Balaji Amines - Attractive price for 2X by 2026

Growth depends on management delivering on guidance after failing once

Company Overview

Balaji Amines Ltd. (BALAMINES) an ISO 9001: 2015 certified company, specialised in manufacturing Methylamines, Ethylamines, Derivatives of Specialty Chemicals and Pharma Excipients. Balaji is the largest manufacturer of aliphatic amines and their derivatives in India.

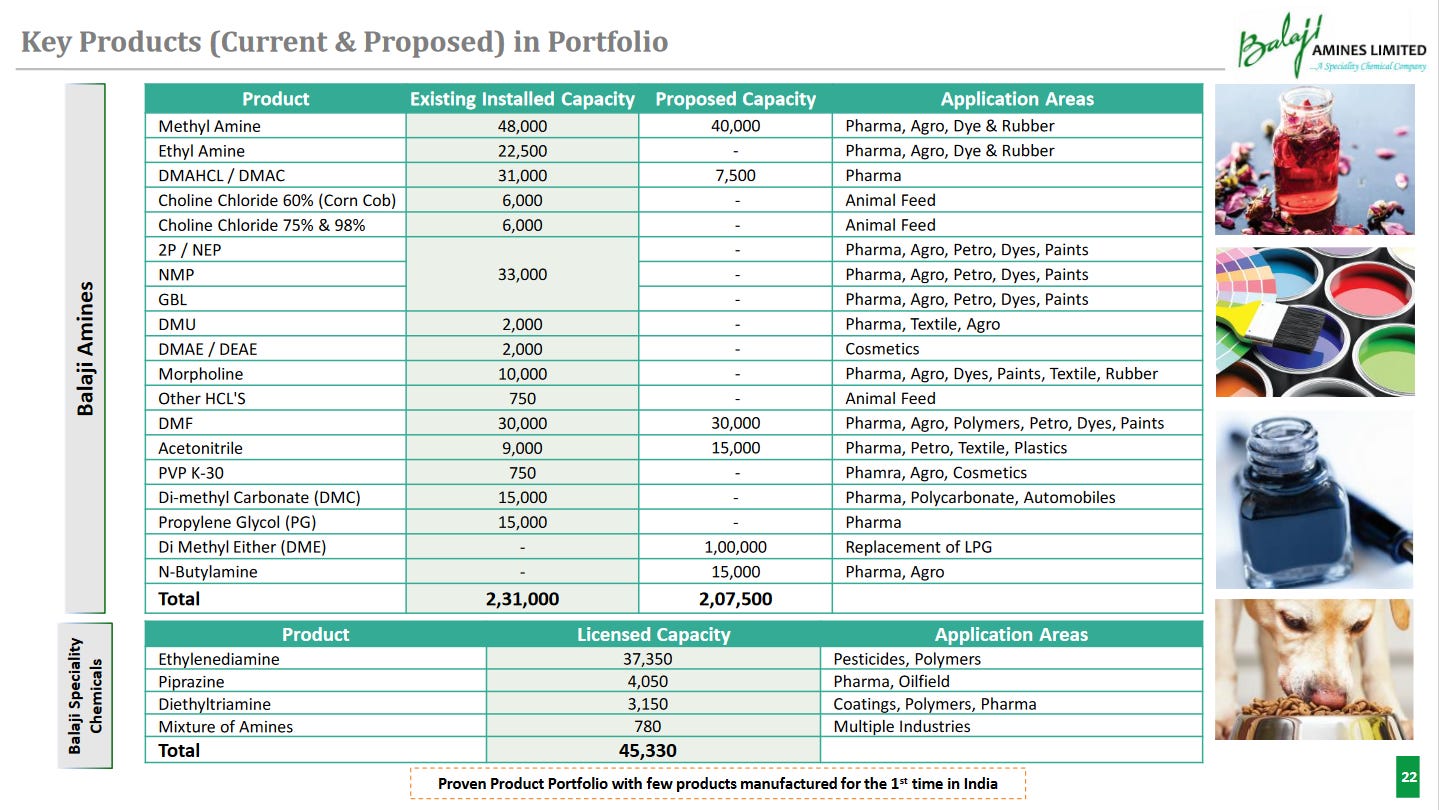

BALAMINESis the market leader in Methylamines production in India with installed capacity of 48,000 TPA. Methylamines is the base product for value-added derivatives. 80% of Methylamines production is captively used.

BALAMINES is the market leader in Dimethyl Formamide (DMF) production in India with installed capacity of 30,000 TPA. Balaji is planning to set up a separate plant for DMF and double its existing capacity by adding a capacity of 30,000 TPA

Share Details

NSE: BALAMINES( balajiamines.com)

Quality: Returns on capital employed in cash

Return ratios have been sold and consistent over the years

Growth

Historically growth has been good on account Phase 1 capex. Future growth will be primarily dependent on Greenfield project and Phase 2 Capex along with the improvements in capacities of Phase 1

Growth Momentum

The impact of the 1% top-line growth is clearly visible on the growth momentum

Outlook

Comments from earning calls about the prospects of the company are guiding a minimum growth of 10% from existing capacities. This compares to the guidance of 10-15% top-line growth by Alkyl Amines (read detailed analysis)

Every year there should be a minimum 10% growth should be there without adding the new capacities

Growth is not expected to come at the cost of margins as the the EBITDA guidance of 26% is in line with the 26.3% EBITDA in FY23

Consolidated will be 26% to 27%, standalone 22%.

With my current run rate with the current situation and current speed, I think we should be going 2026, we should be in a position to touch double the existing number.

The moment we operate all these existing plants and these four plants we aim and we dream our top line should be around Rs. 4,000 crores.

One should be cautious when going thru the management commentary. In the Q4-22 earnings call the management had guided for Rs 2,500 cr in FY23 but ended with Rs 2,355 cr in FY23.

Current financial years I think in a standalone we should be in a position to touch Rs. 2,200 to Rs. 2,300 crores and consolidated we should be in a position to reach Rs. 2,500 crores.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. If I intend to hold it then one needs to keep a watch on the capex and the guidance of doubling capacity by FY26 given the history of guidance miss for FY23 top-line.

If I don't currently own the stock, I might consider BALAMINES given that the stock is available at a PE of 22 and has the potential of doubling by FY26 and top-line growing to Rs 4,000 cr.

Additionally BALAMINES generated a free cash flow of Rs 262 crore on a market cap of around Rs 7,200 crore which means that its available at a free cash flow yield of 3.64% which makes it quite attractive in terms of valuation.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades