Australian Premium Solar Q1 FY26 Results: PAT up 125%, Can Beat FY26 Guidance

Guidance of 75% growth with potential upgrades in FY26. Revenue CAGR of 68% for FY25-27. Available at very attractive valuations with leeway for execution risks.

Share your best AI hacks for stock analysis.

Top hacks will be shared back with everyone — you get to learn from the best too.

1. Solar Manufacturers & Solution Provider

australianpremiumsolar.co.in | NSE - SME: APS

Australian Premium Solar - not suited for all:

Limited Trading Volume - Entry and exit is a problem

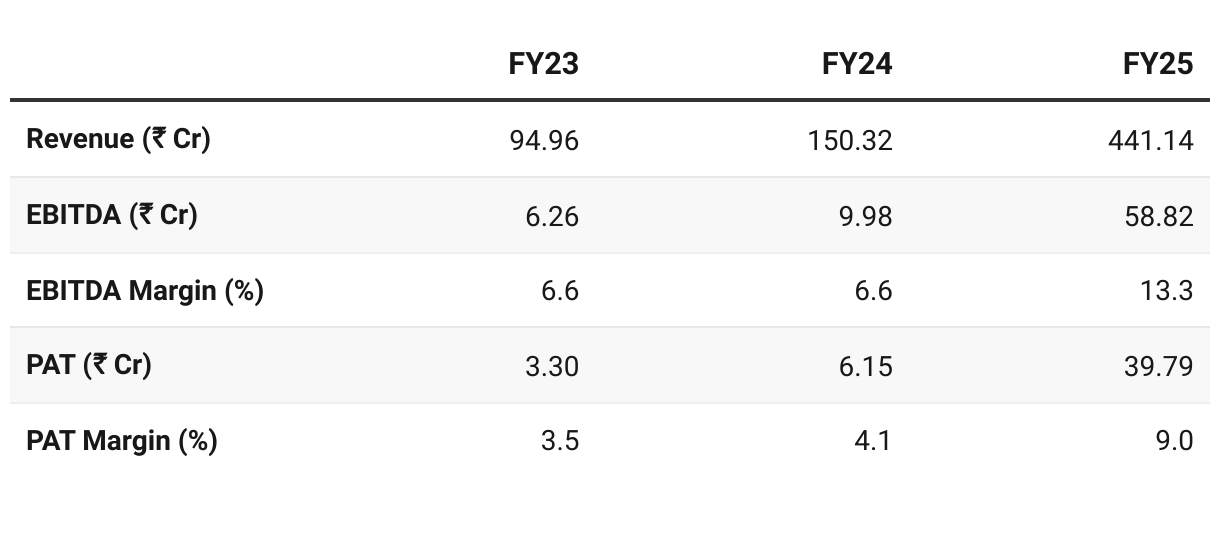

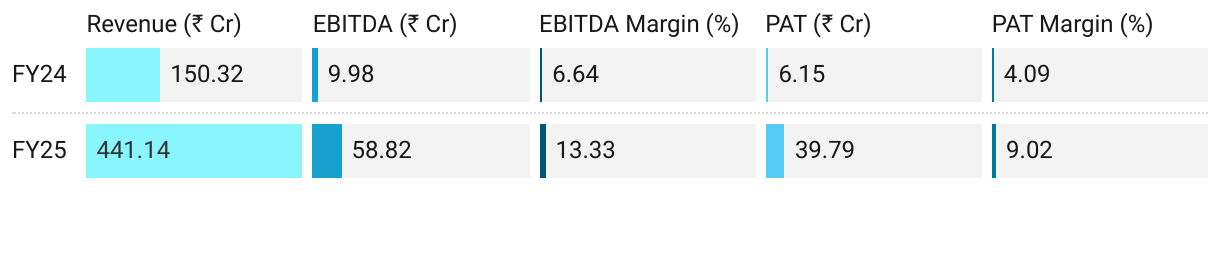

Minimum Purchase = 250 stocks = ₹1.2+ lakh required to enter2. FY23–25: PAT CAGR of 247% & Revenue CAGR of 116%

Capacity & Operations

FY23: 200 MW manufacturing line (Majra, Gujarat). Focused on Gujarat retail rooftop

FY24: Scaled to 600 MW capacity, running at ~70–80% utilization.

FY25:

Procured new TopCon 400 MW line (expandable to 800 MW) – scheduled for commissioning in Aug–Sep 2025.

Began groundwork for 4 GW solar cell project (first 1 GW by FY27, capex ~₹800–900 Cr).

Business Model Evolution

FY23: Rooftop solar retail focus in Gujarat; limited product range (modules + inverters).

FY24: Added solar pump business (leveraging PM-KUSUM scheme).

Won tenders in 2 states, later expanded to 8.

Became a growth driver with higher margins.

FY25:

Strong push into wholesale distribution (75+ distributors).

C&I rooftop segment launched and scaling.

Prepared entry into ground-mounted EPC projects and exports (IEC certification, TopCon demand in US/EU).

Strengthened backward integration plans (solar cell plant).

Between FY23–FY25, APS transformed from a Gujarat-centric rooftop installer into a fast-scaling, multi-segment solar company with pan-India presence and a strategic roadmap into solar cells and exports. The pump and wholesale divisions became key growth engines, while strong execution improved margins and returns.

3. FY25: PAT up 547% & Revenue up 193% YoY

Revenue Mix FY25 (₹ Cr):

Wholesale Distribution: ₹229 Cr (~52%)

Largest contributor, driven by 75+ distributors across 8 states.

Solar Pumps: ₹147 Cr (~34%)

Surged with tender wins under PM-KUSUM, now a high-margin, scale driver.

Margins were higher than rooftop retail because of subsidy-linked pricing and volumes.

Retail Rooftop (Residential + C&I): ₹62 Cr (~14%)

Intentionally capped due to DCR (Domestic Content Requirement) solar cell supply constraints — management plans renewed focus on C&I rooftop from FY26.

Retail share shrank, which actually lifted blended margins, since retail was DCR-constrained and lower scale

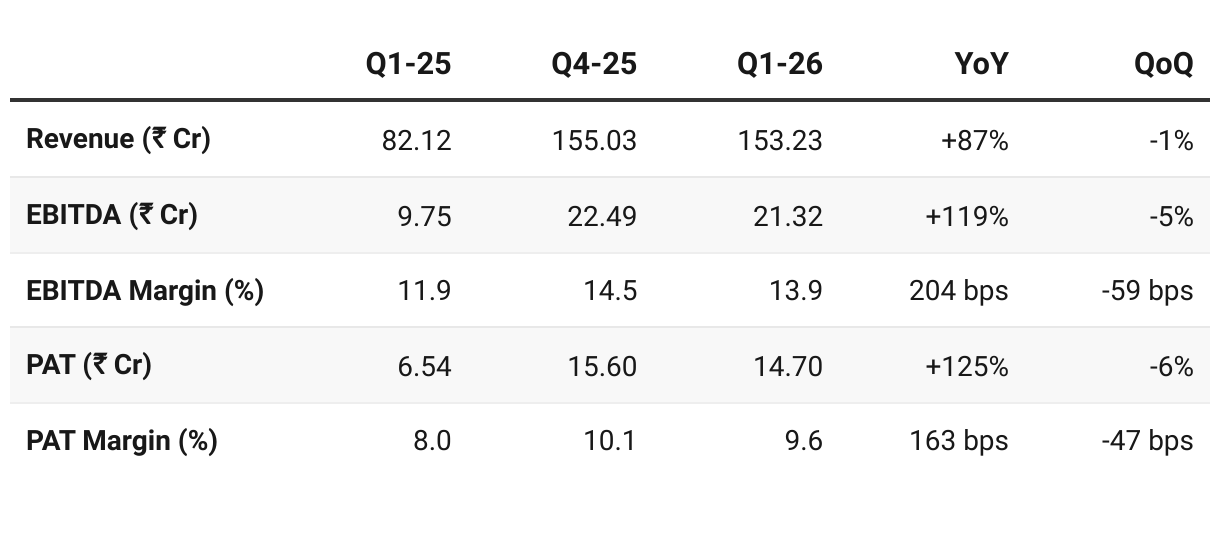

4. Q1 FY26: PAT up 125% & Revenue up 87% YoY

PAT down 6% & Revenue down 1% QoQ

All verticals tracking well: wholesale “worked excellently”; retail/C&I “growing well”; pump segment qualified in nine states with more bids planned.

C&I was launched ~3–4 months prior and is scaling from a small base.

Operations & capacity

Management said they are utilizing full capacity on the existing 600 MW line.

400 MW TopCon expansion targeted to start early Oct 2025;

Next 400 MW expected in the subsequent Q1-27, taking modules toward 1.2 GW phased capacity.

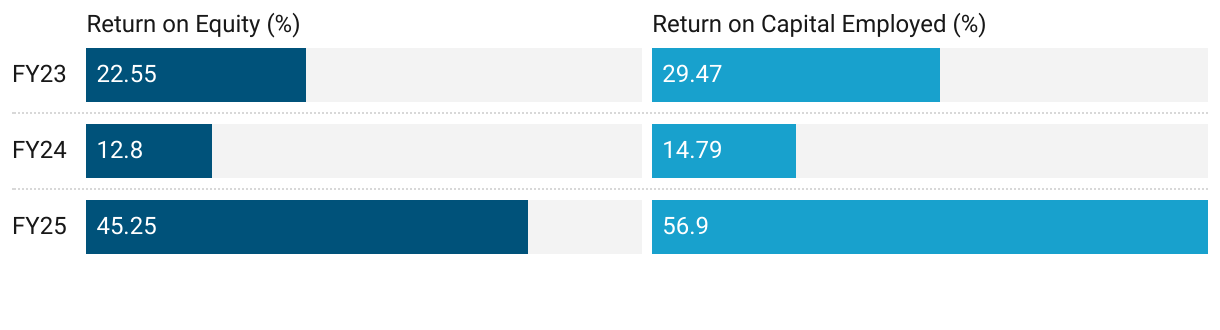

5. Business Metrics: Strong Return Ratios

Funds from IPO in muted FY24 return ratios

6. Outlook: Conservative Growth of 75% in FY26

6.1 FY26 Guidance

We are expecting is about probably 750 to 800 crores by the end of this FY26. And the margins, the EBITDA margin would be around in between probably 12.5 to 14& which will give a PAT of about 9-10% of them.

That's our conservative target, actually, to be precise.

FY2627 I'm talking about we expect turnover of 1,200 to 1,300 from APS then in 2027-2028, probably we expect standalone turnover of APS and its subsidiary like 100% subsidiary. It would be about in the range of 1,700 to 1,800 crore and there would be INR 600 to 700 crores of turnover from A plus solar cell in 2027-2028

APS Growth (as per guidance)

FY26

Expected revenue: ₹750–800 Cr (vs. ₹435 Cr in FY25 → ~75% growth).

Growth mainly from expansion in solar modules, pumps, EPC and retail/wholesale distribution.

No contribution yet from solar cells.

FY27 (2026–27)

Solar cell plant still under construction – so no revenue from solar cell operations.

APS core business (modules, EPC, pumps, inverters, distribution) projected turnover: ₹1,200–1,300 Cr.

FY28 (2027–28)

APS standalone (core business): ₹1,700–1,800 Cr turnover expected.

A+ Solar Cell (subsidiary), the new cell manufacturing vertical, expected to add ₹600–700 Cr.

This would be its first meaningful year of revenue after commissioning.

Total consolidated turnover: ~₹2,300–2,500 Cr.

6.2 Q1 FY26 vs FY26 Guidance — Australian Premium Solar

Ahead of FY26 guidance on revenue growth

Strong Start vs FY26 Guidance:

Annualised Q1 revenue = ~₹610 Cr.

To hit midpoint guidance ₹775 Cr, APS needs ₹207 Cr per quarter.

Given pump installations are seasonally H2-heavy, guidance appears achievable.

Strong Margins:

EBITDA 13.9% and PAT 9.6% already within guided bands → no margin pressure visible.

Wholesale + pump mix is sustaining double-digit profitability.

APS started FY26 on track, with Q1 delivering margins in line with guidance and segment mix already aligned to the annual plan.

Execution of pump orders in H2 and timely TopCon commissioning are key to meeting the ₹750–800 Cr revenue target.

7. Valuation Analysis

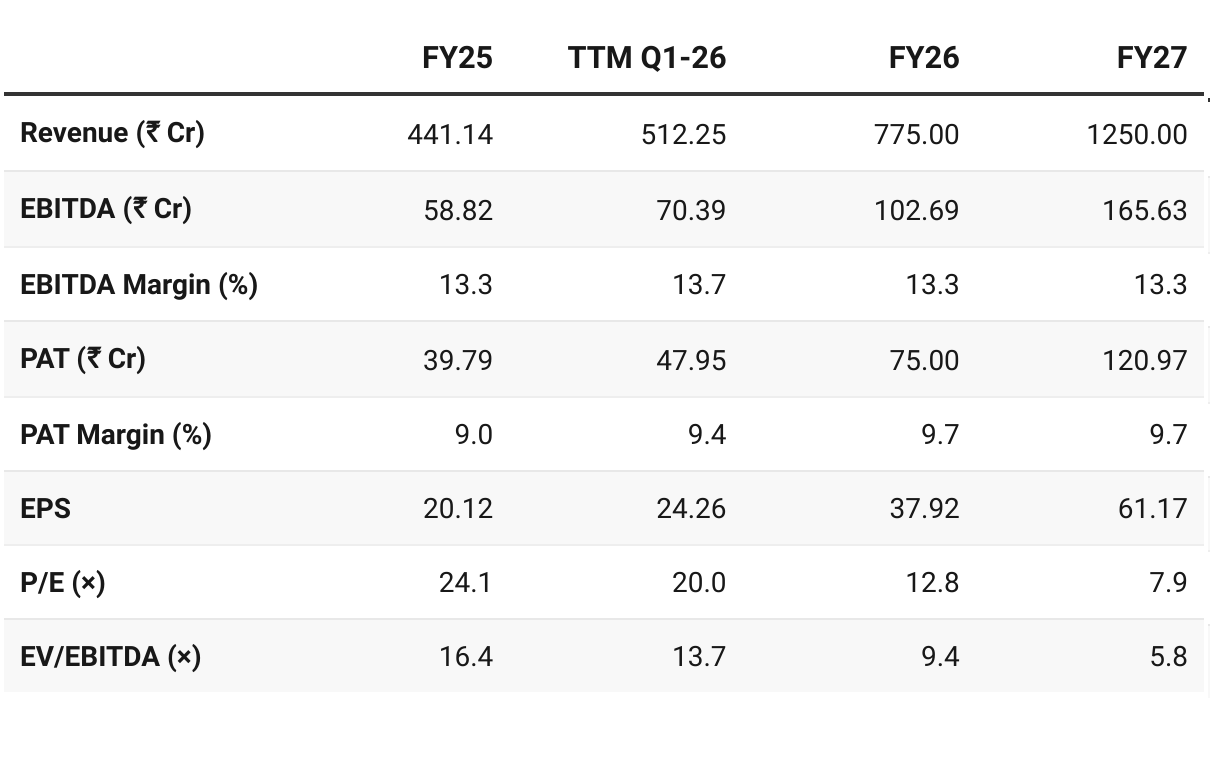

7.1 Valuation Snapshot — Australian Premium Solar

CMP ₹496.6; Mcap ₹972.16 Cr;

Valuation does not consider FY28 as solar cell plant is under construction

Attractive Forward Valuation:

APS looks fair on TTM numbers, but multiples compress sharply as earnings scale.

Scope for valuation re-rating if growth trajectory sustains.

Valuations are undemanding — provide flexibility to sustain periods where performance is not as per guidance

APS, is trading at a discount, reflecting its smaller scale and execution risks (capacity ramp-up, pump order execution, solar cell CapEx).

Looking reasonably priced on FY26E and potentially undervalued on FY27E, provided execution stays on track. Multiples leave room for re-rating as APS transitions from a Gujarat-focused rooftop player to an integrated solar manufacturer.

7.2 Opportunities at Current Valuation

Attractive Forward Valuation: Trading at a discount, well below peers. Scope for re-rating if growth sustains.

Valuations are Conservative: Potential for upgrade of FY26 guidance

Growth Visibility: Pathway to growth is attractive. From ₹435 Cr in FY25 to ₹2,300–2,500 Cr by FY28

Tailwinds — Policy & Government Support

DCR mandates, rooftop subsidies, and PM-KUSUM program create protected domestic market.

Eligible for 25–30% CapEx subsidy on new solar cell line.

7.3 Risks at Current Valuation

Microcap Risk: May not grow into a small-cap; Illiquid, SME-listed; entry/exit difficult

Scale vs Valuation Gap: While valuations look cheap, discount may persist until APS delivers on FY26 and FY27 guidance

Execution Risk: Timely commissioning of the TopCon 400 MW line (Oct 2025) and subsequent 400 MW phase critical to achieving FY26–27 growth.

Working Capital Stress: Pump business (large share of revenues) has subsidy-linked receivables; could pressure cash flows despite strong order book.

CapEx Burden: ₹800–900 Cr for solar cell project – funding mix of debt + equity may dilute returns or strain balance sheet if delayed.

Competitive Intensity: Larger peers (Adani, Waaree, Vikram) with 5–10 GW+ capacity could pressure pricing/market share.

Policy Dependence: Heavy reliance on government programs (PM-KUSUM, rooftop subsidies, DCR rules) — policy changes could impact demand/margins.

Share your best AI hacks for stock analysis.

Top hacks will be shared back with everyone — you get to learn from the best too.

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Kindly correct. Madhusudan Masala written in Future guidance section.