Anand Rathi Wealth: 37% PAT CAGR & 26% revenue CAGR for FY18-24 at forward PE of 35

ANANDRATHI has revised its guidance upwards after a very strong H1-24 where performance in both Q1 and Q2 was quite strong.

1. Leading Private Wealth Solutions company

anandrathiwealth.in | NSE: ANANDRATHI

3rd largest non-bank sponsored mutual fund distributor in India

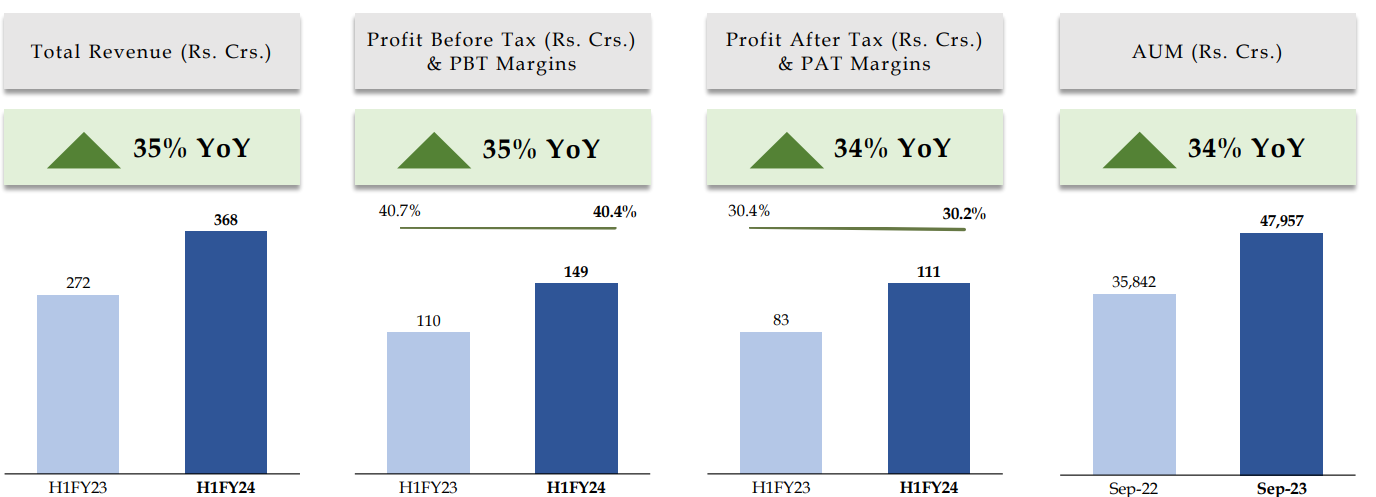

2. FY18-23: PAT CAGR of 30% & Revenue CAGR of 20%

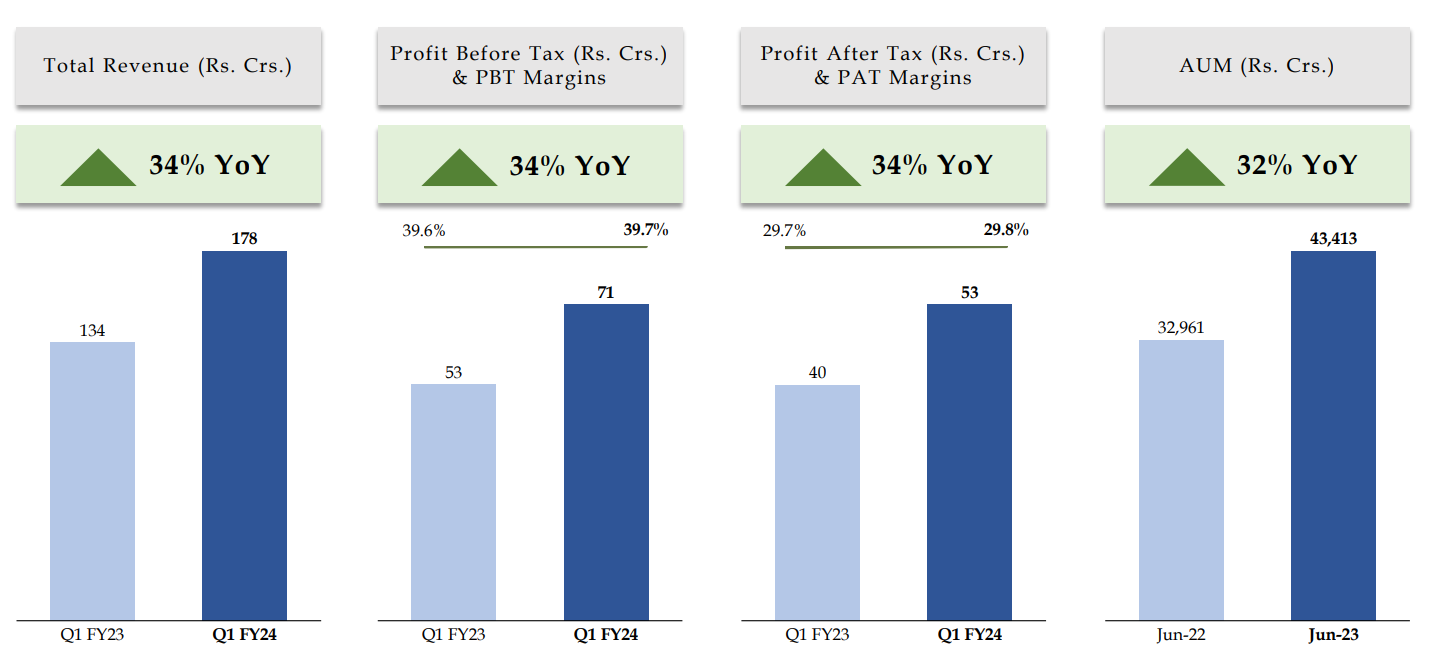

3. Q1-24: PAT up 34% & Revenue up 34% YoY

4. Strong Q2-24: PAT up 33% & Revenue up 36% YoY

Strong QoQ growth: PAT up 8% & Revenue up 6%

5. Overall H1-24 looking strong: PAT up 34% & Revenue up 35%

6. Strong and consistent return ratios

7. Outlook: Outperforming the guidance

Growth outlook for FY-24 vs FY23

Revenue = 29%

PAT = 30%

EPS = 30%

8. 30% EPS growth for FY-24 for a forward PE of 35

9. So Wait and Watch

If I hold the stock then one may continue holding on to ANANDRATHI

ANANDRATHI has delivered a strong H1-24 where both Q1-24 and Q2-24 were good.

Along with the strong H1-24, there is a track-record of delivering results

ANANDRATHI has revised its guidance upwards which gives confidence in the outlook for the remaining part of FY24.

11. Or, join the ride

If I am looking to enter the stock then

ANANDRATHI has delivered a strong H1-24 with PAT up 34% & revenue up 35% at FY24 forward PE of 35 which makes the valuations quite reasonable.

If one feels that the growth momentum guided for FY24 will continue into FY25, then the valuations could start looking attractive

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades