Best Agrolife: Confident to deliver 30% growth with 20% EBITDA margin

30% growth promised for FY23 & delivered. Promise continues in FY24

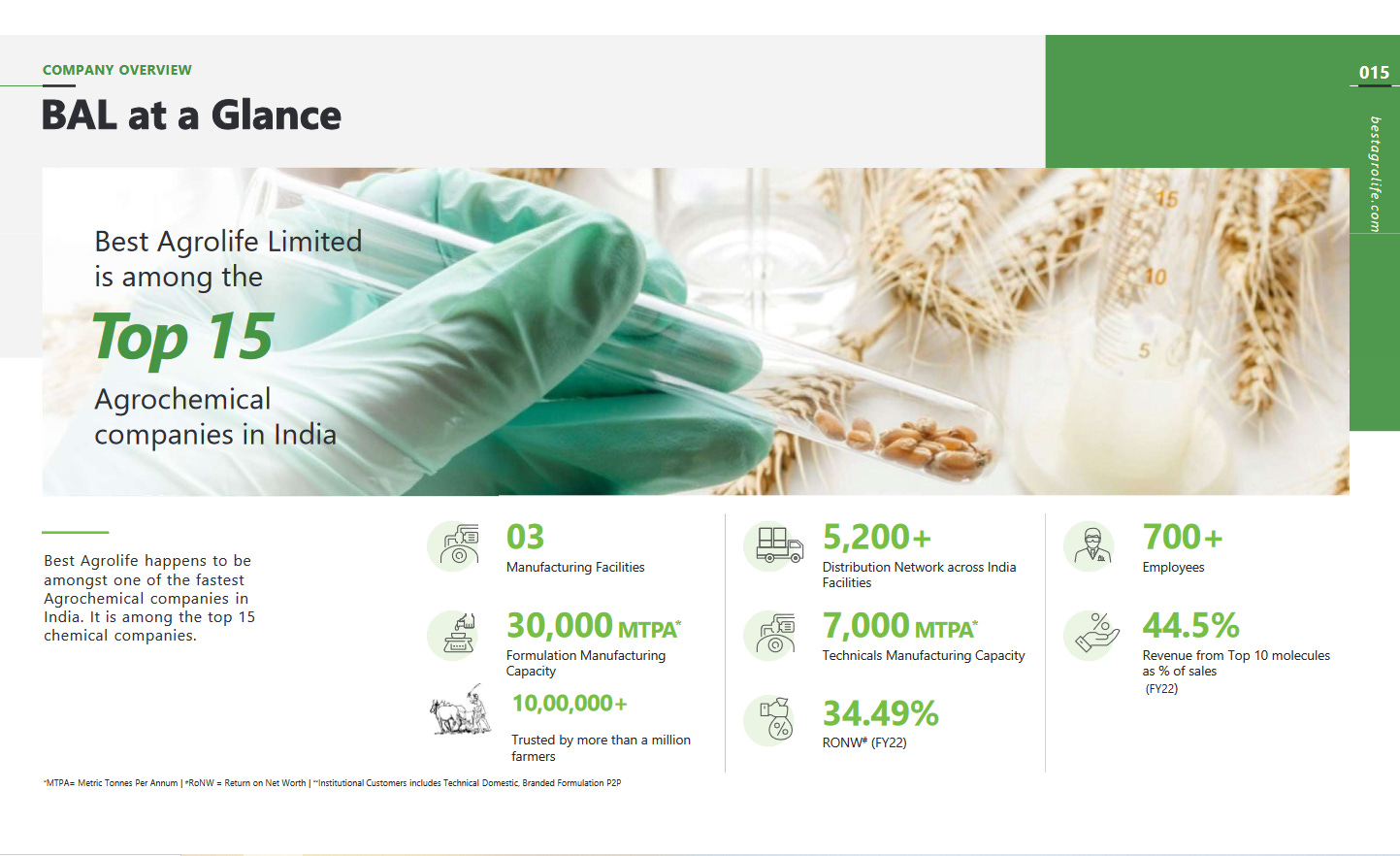

Company Overview

Incorporated in 1992, Best Agrolife Limited is company, engaged in the in the trading of agrochemical products such as insecticides, pesticides, herbicides, fungicides and plant nutrients.

Best Agrolife operates in three business verticals - Technical, Formulations and Branded Products.

It has almost 60+ products, 115+ technical licenses, 450+ formulation licenses, one of the country's most comprehensive portfolios.

The merger of Best Agrochem Private Limited (Transferor Company) with Best Agrolife Limited (formerly Sahyog Multibase Limited) consummated in May 2020. This was a reverse merger, and Sahyog Multibase Limited was a sick unit.

Group company Best Crop Science LLP was converted to Best Crop Science Private Limited and was subsequently taken over by Best Agrolife Limited as a 100% subsidiary and Seedlings India Private Limited was established as a 100% subsidiary of Best Agrolife Limited

Share Details

BOM:539660 ( bestagrolife.com)

Quality: Returns on capital employed in cash

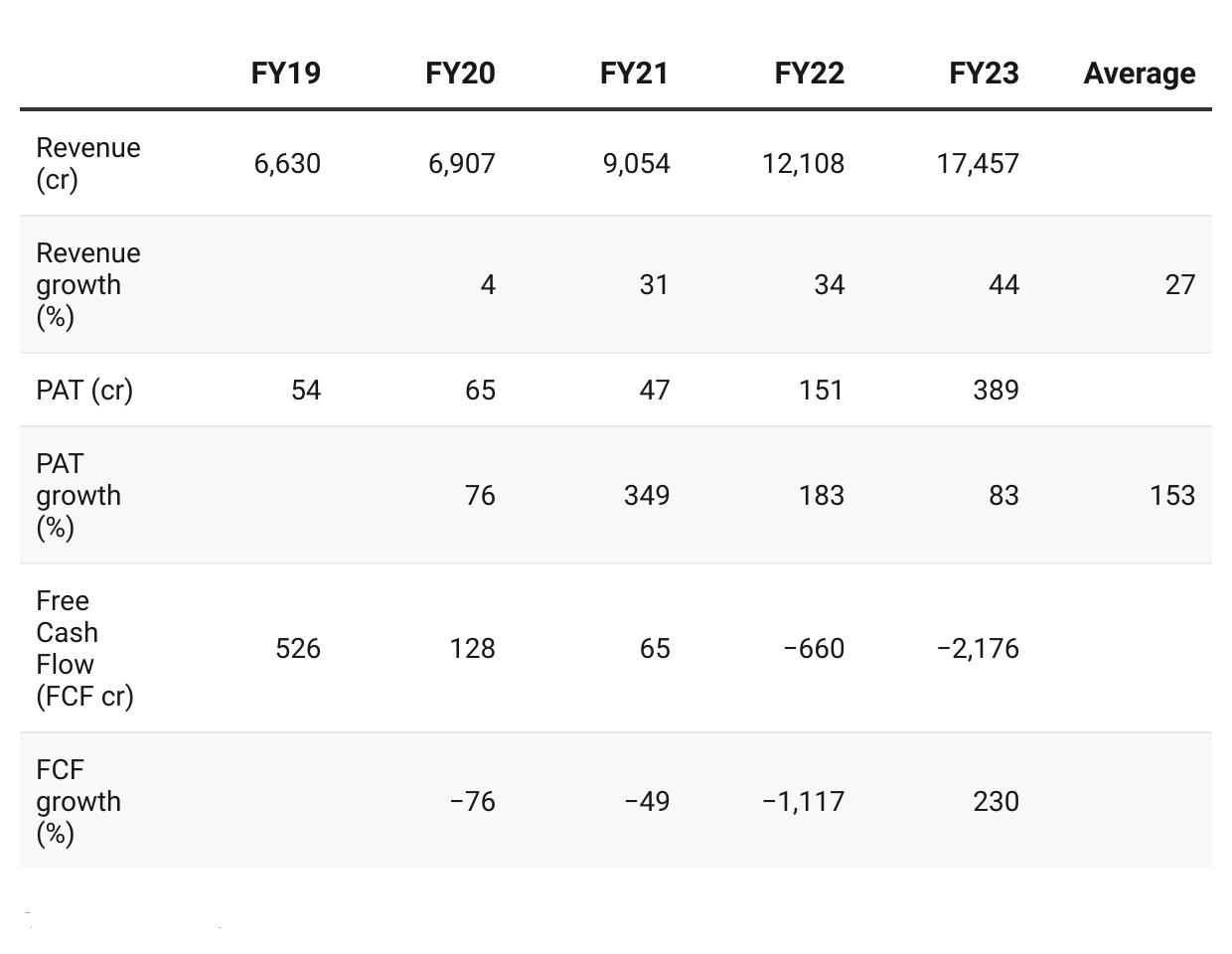

The return profile has changed completely in the last three financial years. However cash conversion performance is quite poor.

Growth

The top-line and bottom-line growth is on account of product launches and changing product mix and its effect is clearly visible from FY21 onward.

Q1-24 Update

On a qoq and yoy basis BAL F24 is pointing towards a strong year ahead. Q1-24 performance is as per the 30% top-line and 20% EBITDA guidance given by the management.

Growth Momentum

The top-line growth and bottom-line growth momentum is extremely strong and this momentum continues into Q1-24

Outlook

Outlook is very attractive with a guidance of 30% growth and 20% EBITDA. In FY22 management had given a FY23 of 30% growth and 20% EBITDA. They delivered on top-line growth but margins were ate 18% against the guidance of 20%

While the agrochemicals industry continues to face challenges, I firmly believe that our niche product basket will not only shield us from industry perils, but also drive robust growth in FY24. This gives us a reason to remain steadfast in our commitment to achieving a 30% growth target and maintaining 20% EBITDA margins for FY24."

Growth and margins driven product launches and changing product mix

Overall, we have an exciting product pipeline ready to be launched in FY24 which are in line with our strategy of introducing more patented and specialised combination products which will help continue strong growth momentum as well as improve our margins in FY24.

Focusing on FY24, we have already launched a couple of technicals in Q1, which are seeing promising traction, with plans to introduce one patented product in Q2. Our pipeline for technicals and niche formulations is geared up for launch over the next few quarters.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. BESTAGRO is on a 30% growth trajectory and one needs to keep riding it and ignore the temporary ups and downs.

If I don't currently own the stock, I may want to enter it at the current level.

Efficiently run company with good return ratios

Outlook for the future is very strong and management is confident on delivering on its guidance on account of product launches and changing mix

Cash generation is a negative

Available at a PE of around 16 based on FY23 earnings. On a trailing 12 months basis BESTAGRO is trading at PE of 13. The valuations are attractive given the guidance by the management.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades