Bondada Engineering FY25 Results: PAT Up 149%, Targets ₹19,000 Cr Revenue by FY27

FY26 growth of 60%+ driven by Solar EPC, BESS execution, and product business scale-up. Premium valuations in the short term provide opportunity over the longer term

1. EPC & O&M Provider

bondada.net | BSE - SME: 543971

2. FY21-25: PAT CAGR 88% & Revenue CAGR 53%

2.1 How Bondada's Business Has Transformed

From single-sector focus to multi-sector diversification

→ Started with Telecom & Solar EPC; now active in Railways, BESS, Solar IPP, and Green Hydrogen.From EPC-only to a full-stack infra platform

→ Added O&M services, in-house manufacturing (MMS, LED, BLDC), and IPP project development.From regional to national + global presence

→ Initially based in AP/Telangana; now operates pan-India and entered international markets (USA).From project executor to product and tech-driven player

→ Developing proprietary tech-enabled offerings like containerized BESS and energy-efficient products.From low-value contracts to high-value PSU + IPP projects

→ Winning large-scale tenders from NLC, MAHAGENCO, TSGENCO, BSNL, and now pursuing solar IPP ambitions.From services-only to balance of execution + annuity-like models

→ Entry into BESS and Solar IPP adds recurring, long-term cash flows to EPC revenue.

3. H2-25: PAT up 146% & Revenue up 99% YoY

PAT up 120% & Revenue up 127% sequentially

Sequential performance doubled across revenue and profit in H2 FY25, showing robust project execution, particularly in solar EPC.

YoY margin gains show better cost control, disciplined execution, and high-margin PSU projects.

H2 FY25 was Bondada’s breakout half-year, solidifying visibility for FY26’s ₹2,600 Cr revenue target.

4. FY25: PAT up 149% & Revenue up 96% YoY

Strong operating leverage: Driven by large PSU solar EPC projects and improved cost efficiencies.

Disciplined execution: Higher volumes with minimal working capital strain; company maintained tight cost control.

Margins at all-time highs: FY25 posted record EBITDA and PAT margins, setting a strong runway for FY26’s ₹2,600 Cr topline ambition.

5.1 Return Metrics: ROE & ROCE at All-Time Highs

Capital Discipline, Operating Leverage, and Business Model Diversification

FY25: Peak Return Year: Driven by fixed-cost absorption, margin gains, and minimal new capex

Return metrics expected to remain strong as Bondada:

Executes ₹2,600 Cr+ topline in FY26

Ramps new verticals (solar IPP, BESS, exports)

Scales product business without proportional capex

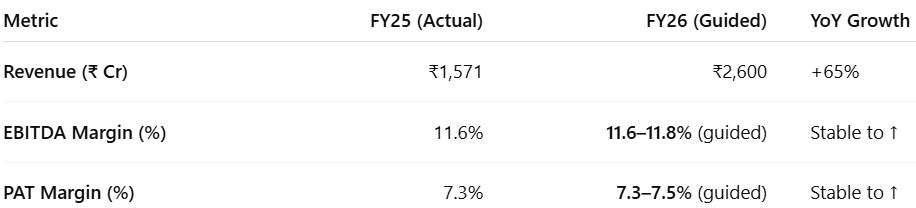

6. Outlook: 50-60% Growth in FY26 with Stable Margin

Driven by solar EPC execution, BESS debut, and product ramp-up

6.1 FY25 Expectations vs Performance — Bondada Engineering

✅ Hits in FY25

Record Revenue Execution: Revenue nearly doubled (+96% YoY) despite large order inflows materializing only mid-year. Execution scaled across PSU solar EPC, telecom, and product segments.

Margin Expansion: EBITDA margin improved 270 bps to 11.6%, driven by operating leverage, product contribution, and better pricing on solar orders.

Order Book Surge: Order book scaled to ₹5,044 Cr by FY25-end, up from ₹1,759 Cr in FY24 — a 3x expansion, providing clear execution visibility for FY26–27.

BESS Foray: Emerged as L1 for 100 MWh BESS project from TSGENCO. Large pipeline of EPC and IPP BESS tenders in progress across NHPC, NTPC, and Tamil Nadu.

IPPs and Railways Added: Solar IPP model launched with MOUs in Assam and AP; Railway segment scaled with ₹228 Cr Kavach and crash barrier infra wins.

Strong Balance Sheet: No net debt; equity base strengthened via ₹107.5 Cr preferential issue + ₹55 Cr warrants (first tranche received). Working capital rotation maintained at ~5x.

❌ Misses in FY25

IPP & Export Contribution Still Modest: IPP revenue limited in FY25; exports (e.g., GameChange USA order) remain 2% of topline. Management expects this to rise in FY26–27.

Execution Lag in Some Verticals: Delays in railway order mobilization and solar IPP land approvals pushed certain project starts into H1 FY26.

Product Monetization Under-Leveraged: While LED, MMS, and BLDC units grew ~35%, product segment still under 15% of total revenue. FY26 aims to double contribution.

Return Ratios Tapered: ROCE dipped to 18.4% (from 22%) due to equity infusion and asset buildup, despite strong PAT growth.

6.2 Outlook for FY26 and Beyond

Aggressive scale-up backed by order visibility, vertical expansion, and margin stability

FY26: High-Confidence Execution Phase

Revenue Growth:

FY26 guidance reaffirms ₹2,600 Cr topline (+65%), supported by:₹5,000+ Cr executable order book (solar, telecom, railways)

Initial revenue from BESS and Solar IPP

Product vertical scale-up (LED, MMS, BLDC motors)

EBITDA Margin Outlook:

Management expects EBITDA margin to hold at ~11.6%, possibly expanding by 10–20 bps, due to:Fixed-price contracts with PSU clients

In-house sourcing of towers and MMS

Better execution leverage on larger contracts

PAT Margin Outlook:

Guided to remain at or slightly above 7.3%, driven by operating leverage and cost control

Long-Term Vision

FY30 Target: ₹10,000 Cr topline

10+ GW cumulative EPC and IPP capacity

2 GW BESS and 2 GW Solar IPP rollout

Double-digit margin profile sustained through vertical integration and exports

Structural Growth Drivers

Vertical Expansion:

Commercialization of Solar IPP projects

Execution of 100 MWh BESS (TSGENCO) and new tenders across NTPC, NHPC, Tamil Nadu

Product Business Scaling:

35–40% CAGR targeted for MMS, BLDC motors, LED lighting

Exports to scale post-GameChange Solar and Middle East outreach

Capital Discipline:

No near-term debt burden

Efficient working capital rotation (5x turnover)

Equity already strengthened via FY25 fundraises

Bondada enters FY26 with strong execution visibility, margin resilience, and sector diversification. Management guidance suggests that EBITDA and PAT margins will hold firm or improve slightly, even as topline scales 65% YoY — setting up a robust launchpad for the company’s ₹10,000 Cr FY30 goal.

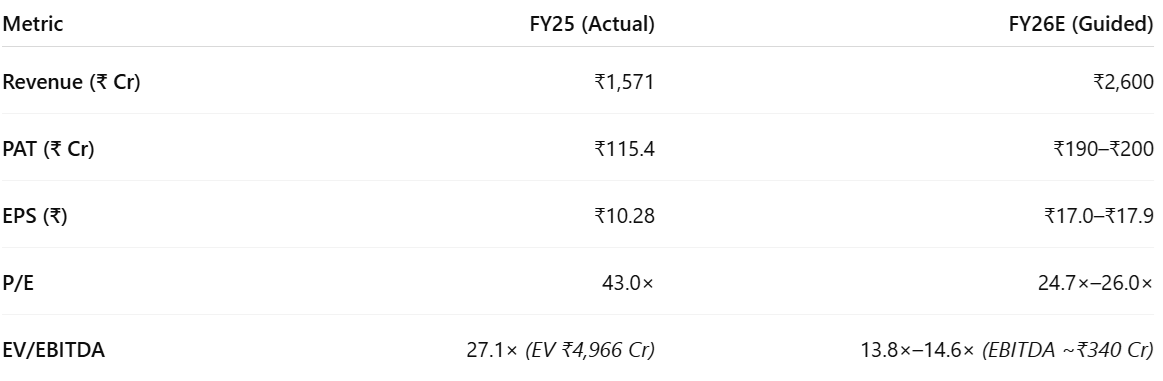

7. Valuation Analysis — Bondada Engineering Ltd

7.1 Valuation Snapshot

FY25 appears fully valued:

At 43× P/E and 27× EV/EBITDA, current price reflects Bondada's FY25 momentum.FY26 sets up a valuation reset:

At ~25× forward P/E on 65% revenue growth and rising margins, Bondada transitions into a fair valuation zone.

Forward Valuation Outlook (FY30)

Using management’s FY30 topline target of ₹10,000 Cr and assuming same EBITDA/PAT margins as FY26:

EBITDA Margin: 11.6% → EBITDA = ₹1,160 Cr

PAT Margin: 7.3% → PAT = ₹730 Cr

EPS (assuming no dilution): ₹65–₹70

Implied P/E at CMP ₹442: ~6.3× to 6.8× FY30E EPS

Even at modest earnings multiples, valuation rerating could drive significant upside as execution scales.

Massive upside potential by FY30:

If Bondada hits its ₹10,000 Cr topline and maintains guided margins, the stock is trading at just ~6× FY30 earnings — implying long-term undervaluation.

Bondada trades at a fair valuation on FY26 estimates, but remains significantly undervalued on a 5-year view. Execution on Solar IPP, BESS, and product exports could unlock strong re-rating potential.

7.2 What’s in the Price?

The current valuation (~43× P/E TTM, ~25× forward P/E) reflects high investor confidence in FY26 execution.

PAT CAGR of ~50% expected over FY25–27, driven by solar EPC execution and product mix improvements.

EV/EBITDA of ~13.8× (FY26E) implies a valuation premium vs most SME EPC/infra peers.

Implied in Valuation:

Execution of ₹2,600 Cr topline in FY26, with margins maintained at ~11.6% EBITDA / 7.3% PAT.

Strong margin stability from fixed-price PSU contracts and in-house sourcing.

Working capital rotation sustained at ~5x.

Contribution from BESS, railways, and early-stage IPP projects starting FY26.

All of FY26 execution is priced in. Any slip in revenue, margin, or vertical ramp-up could trigger a short-term de-rating.

7.3 What’s Not in the Price?

Several upside triggers are underappreciated or unmodeled at current valuations:

Exports: FY25 included just one export contract (GameChange Solar, USA). Management expects exports to scale significantly from FY26–27 (MENA, US, Europe).

Solar IPP and BESS monetization: FY26 to see the first IPP revenues and TSGENCO 100 MWh BESS execution. Neither is priced in fully given lack of historic performance.

Product Business Optionality: BLDC motors, MMS, and LED lighting contribute <15% of revenue today — but expected to double by FY27, with 35–40% CAGR visibility.

Railways and Green Hydrogen: Early projects underway in rail infra (Kavach, crash barriers); hydrogen proposals in pipeline but not modeled in street estimates.

Valuation Re-rating: If Bondada delivers ₹730 Cr PAT in FY30 (as implied by ₹10,000 Cr topline @ 7.3% margin), P/E could compress to <6×, suggesting large re-rating potential.

7.4 Risks and What to Monitor

While execution quality has been strong, investors should monitor key variables that could impact valuation:

Execution Risk: ₹2,600 Cr target for FY26 is nearly 2x FY25 revenue — delivery depends on timely PSU order conversion and IPP project progress.

Product Mix Risk: Delay in ramping high-margin products (BLDC motors, LED, MMS) could cap EBITDA margin improvement.

IPP & BESS Ramp-Up: Both verticals are early-stage; execution delays or regulatory hurdles could push revenue recognition beyond FY26.

Working Capital Build-Up: As order book grows, receivables and inventory days must be tightly managed to avoid liquidity stress as

FY25 saw significant WC build-up:

Sustaining a 5x WC rotation will be critical as revenue doubles.

Raw Material Cost Inflation: MMS and tower prices are sensitive to steel volatility; price pass-through clarity will be key.

Equity Overhang: Warrants (₹55 Cr) are in place; any large equity raise post-FY26 could cap near-term upside.

8. Implications for Investors

8.1 Bull, Base & Bear Scenarios — Bondada Engineering

Base Case reflects continued execution of the guided plan — supported by order book and margin visibility.

Bull Case unlocks optionality from BESS, solar IPP, product scale-up, and exports — creating multi-year re-rating potential.

Bear Case represents execution timing risk, not structural issues — making Bondada’s long-term risk-reward attractive.

Bondada has shown tight cost control and execution rigor, but valuation leaves limited room for FY26 execution error. That said, FY27–30 optionality remains underappreciated — offering asymmetric upside if product, export, and annuity verticals deliver ahead of plan.

8.2 Is There Any Margin of Safety?

✅ Where There Is Margin of Safety

Business Model Strength

Long-standing relationships with PSU clients (NLC, MAHAGENCO, BSNL, TSGENCO) ensure revenue visibility

Product diversification (MMS, BLDC motors, LED) adds structural margin levers

Execution efficiency proven: FY25 EBITDA margin held at 11.6%, with potential upside in FY26

Capital Structure

Major capacity investments completed → lower capex burden going forward

Upside Levers Not Yet Priced In

Product contribution still <15% of topline — strong room for margin upside

Solar IPP and BESS monetization begins in FY26 but not yet modeled into base earnings

Exports expected to scale from <2% to 7–10% by FY27, offering diversification and ASP uplift

Valuation vs Future Earnings

At CMP → FY30E P/E of just ~6.5×, suggesting multi-year earnings locked in

EV/EBITDA expected to fall below 8× by FY27 — attractive zone for infra players with growth visibility

❌ Where There Isn’t Much Margin of Safety

Valuation Is Full (Short-Term)

FY25 P/E: 43× | FY26E P/E: 25–26× → high expectations priced in

FY26 EV/EBITDA of ~13.8× = mid-cycle multiple for an infra business still scaling

Valuation allows very little room for execution error in FY26

Execution & Cash Flow Risks

High FY26 target (₹2,600 Cr) requires flawless project conversion + delivery

Export and product mix ramp could be slower than modeled

Working capital ballooned in FY25

Current valuation leaves little room for FY26 disappointment — but Bondada offers strong asymmetric upside if execution continues and products/exports ramp faster than expected.

If FY26 PAT crosses ₹190 Cr and IPP/BESS verticals begin contributing meaningfully, CMP could prove conservative in hindsight.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer