Beta Drugs: Don't see hurdles to 2X by FY26

Beta Drug promises to deliver 20-25% growth without major capex while maintaining 26% EBITDA margins

Company Overview

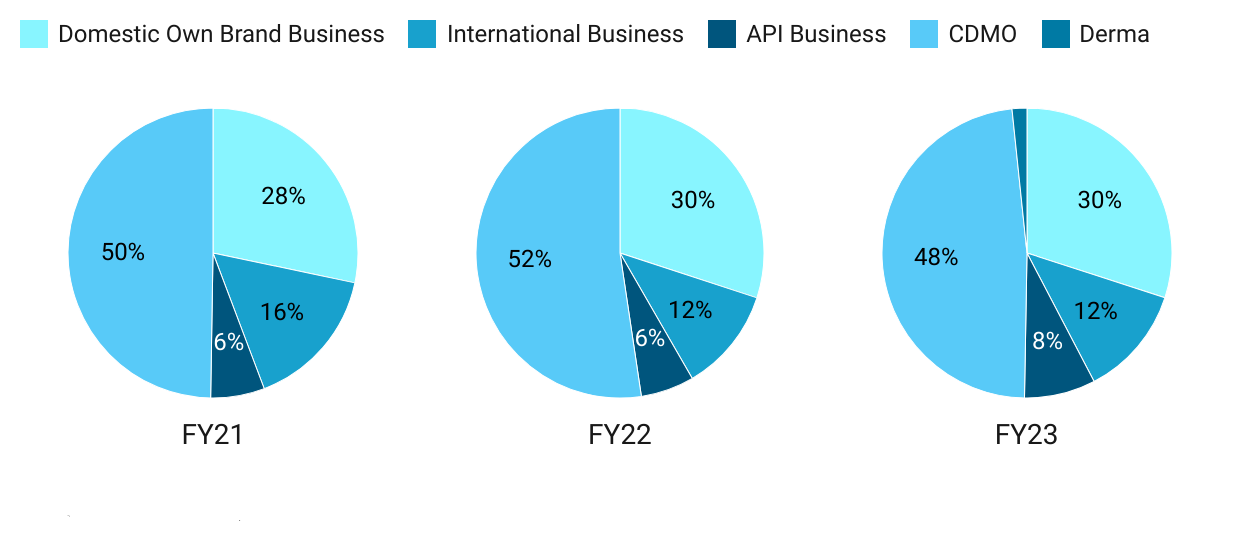

Beta Drugs Ltd is a CDMO in oncology manufacturing and also a manufacturer of a wide range of anti cancer drugs in India within the domestic own brand business. Dermatology as segment was started in Q2-23.

Beta Drugs is now among the top ten players in the cytotoxic Oncology space and aims to be among top five players in the next three years.

Top 5 brands. In fact, they are contributing around 40% to the overall sales. And those brands are AB pacli, Fulvesterant, carfilzomib, Enzalutamide, Carboplatin.

Beta has expanded its production facilities in API & Adley formulations plant. The company has added one more line in API (focusing on regulated markets) and another injectable line with two new lyophilizers in the Adley Formulations plant. lt has further expanded its oral block. The domestic market will be catered from Adley formulations and Beta plant will be dedicated to regulated markets.

Share Details

NSE: BETA ( betadrugslimited.com)

Beta Drugs is available for trading under SME (Small and Medium Enterprises) segment in NSE

Quality: Returns on capital employed

Beta Drugs is an efficiently run company delivering strong return ratios for that last seven years. For a small company its cash conversion is strong.

Beta continues to be net debt free

Growth

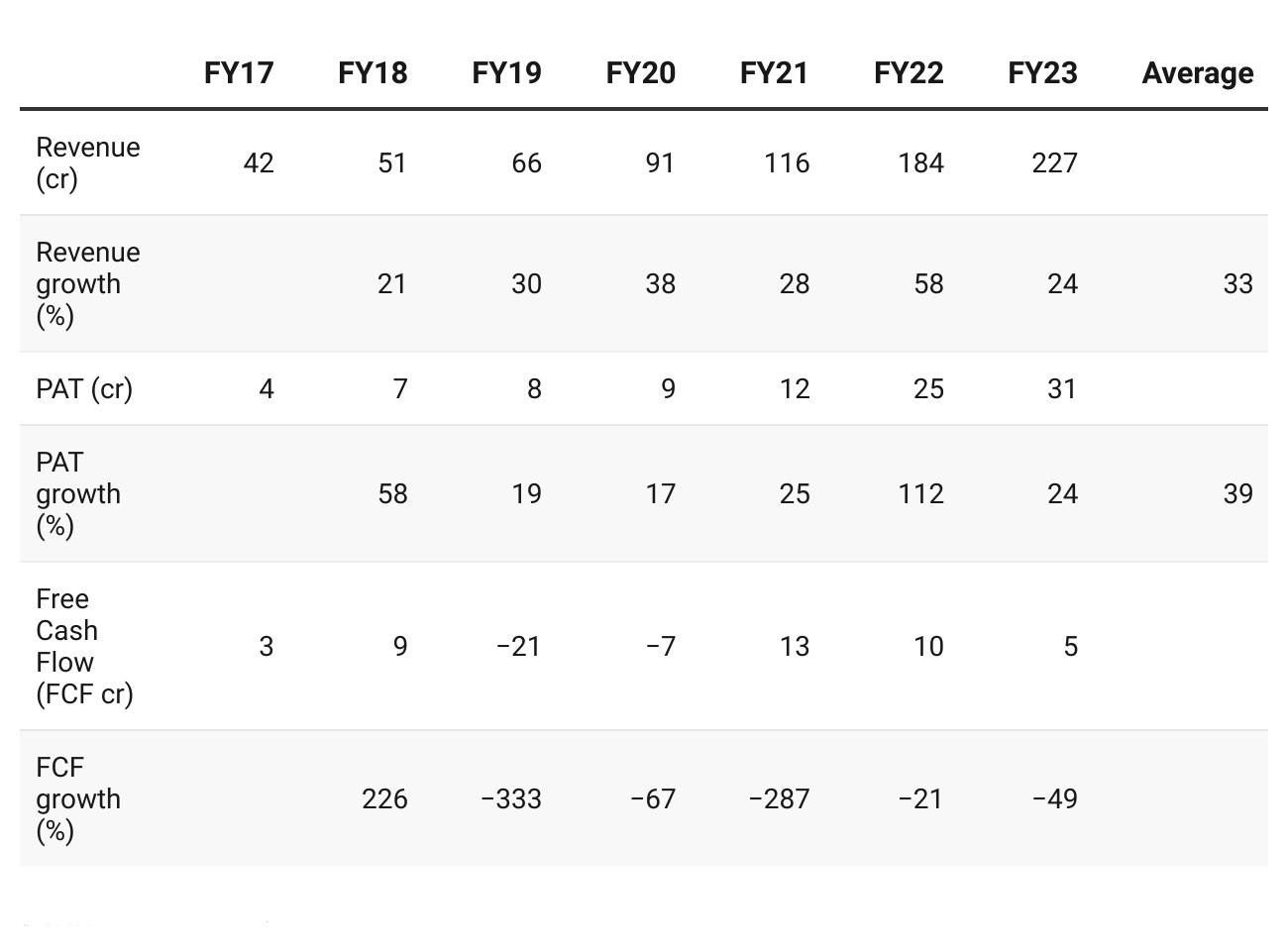

Beta drugs has grown 4.5X in on a small base between FY17 and FY23. The bottom-line has grown in line with the top-line

Growth Momentum

The growth momentum in the top-line and bottom line has been strong across the years.

Outlook

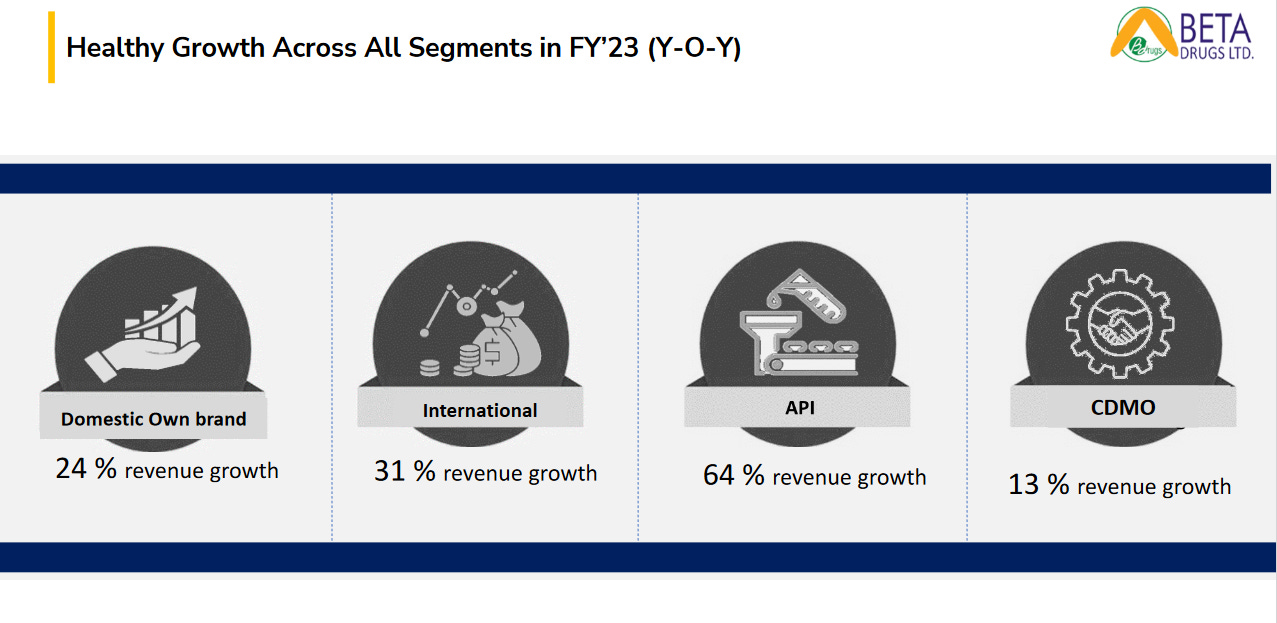

As Beta grows 2x to Rs 450 cr in FY26, the growth is expected to be uniform and not back loaded. The guidance of 20-25% is a slowdown from the historic growth but still its a strong growth guidance.

It will range between 25%-30% in the coming three years.

Recent approvals of ANVISA & INVIMA will drive strong sales from exports in the next three years' The company has also started registration in many PICS countries.

The company has a strong product pipeline of FTLs, NDDS, PARp inhibitors, and TKls which will be launched in the coming months & years. The dermatology division of the company will also grow at a good pace and will be EBITDA positive in the coming 3-4 months

We don't see any hurdle coming across 2 years to 3 years in achieving this target which we have framed for FY ‘25- FY ‘26.

Margins will be stable during the growth and may improve marginally

And coming on to the EBITDA, the EBITDA margins will cross around 26%. And this is the bare minimum which, as I told earlier also, we are targeting. We will see an impact of EBITDA growing beyond 26% also, provided all these things shapes up nicely

The growth will come without requiring any major capex

We don't see now major capex is coming in next two years to three years to achieve the top line, which we have indicated for FY ’25, FY ‘26.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. Beta Drugs is on a growth trajectory with a promise to scale up without needing new capex and maintaining the bottom line.

If I don't currently own the stock, I may want to enter it at the current level.

Efficiently run company with good return ratios

Strong outlook for growth

Management believes that with strong tailwinds coupled with momentum across all its segments; Own Brands, Exports, APl, CDMO & Derma, Beta is poised for strong growth for the next many years.

No major capex planned gives confidence that free cash flow should be generated

Available at a PE of around 26, not quite cheap, but in line with the growth outlook.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades