Bank of Maharashtra: PAT growth of 45% & Net Interest Income growth of 17% in H1-25 at a PE of 9

Strong uptrend in business, sequential QoQ net profit increases since FY20. Robust guidance for FY25. Valuations reasonable given outlook. Potential for momentum to go beyond FY25

1. Why is MAHABANK interesting?

bankofmaharashtra.in | NSE: MAHABANK

MAHABANK business is currently in middle of a strong uptrend, with sequential quarter-on-quarter net profit increases since FY20. It has reported strong results for H1-25, supported by a robust guidance for FY25. Given this growth outlook, the bank's valuations appear reasonable, especially considering the potential for the momentum established since FY20 to continue.2. Public Sector Bank

Products & Services

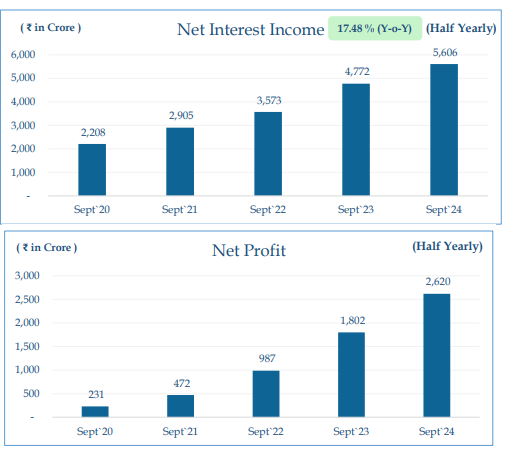

3. FY20-24: PAT CAGR of 80% & Net Interest Income CAGR of 23%

4. FY24: PAT up 56% & Net Interest Income up 27% YoY

5. Q2-25: PAT up 44% & Net Interest Income up 15% YoY

6. H1-25: PAT up 45% & Net Interest Income up 17% YoY

7. Business metrics: Strong Return ratios

8. Outlook: Strong guidance reflecting the strong business execution

Asset growth of 16%

Advances within which would be growing at the rate of 18% to 20%.

Deposit, growth 12% to 15%.

CASA, we will maintain around 50%

RAM to corporate will be 60% to 40% ratio and there'll be plus/minus 2 basis.

Interest income growth, 18% to 20%.

NIM guidance of 3.75% to 3.9%.

Noninterest income also is growing, and we'll keep a guidance of 15% to 20%.

Cost to income, 37%, 38% and I'll keep it below 40%.

ROA, we are comfortable to maintain a guidance 1.5% to 1.6%,

GNPA we will maintain it below 2%.

NNPA between 0.2% to 0.25%.

CRAR would be between 16% to 17%.

9. PAT growth of 45% & Net Interest Income growth of 17% in H1-25 at a PE of 9

10. Hold?

If I hold the stock then one may continue holding on to MAHABANK

Based on H1-25 performance MAHABANK looks on track to deliver as per the management guidance and deliver a strong FY25.

MAHABANK is in the middle of a very strong run it has increased its PAT sequentially QoQ since FY20. One should keep riding the momentum

Asset quality of MAHABANK is acceptable with adequate provisioning and within the guidance range of the management

11. Buy?

If I am looking to enter MAHABANK then

MAHABANK has delivered PAT growth of 45% and Net Interest Income growth of 17% in H1-25 which is indicating to a strong FY25 at a PE of 9 which makes the valuations quite attractive in the short term.

MAHABANK has delivered operating profit growth of 19% for H1-25 at a PE of 9 which makes the valuations attractive from a FY25 perspective

MAHABANK is guiding for Interest income growth, 18% to 20% in FY-25 at a PE of 9 which makes the valuations attractive from a FY25 perspective.

MAHABANK has Q2-25 end net worth of Rs 20,407 cr against a current market cap of Rs 41,988 cr. It is available at a P/B of 2.1 which makes the valuation fully priced from a short term perspective.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer