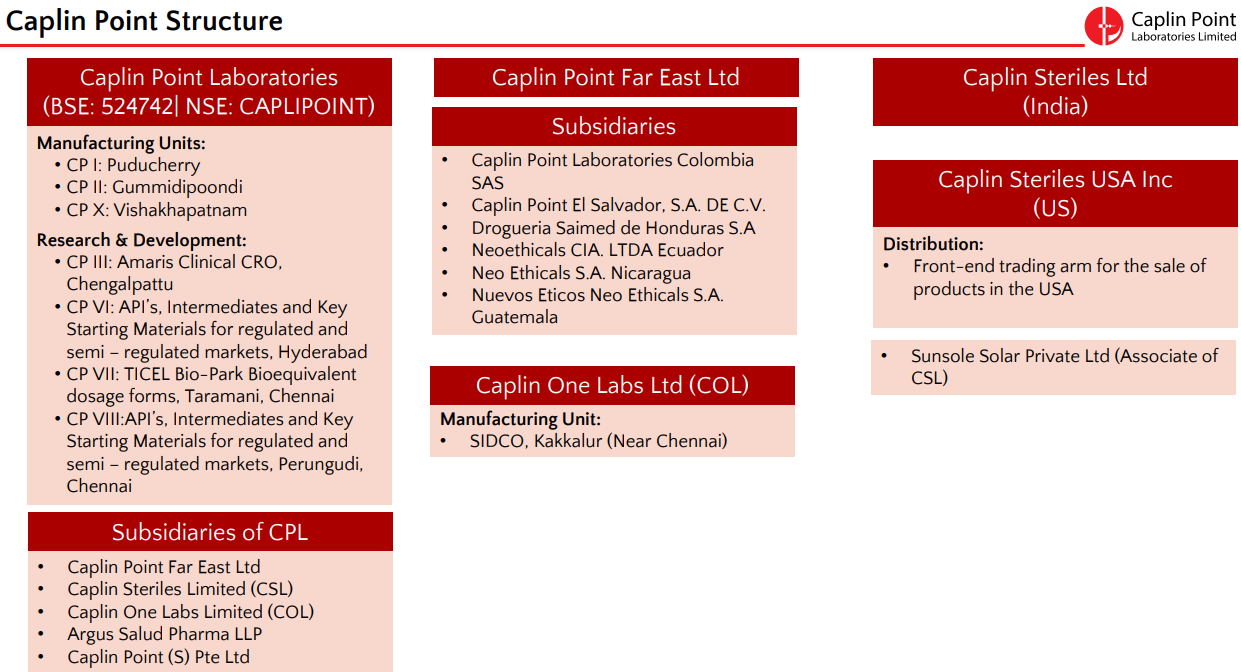

1. Pharma company focused on LATAM, USA & Africa

caplinpoint.net | NSE: CAPLIPOINT

2. FY20-24: PAT CAGR Of 21% & Revenue CAGR of 18%

10 years of consistent YoY Revenue & PAT growth

3. Solid FY24: PAT up 22% and revenue up 16% YoY

4. Q3-25: PAT up 17% and revenue up 13% YoY

PAT up 7% and revenue up 2% QoQ

5. Strong 9M-25: PAT up 16% and revenue up 16% YoY

6. Business metrics: Strong return ratios & cash generation

Most important of all is to ensure that we are maintaining adequate fiscal discipline, stay debt free, focus on our cash flow, bottom line and topline in that particular order in all of our areas of expansion.

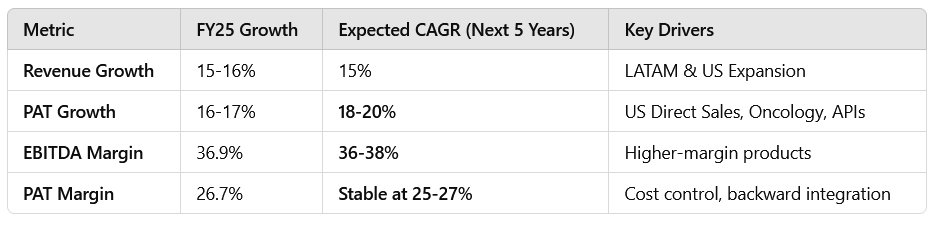

7. Outlook: Consistent growth at a CAGR of 15-18%

i. 15-18% revenue growth

Summary of Revenue Growth Outlook

Overall Revenue Growth Projection:

Revenue to 2X over the next 5 years, particularly from expansion in larger Latin American markets (Mexico, Chile, Brazil, Colombia).

For FY26, the company expects meaningful revenue contributions from non-U.S. regulated markets like Canada, Mexico, Saudi Arabia, Brazil, and Australia.

Revenue Growth by Segment:

LATAM & Emerging Markets Business:

Currently growing at 14-16% CAGR.

Expected to accelerate to 15-18% CAGR over the next few years with expansion into Mexico, Chile, and Brazil.

US Business (Caplin Steriles):

Expected to grow at 25-30% CAGR as the company transitions to direct sales.

Targeting $100 million (~INR 830 Cr) in revenue by FY27-FY28.

Currently at ~INR 350 Cr annual revenue.

Oncology & API Business:

Oncology division has turned profitable in FY25 with ₹34 Cr in revenue.

Expected to significantly contribute from FY26 onwards.

Other Regulated Markets:

New markets (Canada, Mexico, Saudi Arabia, Brazil, Australia) to contribute meaningful revenue from FY26.

First full-year revenue impact expected in FY27.

ii. PAT growth CAGR of 18-20%

Summary of Profit Growth Outlook

Steady profit growth driven by:

Revenue Expansion (LATAM, US, Oncology, APIs).

Sustained EBITDA margin of 36-38%.

Higher-margin business models (own label in the US, backward integration).

Operational efficiency & cost control (lower COGS, R&D investments).

Profit Growth Projections

Oncology business has turned profitable and will significantly contribute from FY26 onwards.

Caplin Steriles (US business) is shifting to direct sales, which will improve margins in FY26-FY27.

Backward integration into APIs will enhance profitability from FY27.

Targeting sustained PAT margins of ~25-27%.

8. PAT growth of 16% and revenue growth of 16% in 9M-25 at a PE of 29

9. Hold?

If I hold the stock then one may continue holding on to CAPLIPOINT

CAPLIPOINT 9M-25 performance is in line with expectation of 15-18% growth planned for FY25

CAPLIPOINT is a consistent-growth, high-margin company with a strong balance sheet, but execution in the US and LATAM will determine whether it delivers a multi-bagger return or stagnates. Long-term investors should monitor ANDA approvals, LATAM traction, and regulatory risks closely.

10. Buy?

If I am looking to enter CAPLIPOINT then

CAPLIPOINT has delivered PAT growth of 16% & Revenue growth of 16% in 9M-25 at a PE of 29 which makes the valuations fully valued in the short term.

Growth outlook of PAT CAGR of 18-20% & revenue CAGR of 15-18% for the next 3-5 years at a PE of 29 makes valuations reasonable from a longer term perspective.

If historical momentum FY20-24 PAT CAGR Of 21% & Revenue CAGR of 18% is sustained which looks reasonable based on 9M-25, at a PE of 29 makes valuations reasonable from a historical perspective

While 15-18% growth is not exciting, what makes CAPLIPOINT standout is a strong and consistent cash generator. With Rs 1,039 cr of cash on balance sheet on a market cap of Rs14,746 cr i.e. 7% of market cap in cash which give a cushion to the valuations

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer