Balu Forge Industries: PAT growth of 176% & revenue growth of 97% for 9M-24 at a PE of 23

Balu delivered ahead of its FY24 guidance of 40-45% revenue growth. It has delivered a revenue CAGR of 50%+ for FY21-23. Possibility of momentum continuing in FY25, provides opportunity in the stock.

1. Manufacturing of crankshafts & forged components

baluindustries.com | BOM: 531112

Balu Forge Industries Ltd (BFIL) is one of the prominent companies in India for producing precision machined components.

It is engaged in the manufacturing of finished and semi-finished crankshafts and various other forged components and has a strong clientele comprising of 25+ OEM’s.

The Company boasts of a precision machining unit with a comprehensive product range which caters to customers across various industries such as automobiles, ships, locomotives, aerospace, defence, oil and gas, railway, marine, prototypes and others

Revenue Split FY23

2. FY21-23: PAT CAGR of 126% & Revenue CAGR of 52%

3. FY23: PAT up 30% & Revenue up 14%

4. Strong H1-24: PAT up 36% & Revenue up 23% YoY

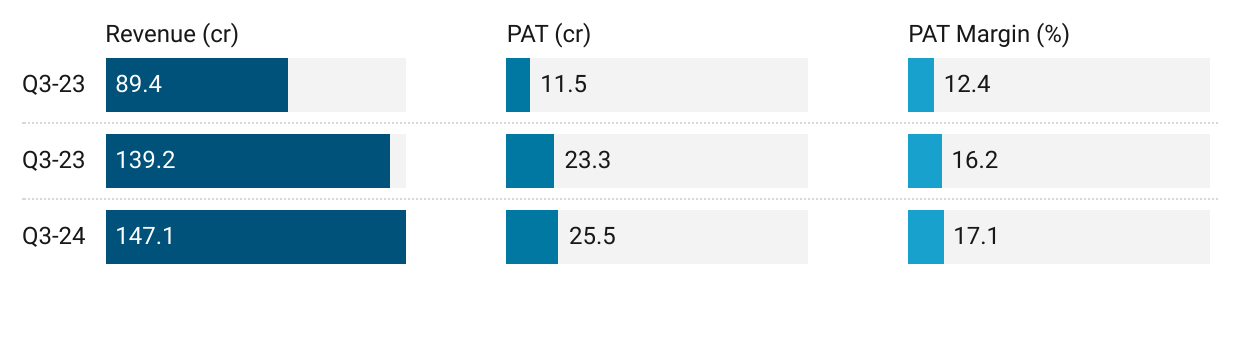

5. Strong Q3-24: PAT up 122% & Revenue up 65% YoY

PAT up 9% & Revenue up 6% QoQ

6. Strong 9M-24: PAT up 176% & Revenue up 97% YoY

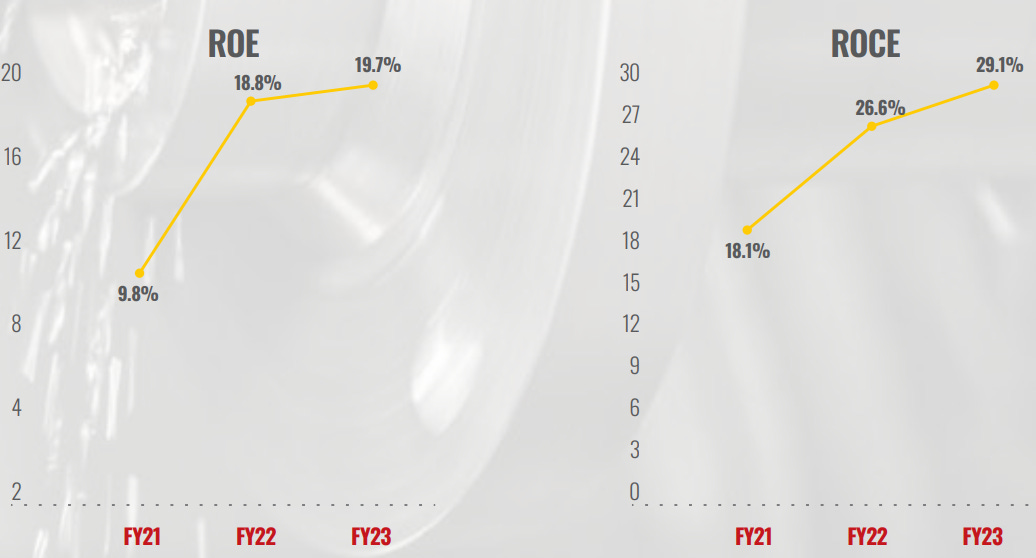

7. Business metrics: Strong return ratios

8. Strong outlook: Revenue growth of 40-45%

i. FY24: Revenue growth of 40-45%

9M-24 growth of 97% is significantly higher than the guidance of 40-45% growth

Revenue is expected to conservatively grow in the range of 40.0%-45.0% in FY24 over FY23, led by new customer addition in sectors like railway and defence.

ii. EBITDA margin 23-24%

EBITDA margin of 22.4% for 9M-24 is a tad bit lower than the guidance of 23-24%

EBITDA margins are expected to be in the corridor of 23.0%-24.0% in the upcoming quarter on the back of increasing scale of operations and efficiencies thereon

9. PAT growth of 176% & Revenue growth of 97% in 9M-24 at a PE of 32

10. So Wait and Watch

If I hold the stock then one may continue holding on to BFIL

Based on 9M-24 performance, BFIL looks on track to deliver the strongest revenue & PAT in FY24

BFIL is in the middle of a strong run and has delivered sequential QoQ growth in PAT in all the three quarters of FY24

BFIL has delivered ahead of its guidance for FY24 and one can wait for Q4-24 to look ahead for the FY25 guidance.

BFIL is unable to convert its profit into cash as revenue is getting converted into receivables. If this trend is not resolved in FY24, it is a red flag and could be cause to exit from the stock

11. Join the ride

If I am looking to enter BFIL then

BFIL has delivered PAT growth of 176% and revenue growth of 97% in 9M-24 at a PE of 23 which makes the valuations quite reasonable in the short term.

On the basis of FY21-23 PAT CAGR of 126% & Revenue CAGR of 52% one can expect the growth momentum in the business to continue in BFIL.

One needs to keep in mind that cash conversion and the wait for the guidance for FY25 till Q4-24 can be the risks in entering the stock.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer