Aditya Birla Money: PAT growth of 102% & Revenue growth of 66% in H1-25 at PE of 13

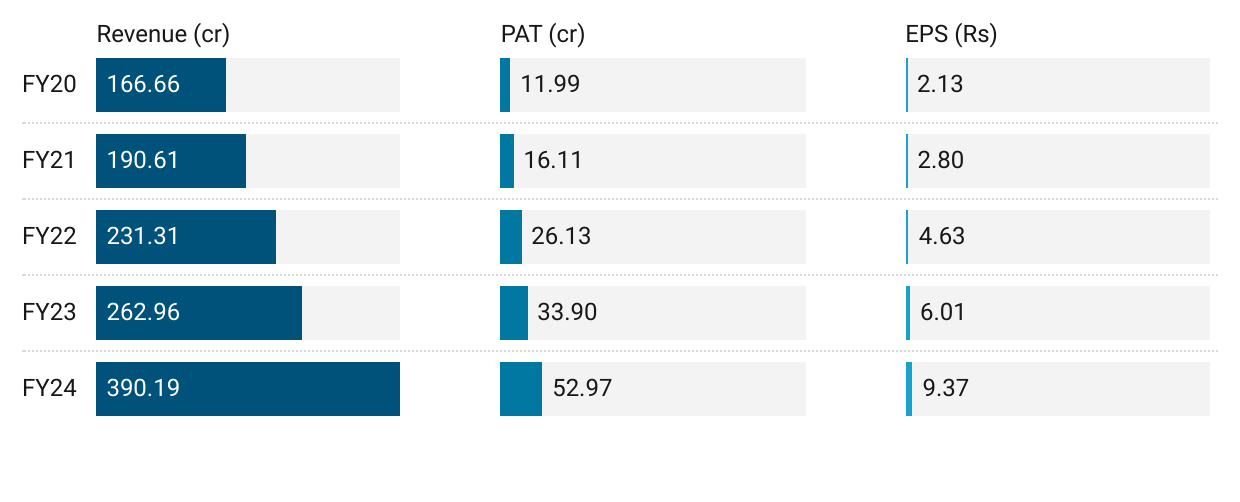

BIRLAMONEY delivered PAT CAGR of 45% & Revenue CAGR of 24% for FY20-24. BIRLAMONEY in the middle of a strong run since Q4-23 delivering QoQ growth. Absence of management commentary is a challenge

1. Full-service broking firm; Portfolio Management Services

stocksandsecurities.adityabirlacapital.com | NSE : BIRLAMONEY

Aditya Birla Capital Ltd, the holding company for the financial services business of the Aditya Birla Group, is the promoter of BIRLAMONEY.

2. FY20-24: PAT CAGR of 45% and Revenue CAGR of 24%

3. Strong FY24: PAT up 56% & Revenue up 48% YoY

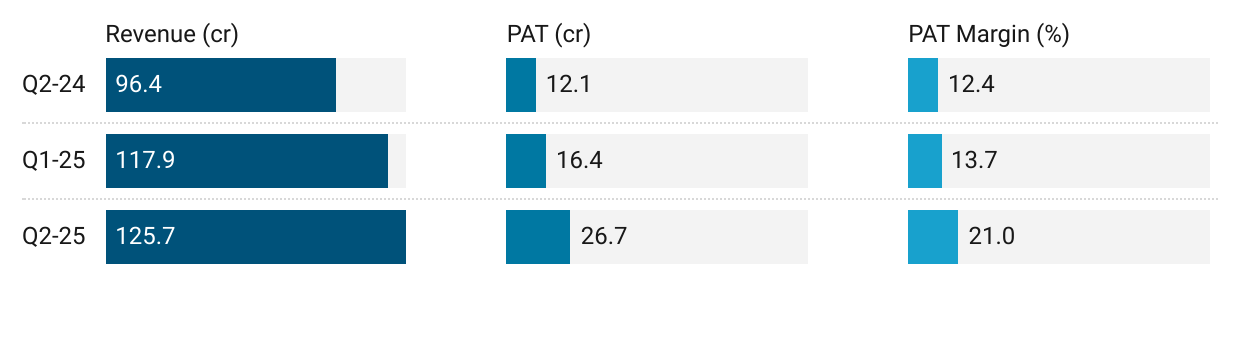

4. Strong Q2-25: PAT up 120% & Revenue up 30% YoY

PAT up 63% & Revenue up 7% QoQ

5. H1-25: PAT up 102% & Revenue up 66% YoY

6. Business metrics: Strong return ratios

7. FY25 Outlook: Expecting continuation of FY20-24 trend

No management commentary is available on BIRLAMONEY

In the absence of management commentary one is expecting the continuation of the long term trend of PAT CAGR of 40%+ as delivered during FY20-24.

H1-25 performance is indicating to a strong FY25.

8. PAT growth of 102% & Revenue growth of 66% in H1-25 at a PE of 13

9. Hold?

If I hold the stock then one may continue holding on to BIRLAMONEY

BIRLAMONEY has delivered the strongest top-line and PAT in FY24 and followed it up with a stronger H1-25

BIRLAMONEY is in the middle of a strong run. Since Q4-23, BIRLAMONEY has delivered QoQ and YoY growth in the top-line. One should stay in as long as this trend continues.

10. Buy?

If I am looking to enter BIRLAMONEY then

BIRLAMONEY has delivered PAT growth of 102% & Revenue growth of 66% in H1-25 at a PE of 13 which makes valuations quite attractive.

Outlook for 40% PAT growth in FY25 based on historic FY20-24 PAT CAGR of 40% and a strong H1-25 at a PE of 13 makes the valuations quite attractive from a longer term perspective.

In the absence of management commentary, the key question is will the performance of BIRLAMONEY in FY24 carry into FY25. Based on H1-25 performance there exists potential for returns in this stock idea.

Previous coverage of BIRLAMONEY

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer