Anand Rathi Wealth Q1-26 Results: Profit Up 28%, Record Net Inflows; FY26 Guidance on Track

On track for 25% PAT growth in FY26. Q1 solid despite weakness in Distribution of Financial Products. Anand Rathi trades at a premium, pricing in 3–4 years of growth

1. Wealth Management Firm

rathi.com | NSE: ANANDRATHI

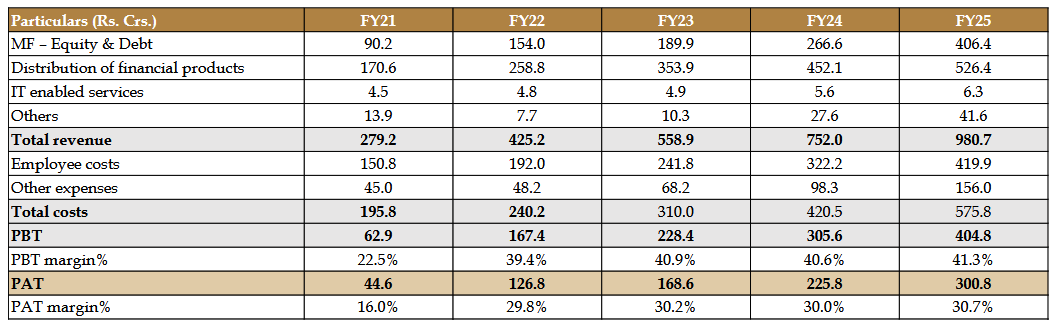

2. FY21-25: PAT CAGR of 61% & Revenue CAGR of 37%

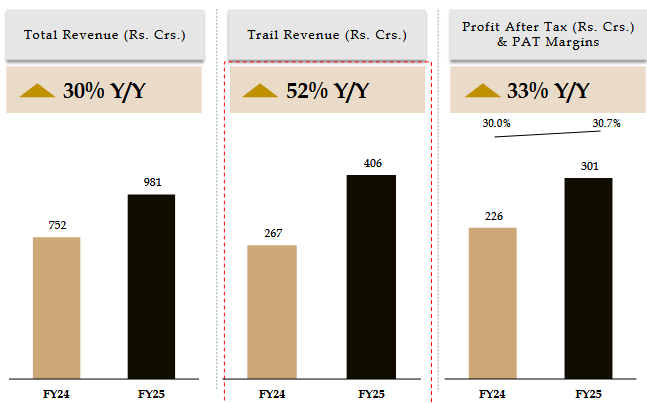

3. Strong FY25: PAT up 33% & Revenue up 30%

4. Q1-26: PAT up 28% & Revenue up 16% YoY

PAT up 28% & Revenue up 18% QoQ

✅ Hits (What Went Well)

Strong Profit Growth

PAT rose 28%. PAT Margin improved, reflecting margin discipline and efficiency.

Surging AUM

AUM grew 27.2% YoY to ₹87,797 Cr — already 88% of FY26 target in Q1.

Driven by both net inflows and market gains, especially in structured products (+42%).

Operating Leverage: Revenue grew 15.8%, but PBT grew 27.6%, indicating cost control and expanding operating margin

Robust SIP and Net Flows

Monthly SIP Inflows: ₹382.5 Cr (↑14%)

Net Inflows: ₹7,500 Cr (↑50% YoY)

Improved RM Productivity

AUM per Relationship Manager: ₹32 Cr (↑10% YoY)

Client Families per RM: also up — more business per advisor

❌ Misses (What Could Be Better)

Slower Growth in Distribution Income

Distribution of financial products grew only 8.3% YoY, much slower than other verticals like MF (+27%) or “Others” (+31%).

Rising Cost Base

Other Expenses up 14.3%, — should be monitored if the trend continues.

Still manageable, but room for more operating leverage.

Digital Wealth Business – Early Stage

Digital AUM at ₹2,055 Cr vs core AUM of ₹87,797 Cr.

Still <3% of total AUM despite push — needs stronger execution.

Employee Cost Growth

While YoY employee cost rise was moderate (5.6%), future scalability depends on managing this while increasing RM productivity further.

Big Beat on Profitability & AUM. Slight lag in distribution growth and cost control, but overall Q1-26 is a solid execution win.

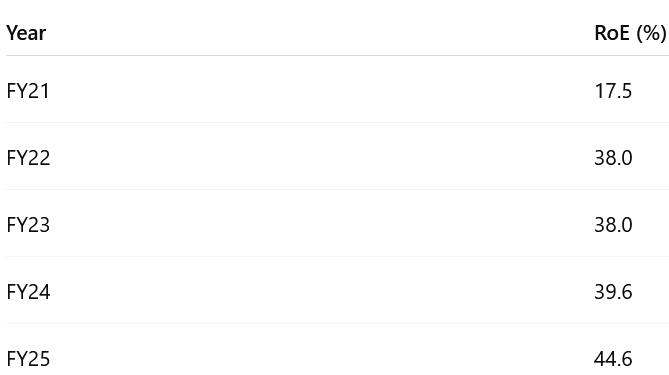

5. Strong return ratios

Anand Rathi is compounding wealth efficiently without heavy reinvestment or leverage

6. FY26: Guidance of 25% Growth

Management commentary after Q1-25 Results: We are confident of achieving our guidance.

7. Valuation Analysis — Anand Rathi Wealth

7.1 Valuation Snapshot

Current TTM P/E: 55.3× — significantly above long-term average for wealth firms.

Forward FY26 P/E: 47× (PAT = ₹375 Cr) — still pricing in strong earnings momentum.

At ~47× forward P/E, the current valuation assumes ~25% PAT CAGR beyond FY26.

To justify or expand this valuation, Anand Rathi must:

Beat ₹375 Cr PAT in FY26

Compound earnings toward ₹600–650 Cr by FY29

Scale tech and maintain high RoE (>40%)

Anand Rathi Wealth looks overvalued at 55× P/E, unless it can beat FY26 PAT guidance or re-rate on AUM scale/tech execution.

Therefore, market is pricing in future earnings growth ~25% CAGR for at least 3–4 years

7.2 Opportunity at Current Valuation

High Quality Compounding: 5-year PAT CAGR > 30%, RoE > 40%, PAT margin > 30% — rare combo

Asset-Light Model: Scalable without heavy capital; RM productivity still improving

Under-penetrated Market: India’s wealth industry (esp. HNI/UHNI) growing at 15–17% CAGR

Sticky Client Base: 79% AUM >3 yrs old, attrition near zero — recurring, predictable revenue

Optionality: Digital Wealth + OFA platforms still small but could unlock growth

Strong Earnings Visibility FY26 PAT guidance of ₹375 Cr is achievable; could exceed if net inflows stay high

If PAT compounds at ~25% CAGR beyond FY26, current price may still deliver decent upside over 3-4 years.

7.3 Risk at Current Valuation

Rich Valuation P/E ~55x TTM, ~47x FY26E — very high; leaves no room for disappointment

Growth Already Priced In Market is assuming >25% PAT CAGR for next 3-4 years

Slow Distribution Growth Only 8.3% YoY in Q1 — flattish trend in a core vertical

Tech Platform Scale-up Slow Digital AUM & OFA still contribute <3% — limited near-term impact

Valuation Compression Risk If AUM growth moderates or PAT misses guidance, stock could de-rate

📌 Even a small growth miss or market correction could compress the multiple — downside risk from re-rating.

Opportunity: Top-tier compounding business in a booming industry with strong fundamentals and optionality

Risk: Fully priced, and even small growth or margin disappointments could hurt returns

Previous coverage on ANANDRATHI

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Astonishing results of Q1