Aditya Vision Ltd - Exciting growth

Limited yet excellent track record, exciting future outlook and available for a reasonable price

Company Overview

Aditya Vision is a modern multi-brand consumer electronics retail chain headquartered in Patna, Bihar. Started with one retail store in Patna in 1999 and currently, is a chain of consumer electronics retail stores with presence in all districts of Bihar and in all the major cities of Jharkhand and Uttar Pradesh (Purvanchal)

Share Details

BOM:540205

Closing Price = 1,550 (22-Jun-23)

52 Week High = 1845. Trading at 16% below 52 wk high

52 Week Low = 714. Trading at 117% above 52 wk low.

P/E = 29

Market Cap = 1,864 cr ( ~$ 227 million)

Quality: Returns on capital employed in cash

Consistently high returns on capital are one sign we look for when seeking companies to invest in. On this front Aditya Vision has delivered magnificently.

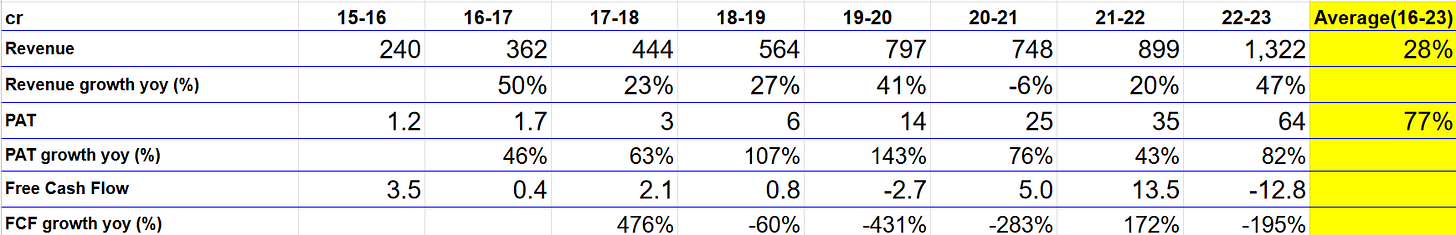

Growth

While high returns on capital are one sign we look another sign is a source of growth. High returns are not much use if the business is not able to grow and deploy more capital at these high rates. On the front of growth too then numbers are excellent. Eight financial years of excellent growth.

Outlook

Our stated goal is 150 stores by financial year 2025. We have already opened five more stores in FY ’24 and have already entered into lease agreements for another 20 more stores. We are confident of achieving our target, if not bettering it.

We have been historically, we have been growing at a pace of around 27%, 28%. So in my opinion, there is no reason why we should not achieve that what we have done in past 10 years.

Our guidance will always remain between 14% to 16% of gross margin.

I don’t think so that our margin will expand any further. We will be striving to maintain it at the same rate.

Management comments during Q4-23 earnings call

So What????

If I own the stock, I will definitely hold on for the long term till the growth story plays out completely.

If I don’t own the stock, I would like to enter it. A company growing both the top line and bottom line along with its return ratios for 8 financial years quoting at a PE of 29 is worth buying into. I would like to dip build a position in the stock over a period of time while keeping in mind the risk of investing in a small company.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades