Bajaj Finance Q4 FY25 Results: PAT up 16%, Strong FY26 Outlook, Premium Valuations

Bajaj Finance guides for strong AUM growth, stable ROA, and lower credit costs in FY26. While valuations remain expensive, execution continues to impress.

Table of Content

Financial Performance Snapshot

Management Commentary & Outlook

Valuation Deep Dive

Implications for Investors: What to Watch

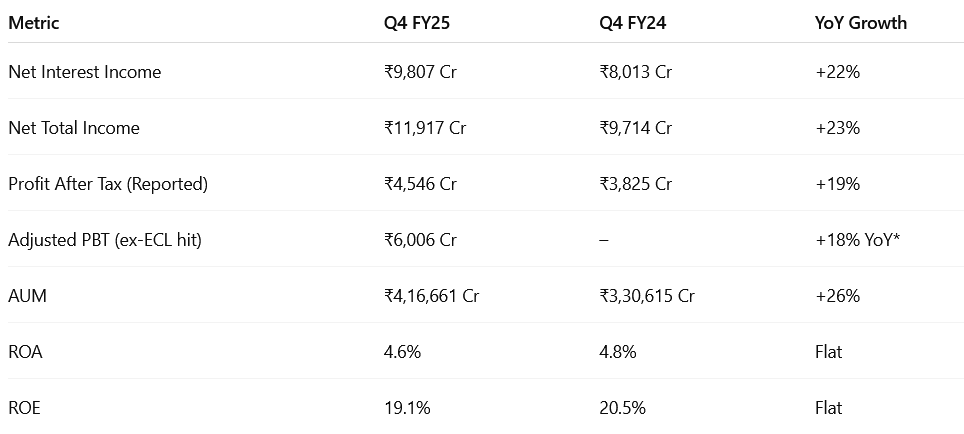

1. Bajaj Finance Financial Performance Snapshot

1.1 What Drove Q4 FY25 Results — and What It Means for Q1

Bajaj Finance delivered a solid Q4 FY25 despite headwinds from elevated credit costs. Adjusted for one-time provisions, profit growth was strong — setting a healthy base for Q1.

Key Drivers:

Volume growth: 10.7M loans booked (+36% YoY).

Customer addition: 4.7M new customers in Q4.

Opex control: Ratio improved to 33.1% of NTI.

One-offs: ₹359 Cr ECL hit due to model refresh on Stage 1 assets. ₹348 Cr tax benefit offset some impact.

Implication for Q1: Run-rate metrics (loan booking, AUM accretion, digital traction) suggest Q1 FY26 will likely start strong unless credit costs remain elevated.

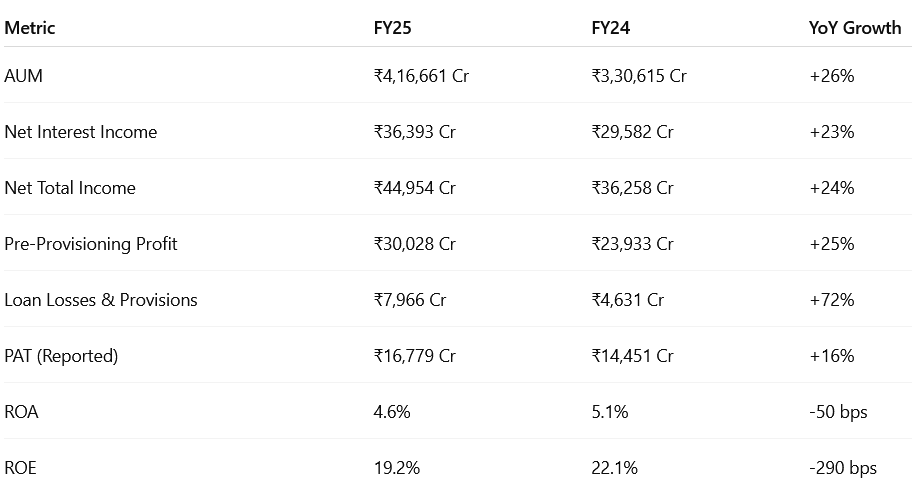

1.2 FY25 Performance in Review: Growth, Margins, Asset Quality

Bajaj Finance closed FY25 with consistent topline growth and robust asset expansion — though credit costs were a drag on profitability.

Takeaways:

Operating leverage: Strong NTI growth + improved opex efficiency (down 80 bps YoY).

Credit cost spike: Major headwind, driven by higher flow-forward rates.

Capital position: Tier-1 CAR at 21.09%, enabling future growth.

1.3 Segmental Trends: B2C, SME, Mortgages, Securities

Segmental AUM YoY Growth:

Highlights:

Gold loans and car finance showed strong growth, suggesting deeper rural/affluent segment penetration.

BHFL maintained high-quality growth with GNPA at 0.29% and PAT up 25% YoY.

Broking arm (BFinsec) grew its PAT 148% YoY on 58% revenue growth.

2. Bajaj Finance Management Commentary & Outlook

2.1 FY26 Guidance: A Balanced Growth Blueprint

Management struck a confident tone on sustaining growth while improving quality and efficiency in FY26. The company laid out clear guidance across metrics:

Narrative: After taking a credit cost hit in FY25, BFL is recalibrating risk in unsecured portfolios while leaning on new engines like gold loans, MSME, and digital partnerships to maintain overall growth momentum.

2.2 FY26 Strategic Priorities: Where Focus Will Be

Management outlined a clear priority stack to deliver FY26 goals:

1. Scaling New Growth Engines:

MSME to become a key growth vertical.

Gold loans scaling across 964 branches.

Corporate leasing and green finance gaining early traction.

2. AI-Led Transformation (FINAI Strategy):

Deploying 100+ AI applications to improve revenue, risk, and productivity.

AI copilots across underwriting, sales, service, and audit.

3. Cost & Risk Optimization:

Opex rationalization via automation and platform leverage.

Conservative credit lens in unsecured products.

4. Digital Engagement:

70.6M+ app users, aiming for 150M by FY29.

Continued cross-sell push using EMI cards, app-based loans, and web traffic.

2.3 Commentary from Management: Signals & Sentiment

“We said what we’ll do — and we delivered on most of it. FY25 saw a credit cost spike, but the underlying engine remains strong. We’ve taken corrective actions and see those yielding results in FY26.”

— BFL Management

Tone of the call:

Acknowledged FY25 as "mixed" — good growth, subdued profit due to credit costs.

Reaffirmed medium-term ambition of sustainable ROA/ROE with a wide moat business.

Clear push towards AI-led operating leverage and diversification beyond consumer lending.

2.4 The Long View: Vision for FY29 and Beyond

Bajaj Finance is transitioning into BFL 3.0 — a full-service FINAI company targeting 200 million customers by FY29. Their long-term strategy includes:

Strategic Vision Pillars:

Be the lowest-cost financial services platform.

Use AI to drive sales, service, underwriting, and audit.

Maintain diversified AUM with sharp risk controls.

Build omnipresent customer engagement across app, web, and physical footprint.

3. Bajaj Finance Valuation Deep Dive

3.1 Current Valuation Snapshot: Metrics and Multiples

Bajaj Finance trades at a valuation that reflects its structural leadership, consistent growth, and digital-first operating model. Below is a snapshot of its key valuation metrics:

Insight: Bajaj Finance justifies its rich multiples through high capital efficiency (ROA, ROE), robust loan growth, and a long-term moat built around digital infrastructure. However, the valuation leaves little room for execution errors or cyclical setbacks.

3.2 How the Valuations Stack Up vs. Peers

Bajaj Finance’s valuation premium is grounded in its execution track record, diversification, and digital flywheel — but it’s meaningfully more expensive than peers.

Vs. Shriram Finance: A deep-value NBFC with lower ROA and higher credit risk; priced for uncertainty. Bajaj commands a quality premium.

Vs. Cholamandalam: Comparable growth and credit discipline, but lacks BFL’s digital ecosystem or customer monetization depth.

Vs. Muthoot Finance: High profitability but limited to a single-product gold loan model. BFL’s diversified playbook earns it broader investor confidence.

Vs. Mahindra & L&T Finance: Still in transition phases, trading at recovery valuations. Bajaj is viewed as a compounding machine, not a turnaround.

Vs. HDFC Ltd (pre-merger): A safe compounder with lower return ratios due to the mortgage business model. BFL’s superior yield and tech edge justify the higher multiple.

Bajaj Finance is priced like a platform, not just a lender.

Its valuation premium isn’t just about past performance — it’s about the ecosystem it has built and the optionality embedded in its digital, product, and AI-led future.Bajaj Finance commands a premium for its growth consistency, digital moat, and operating metrics but the valuation leaves little room for error.

Bajaj Finance remains the benchmark for scalability and resilience — but valuation now reflects that near-fully.

3.3 What’s Priced In: Growth, Risk, and Execution

1. Growth & Profitability Are Assumed Baseline

AUM CAGR of ~25% and PAT CAGR of ~20%+ are not seen as stretch targets — they're expected.

ROA >4.5% and ROE of ~19% are treated as normalised outcomes, not upside scenarios.

The market expects continued operating leverage through stable cost structures and digital efficiencies.

2. Risk Is Considered Well-Contained

GNPA (0.96%) and NNPA (0.44%) are among the best in the NBFC universe — and expected to remain low.

FY25’s higher credit cost (~2.17%) is being discounted as a one-off reset (ECL model refresh) rather than the start of a deterioration cycle.

BFL’s agile underwriting and risk-pricing abilities in unsecured products are trusted.

3. Digital Infrastructure Is Already Valued In

The 70.6 million app user base, 100M+ customers, and 6+ products per customer are seen as durable advantages.

Investors believe Bajaj’s digital-first model translates to lower CAC, higher LTV, and unmatched scalability — and have already priced this moat in.

4. AI (FINAI) Strategy Is a Valuation Floor — Not Yet a Bonus

The company’s BFL 3.0 roadmap, with 100+ AI applications planned across origination, servicing, credit, audit, and operations, is being viewed as an evolution of its tech DNA — not a revolution.

The Street assumes incremental improvements in cost and productivity, not exponential jumps in profitability — at least not yet.

Summary:

Bajaj Finance is being priced like a compounder with a long growth runway — but with zero tolerance for execution errors. It’s not treated like a turnaround or a cyclical NBFC. At 32x P/E, the stock is priced for consistency, not surprises.

3.4 What’s Not Fully Priced In Yet (Optional Upside)

Despite its premium valuation, Bajaj Finance has levers that aren’t fully factored into the current price — any of which could drive upside beyond consensus expectations.

1. Credit Cost Normalization

FY25 saw a one-off spike in provisions (₹7,966 Cr), including ₹359 Cr due to ECL model refresh.

Management has taken corrective underwriting actions. If FY26 credit cost drops closer to 1.85%, EPS could surprise on the upside.

2. Margin Expansion in FY26

Cost of funds peaked at 7.99% in Q4 FY25; management expects it to fall by 10–15 bps in FY26.

Even modest NIM expansion (+10 bps) can meaningfully lift PPOP and PAT — given high financial leverage.

3. Monetization of the 60M+ EMI Card Base

EMI cards have a vast dormant base. Upselling personal loans, insurance, digital credit lines, or cross-selling broking and deposits can boost fee income.

Current valuation assumes steady growth, not hyper monetization of this base.

4. New Growth Engines Yet to Be Proven

MSME lending, gold loans, and corporate leasing are scaling rapidly but contribute <10% of AUM.

If any of these verticals break out in FY26/FY27, it could expand the TAM and growth multiple.

5. FINAI Execution Surprise

Deployment of 100+ AI applications is expected to improve productivity — but the Street is not yet modeling step-function improvements in opex or risk costs.

Early results from AI copilots in sales, service, risk, and audit could surprise positively by FY26 H2.

6. Valuation Re-Rating on ESG or Global Coverage

With ESG upgrades from MSCI (A→AA) and S&P (33→45), Bajaj Finance may enter the radar of new global ESG funds — providing a non-operational trigger for valuation expansion.

Summary:

While Bajaj Finance is priced for quality, it is not priced for breakout upside. If cost of funds falls, credit costs normalize, or monetization of new businesses accelerates, there’s scope for a re-rating — even from current levels

4. Implications for Investors: What to Watch

4.1 Bull, Bear, and Base Case Forecasts for Bajaj Finance

Bull Case: Key Assumptions:

Credit cost improves to ~1.85% as underwriting tweaks and vintage stabilization kick in.

Cost of funds declines meaningfully (by 15–20 bps) due to a more favorable interest rate environment.

Net interest margins expand from pricing normalization and lower funding costs.

AUM growth exceeds 27% driven by strong traction in MSME, gold loans, and cross-sell via digital.

Operating leverage improves faster than expected from early wins in FINAI deployments.

ROA/ROE rise to 4.8% / 21%+ supported by efficiency gains and margin expansion.

Market re-rates the stock with renewed optimism on profitability and platform scaling.

Base Case: Key Assumptions

Credit cost remains within guided corridor of 1.85–1.95% for FY26.

Cost of funds improves marginally (down 10–15 bps), but NIM remains broadly stable.

AUM growth stays between 24–25% — in line with historical CAGR and FY26 guidance.

New segments like MSME and gold loans grow, but remain <15% of overall AUM in FY26.

Opex/NTI improves by 40–50 bps, as modeled — driven by moderate AI productivity gains.

ROA/ROE hold at 4.5–4.6% / 19–20%, supported by balanced growth and profitability.

Market maintains current multiple (~25–26x) due to consistency, but limited surprise.

Bear Case: Key Assumptions

Credit cost remains elevated or rises >2.1% if unsecured portfolio stress resurfaces.

Cost of funds stays sticky due to slower rate transmission or macro disruptions.

NIM contracts due to margin pressure in competitive segments (e.g., personal loans, gold).

AUM growth slows to ~20% amid risk aversion or delayed execution in new lines.

Opex reduction stalls as FINAI execution is delayed or fails to deliver promised efficiencies.

ROA/ROE compress to ~4.2% / 17% — still respectable, but not premium.

Market cuts valuation multiple to 20–22x due to moderation in growth quality.

4.2 Reasons to Stay Invested or Add

Structural Compounder: 26% AUM CAGR + 19% ROE over a long cycle — few peers match this consistency.

Digital Moat at Scale: 100M+ customers, 70M+ app users, and strong cross-sell infrastructure.

Best-in-Class Risk Management: GNPA at 0.96%, NNPA at 0.44% even after FY25 credit events.

AI-Driven Operating Leverage: BFL 3.0 FINAI roadmap could structurally lower opex and credit cost over 3–5 years.

Optional Upsides Not Priced In: MSME, gold loans, EMI card monetization, and margin tailwinds.

Bottom Line: For long-term investors focused on quality and scalability, Bajaj Finance still has legs — especially if credit costs stabilize.

4.3 Key Risks & What to Monitor

Monitoring Checklist:

Credit cost trend vs. guidance corridor (1.85–1.95%)

NIM movement quarter-on-quarter

AUM growth in MSME, gold, and mortgages

Update frequency and adoption of AI applications

4.4 Investor Segmentation Outlook

Disclaimer

Content Accuracy and Reliability: This summary of the earnings call is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities. Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions. No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary. Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional