4 Wheelers OEM Q3-25: Cooling Market, Lean Inventories, SUV Dominance & EV Acceleration

Indian auto OEMs are adjusting product mix, pricing, and inventory as demand moderates. SUVs, EVs, rural markets, and exports will drive growth and profitability in FY26.

Table of Contents

Performance Summary: Company-wise Insights

Demand: Moderating, but with Growth Pockets

Inventory: Lean and Well-Managed

Pricing: Disciplined & Selective Increases

Product Mix : Focus on Profitability & Growth

Conclusion: Emerging Themes for FY26

1. Performance Summary: Company-wise Insights

Insights generated from the management commentary in the Q3-25 earnings call of the companies listed above2. Demand: Moderating, but with Growth Pockets

2.1 Moderation in Passenger Vehicle (PV) Growth

After 2-3 years of high growth, PV demand is now expected to grow in low single digits (3-5%) in FY26.

Rural markets continue to outperform urban demand, supported by good monsoons, rising MSP, and stable farm incomes.

Urban markets, particularly small cars and hatchbacks, remain under pressure due to subdued affordability and high competition.

SUV and premium segments continue to lead demand, helping companies sustain market share and profitability.

2.2 Commercial Vehicles (CV): Stable to Moderate Growth

Bus and passenger carrier segments are performing strongly with double-digit growth.

M&HCV volumes expected to stabilize and improve in Q4 FY25, driven by infra spending and freight demand.

SCV segment remains under pressure but efforts are underway to revive it through new product launches and multi-fuel options.

2.3 Farm Equipment (Tractors): Bullish Outlook

Strong Q4 expected with >15% growth, led by good reservoir levels, strong Rabi sowing, and higher farm incomes.

Full-year FY25 tractor growth estimated at ~7%, with positive sentiment continuing into FY26.

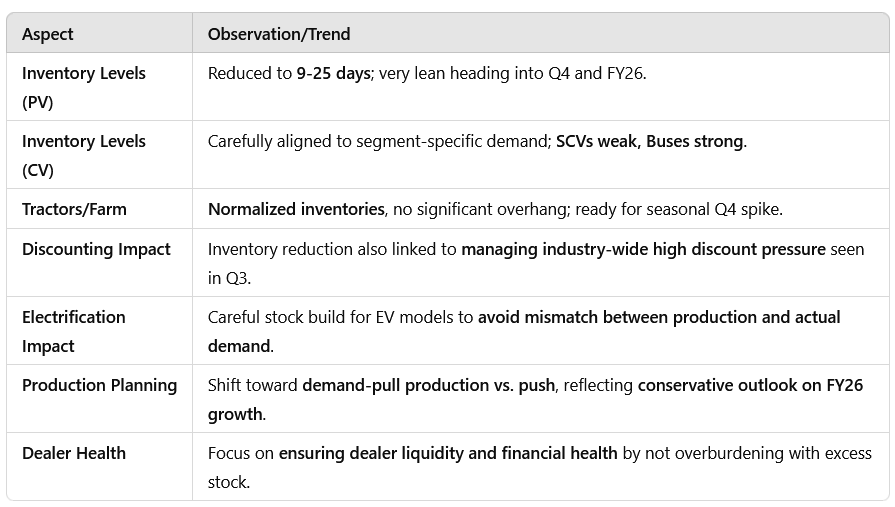

3. Inventory: Lean and Well-Managed

3.1 Passenger Vehicles (PV)

Inventory across OEMs has been reduced to lean levels:

Maruti Suzuki: ~9 days of inventory, among the lowest in the industry.

Tata Motors: Less than 25 days of inventory — sharp reduction post-festive season.

Companies are focused on retail-led sales, avoiding overstocking, and maintaining dealer health.

Production aligned tightly with demand to avoid heavy discounting pressures.

3.2 Commercial Vehicles (CV)

Selective inventory build in buses and passenger carriers to meet rising demand.

SCV inventory being carefully managed, given weak demand.

3.3 Farm Equipment (Tractors)

Inventory normalized and aligned to seasonal demand. No overhang expected going into Q4.

4. Pricing: Disciplined & Selective Increases

4.1 Recent Price Increases Implemented

Most OEMs have taken price hikes of 0.8%–1% in Q4 FY25 to offset cost pressures:

Hyundai, Maruti, Tata, and Mahindra implemented small hikes.

No aggressive pricing actions due to weak urban demand and price-sensitive segments.

4.2 Constraints on Future Price Hikes

High discounting pressure in hatchbacks and sedans limits further hikes.

Strong competitive intensity, especially in EVs, makes it challenging to raise prices aggressively.

4.3 Commodities Impact

Commodity prices stable to softening, easing margin pressures and reducing the need for further hikes.

4.4 EV Pricing: Strategic Focus

EV pricing is competitive but not excessively discounted.

PLI benefits help cushion margins, but companies are focusing on cost reduction and localization to avoid passing all cost pressures to consumers.

5. Product Mix : Focus on Profitability & Growth

5.1 SUV and Premiumization Focus

SUV contributions to sales are at historic highs:

Hyundai: 69%.

Tata Motors: 54%.

OEMs are prioritizing high-margin, feature-rich SUVs over low-margin hatchbacks.

High-end trims with sunroofs, ADAS, and automatics gaining traction, improving ASP and margins.

5.2 EV and CNG Expansion

Aggressive focus on EVs and CNG:

Hyundai: Creta EV, dual-cylinder CNG.

Maruti: e-Vitara EV, CNG accounts for 1 in 3 cars sold.

Tata: Full EV range from Tiago to Harrier EV.

M&M: Born Electric platform, last-mile EV focus.

Companies leveraging PLI benefits and localization to sustain competitiveness.

5.3 Alternative Fuels and Future Tech

Exploring multi-fuel options — flex-fuel, hydrogen, biofuel.

Hydrogen ICE and EVs presented at Bharat Mobility Expo by Tata and Hyundai.

Preparing for regulatory shifts and long-term sustainability.

5.4 Export-Focused Product Strategy

New models designed for domestic and global markets:

Maruti e-Vitara: "Made in India for the World".

M&M SUVs and pickups targeted for emerging markets (South Africa, Australia, Chile).

Tata and Hyundai expanding in LHD markets and Africa.

6. Conclusion: Emerging Themes for FY26

Moderation in growth, with SUV, EV, and rural as key drivers.

Margin protection through premiumization, tight inventory, and localization.

Strategic EV and alternative fuel push, backed by PLI.

Export diversification to hedge domestic demand risks.

Continued focus on multi-fuel readiness (ICE, EV, CNG, Hydrogen).

While demand growth is moderating, Indian auto OEMs are restructuring product mix, pricing, and inventories to adapt to a transforming landscape led by electrification and premiumization. SUVs, EVs, rural markets, and exports will be critical for sustaining growth and profitability in FY26.

Disclaimer

Content Accuracy and Reliability: This information is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities.

Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions.

No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary.

Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional.