Ashoka Buildcon: PAT growth of 326% & revenue growth of 9% in 9M-25 at PE of 3

Guidance of flattish revenue in FY25 with 10-15% growth in FY26. Order book in place to support revenue outlook. Changing into EPC business. Opportunity of PE re-rating inspite of weakness in stock

1. Construction company : EPC + BOT + HAM… changing to EPC

ashokabuildcon.com | NSE: ASHOKA

2. FY20-24: PAT CAGR of 34% & Revenue CAGR of 18%

3. Strong FY24: PAT up 40% & Revenue up 21% YoY

4. Q3-25: PAT up 502% & Revenue down 10% YoY

Ashoka Buildcon & its subsidiary, Ashoka Concessions Limited (ACL), signed agreements to sell their entire stake in five BOT road project.

The sale process is not yet complete but is expected to be finalized soon.

Ind AS 105 requires that when an asset (or subsidiary) is classified as "held for sale", it must stop normal depreciation/amortization

Since amortization has stopped, there’s a reduction in expenses, leading to higher reported PAT.

The recognition of DTA (₹424.27 crore) has boosted the net profit in Q3 FY25.

This does not mean an actual cash inflow, but an accounting adjustment based on expected tax savings.

During the quarter, the Company and its subsidiary Ashoka Concessions Limited has entered into share subscription and purchase agreements and other transaction documents for sale of its entire stake in five of its wholly owned subsidiaries which are engaged in construction and operation of road projects on Build Operate Transfer (BOT) basis, which is subject to completion of certain conditions precedent including approval from the lenders of the respective subsidiaries and other regulatory approvals. Considering the high probability of the sale transaction getting completed, as per Ind AS 105 the assets and liabilities of these subsidiaries have been classified as held for sale in the current quarter. Consequent to this, the amortization of intangible assets in these subsidiaries have been discontinued in the consolidated financial results from the date of classification as held for sale. Further, the Company has also recognized deferred tax asset of Rs 424.27 crores on the difference between the carrying value of the net assets of such subsidiaries in the consolidated books and its tax base

5. 9M-25: PAT up 326% & Revenue up 9% YoY

6. Business metrics: Weakening return ratios

7. Outlook: Revenue supported by order book

i. FY25: Flat Revenue

We'll try to achieve the last year numbers, but it could be short achieved by about 2% or 3%. I'm not sure. We'll just see by how the year ends, a couple of next 2 months ends.

ii. FY26: Revenue growth of 10-15%

So for FY '26, we expect based on the order book received in the last quarter and expected orders in the coming quarters, we expect at least 10% to 15% growth in the revenues over '25

Driven by EPC project execution across roads, railways, power T&D, and building projects.

Key revenue contribution from Road EPC & Power EPC

iii. FY26: Sustainable margins

FY26: margins to the tune of 10% to 11%. (compared to 10.3% in Q3 FY25).

For Q4, we try to achieve the same margins of Q3. Overall mix would be in the range of 8.5%.

Stable execution and cost control expected to maintain this level.

Project mix improvement (less low-margin contracts) to aid margins.

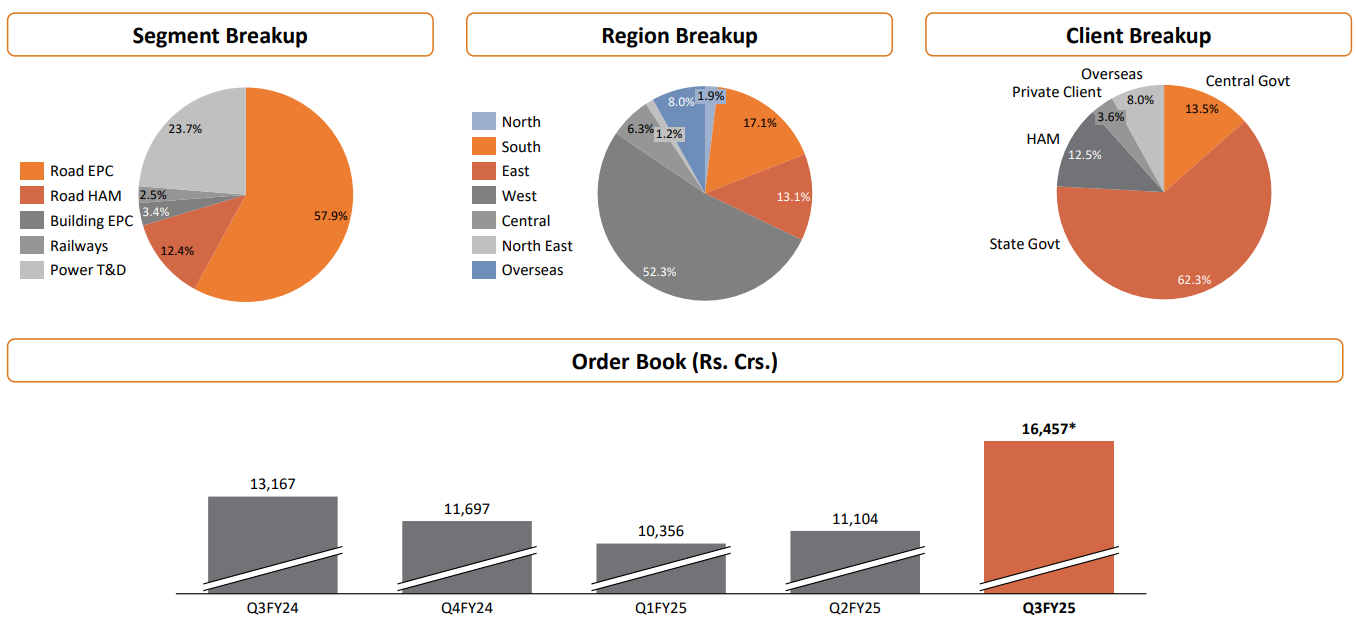

iv. Order book sufficient about 1.5X+ FY26 expected revenue

FY26: Order inflow guidance be in the range of INR12,000-14,000 crores.

NHAI + MoRTH pipeline worth ₹1.11 lakh crore: Strong tendering momentum

Q4 FY25 expected order wins: ₹3,000-4,000 crore.

v. FY26 - Outlook

PAT Growth (After Adjusting for One-Time Gains):

PAT growth will normalize post ₹424 crore deferred tax benefit in Q3 FY25.

Core earnings expected to rise as BOT/HAM divestments reduce interest costs.

Debt Reduction Plan (Key Near-Term Catalyst)

Major Target: ₹4,000 crore Debt Reduction by March 2025

₹2,500 crore from BOT asset sales (target completion: March 2025).

₹1,000 crore from HAM project sales by H1-26.

Reduced interest burden to improve cash flows & net margins.

Shift to Pure EPC Model (Exit from BOT/HAM Assets)

Focus on high-margin EPC business (roads, railways, power, buildings).

HAM/BOT projects will be monetized to free up capital for EPC bidding.

Last remaining HAM project (₹1,700 crore Bowaichandi Road) will stay.

Diversification Beyond Roads

Railways & Power T&D growing in share:

Railways order book: ₹417 crore.

Power T&D: ₹3,796 crore (~23% of total order book).

Target: 30%+ share from non-road segments over 2-3 years.

Urban Infra & International Expansion

Winning large urban infra projects (CIDCO, MMRDA, BMC).

International projects in Bangladesh & Guyana (₹842 crore total).

Exploring Green Hydrogen (MoU with Bihar govt.), but in early stage.

Potential Risks

Delays in BOT/HAM sale approvals (lender & NHAI approvals required).

Execution delays due to election-related slowdowns.

Rising working capital needs in EPC (but improving after BOT sales).

Management’s Strategy to Mitigate Risks

Focus on execution speed & cash conversion cycle improvement.

Avoiding BOT projects → No new bids for BOT models.

Bidding selectively for high-margin EPC projects.

8. PAT growth of 326% & Revenue growth of 9% in 9M-25 at a PE of 3

9. Hold?

If I hold the stock then one may continue holding on to ASHOKA

The guidance of flattish growth in FY25 with 10-15% revenue growth is not exciting. However, the underlying business momentum is in place given the strong order book and guidance of margin expansion.

Order book for ASHOKA is sufficient to not only support Q4-25, but also provides strong visibility in FY26.

Government's infrastructure spending remains strong, benefiting EPC players like Ashoka.

Monetization of assets will bring down leverage, leading to better financial health and improving margins

ASHOKA management is acknowledging the volatility in the stock prices but does not see it related to any negative change in business or the sector.

I think the stock markets are playing out more on public sentiment and sentiment with the government. I cannot really specifically say why stocks are moving up or down in these last couple of months throughout in every sector. So better not said than commit anything on that.

10. Buy?

If I am looking to enter ASHOKA then

ASHOKA has delivered PAT growth of 269% and revenue growth of 21% in H1-25 at a PE of 3 which makes the valuations attractive in the short term.

Low P/E suggests undervaluation, but earnings have one-time tax gains; thus, normalized earnings should be considered.

The revenue guidance of about 10-15% revenue growth in FY26 with 10-11% at a PE of 3 makes the valuations attractive from a FY26 perspective.

ASHOKA has a net-worth of Rs 3,706 cr as Q3-25 end and is available at a market cap of Rs 4,832 cr which implies a price to book of 1.3 which makes valuations quite attractive.

The value unlocking by ASHOKA expected by Apr-March-25 through Asset Monetization will add to the upside in either FY25 or FY26 and makes the valuations at PE of 3 quite attractive.

The risk in the thesis around ASHOKA is if the asset monetization does not go as per plan. However, at a PE of 3 their is a margin of safety in the valuations.

If order execution remains strong and debt reduction happens, P/E could re-rate to ~5-6x (aligning with peers like KNR Constructions, PNC Infratech).

Previous coverage of Ashoka

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer