Aurionpro Solutions: PAT growth of 37% & revenue growth of 37% for 9M-24 at a 38 PE

AURIONPRO is in the middle of a strong run with 11 consecutive quarters of PAT growth. AURIONPRO has a long term goal of 25-30% revenue growth with 15% PAT margin

1. Dominant player in the banking & fintech industry in Asia providing software products & consulting services

aurionpro.com | NSE: AURIONPRO

Segmental Revenue

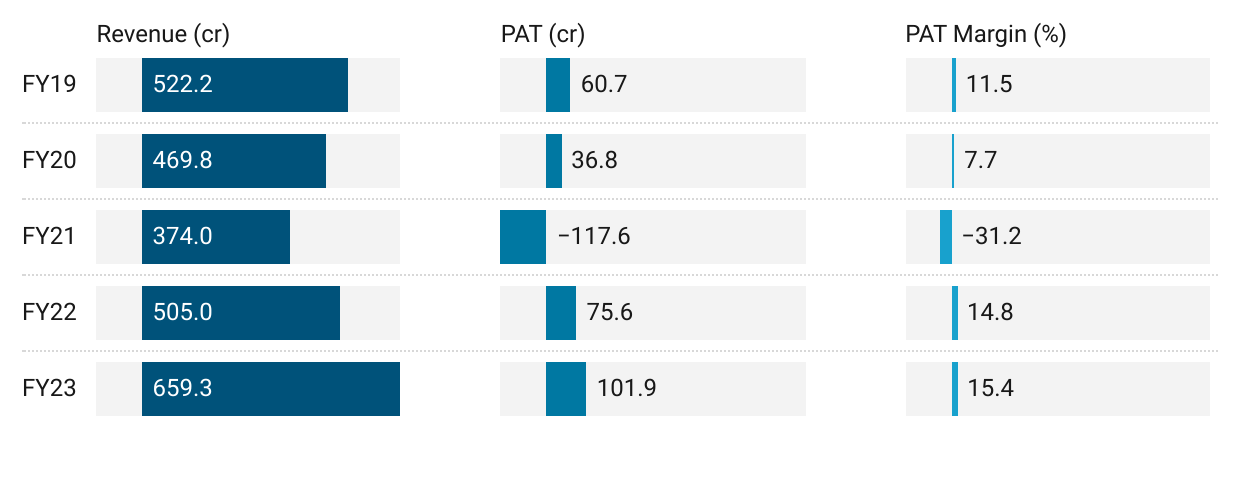

2. FY19-23: PAT CAGR of 14% & Revenue CAGR of 6%

Growth picked up from FY22

3. FY23: PAT up 35% & Revenue up 31%

4. Strong H1-24: PAT up 34% & Revenue up 37% YoY

5. Strong Q3-24: PAT up 44% & Revenue up 37% YoY

PAT up 11% & Revenue up 9% QoQ

6. Strong 9M-24: PAT up 37% & Revenue up 37% YoY

7. Business metrics: Strong return ratios

8. Strong outlook: Strong long term goals

i. Strong long term goals

Management Goal: Top quartile across key metrics

ii. Strong revenue visibility based on order book

Our order book now exceeds Rs. 900 Cr, demand and deal pipeline is the largest it's ever been.

Typically, most of the order book that we declare, is executable I would say +70% of it is executable over the next 12 months.

9. PAT growth of 37% & Revenue growth of 37% in 9M-24 at a PE of 38

10. So Wait and Watch

If I hold the stock then one may continue holding on to AURIONPRO

Based on 9M-24 performance, AURIONPRO looks on track to deliver the strongest revenue & PAT in FY24

AURIONPRO is in the middle of a strong run and has delivered sequential QoQ growth in PAT for 11 consecutive quarters starting Jun-21

The roadmap of long term revenue growth of 25-30% and PAT margin of 15% provides a reason to continue with AURIONPRO over the longer term

11. Join the ride

If I am looking to enter AURIONPRO then

AURIONPRO has delivered PAT growth of 37% and revenue growth of 37% in 9M-24 at a PE of 38 which makes the valuations fairly valued in the short term.

With a long term revenue growth outlook of 25-30% and PAT growth of 15% provides opportunities in AURIONPRO over the longer term at a PE of 38 makes the valuations quite attractive over the longer term.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer