Brand Concepts: PAT growth of 34% & Revenue growth of 67% in H1-24 with guidance of 30%+ revenue CAGR till FY27 at a PE of 63

BCONCEPTS aims for a turnover of Rs 500 crore by FY27 growing at a CAGR of 30-35%. It is licensing premium global fashion brands targeting customers seeing luggage as a fashion accessory

1. Designing and retailing of bags, travel gear, & small leather goods

brandconcepts.in | bagline.in | NSE : BCONCEPTS

BCONCEPTS has licenses for Tommy Hilfiger, United Colors of Benetton and Aeropostale. Additionally, it has its own brands Sugar Rush and The Vertical.

FY23: Small Leather Goods continues to be our largest sort of portfolio and it contributed to almost about 51%, 52% of our overall sales, whereas Travel Gear has contributed to roughly about 46% kind of sales mix. And the rest is your Women Handbags and everything

Product Categories

2. FY20-23: Delivering profits from FY22 after 2 years of losses in FY20 & FY21

3. Strong FY23: PAT up 1220% and Revenue up 89% YoY

4. Strong Q1-24: PAT up 51% and Revenue up 82% YoY

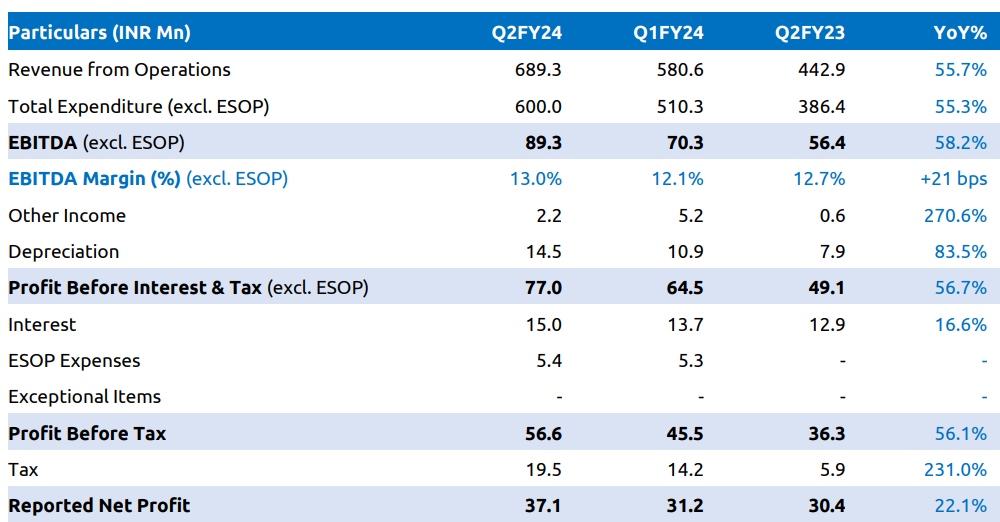

5. Strong Q2-24: PAT 22% & Revenue up 56% YoY

PAT 19% & Revenue up 19% QoQ

6. Strong H1-24: PAT up 34% & Revenue up 67% YoY

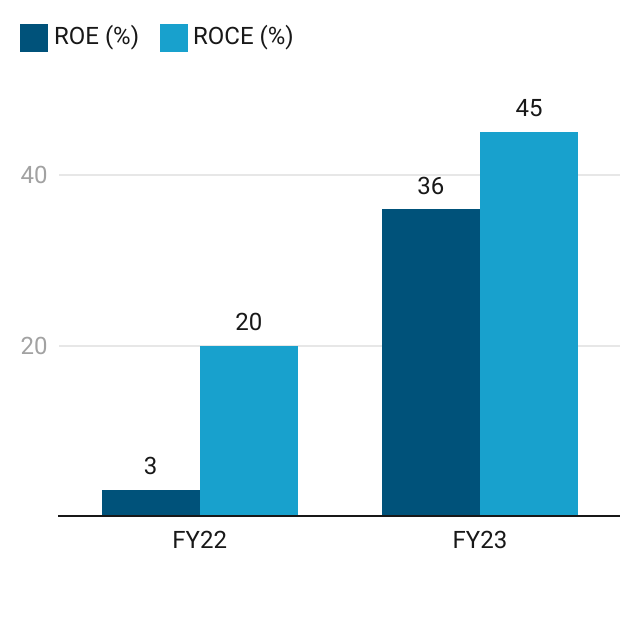

7. Business metrics: Return ratios recovering

Since FY20 and FY21 were loss making and their return ratios can be ignored. However, return ratios have recovered strong in FY22 and FY23

8. Outlook: FY23-27 revenue CAGR of 32%

i. Growth guidance of 32% CAGR. Grow to Rs 500 cr revenue by FY27

aiming to grow at +30% CAGR for the next 3-5 years supported by growth in our existing as well as new brands. We aim to become an Rs.+500 crore revenue company in the next 4 years

ii. FY23 EBITDA margin of 13% to be maintained

the guidance that I would want to give and what we follow internally also is that we don't want to compromise on our EBITDA margins or the PAT margins. And, hence, we will sustain these levels even with this high growth.

9. PAT growth of 34% & Revenue growth of 67% in H1-24 with guidance of 30%+ revenue CAGR till FY27 at a PE of 63

10. So Wait and Watch

If I hold the stock then one may continue holding on to BCONCEPTS.

Based on H1-24 performance, BCONCEPTS looks on track to deliver the strongest yearly performance since FY20

For the medium term a top-line growth outlook of 30%+ is a reason good enough to stay in the stock.

The past record during FY20-23 has weak. Hence one needs to watch and decide on BCONCEPTS at a quarter to quarter level. One doesn’t want to get stuck with a stock where the business is not showing a clear growth trajectory or delivering losses.

11. Or, join the ride

If I am looking to enter the stock then

BCONCEPTS has delivered PAT growth of 34% & Revenue growth of 67% in H1-24 at a PE 63 which makes valuations quite expensive.

Even after revenue CAGR of around 30% till FY27 without margin expansion BCONCEPTS would trade at FY27 forward PE of mid 20 which not cheap either.

BCONCEPTS would look interesting only if there is margin expansion and bottom-line grows faster than top-line but then H1-24 EBITDA margin of 12.1% is lower than the FY23 EBITDA margin of 13%.

Along with the financials one needs to look out for how BCONCEPTS stands against the competition as it tires to position its luggage as fashion accessory and a premium offering against the more established players

Breaking into the luggage market was challenging, given the established players like Samsonite, VIP, and Safari.

Today, people spending most of their day on social media following trends know that luggage now serves as a fashion accessory, with customers seeking stylish options to complement their airport look.

A PE of 63 looks rich in the short term hence positions need to be built over time over bad days when the stock is not doing well.

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades