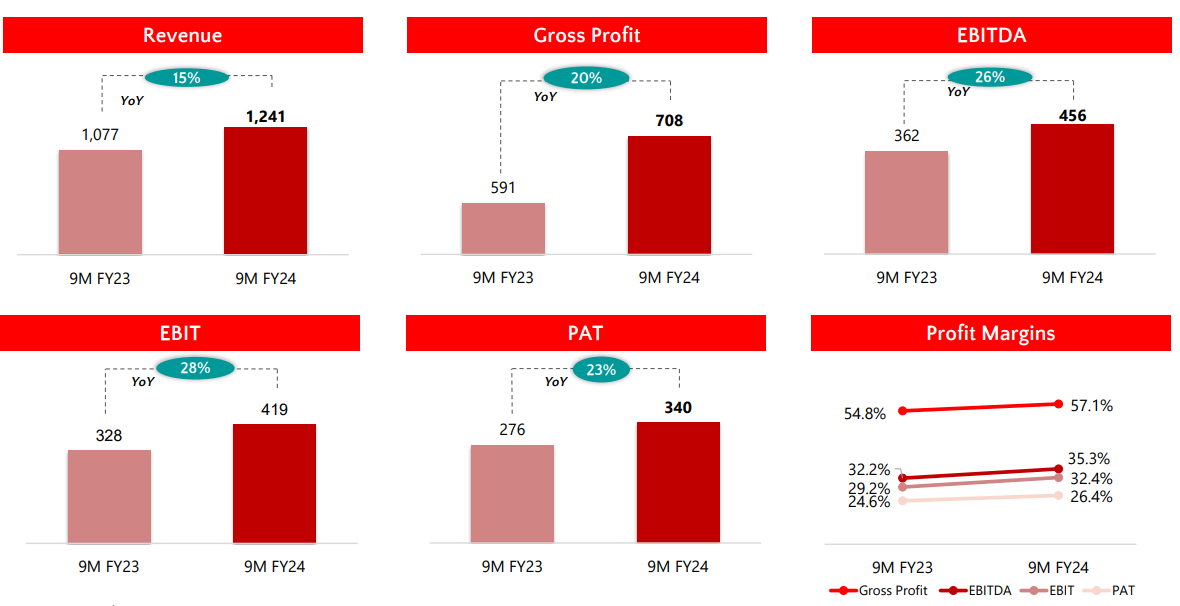

Caplin Point Labs: PAT growth of 23% & revenue growth of 15% in 9M-24 at a PE of 26

CAPLIPOINT has delivered sequential QoQ growth on the top-line and bottom-line in all the 3 quarters of FY24. Its focus is to first deliver cash flow and then look at bottom line and topline growth

1. Pharma company focused on LatAm + Africa

caplinpoint.net | NSE: CAPLIPOINT

CAPLIPOINT outsources 45% of production (China: 35%; Indian vendors:70%) and in-house production is at 55%

2. FY14-23: PAT CAGR Of 35% & Revenue CAGR of 27%

9 years of YoY Revenue & PAT growth

3. Solid FY23: PAT up 22% and revenue up 16% YoY

4. H1-24: PAT up 24% and revenue up 14% YoY

5. Q3-24: PAT up 23% and revenue up 17% YoY

PAT up 3% and revenue up 2% QoQ

6. Strong 9M-24: PAT up 23% and revenue up 15% YoY

7. Business metrics: Strong return ratios & cash generation

Most important of all is to ensure that we are maintaining adequate fiscal discipline, stay debt free, focus on our cash flow, bottom line and topline in that particular order in all of our areas of expansion.

8. Outlook: Strong growth roadmap till FY26

i. FY24: expect low-teens growth for the full company & growth

If you ask me in five years from now we should aim actually at least INR 4,000 to 5,000 Crores but if you ask me what will happen actually in 2024-2025, I am sure we are aiming for a sale of actually INR 2,000 Crores that is the only one I can tell you.

ii. Growth roadmap in place for FY25 & FY26

Will See Higher Revenue From The US Biz From FY25 & Beyond: Caplin Point Labs | CNBC TV18

See, we will continue to grow the way we have been growing and I would prefer to give actually good numbers, maybe starting from '25, '26,

FY25:

CSL line 5 and line 6 will contribute to our growth

increased ANDAs

three replacement of line one with a high speed lines

completion of onco OSD such as tablet and capsule will also increase the revenue

FY26:

we expect completion of onco injectables in addition to OSD to expand OSD general facilities for the new markets.

New and larger geographies of various countries such as Mexico and others where the increase in registration will also contribute to our growth.

ii. Maintaining 24-25% PAT margin

that gross margin of 57.4% I think may not be sustainable in the long run. We will always hope it should be anywhere between 55 and 56% and PAT of about 24 to 25%.

9. PAT growth of 23% and revenue growth of 15% in 9M-24 at a PE of 26

10. So Wait and Watch

If I hold the stock then one may continue holding on to CAPLIPOINT

Coverage of CAPLIPOINT was initiated after Q4-23 results. The investment thesis has not changed after a strong 9M-24. The only changes are the delivery of a strong Q3-24 and the increased confidence in the management to deliver a strong FY24.

CAPLIPOINT 9M-24 performance is in line with expectation of 16-18% growth planned for FY24

CAPLIPOINT has delivered sequential QoQ growth in both top-line and bottom-line in all the three quarters of FY24.

Roadmap for FY25 & FY26 is in place and better growth expected from FY25 onwards

See, we will continue to grow the way we have been growing and I would prefer to give actually good numbers, maybe starting from '25, '26,

11. Or, join the ride

If I am looking to enter CAPLIPOINT then

CAPLIPOINT has delivered PAT growth of 23% & Revenue growth of 15% in 9M-24 at a PE of 26 which makes the valuations acceptable.

Over the medium to long term CAPLIPOINT is promising good numbers from FY25 which provides upside potential in the stock from a long term perspective.

Cash generator with Rs 800+ cr of cash on balance sheet on a market cap of Rs11,247 i.e. ~7%+ of market cap in cash which give a small cushion to the valuations

Potential for inorganic growth

Previous coverage of CAPLIPOINT

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer