BLS International Q2 FY26 Results: PAT up 27%, Ahead of Growth Guidance

Growth guidance of 20–25% CAGR for the next 3-4 year with strong cash-flow generation. Trading at attractive forward valuations creating opportunity of re-rating of multiples

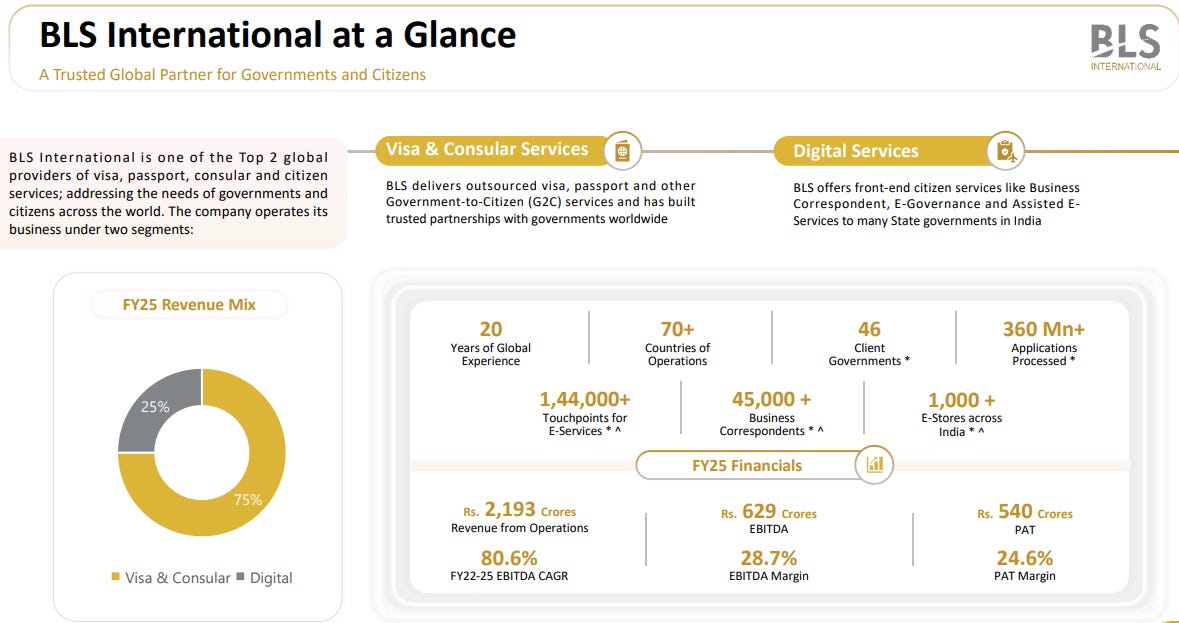

1. Visa & consular services | Digital services

blsinternational.com | NSE: BLS

Acquired 100% shareholding in Trefeddian Hotel (Aberdovey) Limited in the United Kingdom for a total consideration of Rs 78.3 Crores; marking its strategic entry into the hospitality sector.

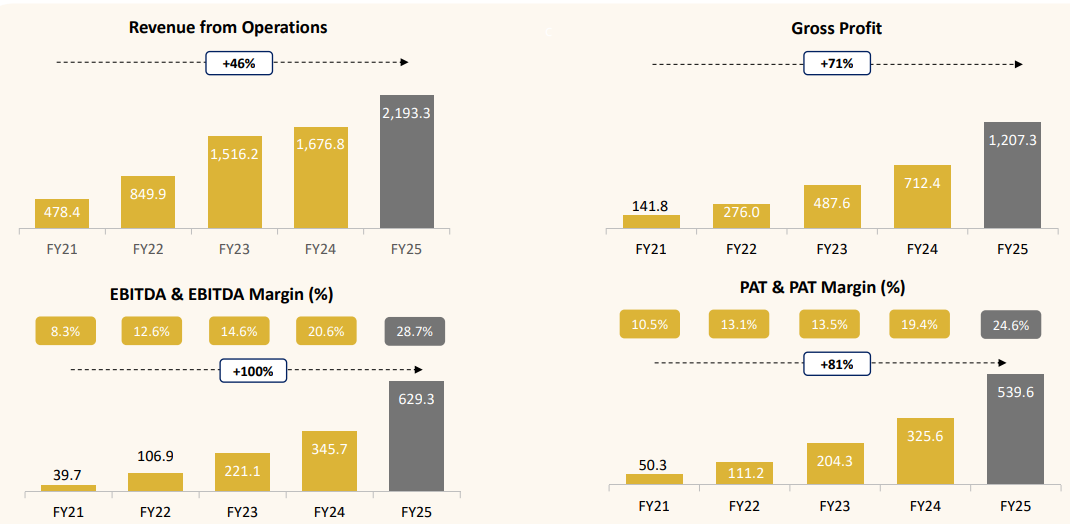

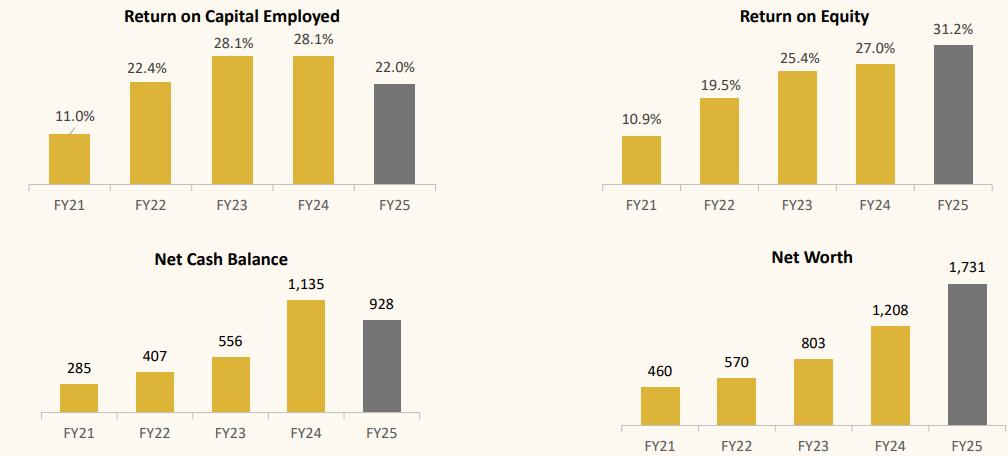

2. FY21-25: PAT growth 81% & Revenue growth 46% CAGR

Strong operating leverage: Each year, fixed costs became more productive—driving margin expansion across EBITDA and PAT.

Structural shift post-FY23: Margin jump from FY23 to FY25 (EBITDA: 14.6% → 28.7%) reflects transformation to a higher-margin, scaled business.

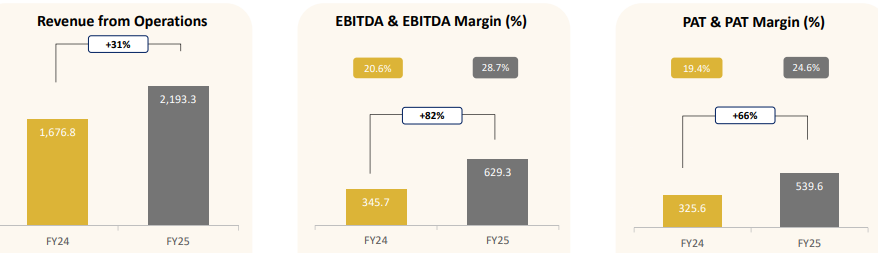

3. FY-25: PAT up 66% and Revenue up 31% YoY

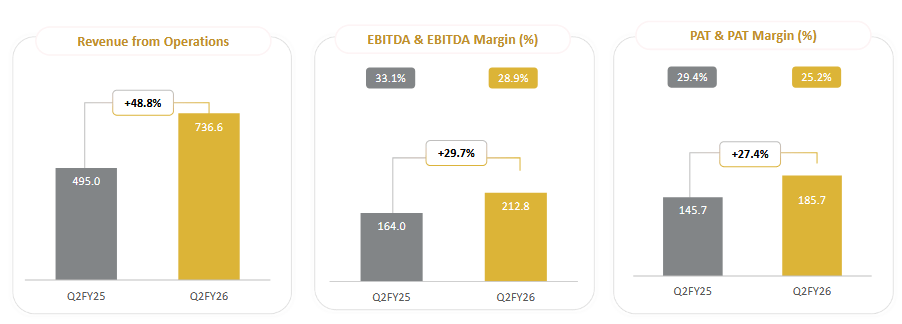

4. Q2 FY26: PAT up 27% & Revenue up 49% YoY

PAT up 3% & Revenue up 4% QoQ

Aadifidelis Solution making BLS a lower margin business

Strong revenue growth on account of higher Visa Applications and also due to consolidation of Citizenship Invest and Aadifidelis Solution

Growth in EBITDA and PAT was driven by Visa business which witnessed shift from partner run model to self managed model in addition to consolidation of Citizenship Invest and Aadifidelis Solutions.

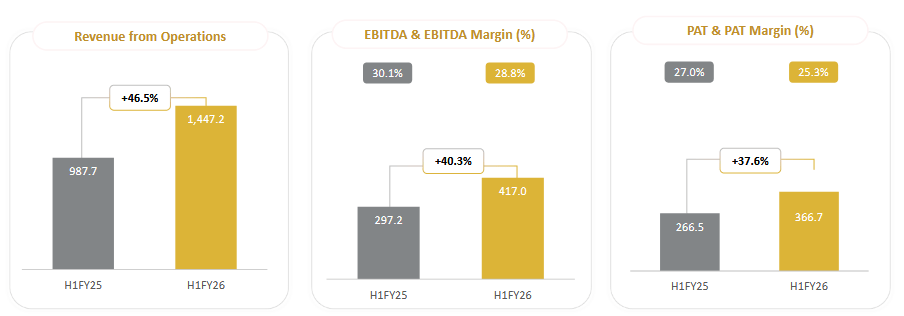

5. H1 FY26: PAT up 38% & Revenue up 47%

BLS of FY26 to be seen as a lower margin business compared to FY25

6. Business Metrics: Strong return ratios

7. Outlook: 20-25% Growth

6.1 FY26 Guidance — BLS International Services Ltd

And what guidance or what we are telling people is that now with the increased base also, next 3-4 years, we would continue to grow 20%-25% in terms of profitability, revenue, etc.

Together, blended margins should be in the range of 29-30%, which is our goal.

BLS expects to compound revenue and profits at 20–25% over the next 3–4 years.

Predict stable ~40% Visa margins.

Consolidated margins are expected to be around ~28–29%.

Strong visibility from long-duration contracts. BLS plans rapid expansion of Digital services even at lower margins.

Expected to continue with disciplined M&A funded by a strong net-cash balance sheet.

7.2 H1 FY26 Performance vs FY26 Guidance

Revenue: Ahead of the 20-25% growth guidance

Even if we assume 20-25% growth in H2-26 over H2-25, it would lead to about ~30% growth in FY26 over FY25 revenue

Margins: H1 FY26 margins are sustainable and in-line with guidance

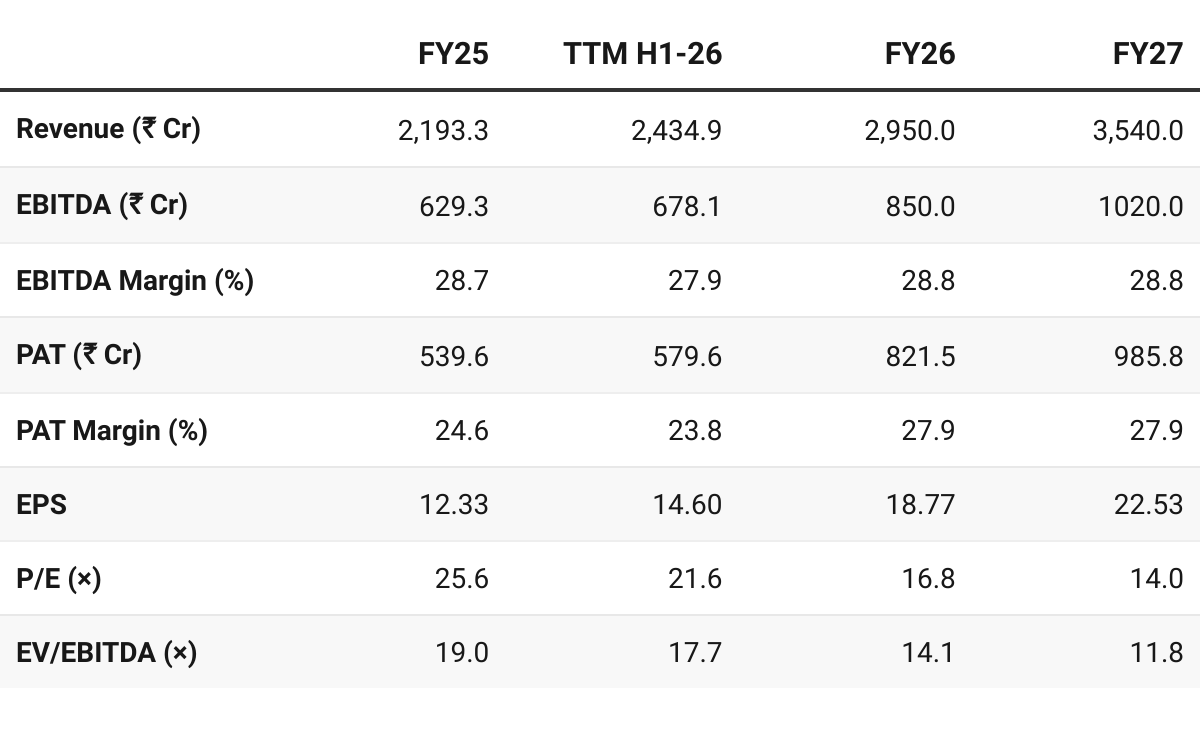

8. Valuation Analysis

8.1 Valuation Snapshot — BLS International

Current Market Price = ₹315.5

Market Cap = ₹12,988.8 Cr

Assumptions:

FY26 Revenue = H1 FY26 revenue + 1.25*H2 FY25 revenue

FY27 Revenue = 20% growth over FY26

Margins of H1 FY26 maintained

BLS generated free cash flow of ₹475 Cr in H1 FY26.

BLS is available at free flow yield of 3.66% (not annualized) given the current market cap of ₹12,989 Cr

Valuations are very attractive from a free-cash flow yield perspective

At a FY27 P/E of 14× the growth has not been fully discounted

The recent action of the Ministry of External Affairs (MEA) temporarily barring BLS from participating in new tenders for Indian missions for two years is a reason

Needs to be watched carefully for the impact of temporary bar

If growth momentum continues provides opportunity for re-ratings of multiples

8.2 Opportunity at Current Valuation

Valuations are attractive for a business generating cash available at a FY26 P/E of 17×

The opportunity for re-rating of multiples exists if the promised guidance is delivered.

Given the history of M&A and the cash reserves available, BLS can surprise on the upside and deliver higher than the 20-25% guided growth

Large Global Visa Outsourcing Market Still Under-Penetrated

Only ~50% of global visa volumes are outsourced today.

Outsourcing expected to rise to 70% of value and 50% of volumes by 2029.

BLS, as the #2 global player, is positioned to capture disproportionately large share.

Strong Tender Pipeline Over Next 12–18 Months

Over USD 1+ billion worth of contracts coming up globally.

BLS bids for all major tenders, backed by strong track record and pricing advantage.

New wins (US, China, Europe) continue to expand footprint.

7.3 Risk at Current Valuation

Growth is dependent on the acquisitions as the Visa business growth of 10.5% in H1 is not very exciting

Tender-dependent business model; loss or non-renewal of any major contract can materially impact revenue.

Ministry of External Affairs (MEA) has temporarily barred BLS from participating in new tenders for Indian missions for two years

High competition in global visa outsourcing increasing pricing pressure

Visa volumes tied to global travel cycles; downturns from geopolitical tensions, or economic slowdown directly hit revenue

Digital business (Aadifidelis, BC network) has structurally lower margins — risk of consolidated margin dilution.

BLS has a track-record of growing by M&A. Nevertheless, the recent acquisition of Trefeddian Hotel, an unrelated business, needs to be watched carefully.

Hospitality margins will be lower than the current consolidated margins.

Limited further margin upside from Visa business now that partner → self-managed transition is largely complete.

Previous coverage of BLS

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer