Anand Rathi Wealth: 34% PAT growth & 35% revenue growth in FY24 at a PE of 75

Strong performance in FY24 already in the price. Guidance for FY25 is already in the price. While ANANDRATHI is executing well the stock price may have run ahead

1. Leading Private Wealth Solutions company

anandrathiwealth.in | NSE: ANANDRATHI

3rd largest non-bank sponsored mutual fund distributor in India

2. FY18-24: PAT CAGR of 30% & Revenue CAGR of 22%

3. Strong 9M-24: PAT up 34% & Revenue up 35%

4. Strong Q4-24: PAT up 33% & Revenue up 34%

5. Strong FY-24: PAT up 34% & Revenue up 35%

6. Strong and consistent return ratios

Return on Equity

7. Outlook: Conservative guidance for FY25

We are confident in our future, projecting a continued growth trajectory of 20%-25%.

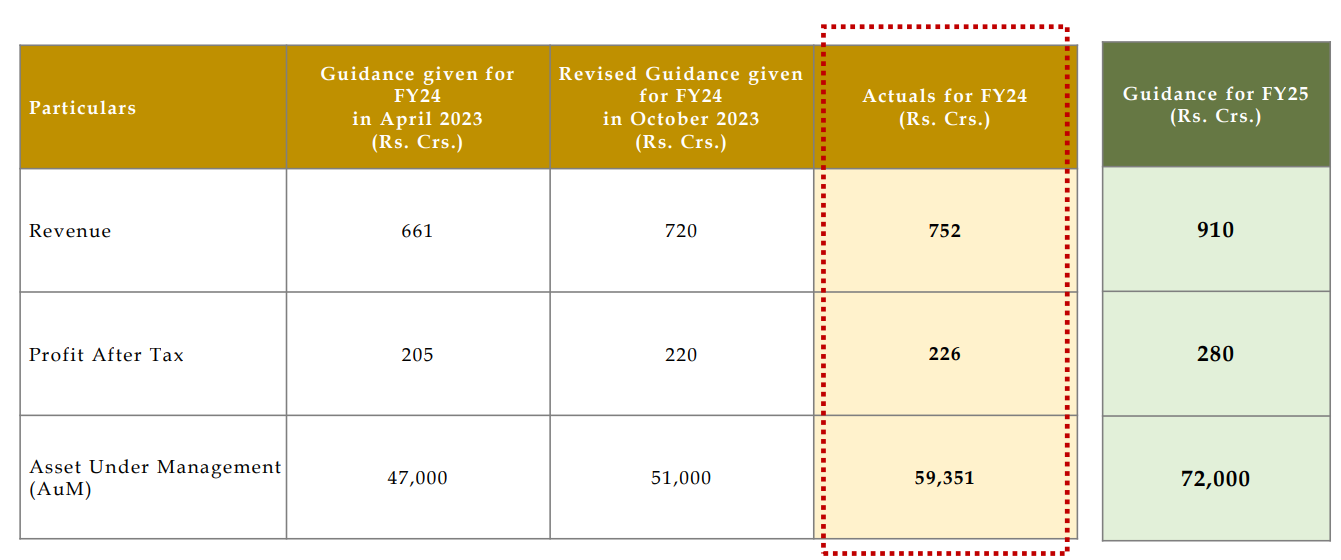

FY24: Outperforming the guidance for the year

FY25: Guiding for a slow down in growth momentum in FY25 compared to FY24 is indicative of a very conservative guidance to create an opportunity to revise the guidance upward during the year

Revenue growth of 21%

PAT growth of 24%

8. PAT growth of 34% & Revenue growth of 35% 9M-24 for a PE of 56

9. So Wait and Watch

If I hold the stock then one may continue holding on to ANANDRATHI

Coverage of ANANDRATHI was initiated after Q2-24 results. The investment thesis has not changed after a strong Q4-24. The management has beaten its guidance for FY-24.

Given the 30%+ top-line & bottom-line growth rates in FY24 the guidance for 20-25% growth in top-line & bottom line looks conservative. One can take a quarter by quarter view on ANANDRATHI and see if it revises its guidance in the middle of FY25, the way it did in FY24

11. Or, join the ride

If I am looking to enter ANANDRATHI then

ANANDRATHI has delivered a strong FY24 with PAT up 34% & revenue up 35% at PE of 75 which makes the valuations quite rich in the short term.

The strong performance in FY24 is already discounted in the price. Outlook for FY25 is already in the price at PE of 75. While the company is executing well the stock price may have run ahead of its business performance in the short term.

At a PE of 75 the margin of safety is limited in ANANDRATHI, one not so strong quarter and the stock may start looking quite expensive.

From the ANANDRATHI management’s perspective, the stock is not over valued from a longer term perspective and its ready to buy back (subject to shareholders approval) its equity at a price which is close to 10% premium over the prevailing market price.

The Board of Directors has approved a proposal to buyback up to 3,70,000 Equity Shares at Rs. 4,450 per equity share for an aggregate amount not exceeding Rs. 164.65 crores, representing 0.88% of the total paid up equity share capital

Previous coverage on ANANDRATHI

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Appreciate that you share financial updates of indian companies here 👍