Agarwal Industrial Corporation: 6.8X revenue & 10.3X PAT FY17-23 at reasonable valuations

FY24 to grow as the same trajectory as FY23 on the back of year on year growth in the last seven years

1. Largest integrated player transporting Bitumen into India

Largest Bitumen company in the private sector

aicltd.in | NSE: AGARIND

Agarwal Industrial Corporation Ltd is an integrated bitumen logistics and ancillary company. It plays a prominent role right from sourcing of bitumen to ocean transportation, to storage, to value addition and manufacturing, to road transportation and finally, sending it to our final customers.

Ocean transportation is done either by own vessels or vessels hired from third parties. Transportation of bitumen via the ocean is a key lever in the business and has to be kept in mind while analysing the business

Highest ever numbers in terms of top line operating profit and bottom line in FY 23.

2. EPS = 6X from FY17 to FY23

Barring FY18, earnings per share (EPS) has grown year on year for every year from FY17 to FY23

3. Blistering business growth driving EPS

YoY growth delivered every year for the last seven years

Revenue = 6.8X between FY17-FY23 at CAGR of 38%

PAT = 10.3X between FY17-FY23 grew faster than the top-line at CAGR of 47%

FY23 performance

The company has reported a 26.35% rise in the total revenue at INR2,024.08 crores in FY '23.

Company has reported a 32.03% rise in EBITDA at INR144.57 crores in FY '23.

Company's FY 23 PAT surged by 44.87% from INR63.68 crores in FY '22 to INR92.25 crores in FY 23

4. High quality growth, return ratios have improved

Not only PAT margins have increased, so have the return rations. Most importantly returns are getting converted to cash.

5. Potential to improve EBITDA by 35%

Transportation of bitumen by own vessels improving margins

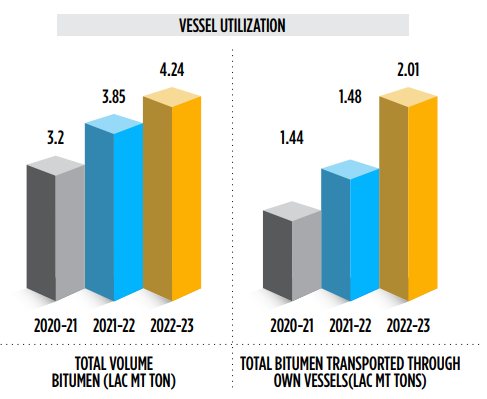

Of the 4.24 Lac MT of volume in FY24, 2 Lac MT was brought to India through own bitumen vessels. The balance was transported to India through hired third party vessels.

If all the volume had been transported by own vessels there was a potential to increase EBITDA by another Rs 50 cr against the FY23 EBITD of Rs 150 cr i.e. a potential to increase EBITDA by another 35%

If we are able to meet this demand, this additional volume, through our own bitumen vessels, we will be able to save $15 per metric ton in this volume. So somewhere around 50 crores.

6. Addition of two own vessels to improve margins in FY24

Addition of two new vessels to improve bottom-line in FY24

There was a seventh vessel which was deployed half of February and the eighth vessel, Rudra, is being operational in the current year and it was not a part of the business in the last year. So the seventh and eighth vessels effectively will be fully operational in the current year and the operational on top line and bottom line will be seen in this year.

7. In addition to margins, strong guidance for FY24

i. Expect the FY23 performance to continue in FY24

We believe that we continue to grow in coming years and for 2024 we are expecting to grow at the same pace as in FY 23.

ii. 10-20% volume growth for FY24 vs 10.13% in FY23

As informed on all the con calls, we are targeting a volume of additional volume of 10% to 20% on a year on year basis.

10. EPS CAGR of 35% for FY17-23 at a PE of 13

Valuations at a 13 PE, very attractive considering past EPS CAGR of 35%

11. So Wait and Watch

If I hold the stock then one must

Wait and watch for quarterly results to see if the growth momentum is continuing at the same pace as before

12. Or join the ride

If I am looking to enter the stock then

Valuations are reasonable. PE of 13 for past EPS growth at 39% CAGR

Potential for margin improvements and bottom-line growing faster than top-line to continue till close to 80%+ of volumes are transported by own vessels. Two more vessels getting added in FY24 will add to the volume of bitumen being transported by own vessels and drive bottom-line in FY24

Potential for top-line growth on account of industry tailwinds and new markets

This is multi-year story and should enter AGARIND with an intent to stay in for a few years and see multi-bagger returns from current levels.

Don’t like what you get every morning?

Let us know at hi@moneymuscle.in

Will send you better stuff.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades