Bondada Engineering H1 FY26 Results: PAT Up 171%, On-track FY26 Guidance

Revenue CAGR of 69% for FY25-27. 2x revenue in FY26. Project margins are stable. Operating leverage to drive margin expansion. Available at attractive valuation

1. EPC & O&M Provider

bondada.net | BSE - SME: 543971

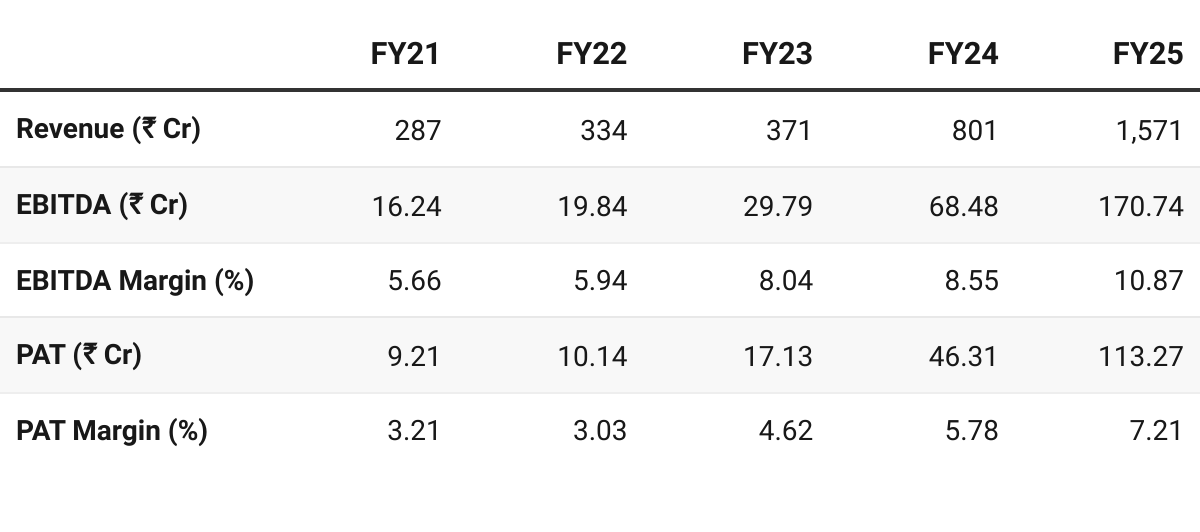

2. FY21-25: PAT CAGR of 87% & Revenue CAGR of 53%

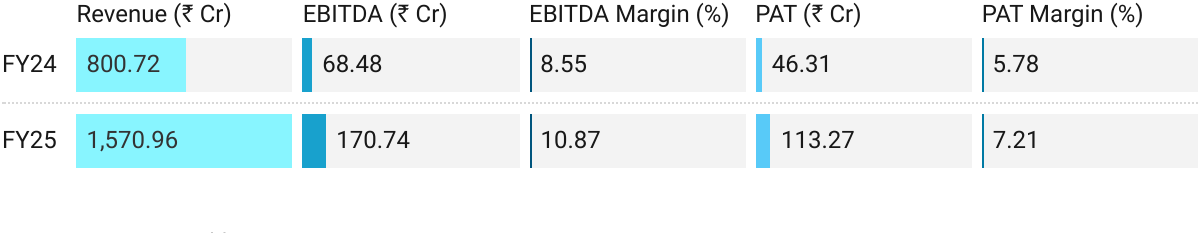

3. FY25: PAT up 145% & Revenue up 96% YoY

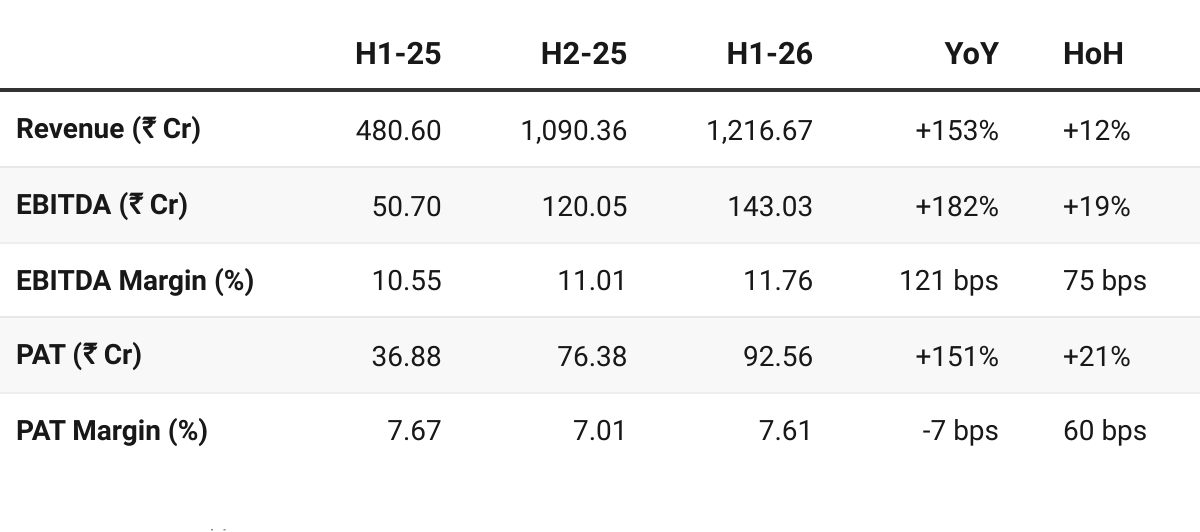

4. H1-26: PAT up 171% & Revenue up 34% YoY

Growth driven by strong execution of projects in its order-book.

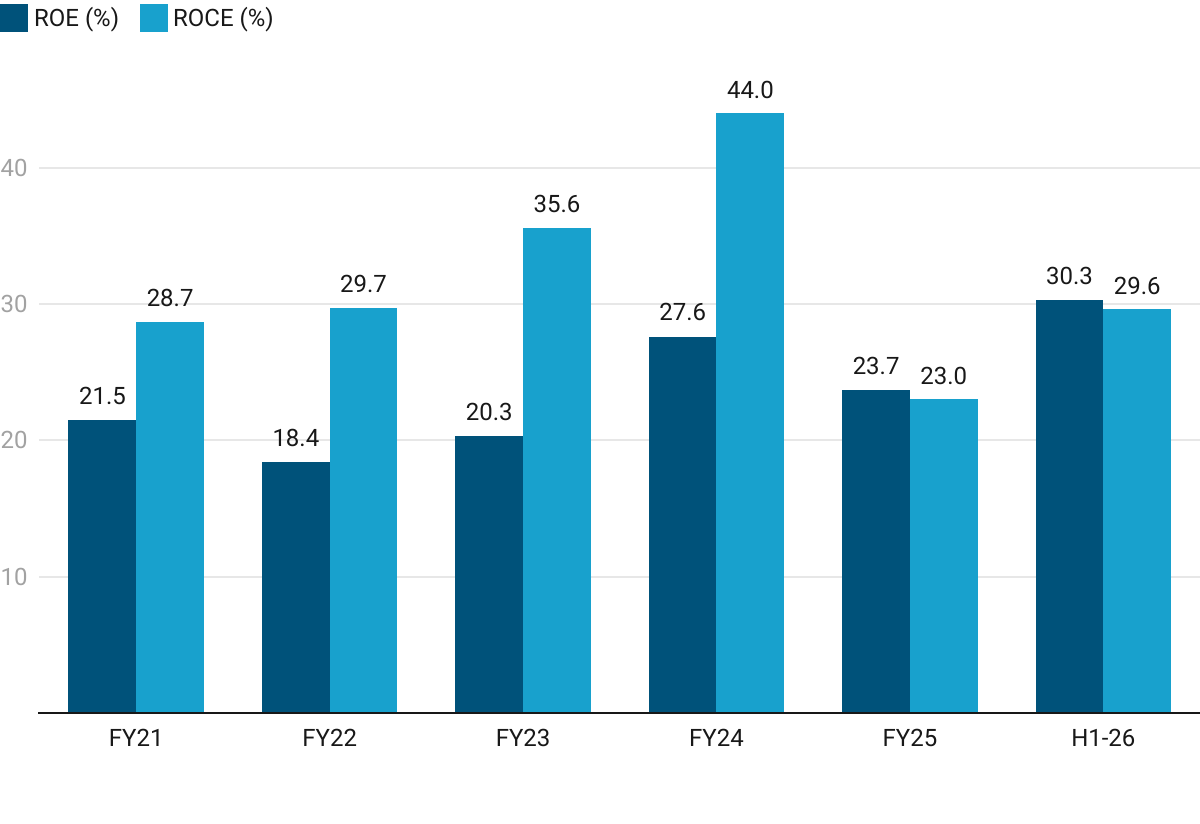

5. Business Metrics: Strong Return Ratios

6. Outlook: 94% Revenue Growth in FY26

6.1 Management Guidance

Revenue

FY26: H1 contributes to 40% of yearly revenue while H2 contributes 60% of yearly revenue

FY27: Conservative estimate of ₹4,500 Cr revenue

FY30: Revenue of $1 billion — Horizon 2030 - Charting a Billion-Dollar Vision

Margins:

FY26: EBITDA and PAT margins to sustain in H2 with possibility of 100 bps margin expansion on account of operating leverage

FY27: FY26 margins are to be sustained

FY26 revenue expectation =₹3,040 Cr (based on 40:60 split) i.e. 94% growth

Order-book supports revenue projections

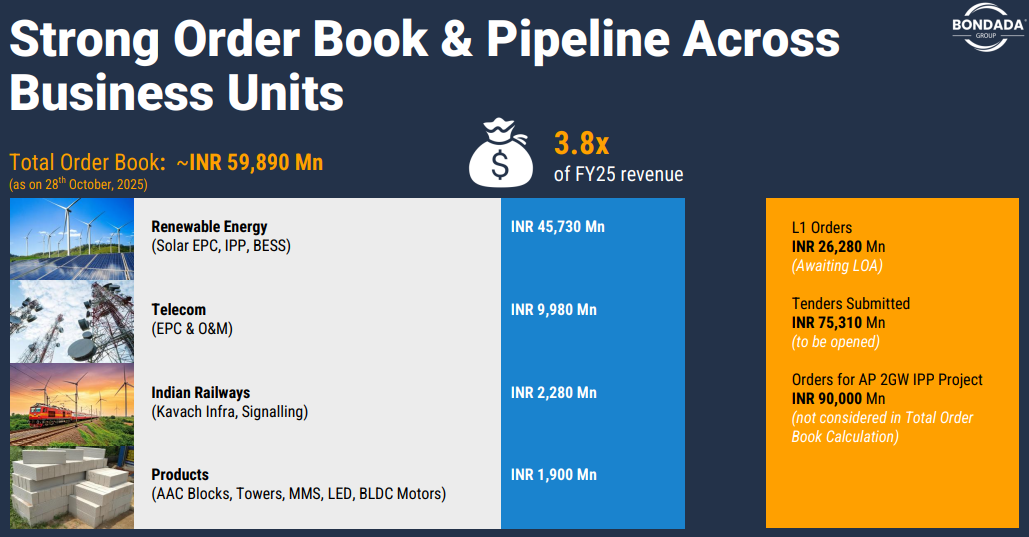

~₹7,500 Cr of cumulative revenue guided for FY26 and FY27 of which ~₹1,200 Cr is delivered in H1-26. This implies that ~₹6,300 Cr of expected revenue till FY27 is supported by an order-book of ~₹5,989 Cr and order ~₹900 Cr not included in current order book.

6.2 H1 FY26 Performance vs FY26 Guidance

Revenue and Profitability On Target

H1 FY26 projects to continue into H2 FY26

Management confident of H2 FY26 delivering 60% of yearly revenue

Stable margins as project profile will not change with possibility of margin expansion on account of operating leverage

7. Valuation Analysis — Bondada Engineering

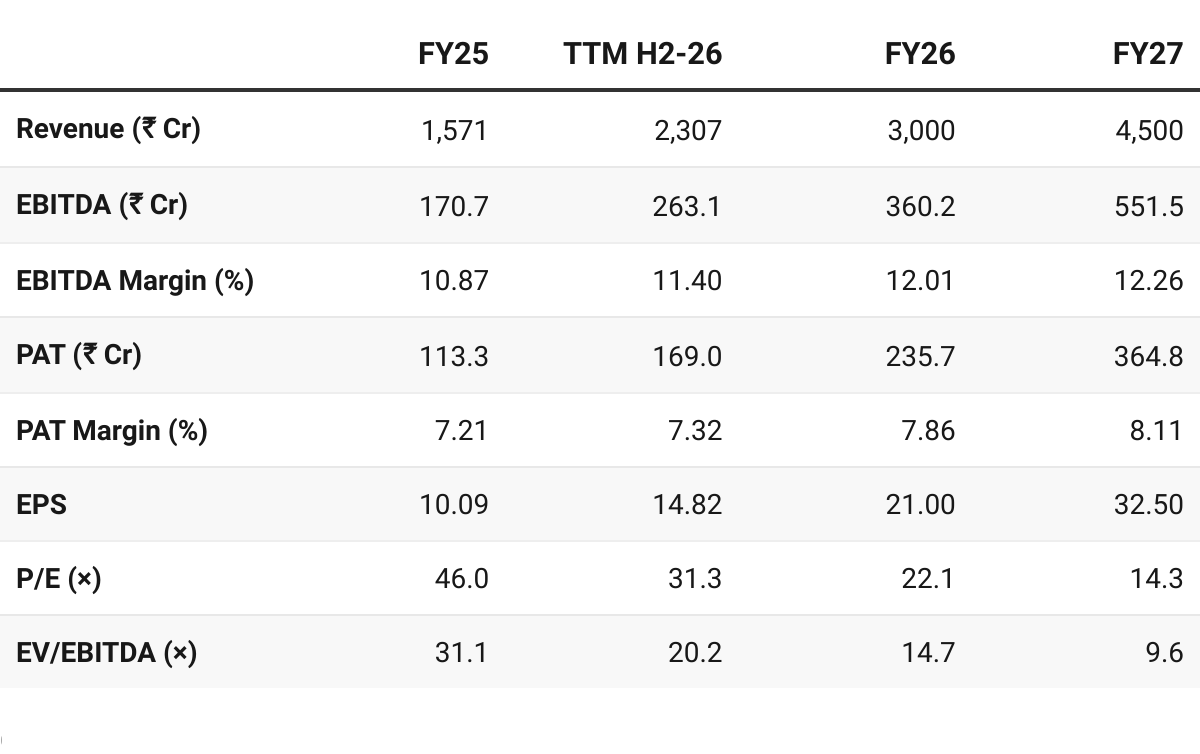

7.1 Valuation Snapshot

CMP ₹462.3; Mcap ₹5,158.96 Cr

While management has guided for 100bps margin expansion, modelling a conservative improvement in margin with 50bps improvement considered over 2 years

FY26 Margins = 25 bps improvement over H1-26 margins

FY27 Margins = 25 bps improvement over FY-26 margins

7.2 Opportunity at Current Valuation

Re-rating Potential

Re-rating potential: At ~14× FY27E P/E and 10× EV/EBITDA, trades at a discount. Sustained execution as per guidance could drive a significant re-rating and create an opportunity in the stock.

Optimality of new businesses: Recently expanded into Data Centers (O&M services) and Defence & Aerospace — impact of these business is yet to be discounted in the valuations

Horizon 2030: Impact of $1 billion revenue by FY30 is longer term opportunity indicating that the story has potential to continue beyond FY27

7.3 Risk at Current Valuation

Execution of Guidance

The opportunity is based on execution of guidance. If execution falters, the impact will be seen in the stock price

Oder-book is based on EPC contracts which are multi-year contracts ~2.5 years. Slow down in contract execution is a risk.

The opportunity in Bondada is based purely on riding the industry tailwinds in the renewable space. If the tailwinds change direction so will the stock

Optionality from new business may not yield results — Revenue from Data Centers is expected in Q3 FY27. No clear timelines for Defense business in place as of now.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer